Institutions Ch 12 (Done)

1/87

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

88 Terms

Commercial banks (CBs) are unique in the special services they perform and the level of regulatory attention they receive

As a result, they are also unique in the type of assets and liabilities they hold

Ultimate measure of a CB’s performance is the value of its common equity to its shareholders

Financial statements of commercial banks are ideal candidates to use in examining the performance of depository institutions, given the extensive regulation and accompanying requirements for public availability of financial information

CAMELS

Regulators use ___________ ratings to evaluate the safety and soundness of banks

CAMELS ratings rely heavily on financial statement data

Components

Capital adequacy

Asset quality

Management

Earnings

Liquidity

Sensitivity to market risk

Capital adequacy

Evaluated in relation to the volume of risk assets; the volume of marginal and inferior quality assets; the bank’s growth experience, plan, and prospects; and the strength of management

Asset quality

Evaluated by the level, distribution, and severity of adversely classified assets; the level and distribution of nonaccrual and reduced-rate assets; the adequacy of the allowance for loan losses; and management’s demonstrated ability to administer and collect problem credits

Management

Evaluated against virtually all factors considered necessary to operate the bank within accepted banking practices and in a safe and sound manner

Earnings

Evaluated with respect to their ability to cover losses and provide adequate capital protection; trends; peer group comparisons; the quality and composition of net income; and the degree of reliance on interest-sensitive funds

Liquidity

Evaluated in relation to the volatility of deposits; the frequency and level of borrowings; the use of brokered deposits; technical competence; availability of assets readily convertible into cash; and access to money markets or other ready sources of funds

Sensitivity to market risk

Reflects the degree to which changes in interest rates, foreign exchange rates, commodity prices, or equity prices can adversely affect an FI’s earnings or economic capital

CAMELS ratings range from 1 to 5:

Composite “1”— Institutions in this group are basically sound in every respect.

Composite “2”— Institutions in this group are fundamentally sound but may reflect modest weaknesses correctable in the normal course of business.

Composite “3”— Institutions in this group exhibit financial, operational, or compliance weaknesses ranging from moderately severe to unsatisfactory.

Composite “4”— Institutions in this group have an immoderate volume of serious financial weaknesses or a combination of other conditions that are unsatisfactory.

Composite “5”— Reserved for institutions that have an extremely high immediate or near-term probability of failure.

Federal Financial Institutions Examination Council (FFIEC) prescribes uniform principles, standards, and report forms for depository institutions

Financial statements of CBs must be submitted to regulators and stockholders at the end of each calendar quarter

Federal Financial Institutions Examination Council (FFIEC)

___________________________________________________ prescribes uniform principles, standards, and report forms for depository institutions

Financial information on CBs is reported in two basic documents:

Report of condition (or balance sheet) presents financial information on a bank’s assets, liabilities, and equity capital

Report of income (or income statement) presents major categories of revenues and expenses and the net profit (or loss) for a bank over a period of time

Report of condition (or balance sheet)

_______________________________ presents financial information on a bank’s assets, liabilities, and equity capital

Report of income (or income statement)

___________________________________ presents major categories of revenues and expenses and the net profit (or loss) for a bank over a period of time

off-balance-sheet (OBS) activities

All FIs, and particularly commercial banks, are engaging in an increased level of ___________________________

Cash and due from depository institutions (Assets)

Consists of vault cash, deposits at the Federal Reserve, deposits at other financial institutions, and cash items in the process of collection

None of these generates much income for the bank

Investment securities (Assets)

Consists of federal funds sold, repurchase agreements (RPs or repos), U.S. Treasury and agency securities, securities issued by states and political subdivisions (municipals), mortgage-backed securities, and other debt and equity securities

Generate some income for the bank

Highly liquid, low default risk, and can usually be traded in secondary markets

Loans and leases (Assets)

Categorized as commercial and industrial (C&I) loans, loans secured by real estate, individual or consumer loans, and other loans

