Finance formulas

1/65

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

66 Terms

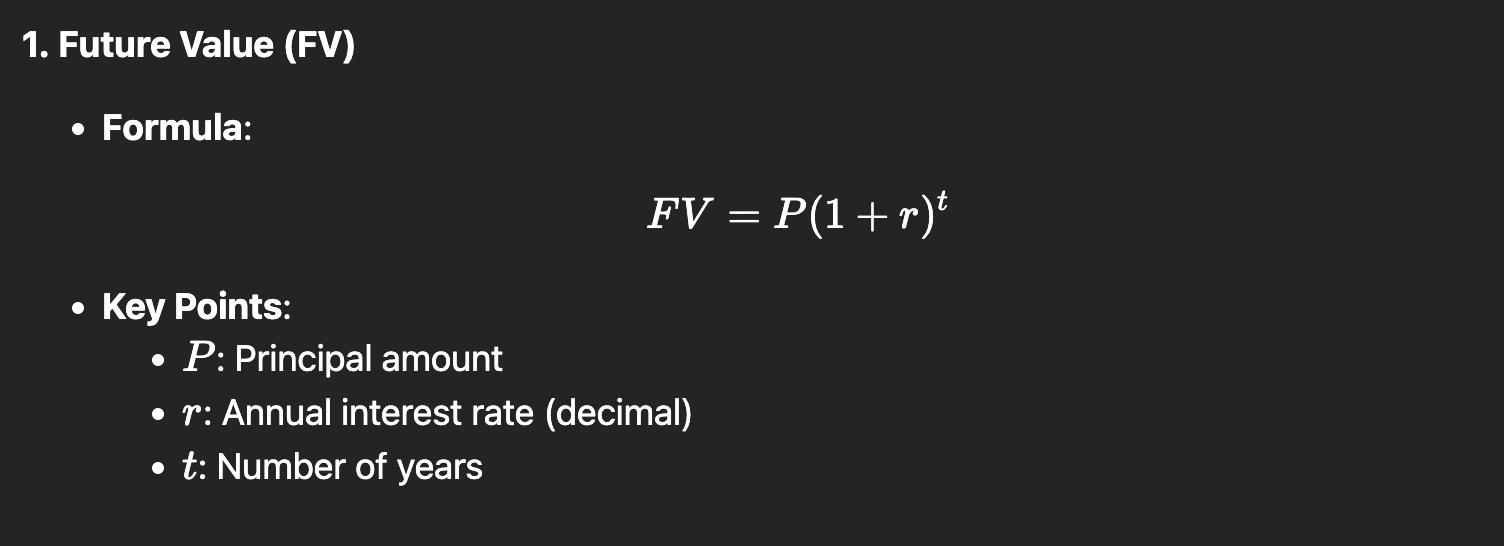

Chap 2: FV

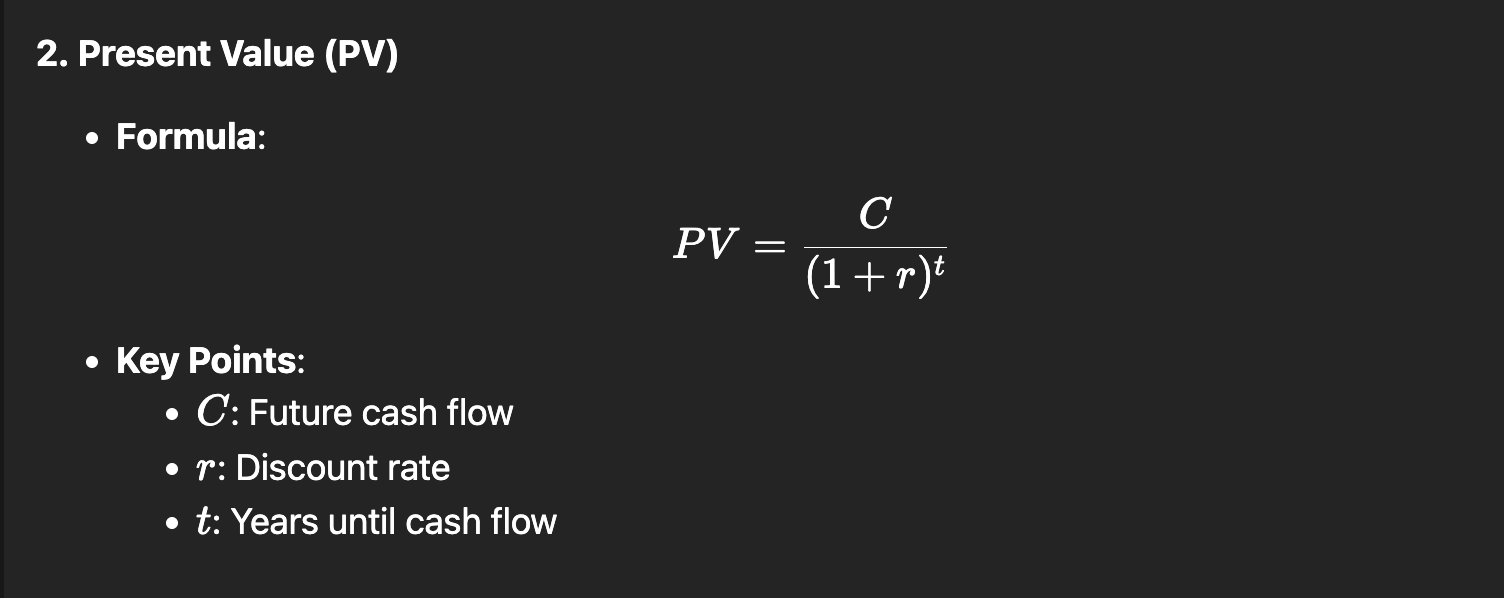

Chap 2: PV

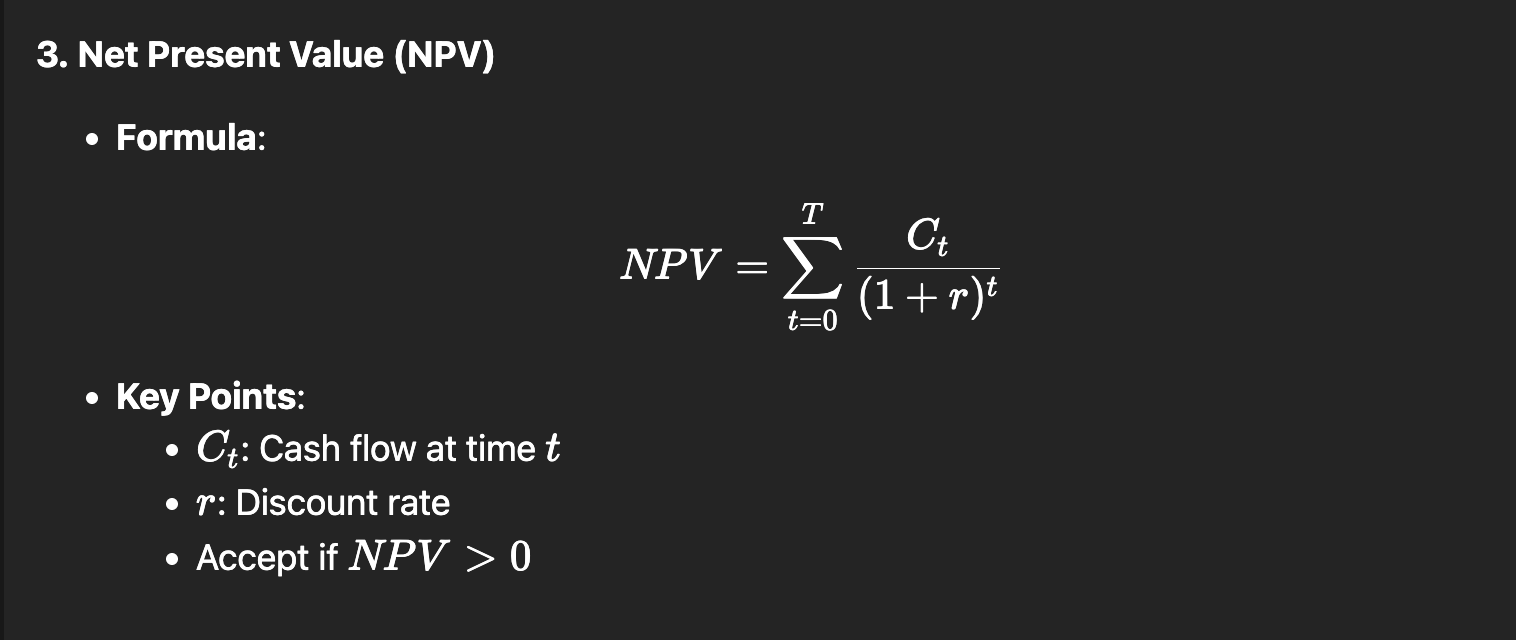

Chap 2: NPV

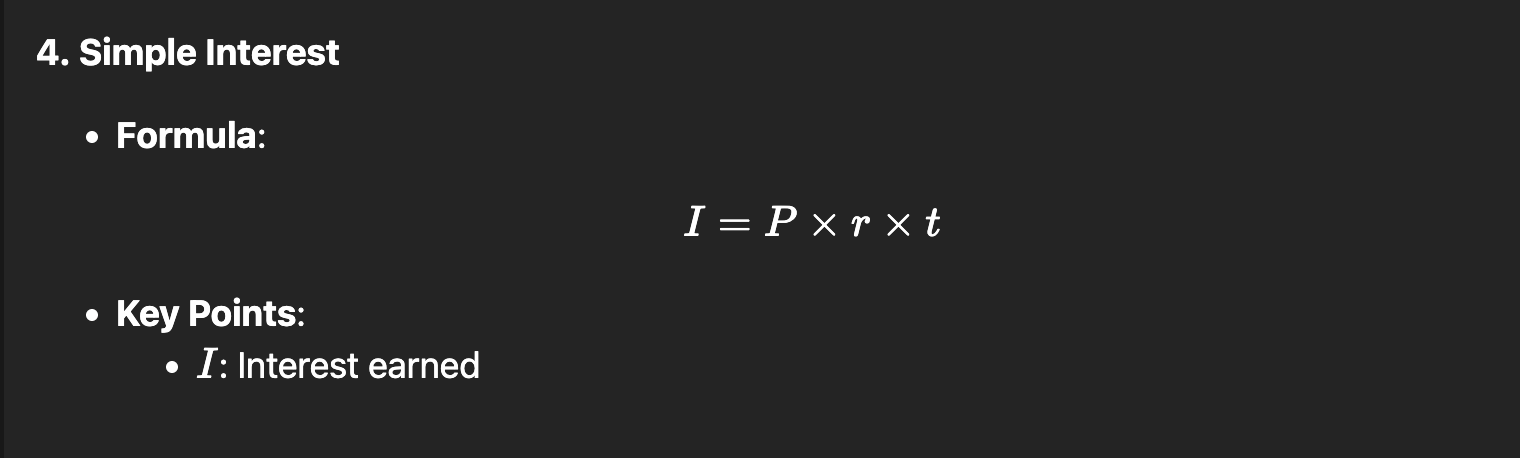

Chap 2: Simple Interest

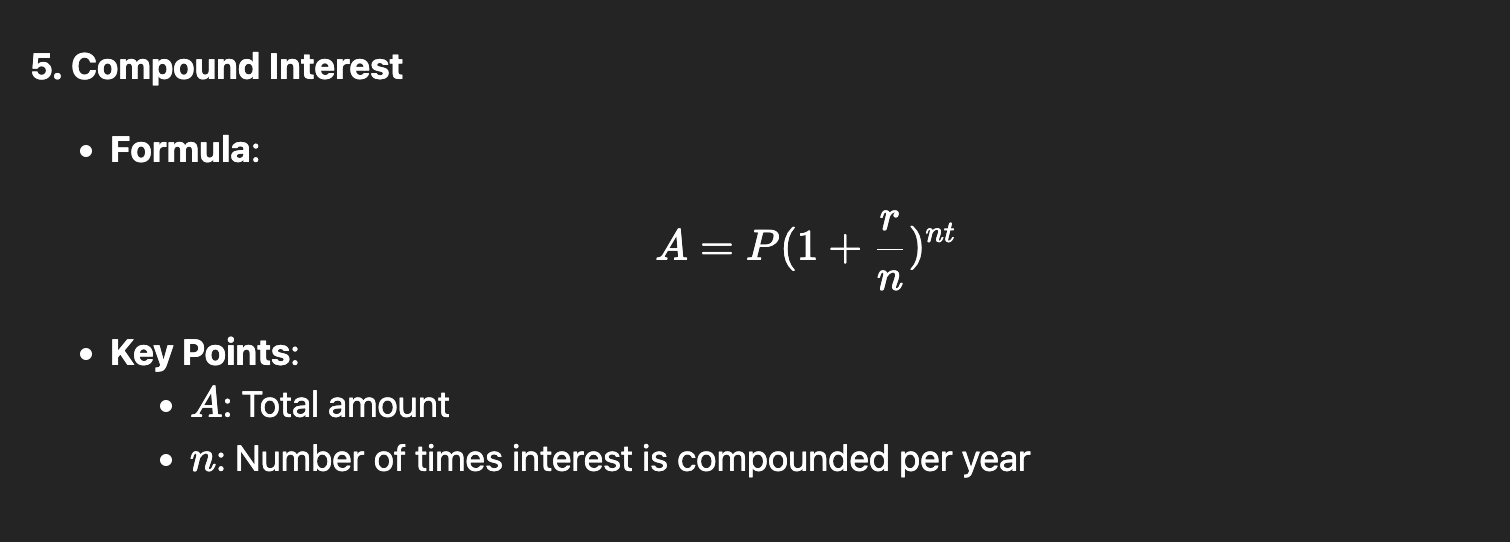

