Econ unit 2 - microeconomics

1/126

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

127 Terms

demand

quantity of a good/ service that consumers are willing and able to purchase at various prices during a specific period.

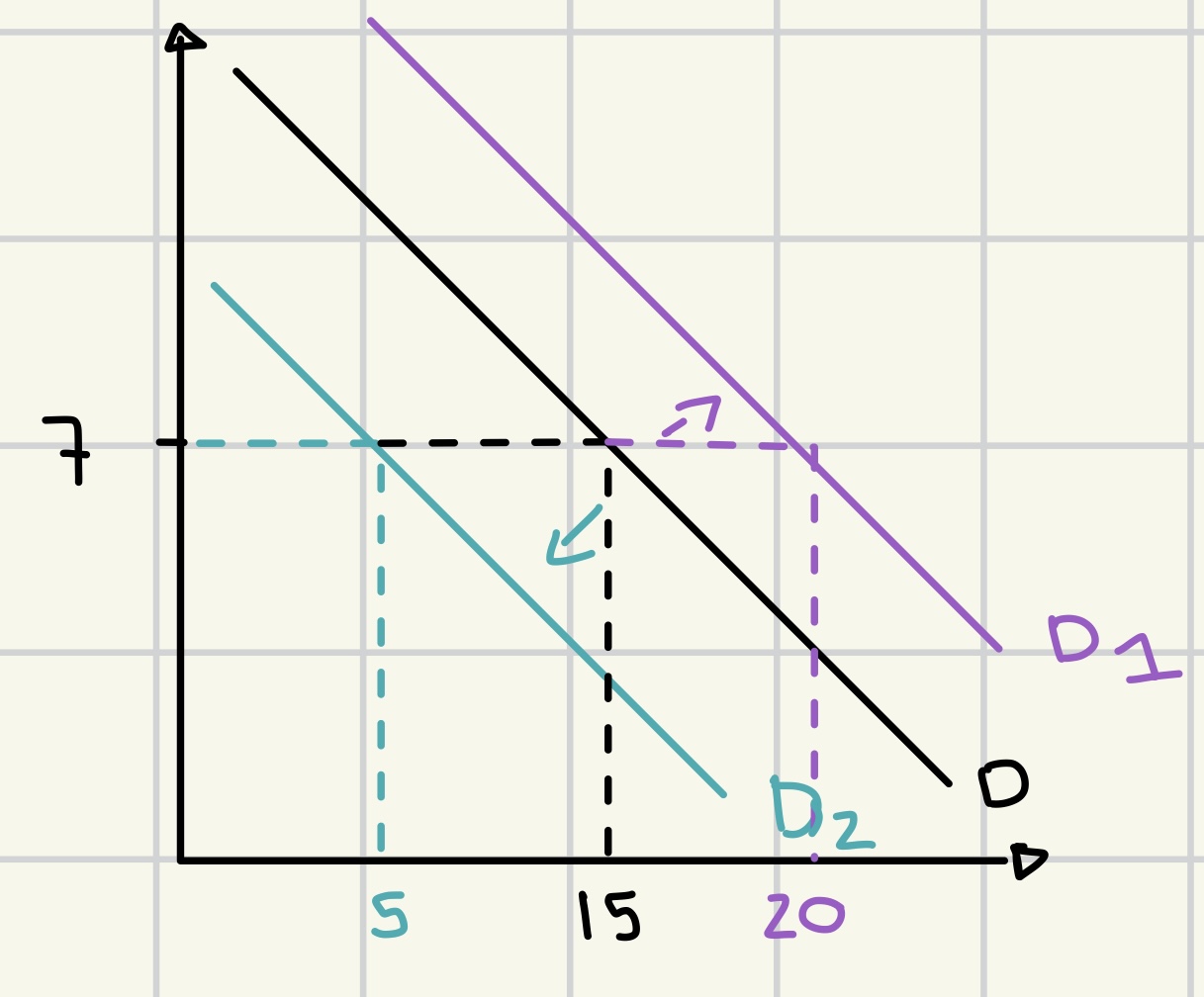

demand curve

A graphical representation of the relationship between the price of a good or service and the quantity demanded by consumers.

law of demand

price ↑= quality demanded ↓

non-price determinants of demand

income ↑ = quality demanded ↑ (D → D1)

good preference↑ = quantity demanded ↑ (D → D1)

price of substitute↑ = quantity demanded↑ (D → D1)

number of consumers ↑ = quantity demanded ↑ (D→ D1)

price of complementary goods ↑ = quantity demanded ↓ (D → D2)

supply

amount of a good or service that producers are willing and able to sell at various prices over a specific time period.

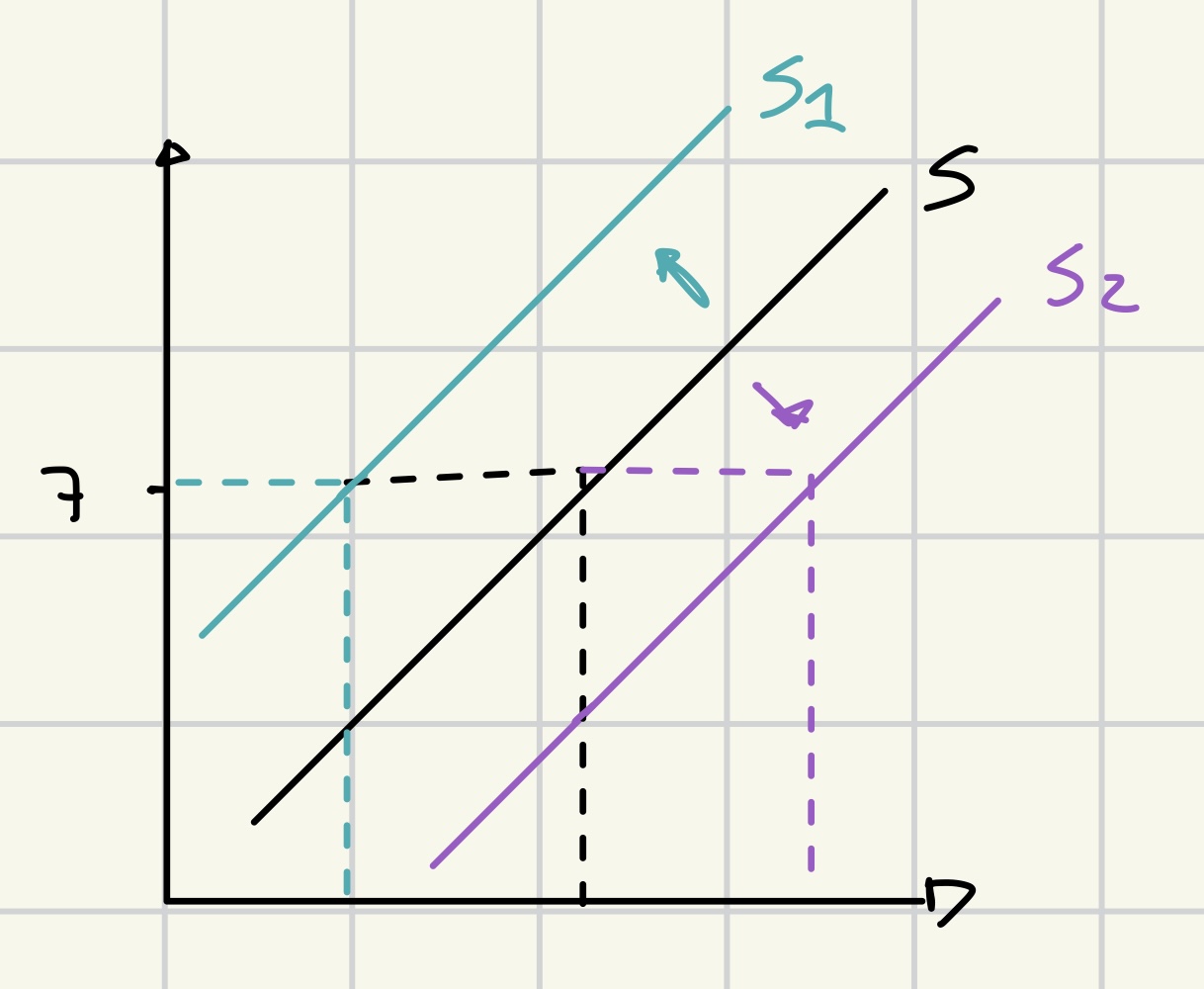

supply curve

a graphical representation of the relationship between quantity supplied and price

law of supply

price ↑ = quantity demanded ↑

non price determinants of supply

subsidies ↑ = supply ↑ (S→ S2)

new technology ↑ = supply ↑ (S→ S2)

competitors ↑ = supply ↑ (S→ S2)

cost of production ↑ = supply ↓ (S→ S1)

taxes ↑ = supply ↓ (S→ S1)

weather disaster = supply ↓ (S→ S1)

opportunity cost of related products ↑ = supply ↓ (S→ S1)

