Unit 4 - Investment Companies

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

Investment Company Act of 1940

defines investment companies

mutual funds, face-amount certificates (FACs), unit investment trusts, and management companies

investment company: a corporation or trust that pools investors’ money and then invests that money in securities on their behalf

each fund has a clearly defined objective (ex. growth or income)

pooling funds in this way gives a small investor the purchasing power of a large investor

raise capital by selling shares to the public

must abide by the same registration and prospectus requirements imposed on other issuers by the Securities Act of 1933

subject to regulations regarding how their shares are sold to the public

Face-Amount Certificates (FACs)

a contract between an investor and an issuer in which the issuer guarantees payment of a stated (face) amount to the investor at some set date in the future

in return, the investor agrees to pay the issuer a set amount of money

either as a lump sum (fully paid FAC) or in periodic installments

not managed

once the portfolios are composed, they don’t change

**investment companies under the Investment Company Act of 1940

Unit Investment Trusts (UITs)

an investment company organized under a trust

have trustees

create a portfolio of securities designed to meet the UIT’s objectives

sell redeemable units or shares in the portfolio

each share is an undivided interest in the entire portfolio

portfolio is fixed

have a fixed end or maturity date

debt-based → will end when the last bond in the portfolio matures

equity-based → end date when the portfolio is liquidated and the funds are distributed to investors

b/c it’s fixed, there’s no need for active management and no portfolio turnover

don’t assess management fees

shares are redeemable with the issuer at intervals specified in the prospectus

Management companies

actively manages a securities portfolio to achieve a stated investment objective

closed end or open end

both sell shares to the public in an IPO

closed end → initial offering of shares is limited (closes after a certain # of shares are sold)

open end → perpetually offering new shares to the public

Open End vs Closed End Investment Companies

Mutual Funds

a pool of investors’ money invested in various securities as determined by the fund’s stated investment objective

issues common stock

don’t trade in the secondary market

investors purchase shares from the fund

redeem shares with the issuer who sends out money and cancels the investor’s shares

shares are redeemable securities (guaranteed) → the shares are marketable and liquid

owners have an undivided interest → no owner has higher status than another

generate dividends and capital gains for investors

they choose to either reinvest those or receive them in cash

reinvestments are done at the fund’s current NAV

distributions are taxable

may be sold in full or fractions

allows investors to specify a $ amount rather than # of shares

managed by investment managers

provides an investor w/ ownership in a diversified portfolio even w/ a small investment

maximum sales charge is 8.5% of the POP

shareholders have voting rights

Divided into Class A, B, C, or no load

Class A (Front-End Load) Shares

front-end sales charge

sales charges are paid at the time an investor buys shares

charge is taken from the total amount invested

Class A shares are best for investors with large investments and longer time frames. This allows the investor to lower the load cost overall and spread the one-time cost over several years.

Class B (Back-End Load) Shares

back-end sales load

contingent deferred sales charge (CDSC)

charge is paid at the time an investor redeems shares

the full investment amount is available to purchase shares

reduced by a % each year after purchase (declining sales charge)

charge is applied to the proceeds of any shares redeemed that year

usually drops to 0 after awhile

becomes Class A shares at that point

Class B shares are best for investors with smaller investments and longer time frames to get past the back-end loads.

Class C (Level-Load) Shares

have a 0.25% annual shareholder services fee, charged quarterly

fees never go away → level load

typically have a one-year, 1% CDSC to discourage short-term trading of the fund

have 12b-1 fees

appropriate for investors who have short time horizons b/c the annual charges make them expensive

Class C shares are best for investors with short time frames of at least a year but not more than five years. The size of the investment is less relevant for Class C shares; for Class C, it is the time frame that matters.