Chap 2: Compound Interest

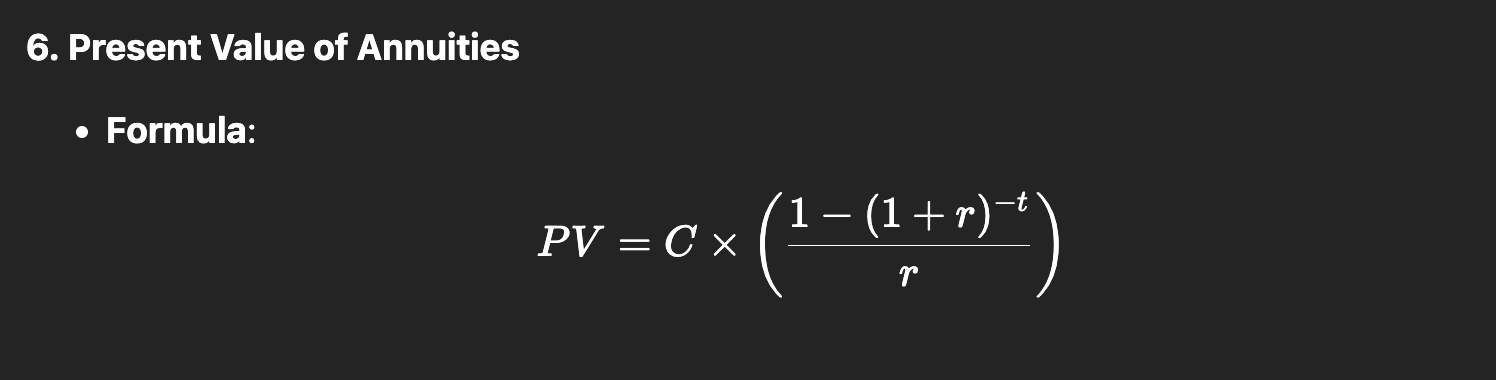

Chap 2: PV of Annuities

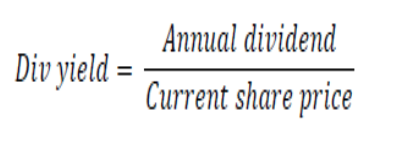

Chap 2: Dividend Yield

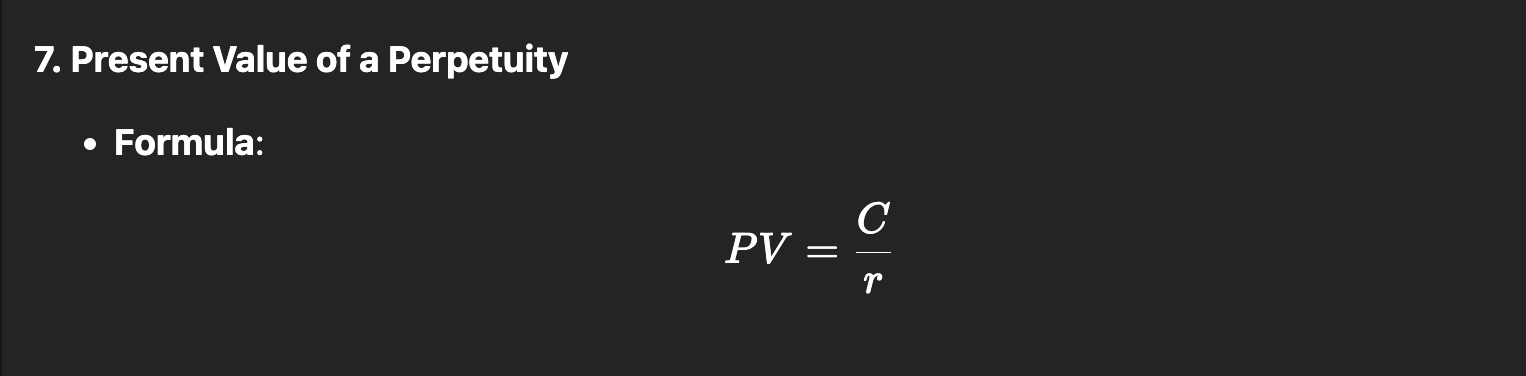

Chap 2: PV of Perpetuity

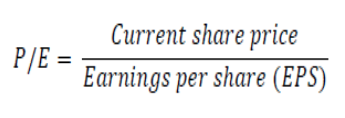

Chap 2: PE Ratio

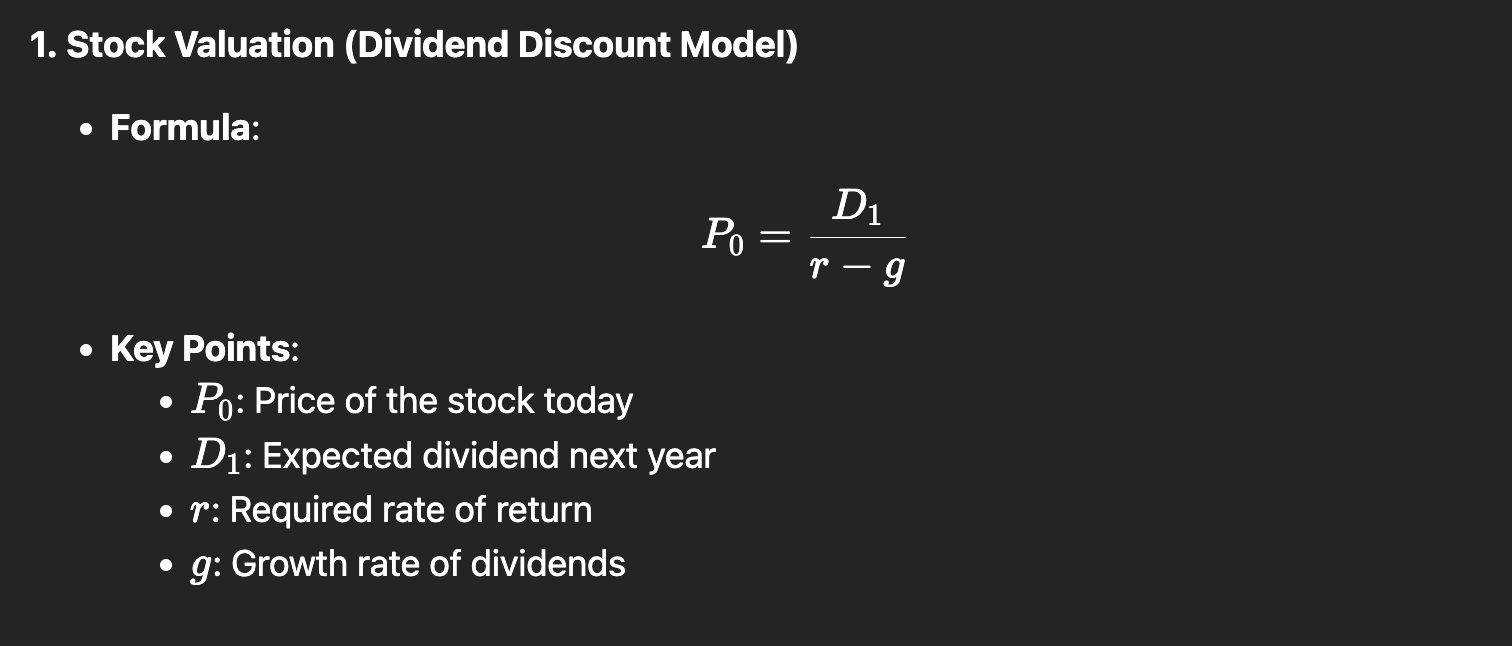

Chap 3: Stock Valuation (DDM)