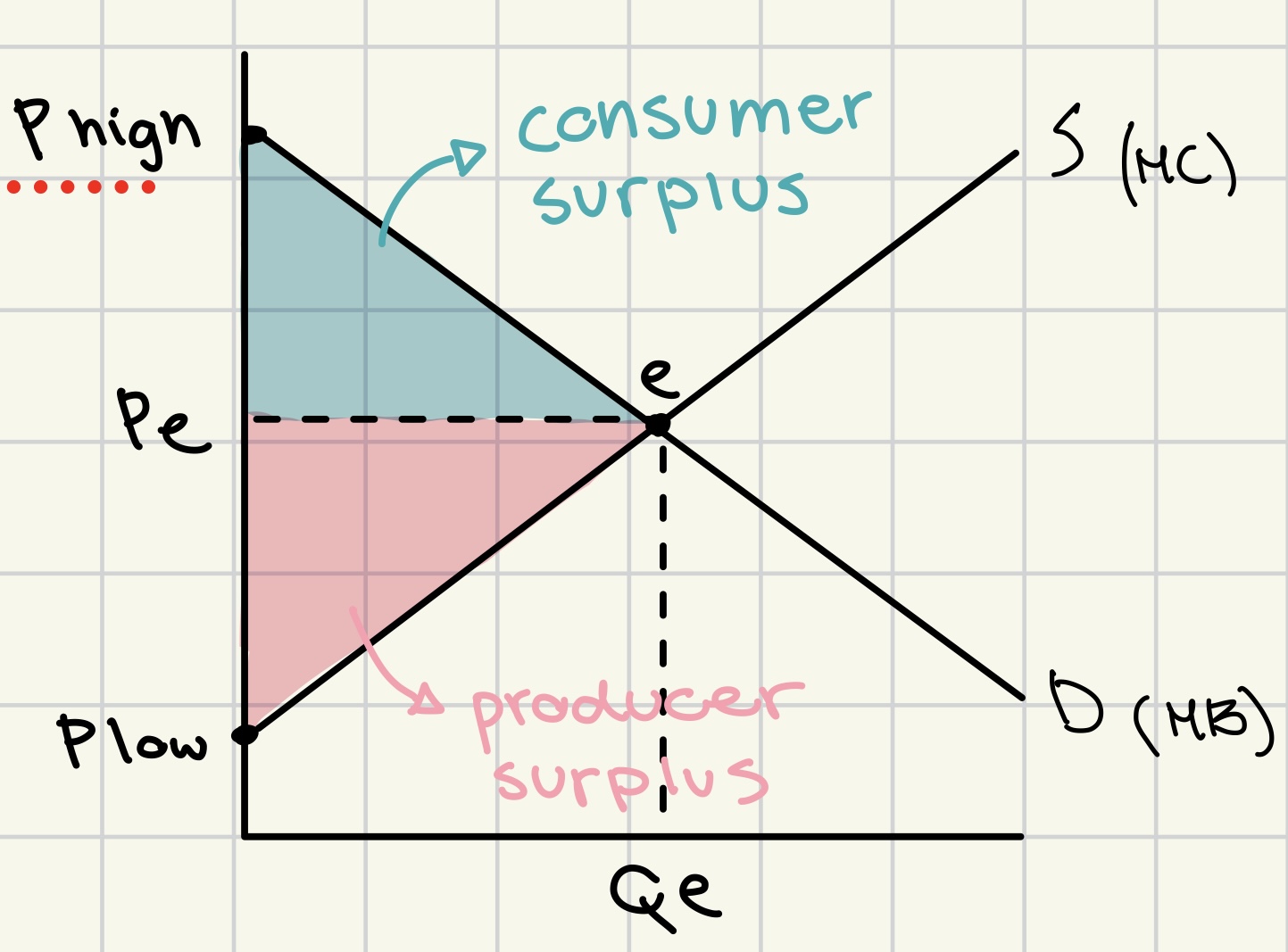

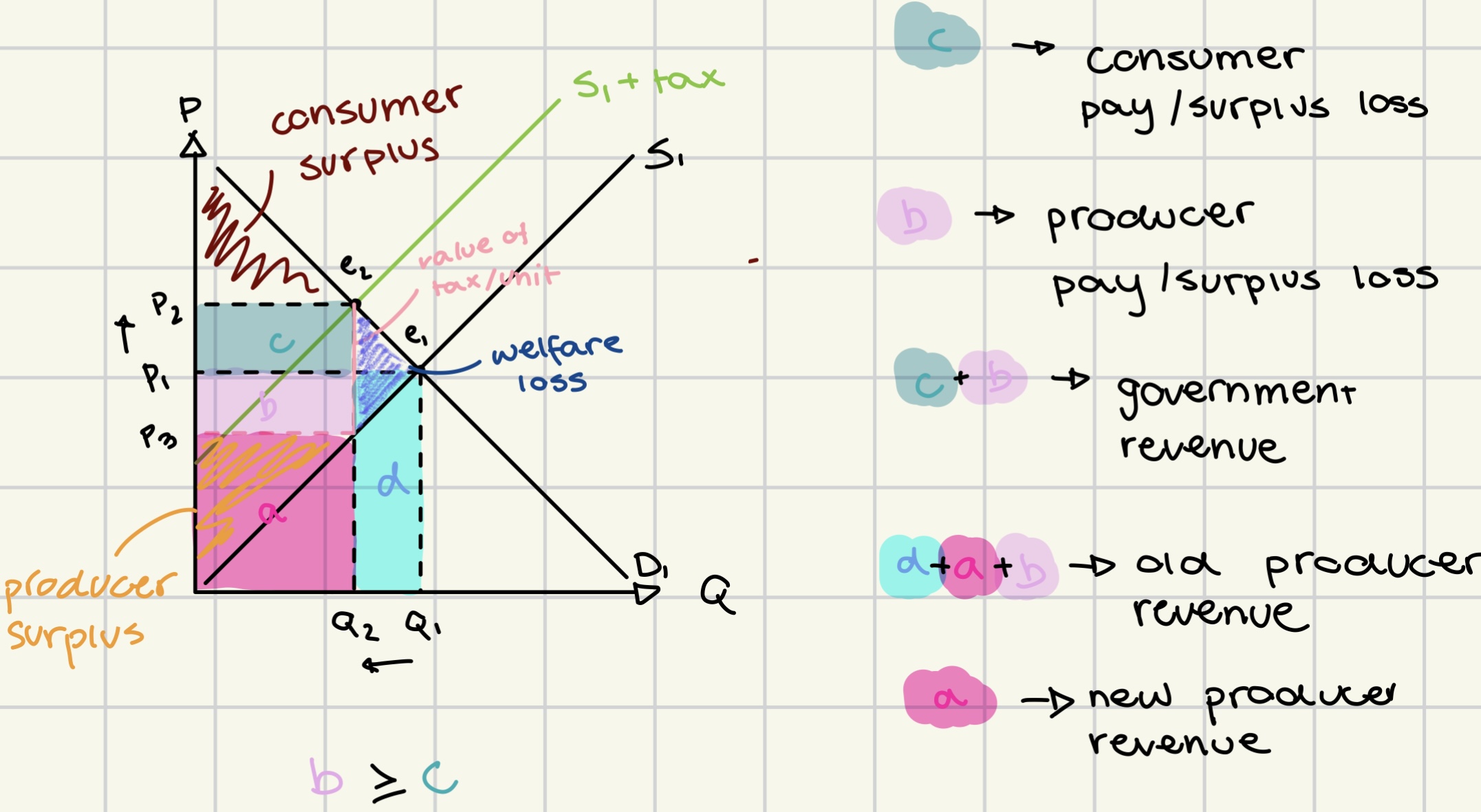

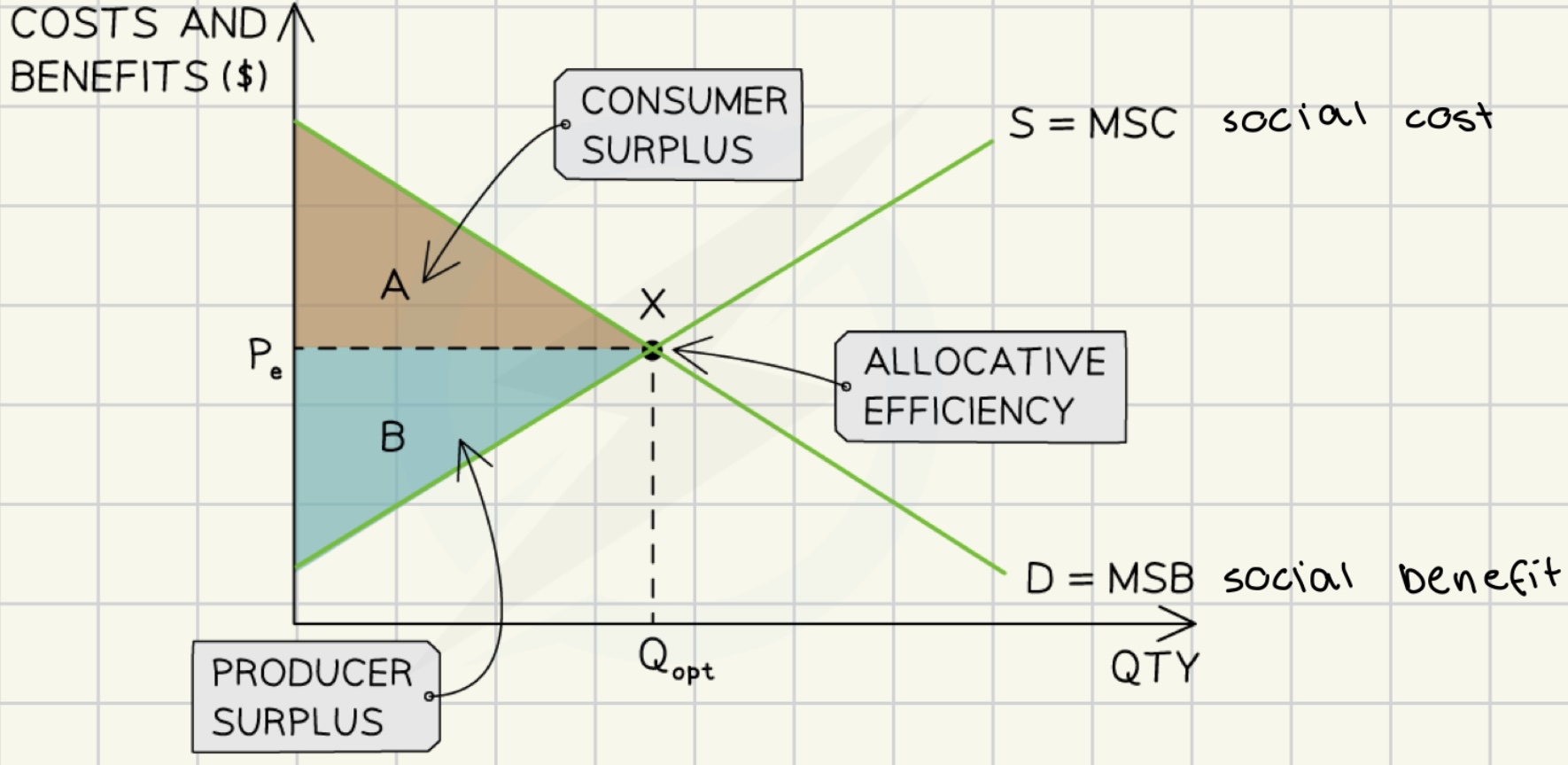

consumer surplus

difference between the amount the consumer is willing to pay for a product and the price they have actually paid

benefit gained by the consumer for purchasing the product at a lower price.

producer surplus

difference between the price producer is willing to sell a product for and the price they actually do

benefit to producers from selling at a higher price than their minimum acceptable price.

producer and consumer surplus graph

supply ↑ = producer/consumer surplus ↑

demand ↑ = producer/consumer surplus ↑

allocative efficiency/ equilibrium

resources are distributed in a way that maximizes total societal welfare

quantity of a good produced is equal to the quantity demanded.

productive efficiency

at minimum average total cost

all resources are utilized effectively.

traditional economic theory

Focuses on supply and demand to determine prices and allocation of resources in a market.

consumer rationality

utility maximization

perfect information

limitations of the assumptions of rational consumer choice

biases

bounded rationality

bounded self-control

bounded selfishness

imperfect information

forms of biases

based on experience

framing ‘20% fat vs 80% fat free’

anchoring (seller suggest a higher price than the real value)

availability bias

bounded rationality theory

individuals make decisions based on the limited information available to them, leading to less-than-optimal choices.

bounded self control

the tendency to struggle with making choices that align with long-term goals due to immediate temptations and distractions.

bounded selfishness

the tendency of individuals to prioritize their own interests over the collective good, often leading to suboptimal outcomes for the group.

imperfect information

the situation where all relevant information is not available to consumers or producers, leading to suboptimal decision-making in markets.

types of choice

default

restricted

mandated

nudge theory EAST

using reinforcement and indirect suggestions can influence the motivation and decision-making of individuals.

E - easy → simplify

A - attractive → gain people’s attention

S - social → individuals may be influenced by others doing said thing

T - timely → identify when people are most responsive

advantages of nudge theory

cost effective

preserves freedom of choice

improves public health

improves decision making

improves sustainability

encourages positive behavior change.