No-Load Shares

companies marketing their shares directly to the public, eliminating the need for underwriters and the sales charges used to compensate them

shares purchased at NAV

permitted to charge fees that aren’t considered sales charges

Reducing Front-end Loads

Class A shares have lower expense ratios, making them a more efficient way for most people to invest

b/c the sales charge is paid up front, the investor has no surprise sales charges when they redeem their shares

downside → investor loses a portion of their invested capital up front (impacting their return)

there are ways to reduce the charge (breakpoints)

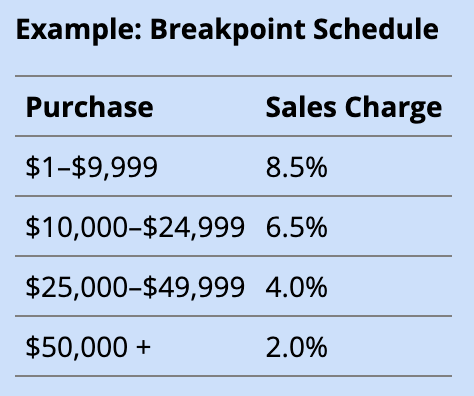

Breakpoints

quantity discounts on Class A mutual fund sales charges

the greater the $ amount of a purchase, the lower the sales charge

follows a breakpoint schedule

most mutual funds allow investors to combine orders among related accounts in order to achieve a better breakpoint

Letters of Intent (LOI)

a person who plans to invest more money w/ the same mutual fund may decrease the sales charges by signing a LOI

investors tells the fund company their intention to add the additional funds needed to reach a specified breakpoint within 13 months

the fund applies the better breakpoint to all purchases during that period

lower sales charge = customer buying more shares for the amount they invest

extra shares from the reduced sales charges are held in escrow

a customer who completes the LOI received the escrowed shares

if someone doesn’t complete the LOI can either pay the difference in sales charges or surrender the escrowed shares

can be backdated up to 90 days

LOI begins the date of the letter

Breakpoint Sales

a sale just below a breakpoint

allowing a sale at an amount just below a breakpoint can be viewed as an effort by representatives to make higher sales charges

inconsistent w/ just and equitable principals of trade

the representative’s failure to disclose the breakpoint that triggers a violation

Rights of Accumulation

allow an investor to qualify for reduced sales charges

are available only for later investments

allow for reduced sales charges that will not apply to the first transaction

allow the investor to use any growth in the share price to qualify for breakpoints

don’t impose time limits

the customer may qualify for reduced sales charges when the total value of shares purchases meets a breakpoint

looks at the higher of these two:

current value of the position

the total of the investments made to date

Combination Privilege

a mutual fund sponsor (fund family) may offer more than one fund

an investor may receive a reduced sales charge by combining investments of two or more funds within the same family to reach a breakpoint

Exchange Privilege

allow an investor to redeem an investment in one fund for an equal investment in other fund in the same family w/o paying an additional sales charge

avoids any new sales load

taxable event

NAV

(total assets - total liabilities) / outstanding shares = NAV per share

calculated at least once per day

Liabilities and Expense Ratio

manager’s fee: cost of the investment advisor that makes the investment decisions for the portfolio

admin costs: trading, legal and accounting, transfer agent, etc

board of director’s costs: board members paid for their time plus other things related to them

12b-1 fees: used to pay for certain costs of distribution, usually for advertising and trailing commissions to BDs

expense ratio → actual cost of the expenses

fund’s expenses for a year / its average net assets for that year

Forward Pricing

the transaction price is based on the next time NAV is calculated going forward

Public Offering Price (POP)