Major asset items on the bank’s balance sheet and generate the largest flow of revenue income

Least liquid asset items and a major source of credit and liquidity risk for most banks

Other assets (Assets)

Consists of items such as trading assets, premises and fixed assets, other real estate owned, intangible assets, and other

Generally a small part of the bank’s overall assets

Liabilities

Liabilities consist of various types of deposit accounts and other borrowings used to fund the investments and loans on the asset side of the balance sheet

Deposits (Liabilities)

Demand deposits are transaction accounts that generally pay no explicit interest

Negotiable order of withdrawal (NOW) accounts pay interest when a minimum balance is maintained

Money market deposit accounts (MMDAs) have retail savings accounts and some limited checking account features

Other savings deposits include all savings accounts other than MMDAs

Deposits in foreign offices are generally large and held by corporations with a high level of international transactions and activities

Retail certificates of deposits (CDs) are time deposits with a face value below $100,000

Core deposits

Wholesale certificates of deposits (CDs) are time deposits with a face value of $100,000 or more

Negotiable instruments, meaning they can be resold by title assignment in a secondary market to other investors

If wholesale CDs are obtained through a brokerage or investment house rather than directly from a customer, they are referred to as brokered deposits

Negotiable order of withdrawal (NOW) accounts

___________________________________________ pay interest when a minimum balance is maintained

Money market deposit accounts (MMDAs)

____________________________________ have retail savings accounts and some limited checking account features

Other savings deposits

______________________ include all savings accounts other than MMDAs

international transactions and activities

Deposits in foreign offices are generally large and held by corporations with a high level of _________________________________

Retail certificates of deposits (CDs)

_______________________________ are time deposits with a face value below $100,000

Wholesale certificates of deposits (CDs) are time deposits with a face value of $100,000 or more

Negotiable instruments, meaning they can be resold by title assignment in a secondary market to other investors

If wholesale CDs are obtained through a brokerage or investment house rather than directly from a customer, they are referred to as brokered deposits

Wholesale certificates of deposits (CDs)

___________________________________ are time deposits with a face value of $100,000 or more

Negotiable instruments

___________________, meaning they can be resold by title assignment in a secondary market to other investors

brokered deposits

If wholesale CDs are obtained through a brokerage or investment house rather than directly from a customer, they are referred to as ________________

Borrowed funds (Liabilties)

Federal funds

Repurchase agreements (RPs or repos)

Other borrowing

Banker’s acceptances (BAs), commercial paper, medium-term notes, and discount window loans

Other liabilities (Liabilities)

Do not require interest to be paid

Accrued interest, deferred taxes, dividends payable, minority interests in consolidates subsidies, and other miscellaneous claims

Equity capital (Liabilities)

Preferred and common stock

Surplus and additional paid-in capital

Retained earnings

Off-balance-sheet items

____________________ are contingent assets and liabilities that may affect future status of a FI’s balance sheet

Loan commitments are contractual commitments to loan to a firm a certain maximum amount at given interest rate terms (Off-Balance-Sheet Assets and Liabilities)

Bank may charge up-front fee and/or commitment fee

Only when the borrower draws on the commitment do the loans made under the commitment appear on the balance sheet

Loan commitments

___________________ are contractual commitments to loan to a firm a certain maximum amount at given interest rate terms

up-front fee | commitment fee

Bank may charge ___________ and/or ______________

Letters of credit (LCs) (Off-Balance-Sheet Assets and Liabilities)

Commercial LCs are contingent guarantees sold by an FI to underwrite the trade or commercial performance of the buyers of the guarantees

Standby LCs cover contingencies that are potentially more severe than contingencies covered under trade/commercial LCs

Commercial LCs

_________________ are contingent guarantees sold by an FI to underwrite the trade or commercial performance of the buyers of the guarantees

Standby LCs

____________ cover contingencies that are potentially more severe than contingencies covered under trade/commercial LCs

Loans sold are loans originated by the bank and then sold to other investors that can be returned (sold with recourse) to the originating institution (Off-Balance-Sheet Assets and Liabilities)