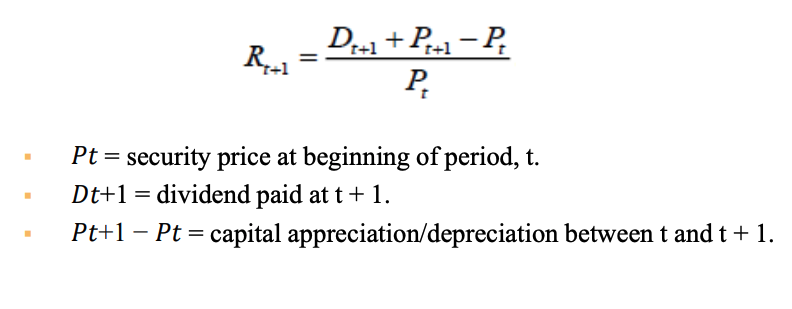

Chap 3: Realized Return

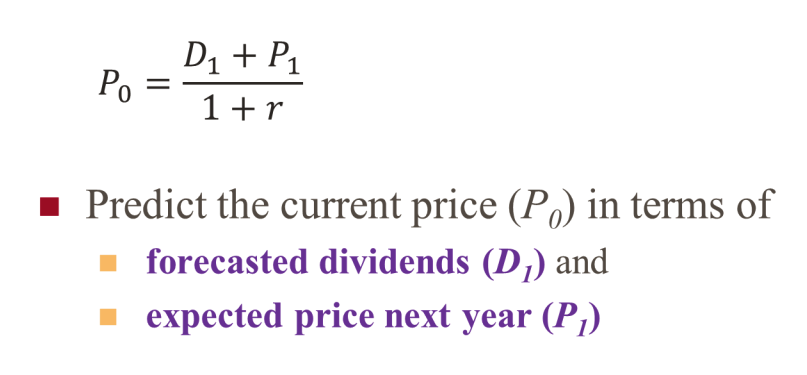

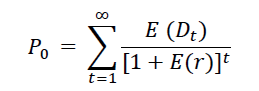

Chap 3: Fundamental Valuation

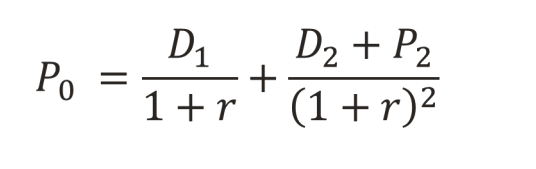

Chap 3: Fundamental Valuation when you want to replace P1

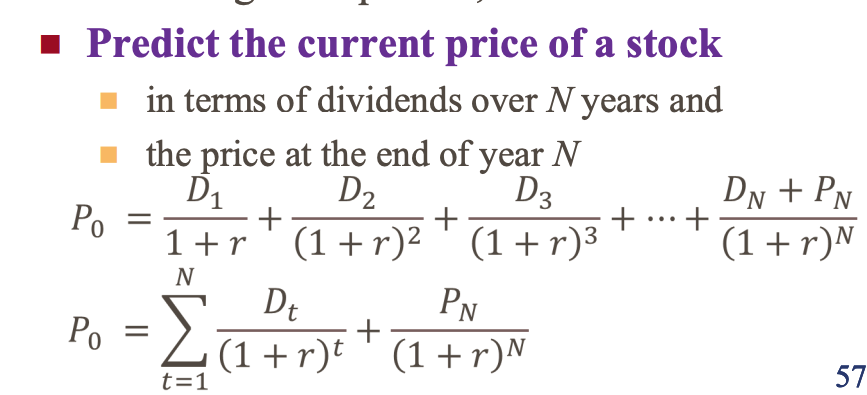

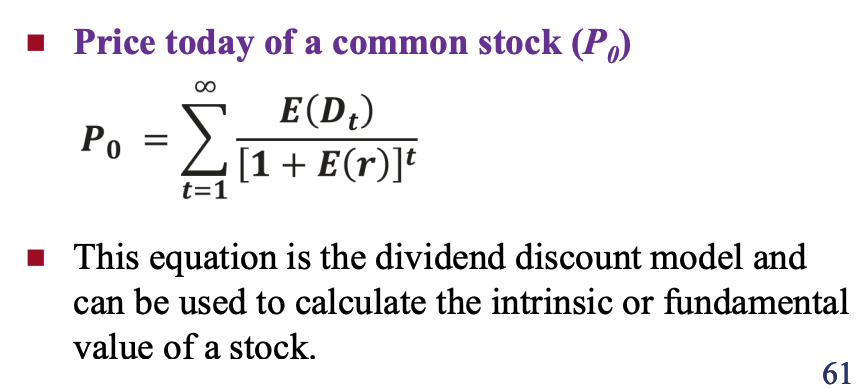

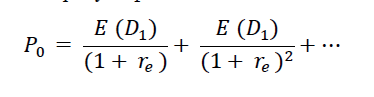

Chap 3: Generalized Valuation

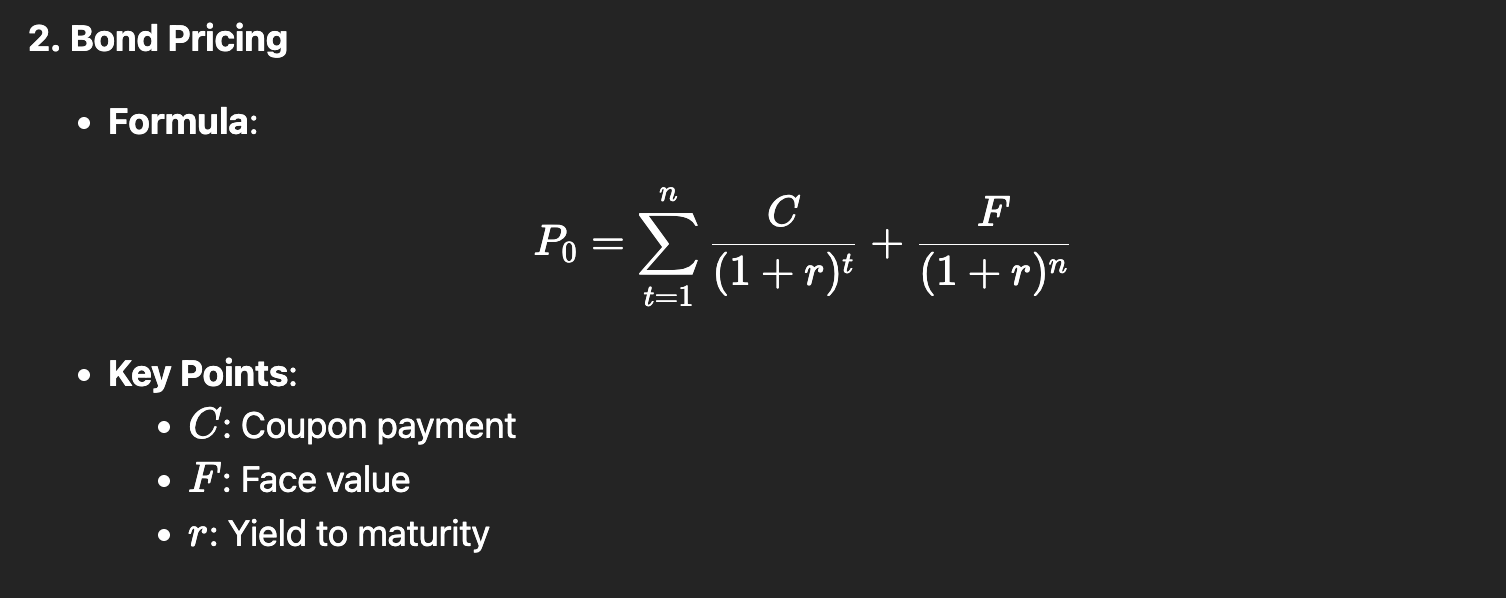

Chap 3: Bond Pricing

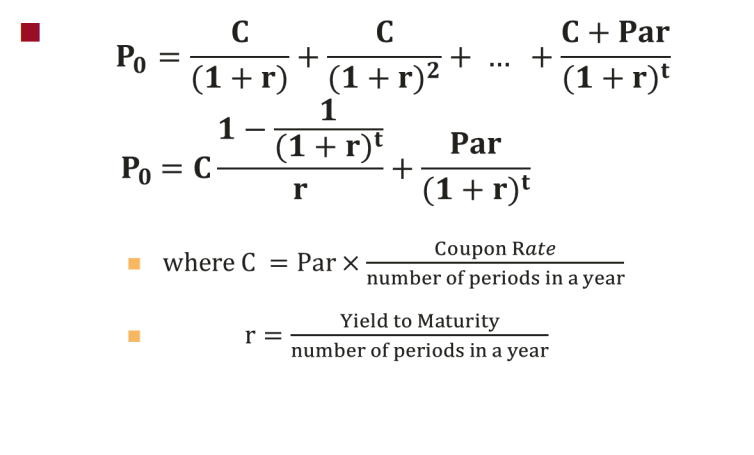

Chap 3: Coupon Bond Pricing

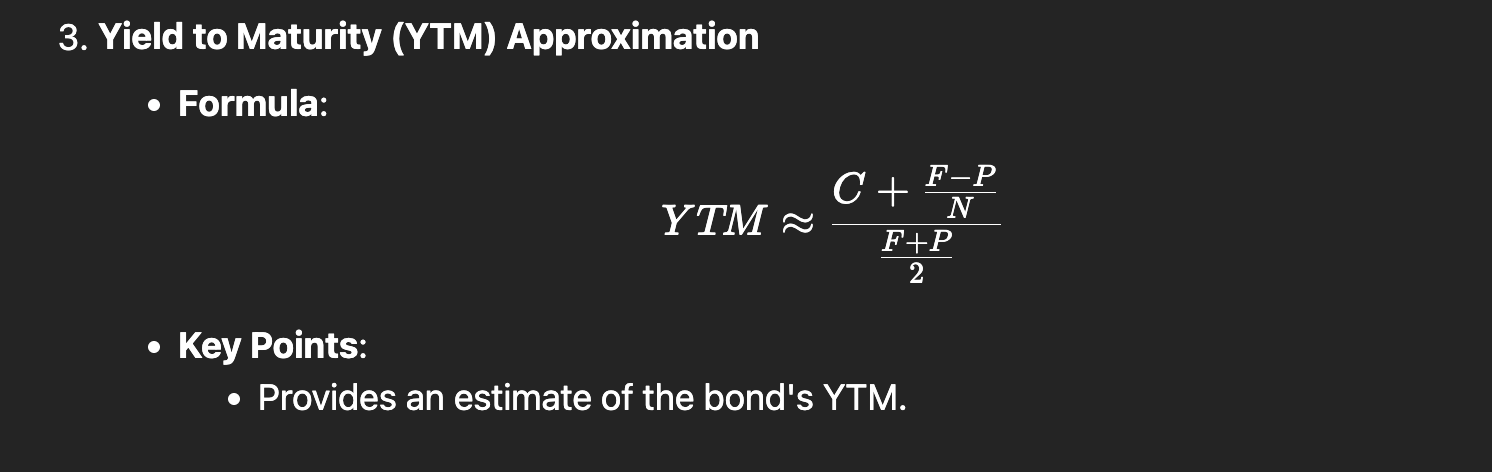

Chap 3: YTM Approximation

Chap 3: DDM

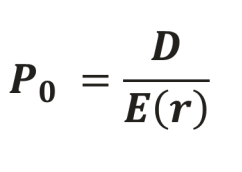

Chap 3: Zero Growth Model