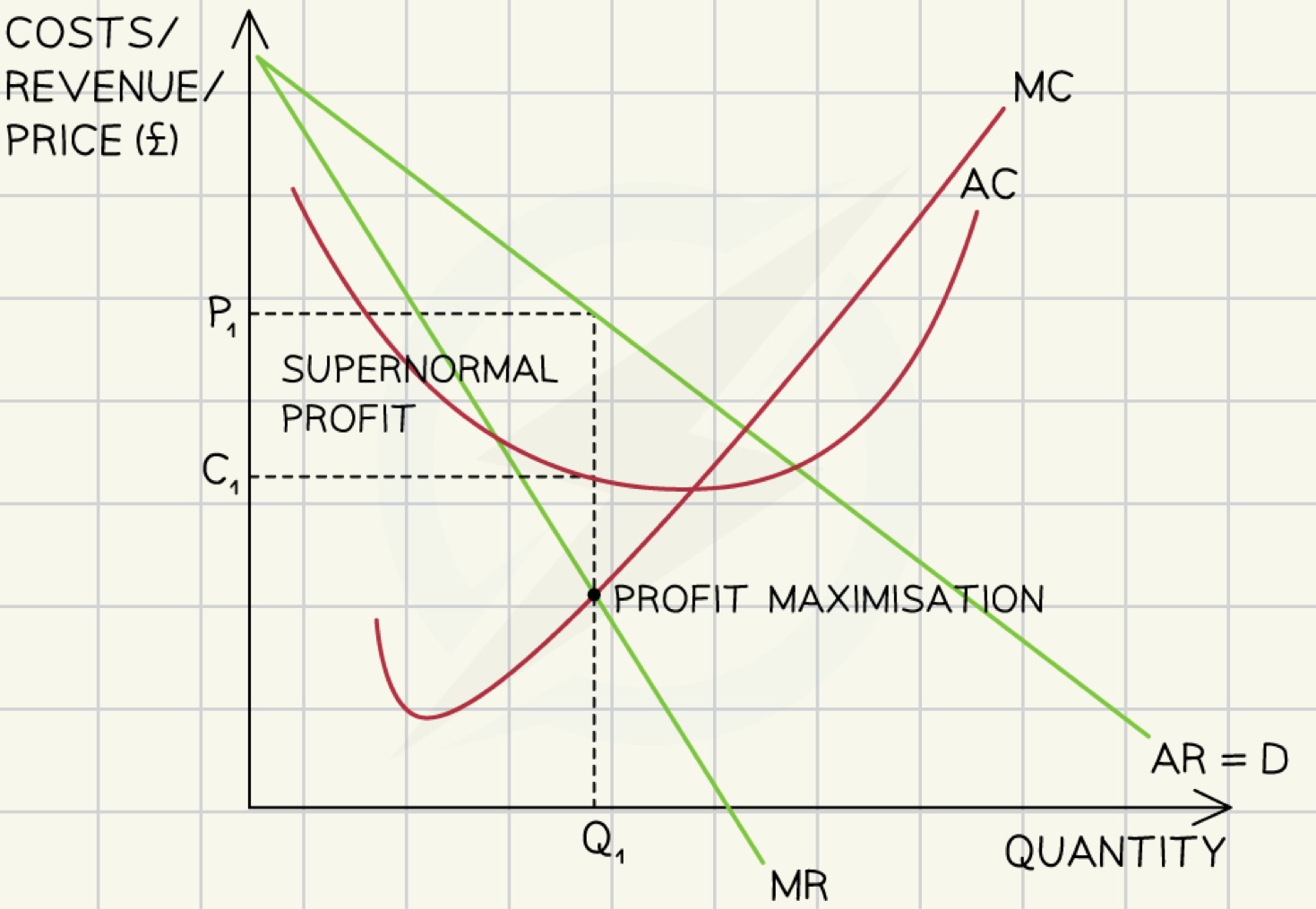

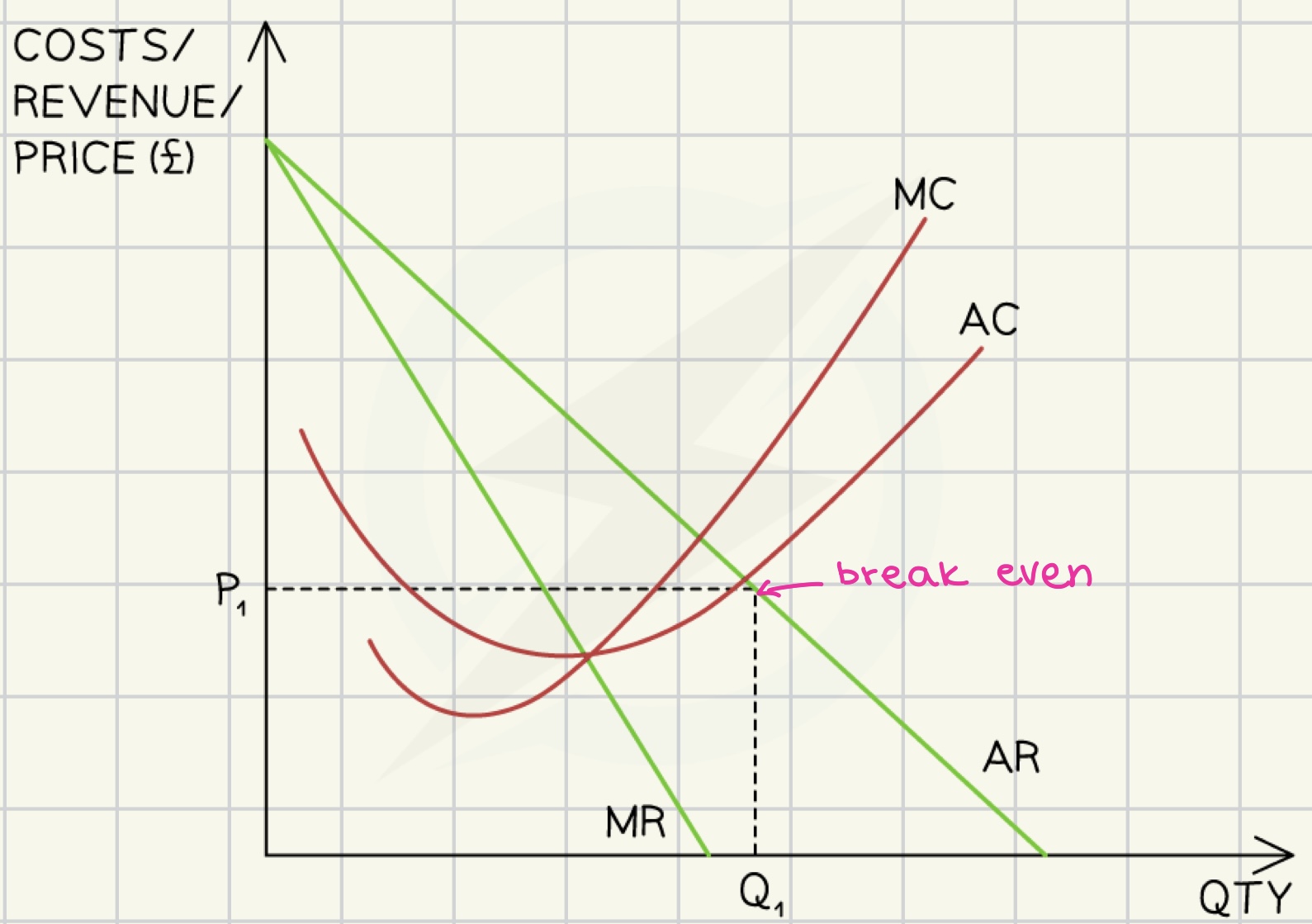

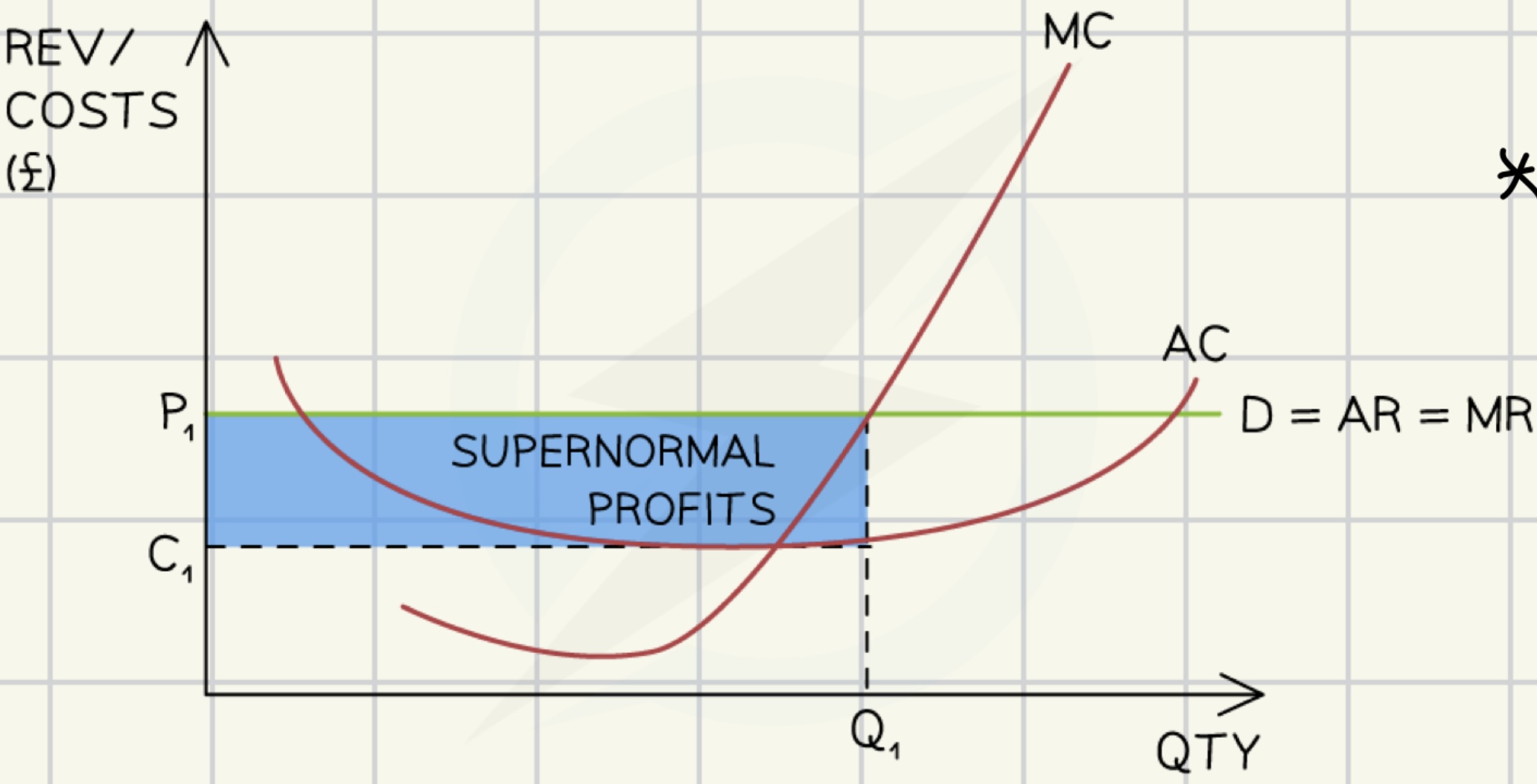

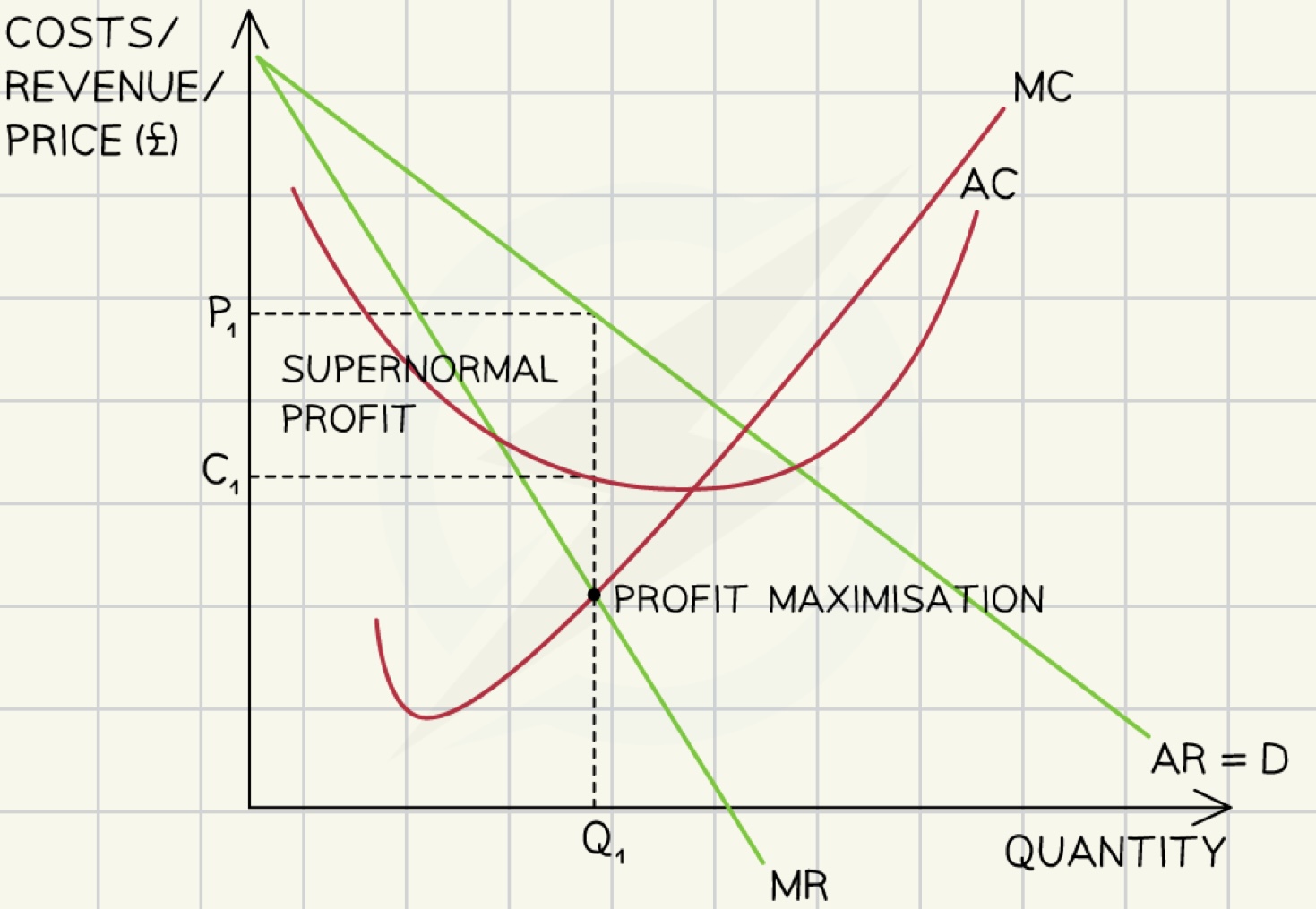

profit maximization

the process of increasing profit by determining the most effective level of production and pricing strategy.

marginal costs = marginal revenue

→ beyond this point with each unit produced marginal loss occurs

p1 = selling price

c1 = average cost

super-normal profit = total revenue> total costs

advantages of profit maximization

enables financial stability and growth

enhances shareholder values

efficient allocation of resources

drives innovation and competitiveness

disadvantages of profit maximization

ethical and social concerns

may neglect long-term sustainability and employee welfare.

lack of knowledge about the point of profit maximization

often results in higher prices for consumers

growth

an increase in the capacity of an economy to produce goods and services over time, often measured by GDP.

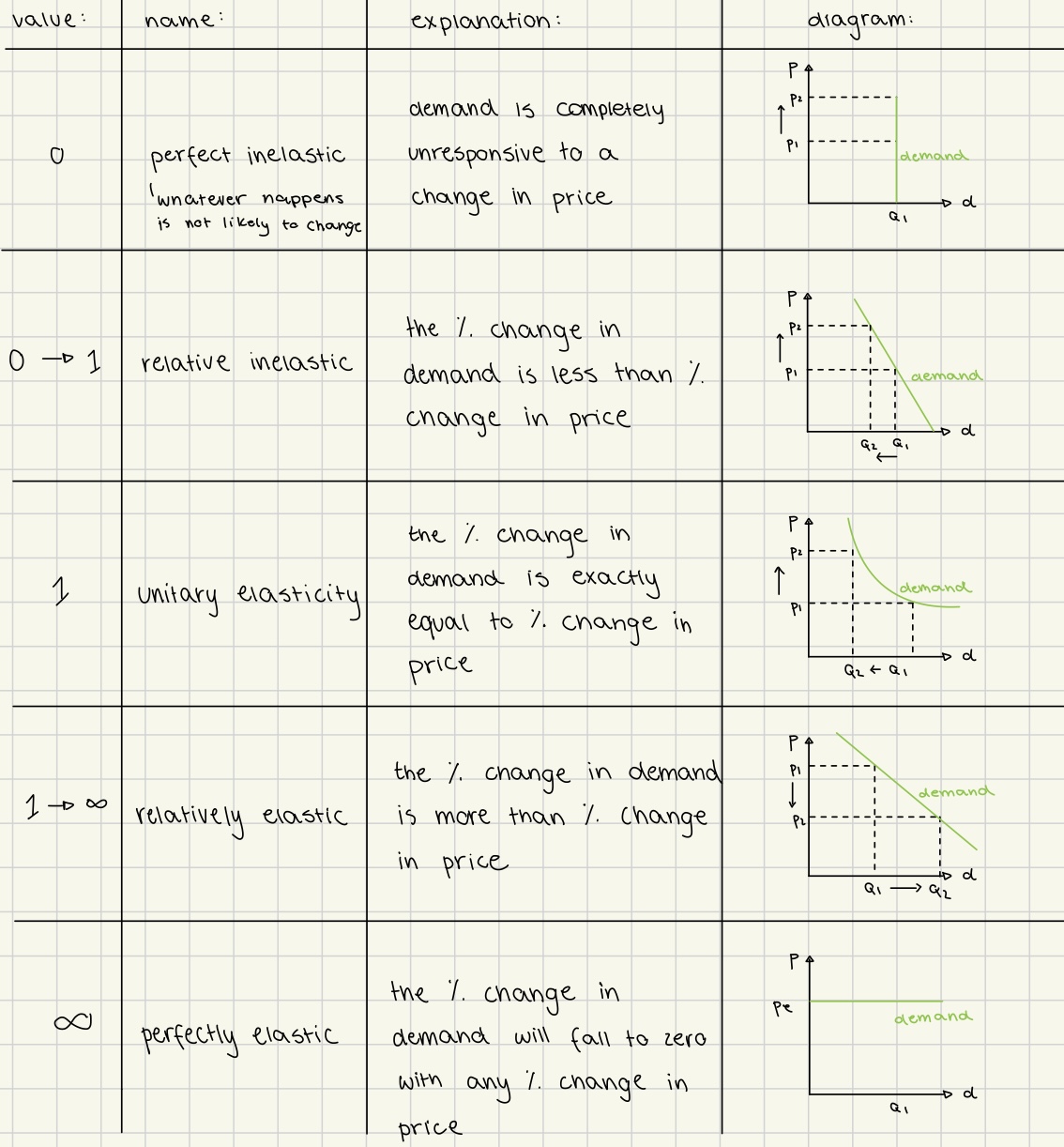

price elasticity of demand

measure of how responsible the quality demanded is to a change in its price

indicates consumers’ sensitivity to price changes

price↑ = demand ↓

price elasticity of demand formula

PED = % change in quantity demanded / % change in price

interpreting PED values

determinants of PED

availability of substitutes ↑ = PED ↑

addictiveness of the product ↑ = PED↓

price of products as proportion of income ↓ = PED ↓

consumers are less responsive to price changes of cheap products

time period

short term = low PED

long term = high PED

total revenue rule

to maximize revenue businesses should

increase the price of products that are inelastic in demand

big increase in price results in small decrease in demand

decrease the price of products that are elastic in demand

small decrease in price results in big increase in demand

income elasticity of demand YED

measures the responsiveness of demand for a product to changes in consumer income

positive YED indicates that a good is a normal good,

negative YED signifies an inferior good.

influenced by factors that affect the wages

minimum wage

taxes

YED formula

YED = % change in quantity demanded / % change in income

YED values

inferior goods

YED<0

income ↑ = demand ↓

normal goods

YED>0

income↑ = demand↑

luxury goods

YED> 1

income↑ = demand↑↑

price elasticity of supply PES

measures the responsiveness of the quantity supplied of a good to changes in its price.

higher PES value indicates that supply is more responsive to price changes.