Recourse is the ability to put an asset or loan back to the seller should the credit quality of that asset deteriorate

Loans sold

______________ are loans originated by the bank and then sold to other investors that can be returned (sold with recourse) to the originating institution

Recourse

______________ is the ability to put an asset or loan back to the seller should the credit quality of that asset deteriorate

Derivative securities include futures, forward, swap, and option positions taken by the FI for hedging or other purposes (Off-Balance-Sheet Assets and Liabilities)

Banks can be either users or dealers of derivatives

Counterparty, or contingent credit, risk is likely to be present when banks expand their positions in futures, forward, swap, and option contracts

Derivative securities

___________________ include futures, forward, swap, and option positions taken by the FI for hedging or other purposes

Trust services (Other Fee-Generating Activities)

Trust departments of commercial banks hold and manage assets for individuals or corporations

Processing services (Other Fee-Generating Activities)

Commercial banks have traditionally provided financial data processing services for their business customers, including managing a customer’s accounts receivable and accounts payable

Bank cash management services include the provision of lockbox services

Correspondent banking (Other Fee-Generating Activities)

Provision of banking services to other banks that do not have the staff resources to perform the service themselves

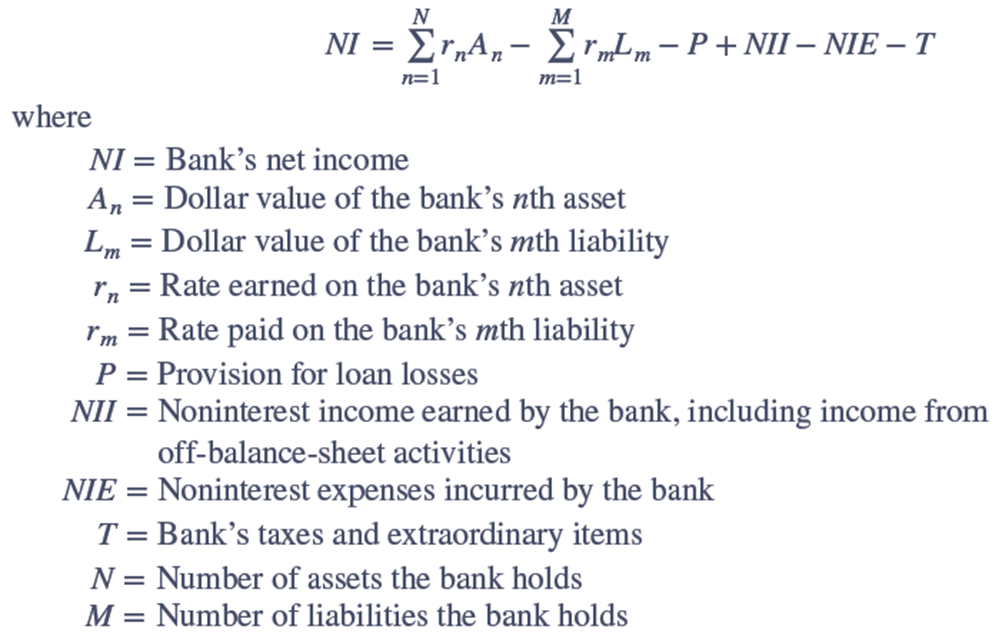

Income statement

________________ identifies interest income and expenses, net interest income, provision for loan losses, noninterest income and expenses, income before taxes and extraordinary items, and net income from on- and off-balance sheet activities

Interest income is taxable, except for that on municipal securities and tax-exempt income from direct lease financing

Interest and fee income on loans and leases is the largest interest income-producing category

Taxable equivalent interest income is equal to interest income divided by 1 minus the banks’ tax rate

Interest income

_________________ is taxable, except for that on municipal securities and tax-exempt income from direct lease financing

Interest expense

_______________ is the second major category on a bank’s income statement, and items listed here come directly from the liability section of the balance sheet