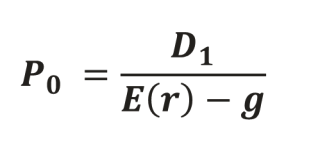

Chap 3: Gordon Growth Model

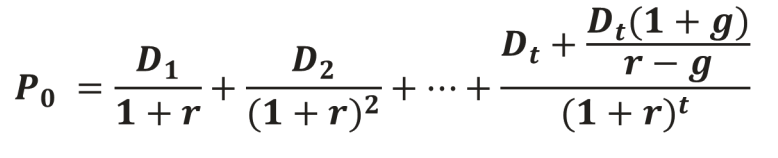

Chap 3: Multistage Growth Model

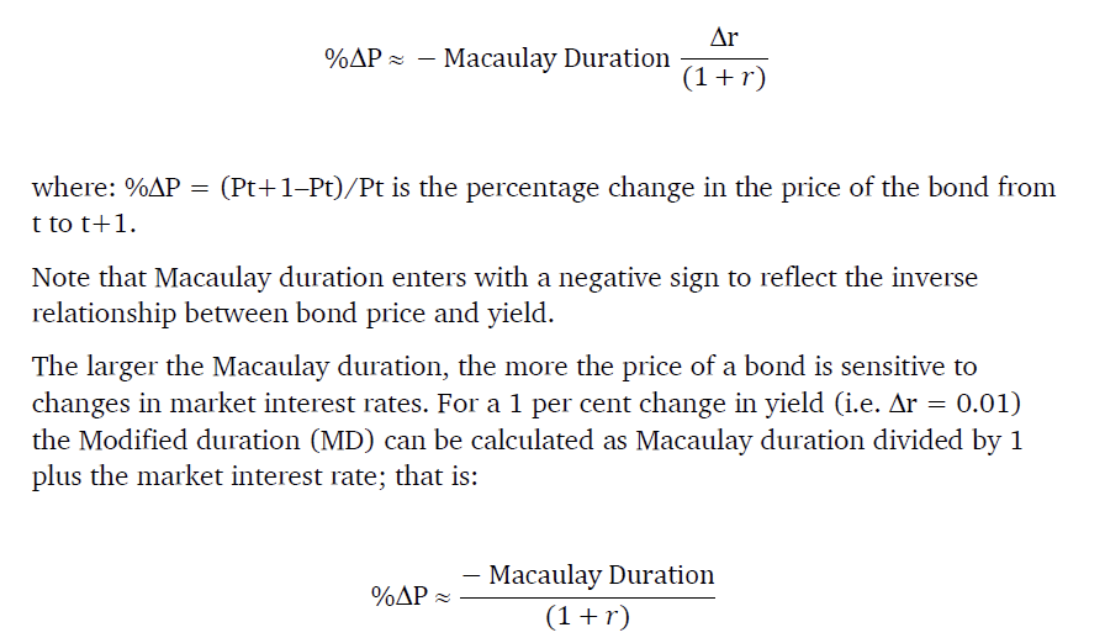

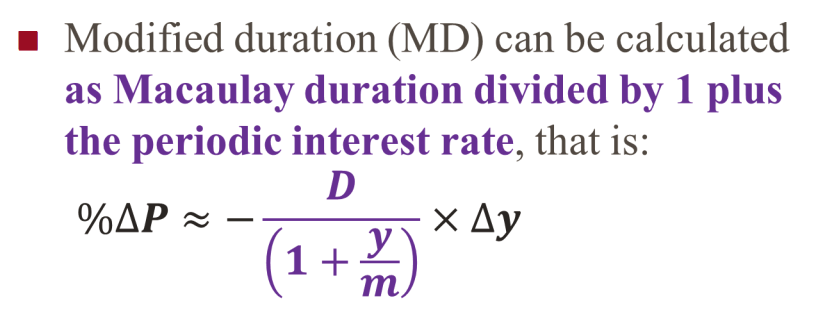

Chap 3: Modified Duration relationship with macaulay duration

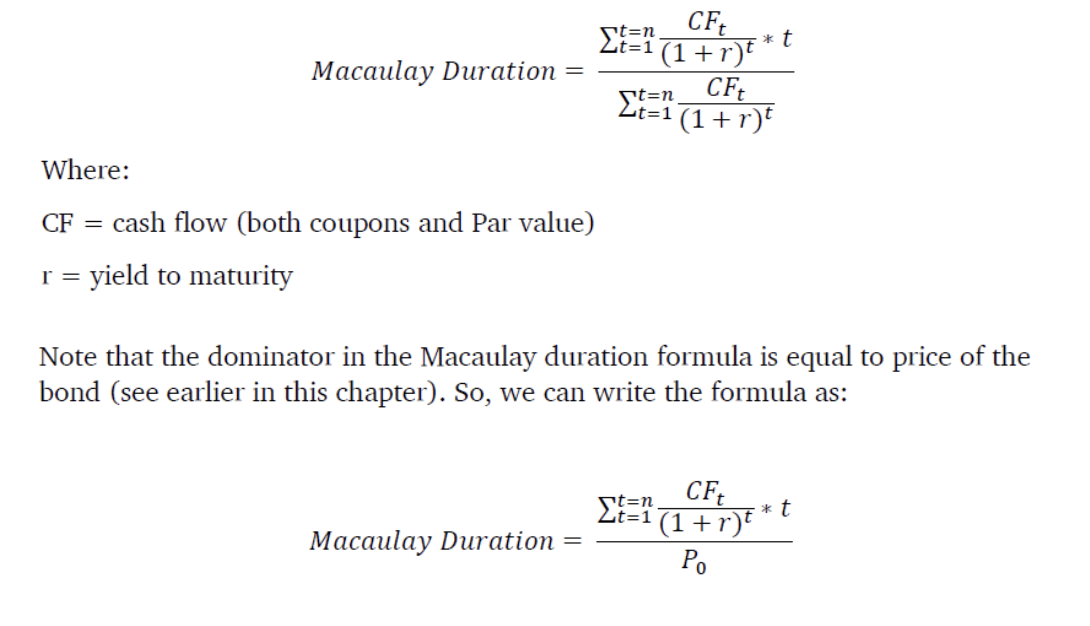

Chap 3: Macaulay Duration

Chap 3: Modified Duration

Chap 3: Value of Equity Stock

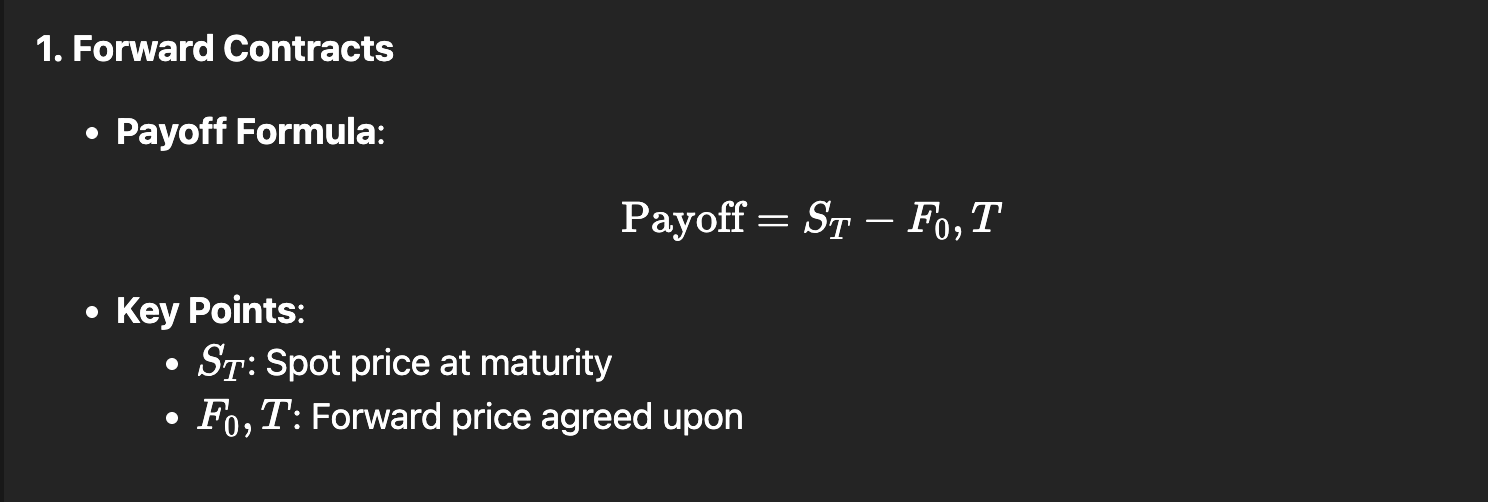

Chap 4: Forward Contracts

for short: f-s for long: s-f

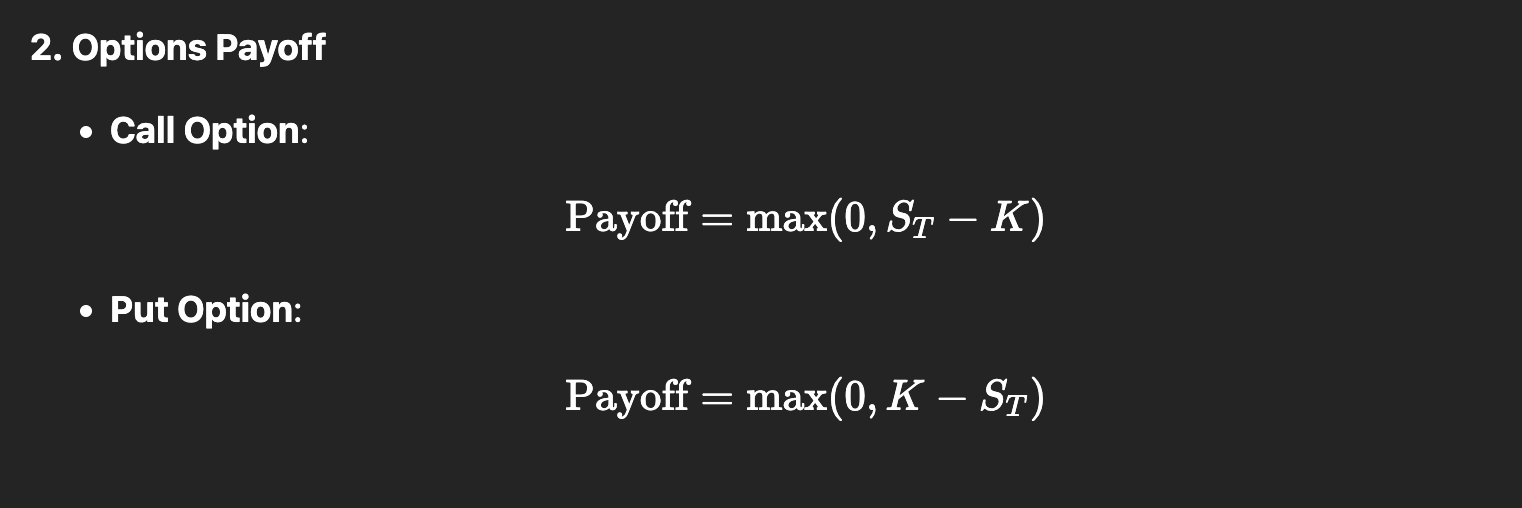

Chap 4: Options Payoff

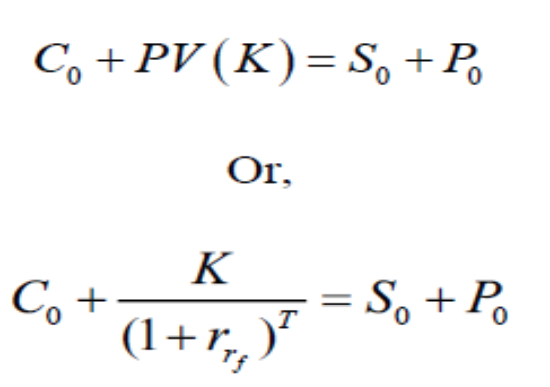

Chap 4: Put-Call Parity

Chap 4: Black-Scholes Option Pricing Model (Call Option)