NAV + SC = POP

sales charge (SC) is a percentage of POP

load fund → POP will always exceed the NAV

no-load fund → NAV = POP

SC can’t exceed 8.5% of POP

NAV > POP → closed-end fund

**order for MF → declaration day, record and pay date, ex-dividend date

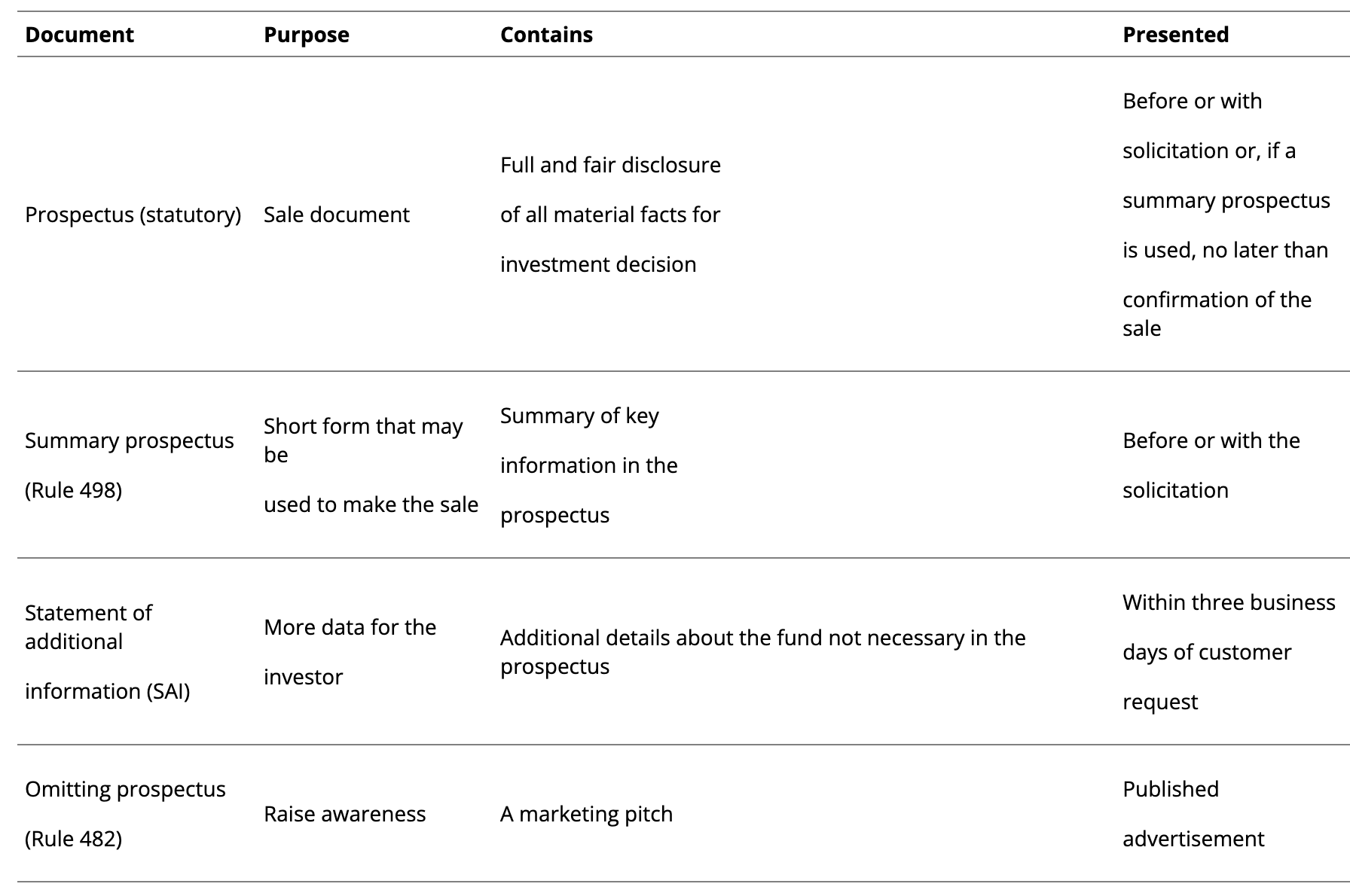

Disclosure Documents

Conduit Theory to Mutual Fund Taxation

to avoid the potential for taxation at three levels on the same dollar (triple taxation)

allows investment companies to avoid taxes on the dividends it pays shareholders if they meet certain criteria

companies qualify under subchapter M of the Internal Revenue Code

company calculates their Net Investment Income (NII) by doing Dividends + Interest - Expenses

investment company distributes at least 90% of the funds NII in dividends

Annuity

contract made with a life insurance company and is designed to provide retirement income

stream of payments guaranteed for some period of time

non-qualified

the investor puts money into an annuity where it grows tax deferred

accumulation phase → investor doesn’t pay taxes until money is withdrawn

annuitization → at retirement, the investor begins to receive an income

annuity phase → period during which the investor receives payments

Fixed Annuities

The contract has a set interest rate during the growth phase (also called the accumulation phase).