Net interest income

= interest income - interest expense

Provision for loan losses

_______________________ is a noncash, tax-deductible expense, and it is the current period’s allocation to the allowance for loan losses listed on the balance sheet

Noninterest income include all other income received by the bank as a result of its on- and off-balance sheet activities

Total operating income = interest income + noninterest income

Noninterest income

__________________ include all other income received by the bank as a result of its on- and off-balance sheet activities

Total operating income

= interest income + noninterest income

Noninterest expense items consist mainly of personnel expenses and are generally large relative to noninterest income

Items in this category include salaries and employee benefits, expenses of premises and fixed assets, and other operating expenses

For almost all banks, noninterest expense is greater than noninterest income

Noninterest expense

___________________ items consist mainly of personnel expenses and are generally large relative to noninterest income

Income before taxes and extraordinary items

_______________________________________ (i.e., operating profit) is calculated as net interest income minus provisions for loan losses plus noninterest income minus noninterest expense

Income taxes

_____________ include federal, state, local, and foreign income taxes due from the bank

Extraordinary items and other adjustments are events or transactions that are both unusual and infrequent

E.g., changes in accounting rules, corrections of accounting errors made in previous years, and equity capital adjustments

Extraordinary items

_________________ and other adjustments are events or transactions that are both unusual and infrequent

Net income is calculated as income before taxes and extraordinary items minus income taxes plus (or minus) extraordinary items

Bottom line on the income statement

Net income

____________ is calculated as income before taxes and extraordinary items minus income taxes plus (or minus) extraordinary items

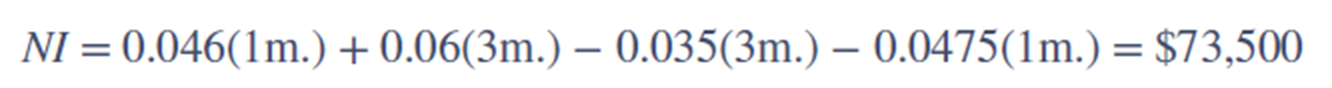

There is a direct relationship between the income statement and the balance sheet of commercial banks

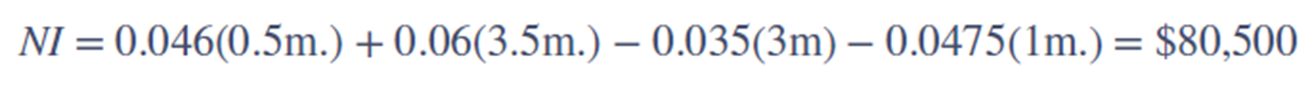

Changing the mix of assets or liabilities on the balance sheet has a direct effect on net income equal to the size of the rate difference times the dollar value of the asset or liability being changed

Suppose that a bank has the following net income:

The bank replaces $500,000 of assets currently yielding 4.60 percent with assets yielding 6 percent. As a result, net income increases by $7,000 [(6% - 4.6%) x $500,000], or

Ratio analysis allows a bank manager to evaluate the bank’s:

Current performance;

The change in its performance over time (time series analysis of ratios over a period of time); and

Its performance relative to that of competitor banks (cross-sectional analysis of ratios across a group of firms)

Uniform Bank Performance Report (UBPR)

The __________________________________ , a tool available to assist in cross-sectional analysis, summarizes the performance of banks for various peer groups, for various size groups, and by state

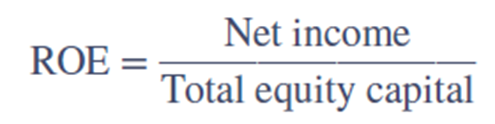

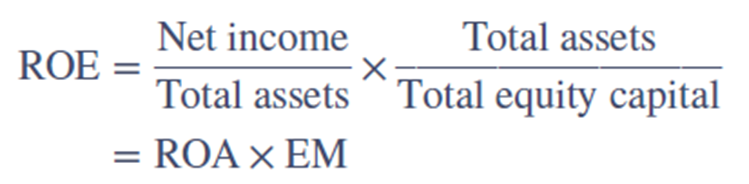

Return on equity (ROE) framework starts with ROE, and then breaks it down to identify strengths and weaknesses in a bank’s performance