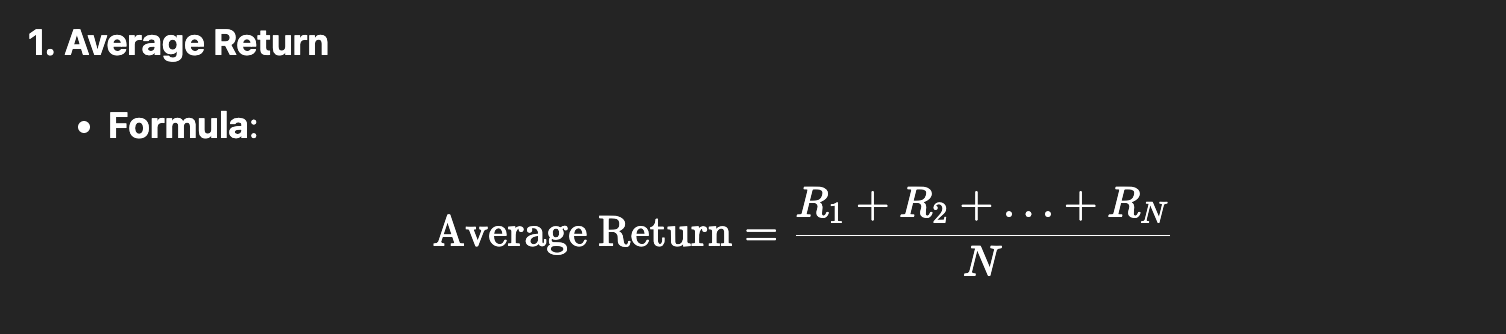

Chap 5: Avg Return

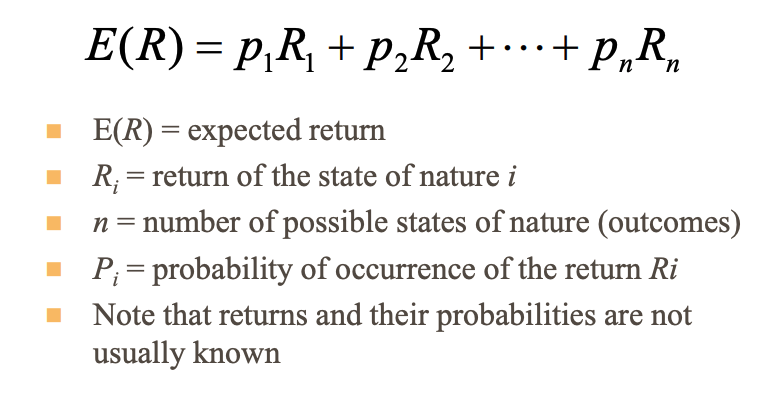

Chap 5: Expected Return

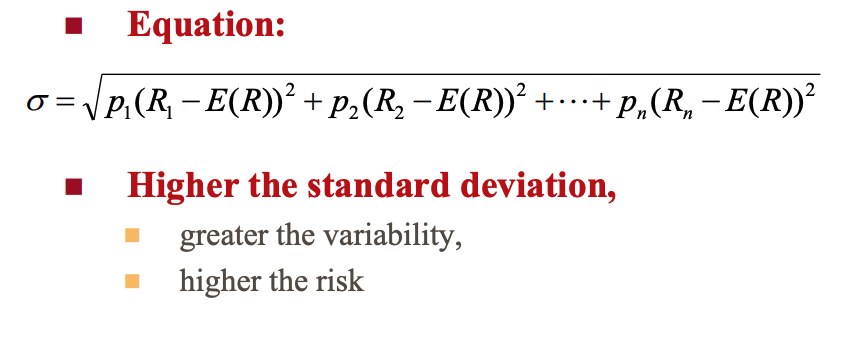

Chap 5: Standard Deviation

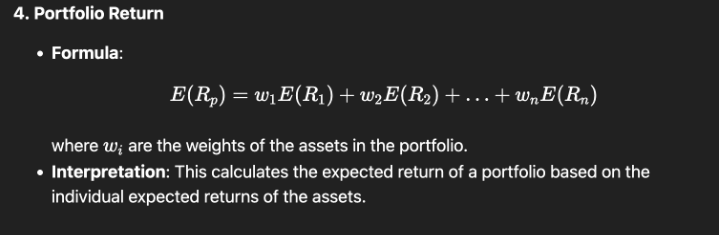

Chap 5: Portfolio Return

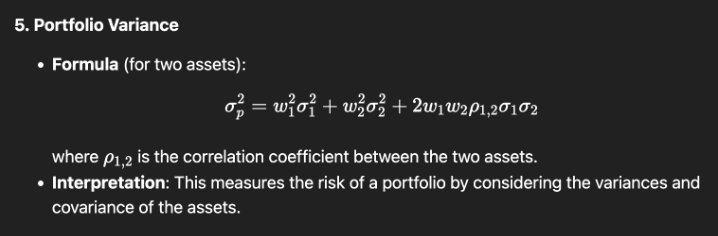

Chap 5: Portfolio Variance

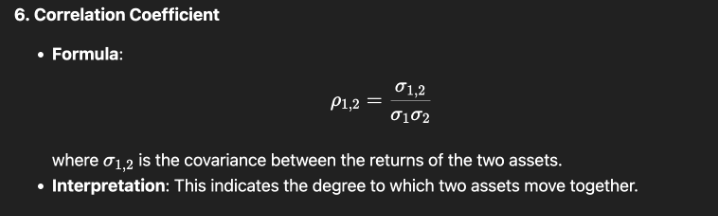

Chap 5: Correlation Coefficient

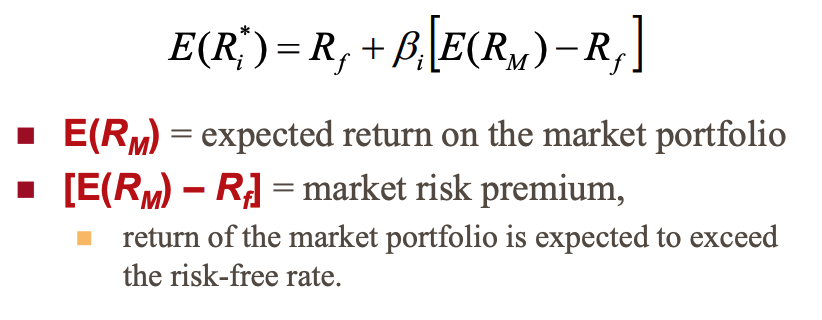

Chap 5: CAPM

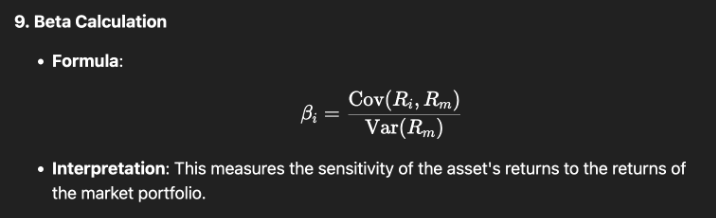

Chap 5: Beta Calculation

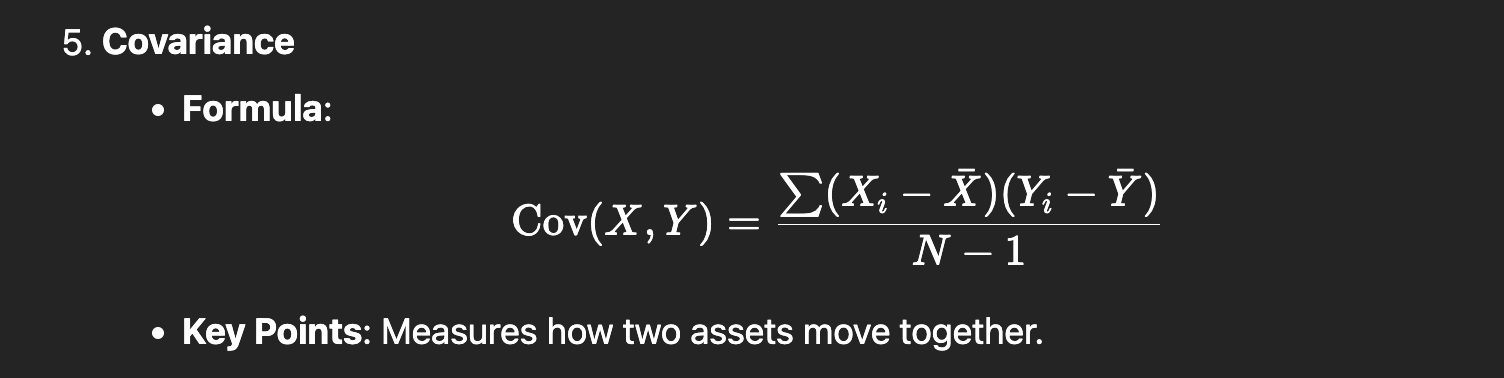

Chap 5: Covariance