PES formula

PES = % change in quantity supplied / % change in price

PES values

0 → perfectly inelastic/ unresponsive

0-1 → relatively inelastic

1→ relatively elastic

1-∞→ perfectly elastic/fully responsive

determinants of PES

production time ↑= PES↑

availability of resources↑ = PES ↑

flexibility of the production process = PES ↑

reasons for government interventions into the market

to support firms

intervene to support key industries

to promote equity

intervene to reduce opportunity gap between rich and poor

to collect government revenue

provision of essential services, public and merit goods

to support poorer households

to correct market failures

intervene to influence level of consumption/ production

methods of government interventions

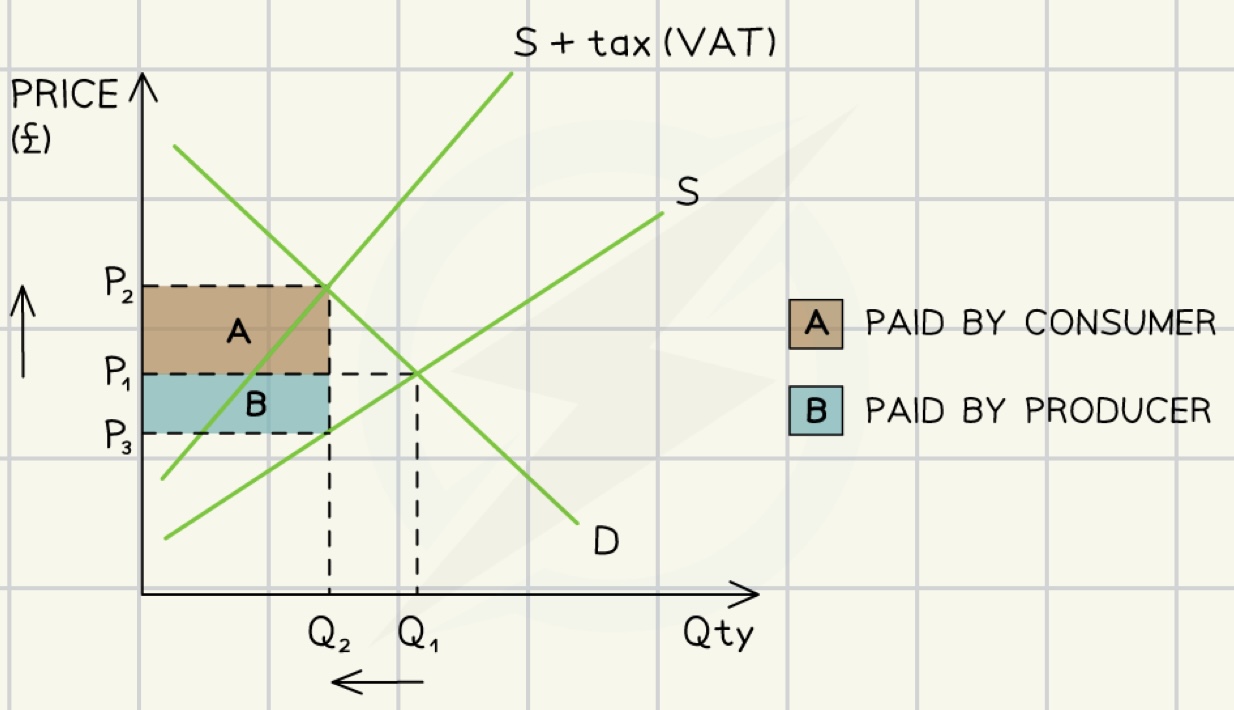

indirect taxes

subsidies

price controls

price ceilling

price floor

taxes types

direct

income tax

indirect

goods and services tax

direct taxes types

progressive (more you earn more you pay, tax brackets)

flat/ fixed

regressive (more you earn less you pay)

indirect taxes types

general taxes (on all goods and services)

excise taxes

on alcohol

tobacco

sugar

indirect taxes

imposed on government causing supply curve to shift left

ad valorem VAT indirect tax

amount of good/service↑ = tax↑

specific indirect tax

fixed tax per unit of output

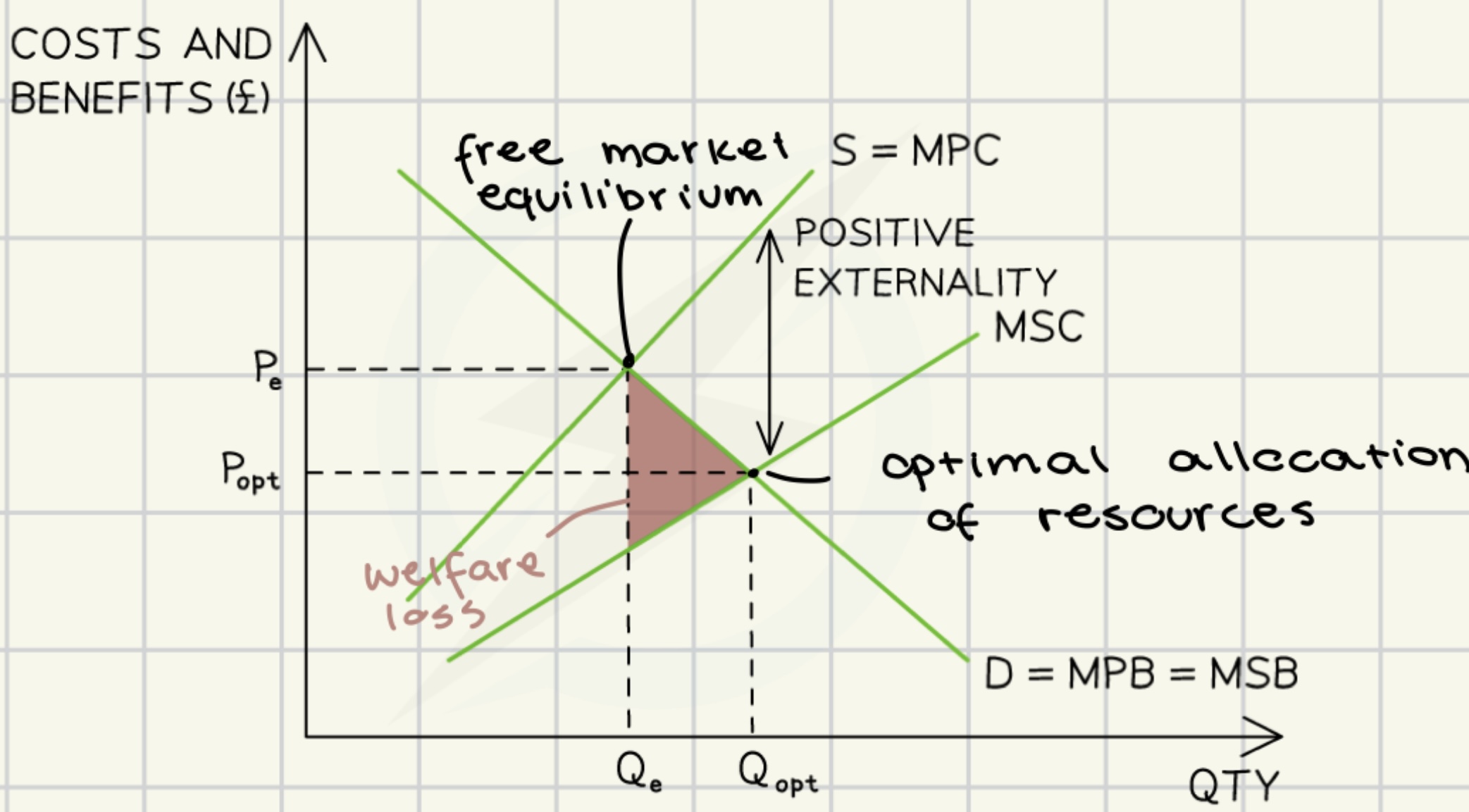

welfare loss

cost to society caused by the lack of efficiency in the allocation of resources

advantages of indirect taxes

raises price and lowers demand for demerit goods

raises revenue for government

disadvantages of indirect taxes

tax may be ineffective on demerit goods

helps develop illegal/ grey markets

may lead to staff layover due to lower demand

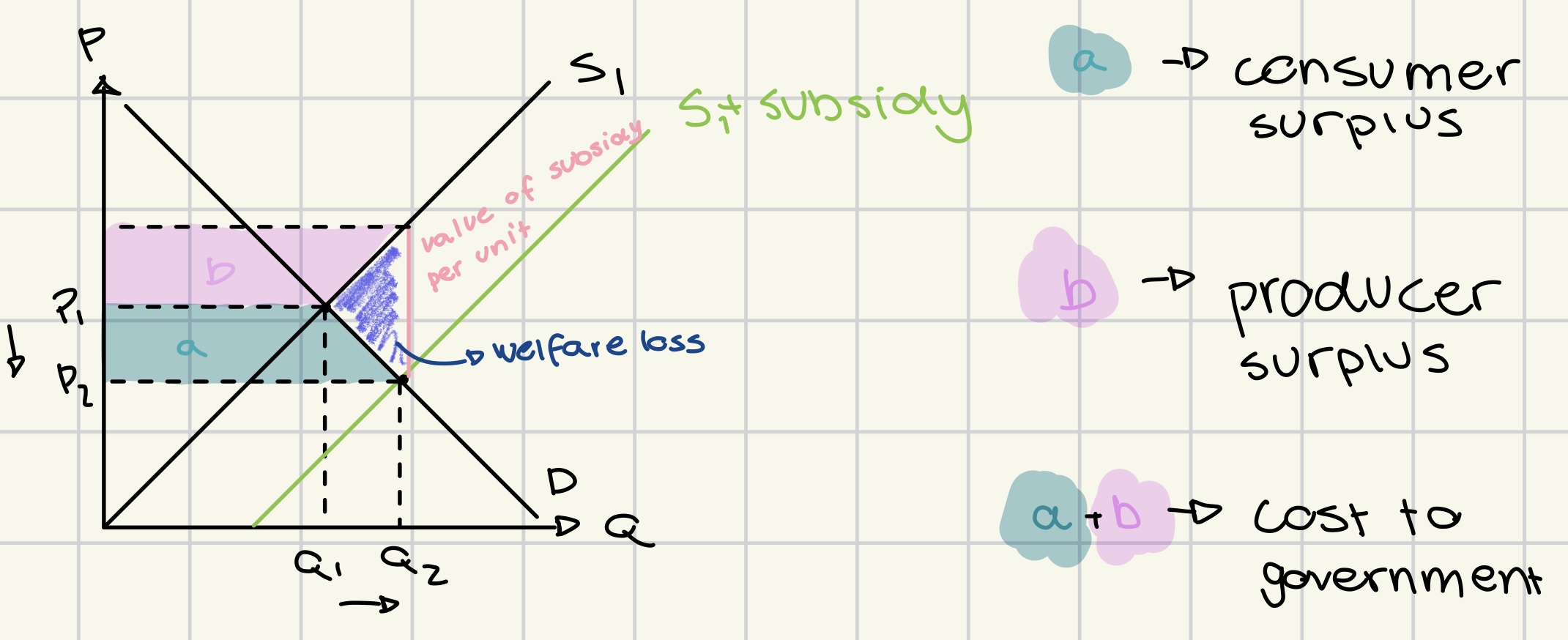

subsidies

financial assistance given by the government

to increase production

to increase provision of merit goods

to reduce costs

to support employment

advantages of subsidies

financial benefits for producers

lowers prices for consumers

increases supply of merit goods

wealth redistribution

may benefit lower-income individuals

encourages economic growth.

disadvantages of subsidies

opportunity cost

over-dependency

may stifle innovation and efficiency improvements

fairness concerns

mis-allocation of resources

fossil fuel subsidy may discourage investment in green energy

environmental and social impacts

price controls

government regulations that set maximum or minimum prices for goods and services to stabilize the economy.