ROE measures the amount of net income after taxes earned for each dollar of equity capital contributed by the bank’s stockholders

ROE can be decomposed into two component parts:

Return on assets (ROA)

____________________ determines the net income produced per dollar of assets

Equity multiplier (EM)

___________________ measures the dollar value of assets funded with each dollar of equity capital

The higher this ratio, the more leverage or debt the bank is using to fund its assets

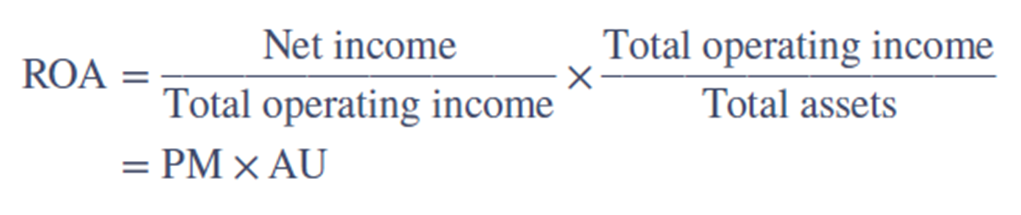

ROA can also be broken down into two components:

Profit margin (PM) measures a bank’s ability to control expenses and thus its ability to produce net income from its operating income (or revenue)

Breakdown of PM can isolate the various expense items listed on the income statement as follows:

Interest expense ratio

Provision for loan loss ratio

Noninterest expense ratio

Tax ratio

Profit margin (PM)

________________ measures a bank’s ability to control expenses and thus its ability to produce net income from its operating income (or revenue)

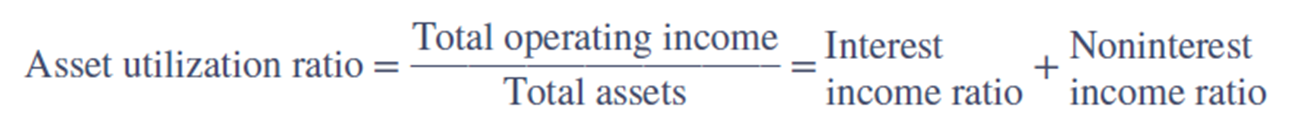

Asset utilization (AU)

___________________ measures the extent to which the bank’s assets generate revenue

Asset Utilization Ratio Formula

Net interest margin (NIM)

_____________________ measures the net return on a bank’s earning assets

Net interest margin formula

Spread

________ measures the difference between the average yield on earning assets and average cost of interest-bearing liabilities

Spread Formula

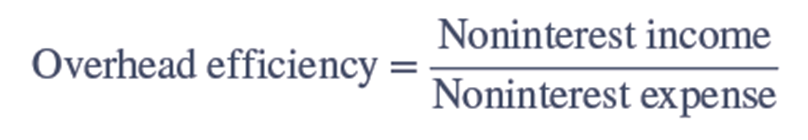

Overhead efficiency

_________________ measures the bank’s ability to generate noninterest income to cover noninterest expenses

Overhead efficiency Formula

Many components of key ratios provide additional insight into the financial stability of banks

See Table 12-6 for a decomposition of profit margin

See Table 12-7 for a decomposition of asset utilization

Retail, wholesale, and community banks operate in different market niches that should be noted when performing financial statement analysis

Large banks have greater access to purchased funds and capital markets compared to small banks

Large banks generally operating with lower amounts of equity capital than small banks

Large banks generally use more purchased funds and fewer core deposits than do small banks

Large banks tend to put more into salaries, premises, and other expenses than do small banks

Large banks tend to diversity their operations and services more than small banks, and they also generate more noninterest income