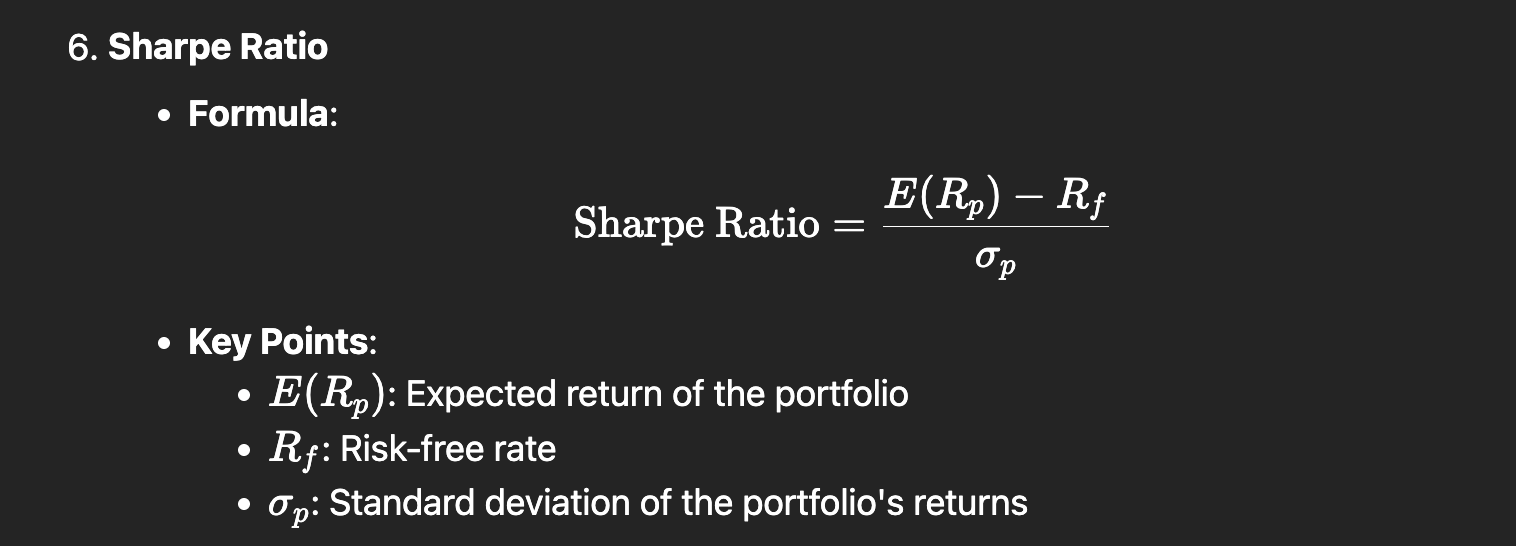

Chap 5: Sharpe Ratio

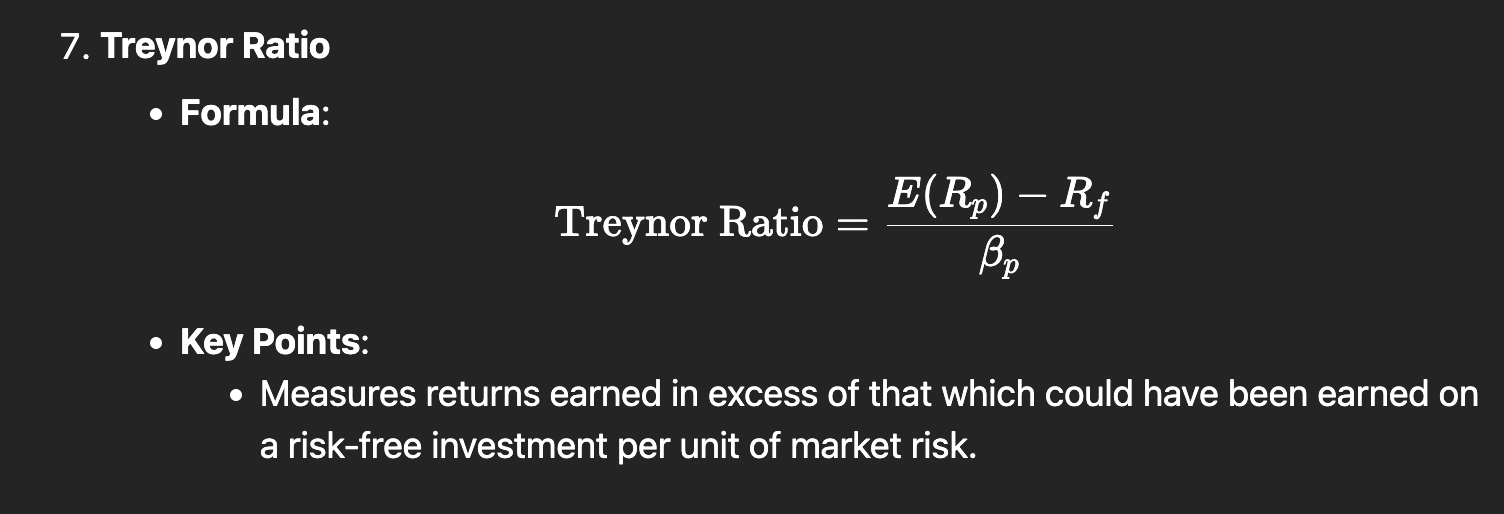

Chap 5: Treynor Ratio

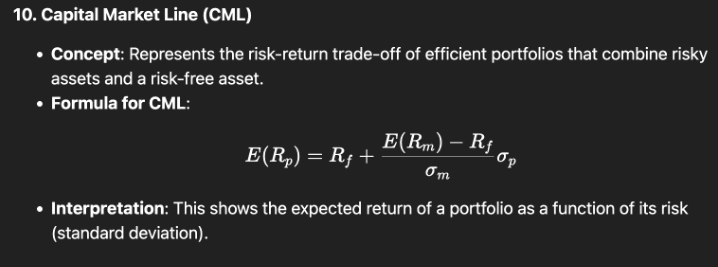

Chap 5: CML

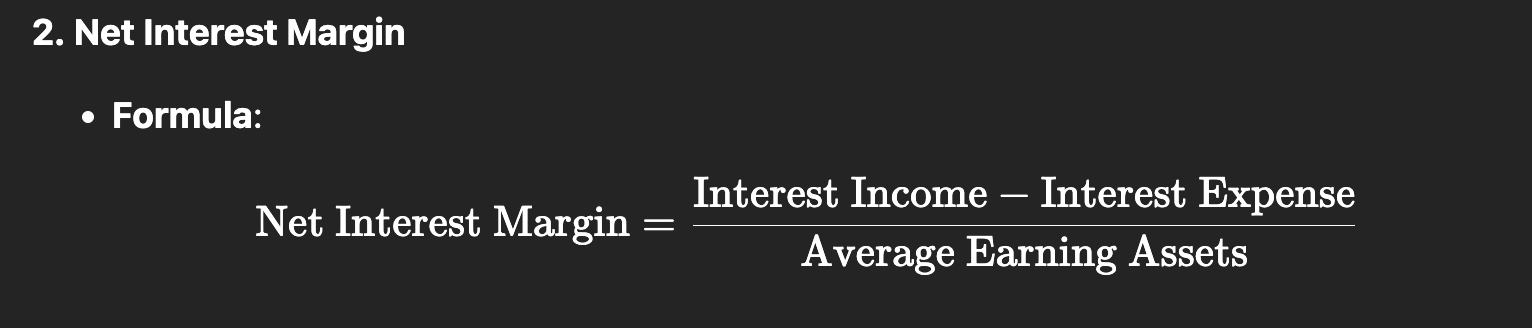

Chap 6: Net Interest Margin

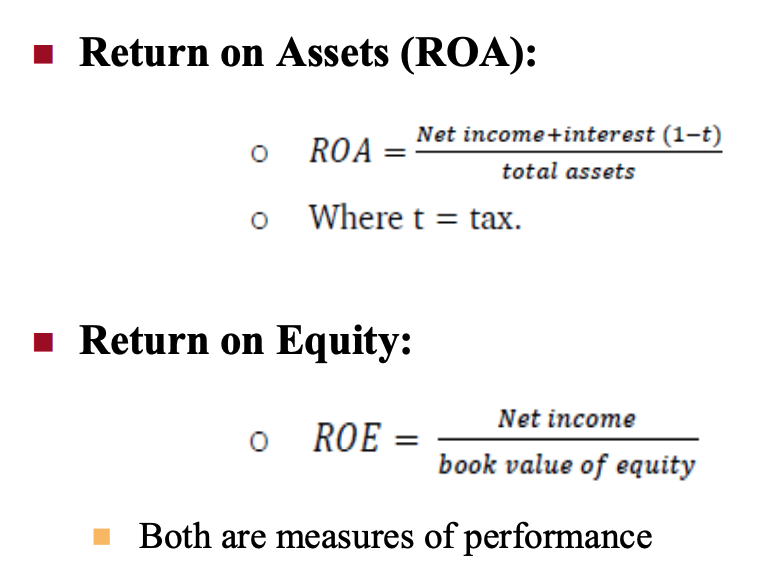

Chap 6: ROA & ROE

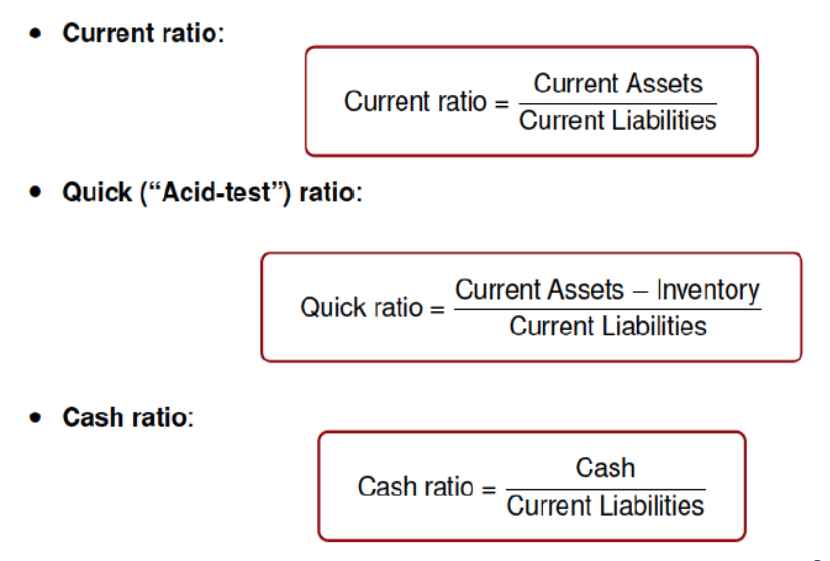

Chap 6: Liquidity Ratios

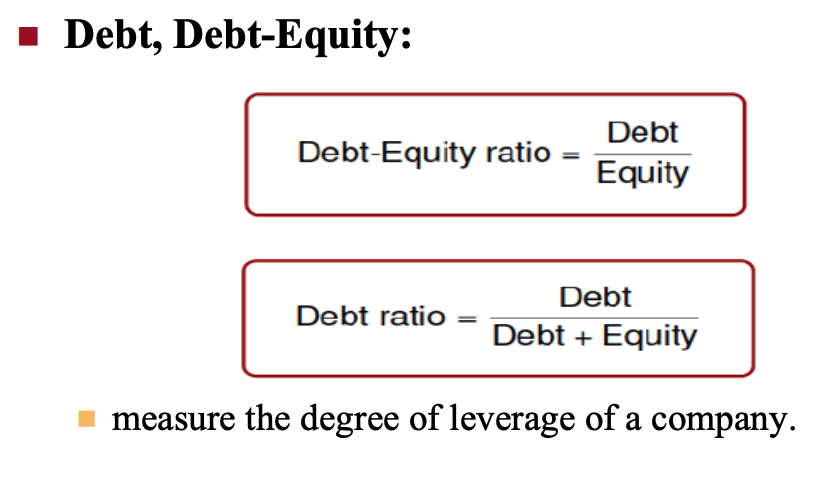

Chap 7: Leverage Ratios

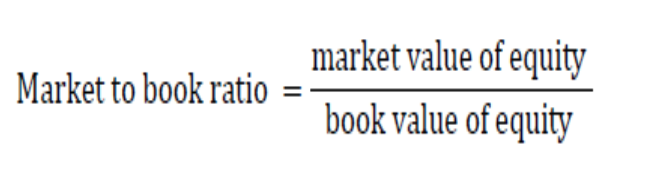

Chap 7: Market to book ratio

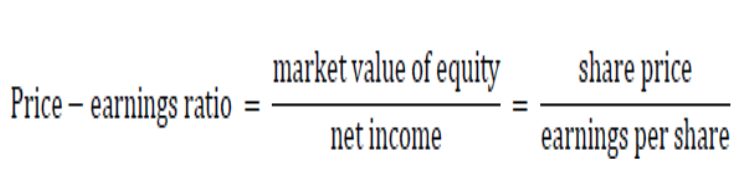

Chap 7: PE ratio