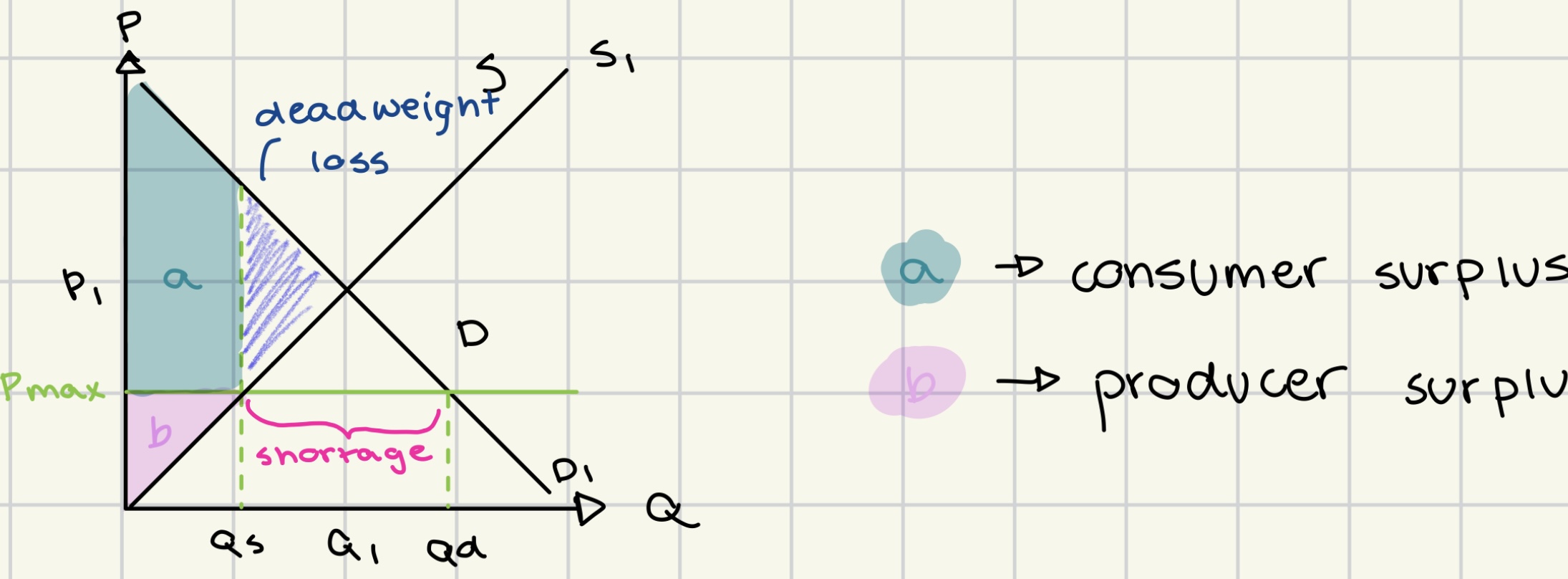

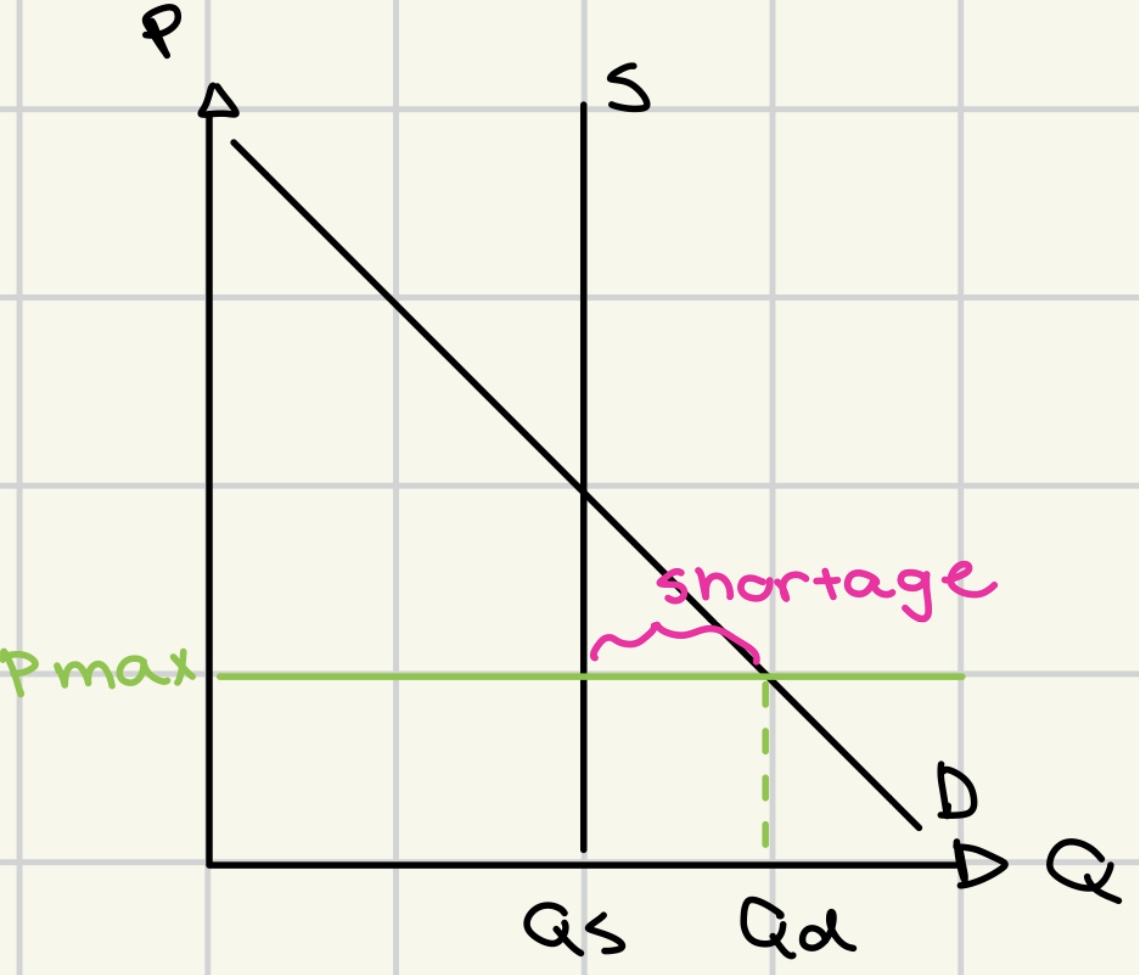

price ceiling

government-set maximum price that can be charged for a good or service

to protect consumers from excessively high prices.

government use of price ceiling

long period of time

rent control

medicine for chronic conditions

short period of time

to stabilize markets that have increased prices due to unusual context

advantages of price ceiling

increased consumer surplus

benefit from lower prices

can protect vulnerable consumers during disasters

can prevent monopolies from setting excessively high prices

disadvantages of price ceiling

shortages

decreased producer surplus

reduces quality

wastage/ over-consumption/ inefficient allocation of scarce resources

creation of illegal/ grey markets

government may have to supply the product to meet the excess demand of necessities

fixed supply and price ceiling (concert tickets)