The rate may fluctuate from year to year but is never less than zero.

When the annuitant chooses to begin payments (called annuitization), the amount is fixed based on a formula and the payment does not change.

This is called the annuity phase.

The investment (called a premium) is invested in a general account and managed by the insurance company.

The insurance company must pay the guaranteed return even if the investment return does not cover the cost.

This is called investment risk. The insurance company takes on the investment risk with a fixed annuity.

The rate of return and fixed payment may not keep pace with inflation.

This is called inflation or purchasing power risk. The investor takes on inflation risk in a fixed annuity.

There is no market risk in a fixed annuity, so a fixed annuity is not a security.

A fixed annuity requires a life insurance license to sell, not a securities license.

Variable Annuities

investor takes on the investment risk

Premiums are placed into a separate account to be invested as the customer directs.

Funds in the separate account are directed into one or more subaccounts.

Subaccounts are a type of investment company and are classified as UITs or open-end management companies.

A classification as an open-end management company is more common.

Subaccounts operate much like mutual funds, but they are not mutual funds. They are separate accounts; do not call them mutual funds.

The subaccounts will have investment objectives similar to mutual funds.

Subaccounts are investment companies under the Investment Company Act of 1940, so they are considered securities.

The presence of securities within the VA makes the VA a security and subject to securities regulations.

The value of a separate account fluctuates with the investment returns of the subaccounts.

The returns may exceed the rate of inflation but are not guaranteed to do so.

Subaccounts may lose value due to market fluctuations.

All fees must be disclosed, and they include

administrative fees,

investment advisor fees,

custodial fees, and

surrender charges.

If the annuitant dies during the accumulation period, the beneficiary receives the greater of the account value or the premiums paid.

Sales of VAs require both a securities license and a life insurance license.

supplement an investor’s retirement

should maximize use of qualified retirement accounts before using a VA

Fixed vs Variable Annuities

Annuitization

when an investor reaches retirement, they may choose to annuitize their contract

a one-time, irreversible election to give up ownership of the assets of the annuity in return for a lifetime income guaranteed by the insurance company

initial payment based on a formula that has SAAPI

S of the annuitant

Age of the annuitant

Amount in the annuity

Payout option selected

assumed Interest rate (AIR) from investments in the separate account

Suitability of VAs for customers

A VA is for retirement income, not for a more immediate purpose like education funding or a home purchase.

A VA is a supplement to retirement income and is not a suitable investment for other investment needs.

A VA is not for preservation of capital.

A VA should be funded with available cash. VA funding should not come from

existing retirement or other tax advantaged savings,

cashing out a life insurance policy,

selling other investment assets,

borrowing against an asset, like a home equity loan.

A VA should not be used inside another tax-advantaged account like an individual retirement account or 401(k).

All other available contributions to qualified retirement plans should be maximized before a VA is used.

The customer should have the risk tolerance to handle market risk.

Tax Rules for VAs

they’re tax deferred, not tax-free

no tax consequences until they are withdrawn

when growth is withdrawn from a VA, it is taxable as ordinary income (not capital gain) for the year of the withdrawal

taxing annuitization

when the investor annuitizes, they surrender the value of the account to the insurance company in return for a life income

each payment will be part return of principal (the exclusion ratio) and part taxable income

taxing lump sum

the investor takes everything out and closes the annuity

the growth becomes taxable income and the rest is return of principle

taxing partial withdrawal

happens when the investor takes out a portion of the investment in a VA

withdrawal is from the growth first

(LIFO)

**any taxable amount taken out before the annuitant is 59.5 years old will be subject to a penalty of 10%

1035 Exchange

Funds in an annuity may be transferred directly to another annuity

these funds aren’t considered a withdrawal and aren’t subject to taxes

there still may be surrender fees