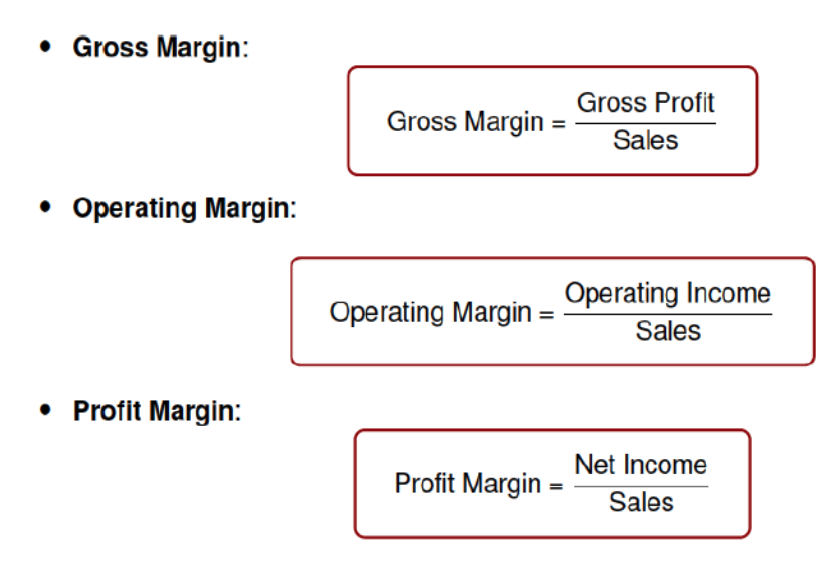

Chap 7: Profitability Ratios

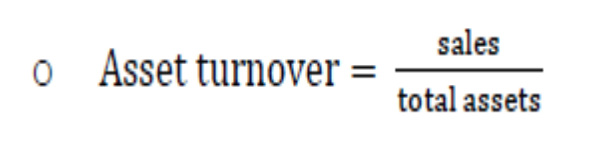

Chap 7: Asset Turnover Ratio

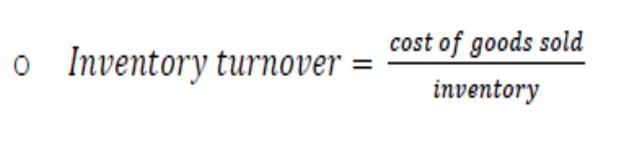

Chap 7: Inventory Turnover

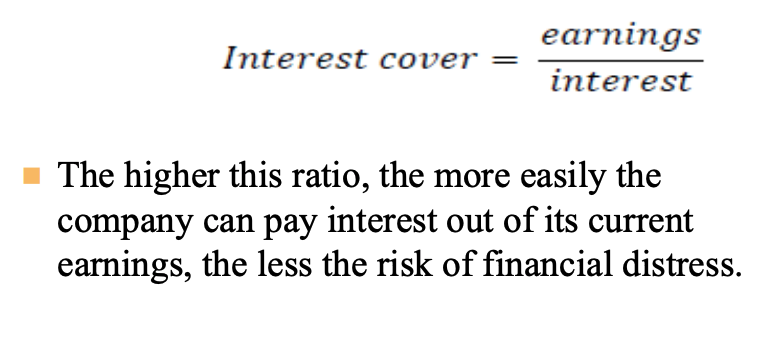

Chap 7: Interest Cover

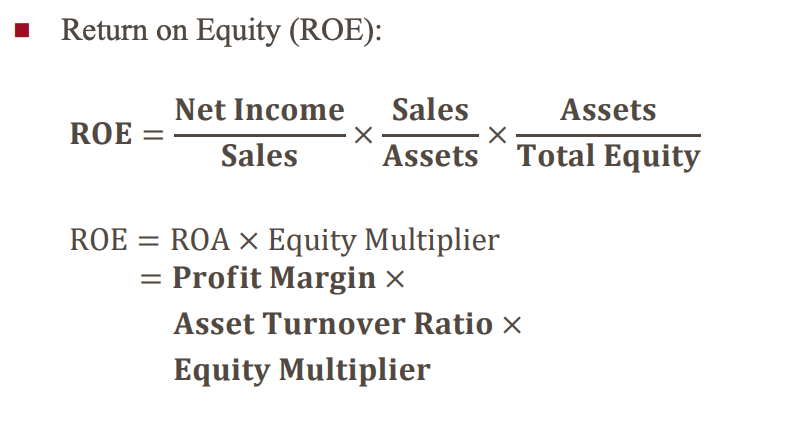

Chap 8: Du Point Identity

Chap 8: Cost of Equity Capital

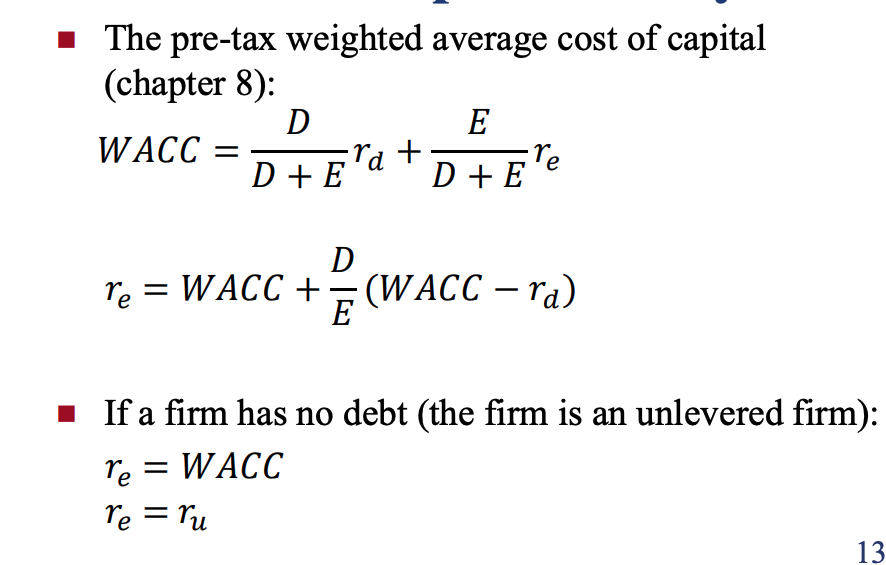

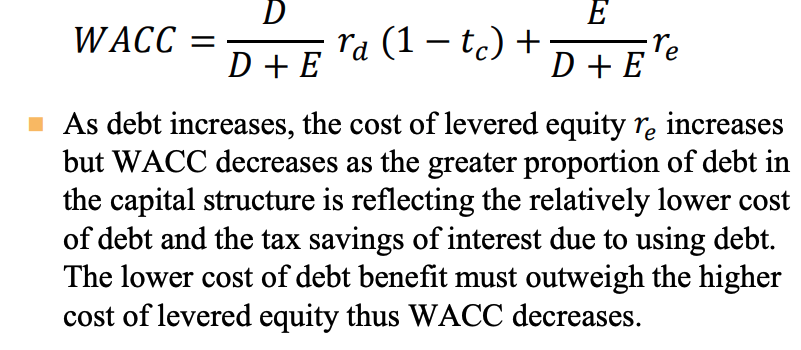

Chap 8: WACC

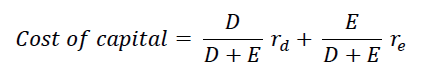

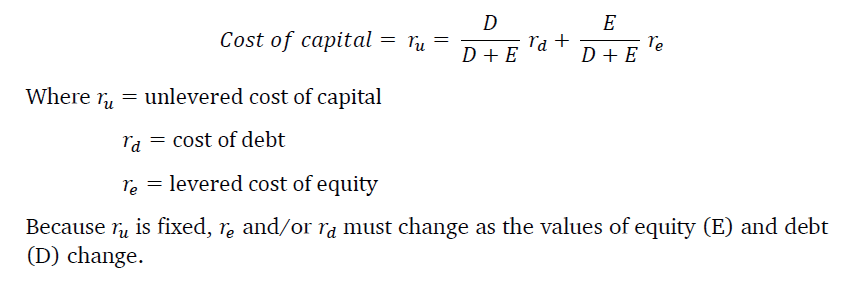

Chap 9: Cost of Capital

Chap 9: Cost of Capital Fallacy