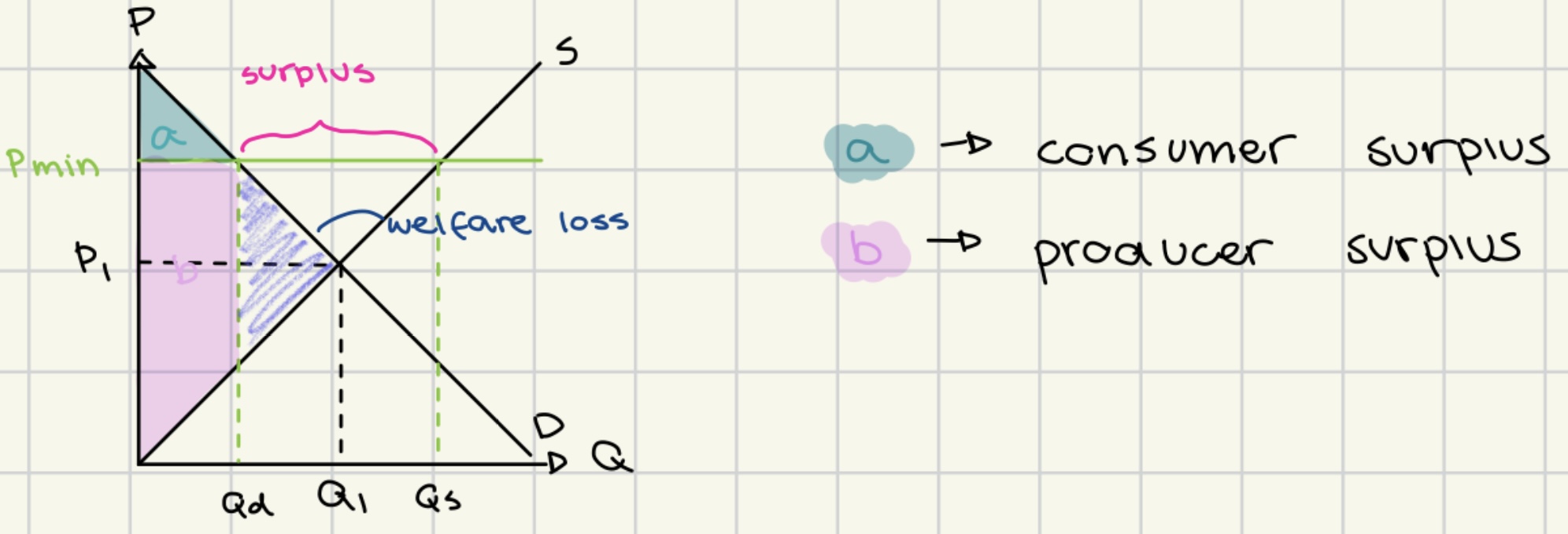

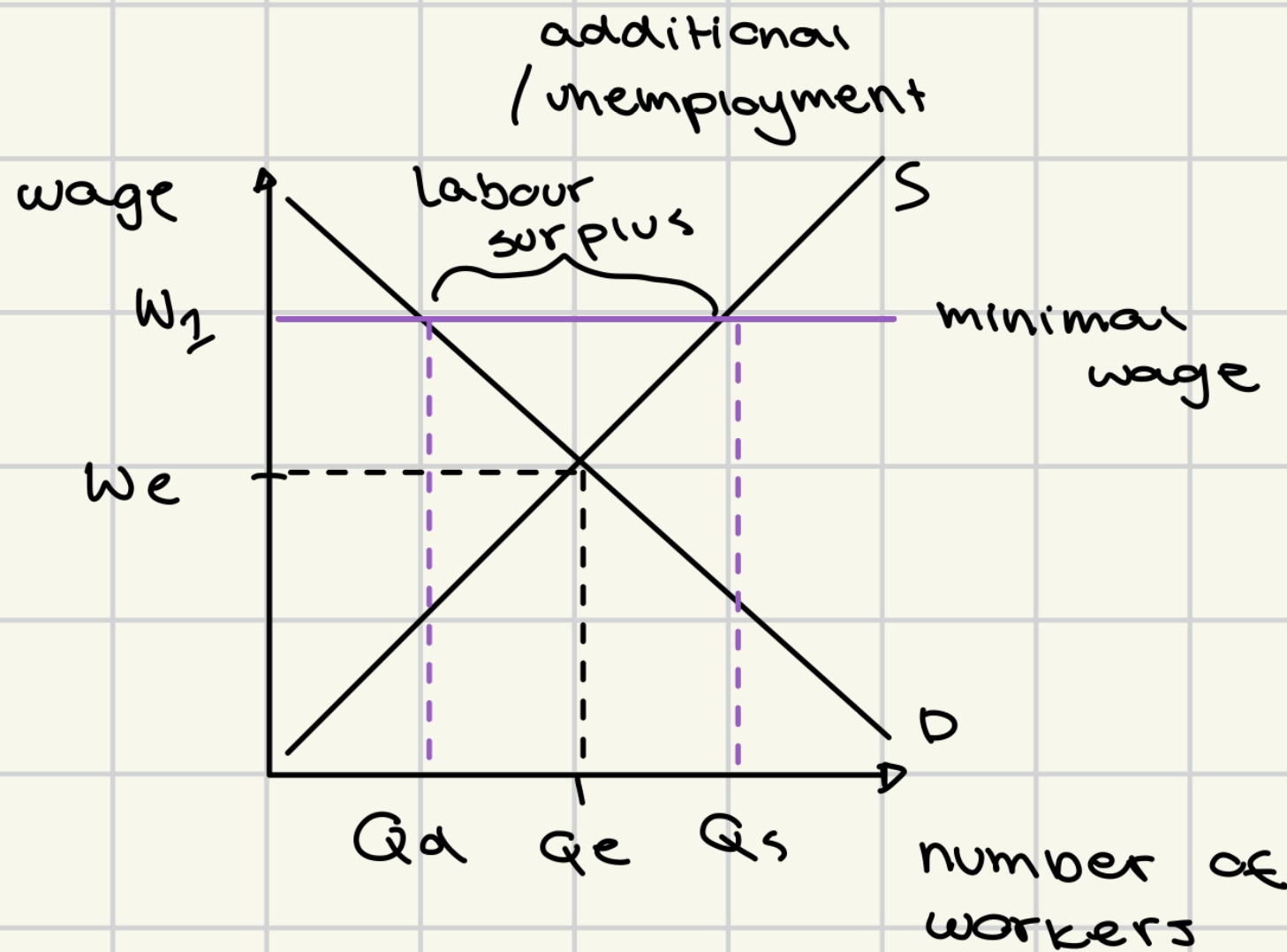

price floor

a minimum price set by the government to prevent prices from being too low

to ensure producers have a fair price

often applied in agricultural markets

government use of price floor

help producers earn more in times of crisis

decrease consumption of a demerit good

to protect workers from wage exploitation

minimal wage

advantages of price floor

increased producer surplus

minimal compensation secured for suppliers

prevention of price fluctuations and market stability

disadvantages of price floor

supply surplus

decreased consumer surplus

potential unemployment

increased prices for consumers

black markets may emerge.

minimum wage

advantages of minimum wage

increased income for workers

reduction of poverty

improved worker productivity and morale.

disadvantages of minimum wage

potential job loss

higher costs od production

reduced demand for low-skilled labor

market failure

occurs when the allocation of resources, goods and services is less than optimal

causes of market failures

public goods

common pool resources

negative externalities of consumption

negative externalities of production

positive externalities of consumption

positive externalities of production

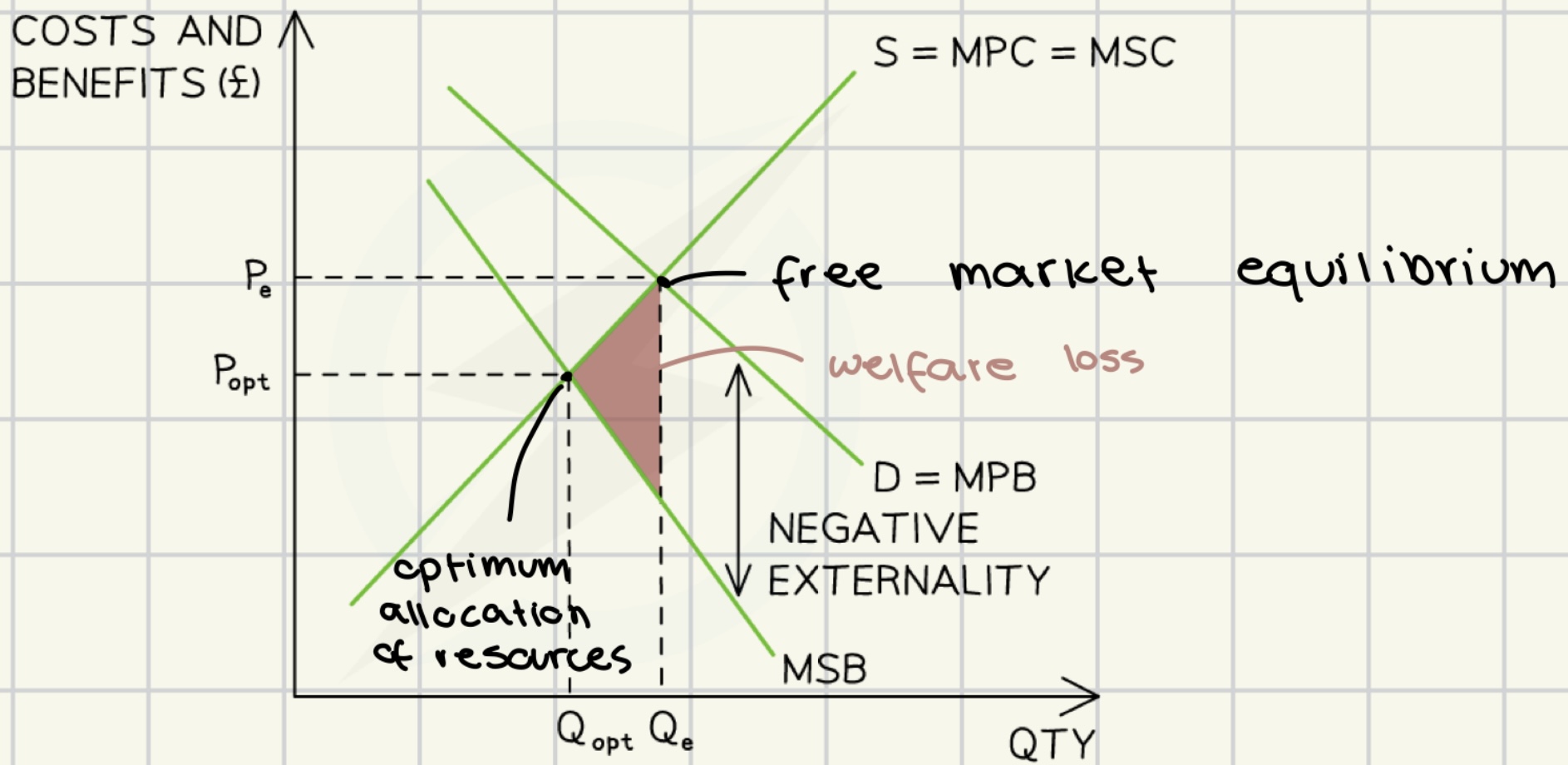

marginal private benefit MPB

the additional benefit received by consumers from consuming one more unit of a good or service.

marginal private cost MPC

the additional cost incurred by producers for producing one more unit of a good or service.

marginal social benefit MSB

the total benefit to society from the consumption of one more unit of a good or service.

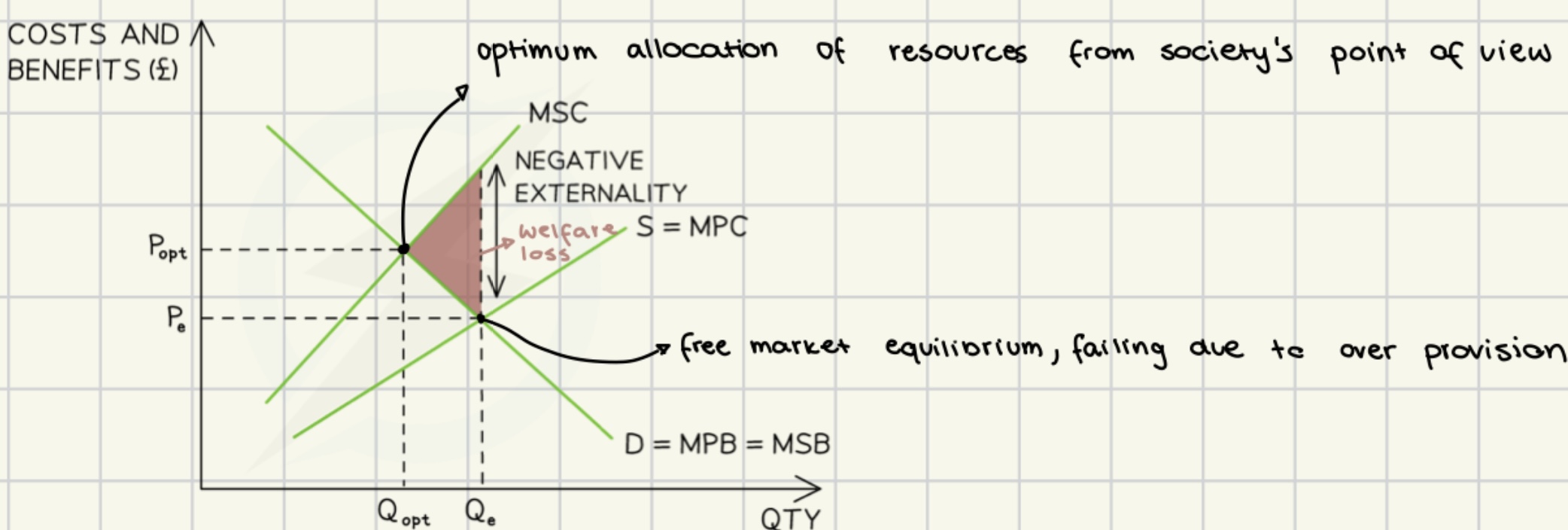

marginal social cost MSC

the total cost to society of producing one more unit of a good or service.

socially optimum output

MSB = MSC

level of output desired without market failure

negative externalities of production

created during production

failing due to over-provision

producers only consider private and not external costs

air pollution, water contamination, health problem

ways of correcting negative externality of production

taxation

regulation and legislation

subsidies

tradable permits

negative externalities of consumption

caused during consumption of demerit goods

failing due to over-consumption

consumers consider only private costs and not external

waste

ways of correcting negative externalities of consumption

education

taxation

regulation

campaigns and advertisements to improve consumer behavior

demerit goods

Goods that are considered harmful to individuals and society

merit goods

Goods that are deemed beneficial for individuals and society, often under-consumed if left to the market.

positive externalities of production

created during production

market is failing due to under-provision

only private benefits are considered by producers and not external

ways of correcting positive externalities of production

subsidies

regulations

direct government provision of goods that enhance social benefits.

price floor

positive externalities of consumption

created during consumption of merit goods

failing due to under-consumption

customers only consider private benefit and not external

ways of correcting positive externalities of consumption

subsidies to consumers

public awareness campaigns

government provision of merit goods

consumer nudges

perfect/ symmetric information

A situation where all consumers and producers have equal access to all relevant information, leading to optimal decision-making in the market.

imperfect/ asymmetric information

A situation where one party in a transaction has more or better information than the other, leading to suboptimal decision-making in the market.

government responses to assymetric information

government responses

regulation

provision of information

licensure (obtaining a license by service/ good provider)

private responses

screening/ research by buyers

signalling by sellers

eg. warranties, brand name, service records

moral hazard

when one party takes risks, but doesn’t face full costs of the risks because the full costs are borne by the other party

buyers of insurance change their behavior after obtaining insurance, so that the outcome works against the interests of the seller of insurance