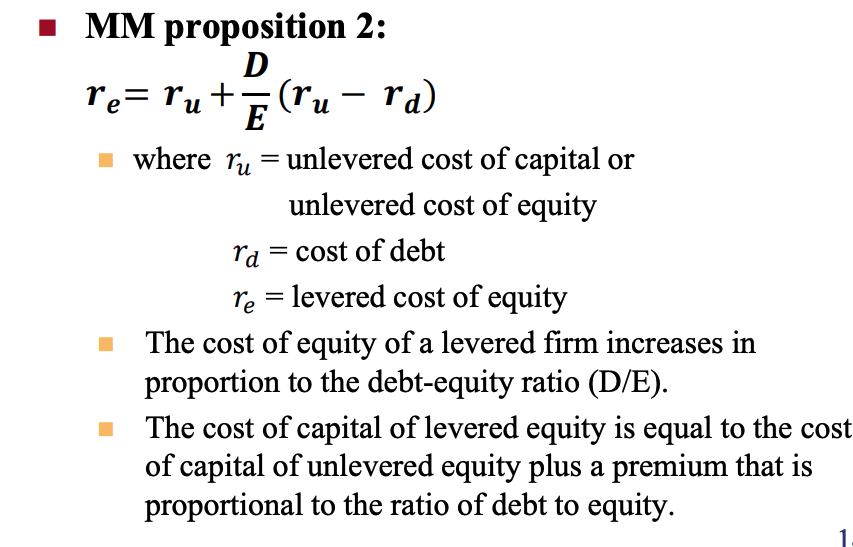

Chap 9: MM2

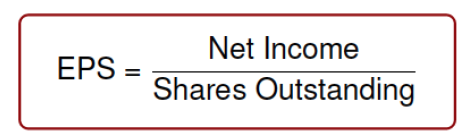

Chap 9: Earnings Per Share

Chap 9: Share Price

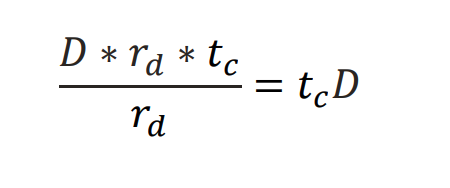

Chap 9: Tax Shield PV

Chap 9: MM Theory

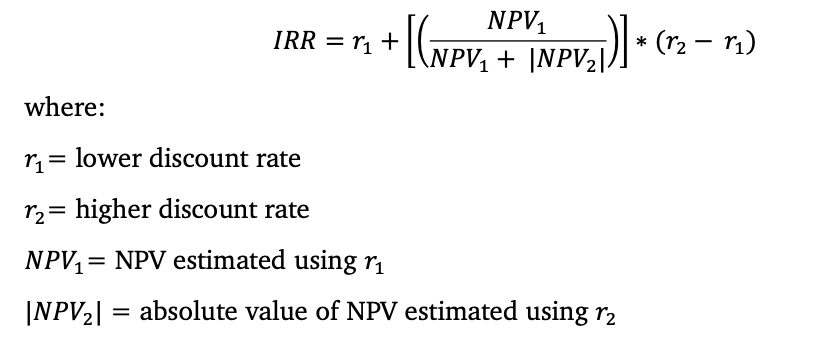

Chap 11: IRR interpolation method

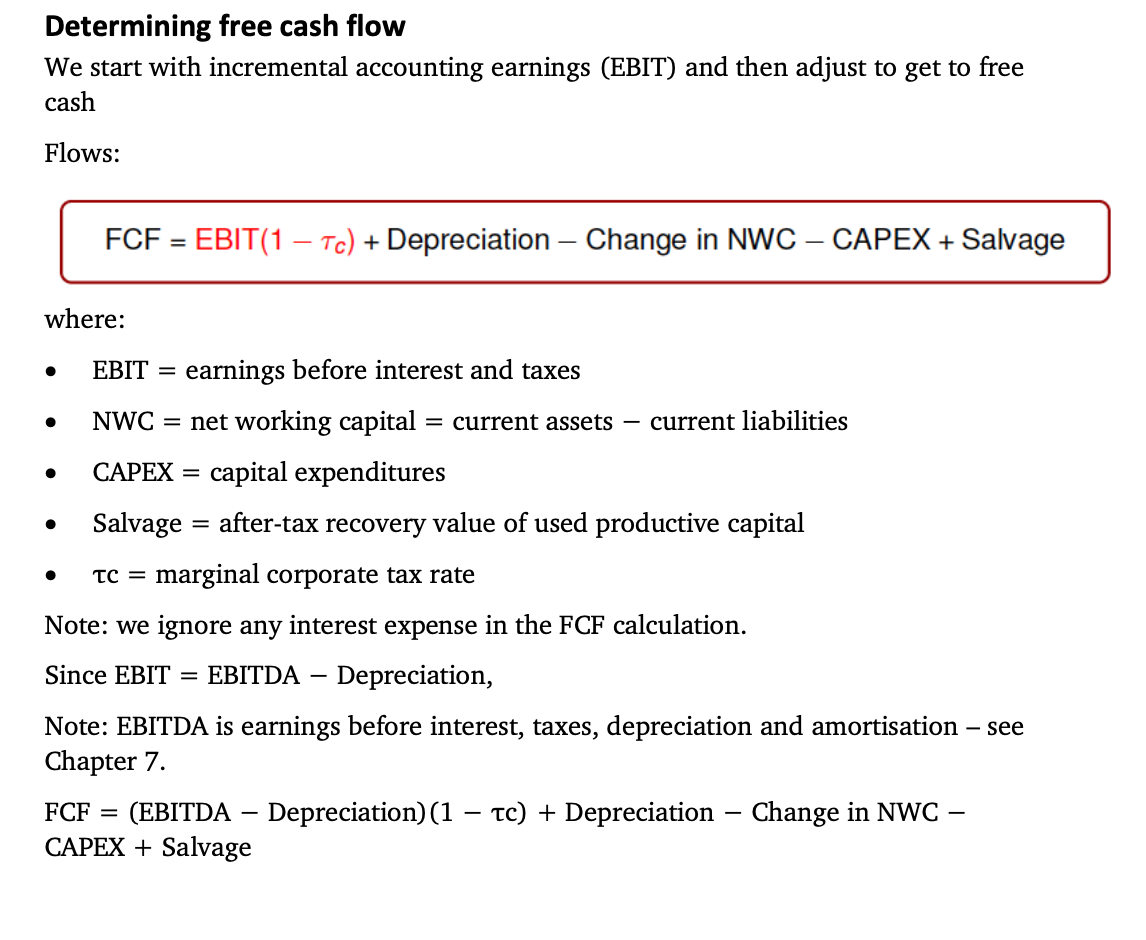

Chap 11: Free Cash Flow

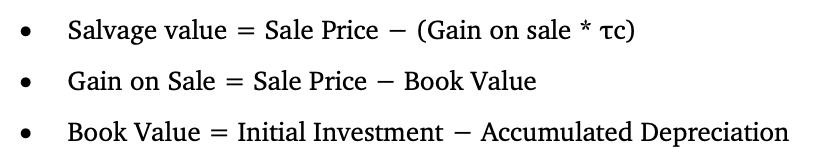

Chap 11: Salvage Value

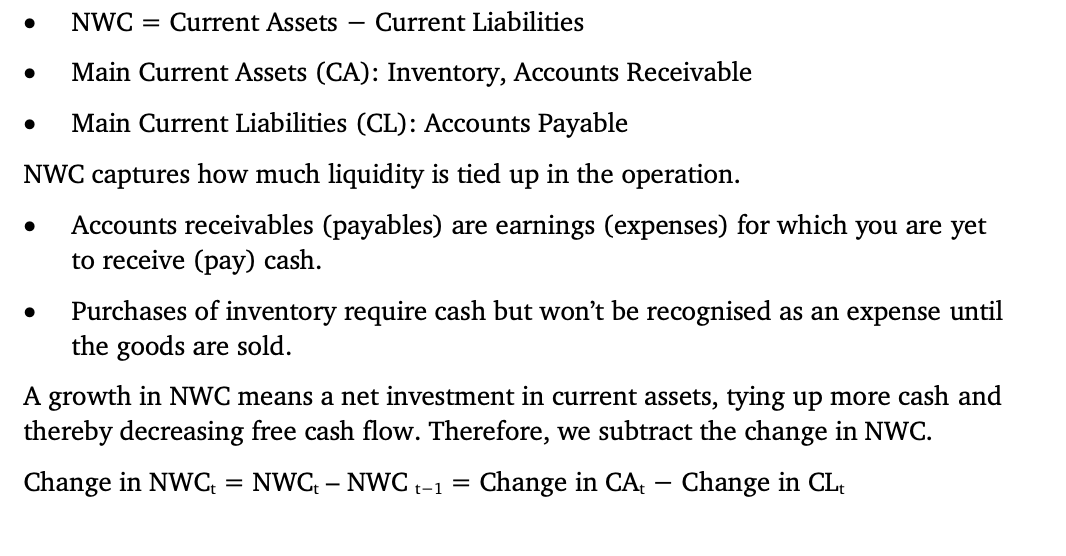

Chap 11: Net Working Capital (NWC)

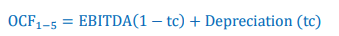

Chap 11: Operating Cash Flow (OCF)