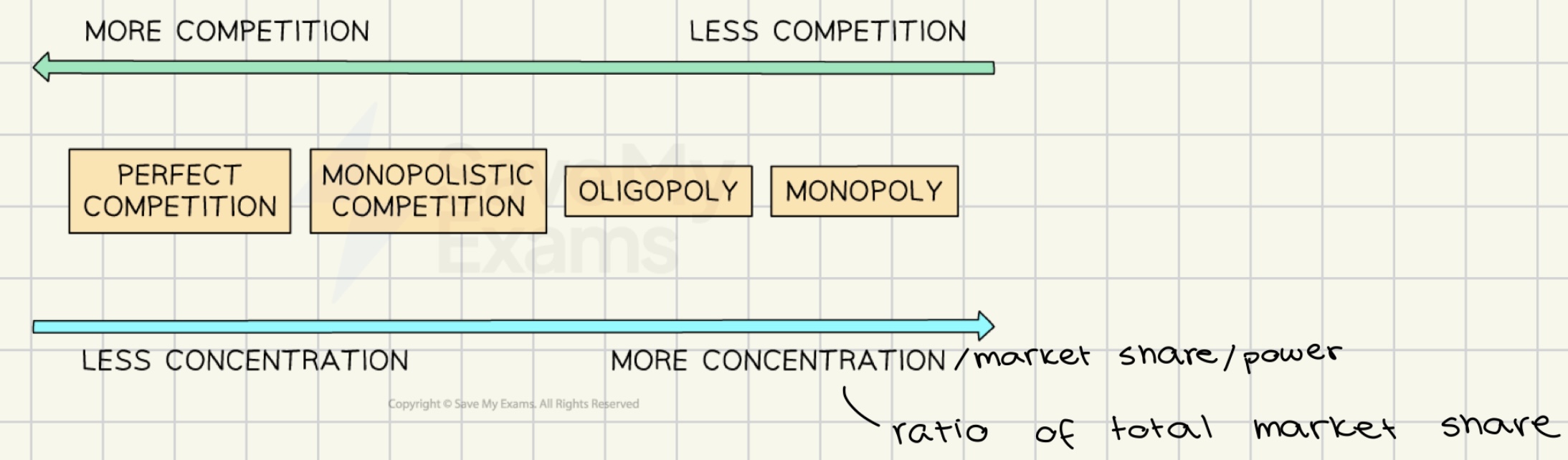

market structures

perfect competition

imperfect competition

monopolistic competition

oligopoly

monopoly

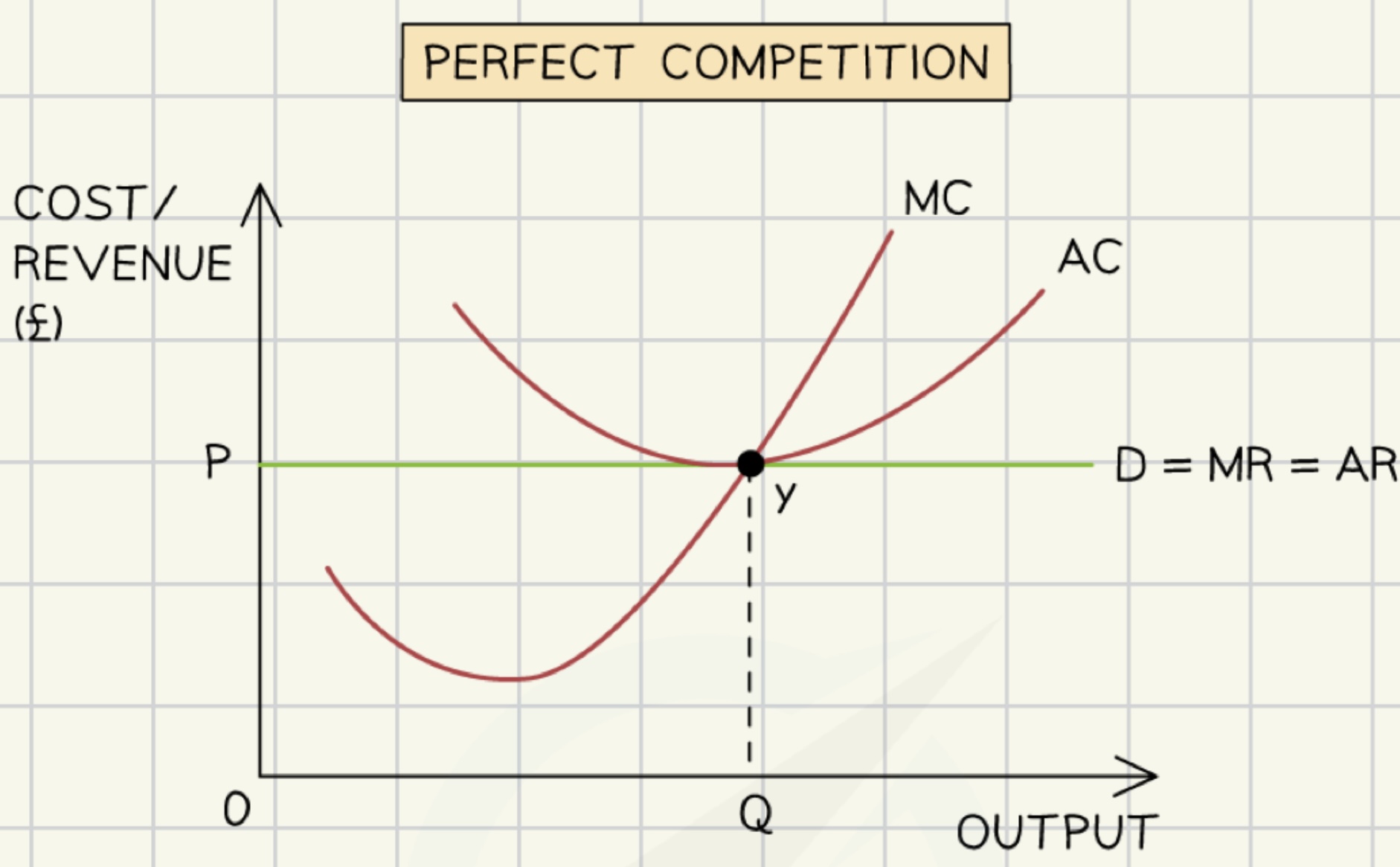

perfect competition

A market structure characterized by

many small firms

homogeneous products

no barriers to entry or exit

no market power

perfect knowledge

perfect competition

leading to optimal outcomes for consumers and producers.

eg. agriculture

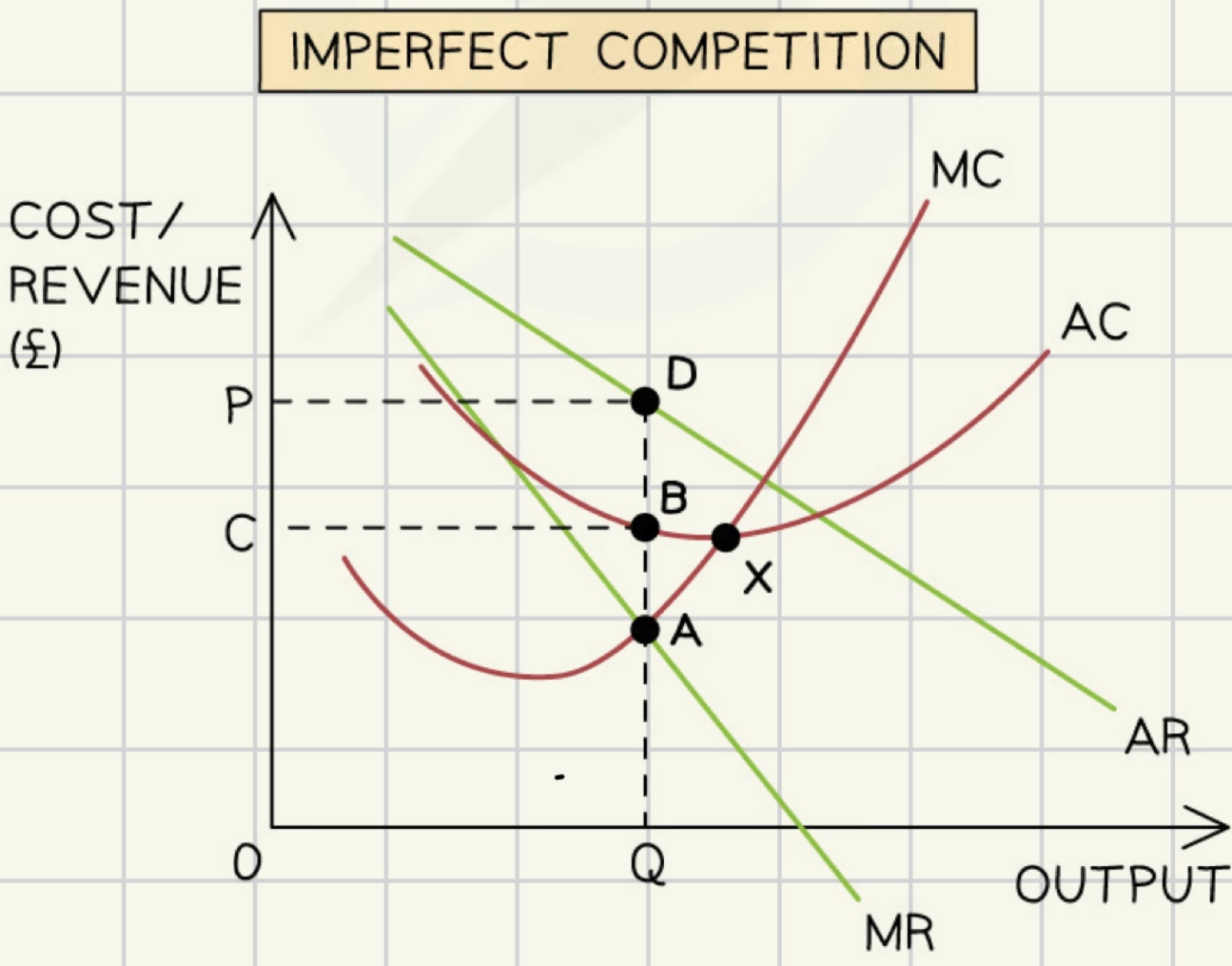

imperfect competition

A market structure where individual firms have some control over price due to product differentiation, which results in a range of firm market power and potentially inefficient outcomes.

monopolistic competition

many relatively small companies

differentiated products

low barriers to entry

some market power

imperfect knowledge among consumers

good amount of competition

eg. restaurants, computer games, books, furniture

oligopoly

few large companies

mutual interdependence

differentiated or homogeneous products

high barriers of entry

significant market power

imperfect knowledge

some competition

eg. cars,household appliances, detergents, cereal

monopoly

one large company

unique product

no close substitutes

high to impossible barriers of entry

complete market power

imperfect knowledge

no competition

eg. public utilities

profit maximisation

profit = total revenue - total costs

break even/ normal profit

total revenue = total costs

abnormal profit

total revenue > total costs

profit loss

total revenue < total costs

profit maximisation rule

a firm should continue producing additional units until

marginal costs MC = marginal revenue MR

marginal costs MC

change in total costs resulting from additional unit produced

marginal revenue MR

the increase in revenue resulting from an additional unit produced