Market structures - Monopolies and perfect competition (3.4.5, 3.4.3)

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

19 Terms

What are the 3 types of monopolies?

Pure monopoly - When there is only 1 firm in the market

Legal monopoly - When a firms market share is over 25%

Natural monopoly - When it is it’s naturally most efficient for there only to be 1 firm in the market

What assumptions are made when modelling a monopoly?

1) Assuming there is only 1 firm in the market

2) Assume that the firm is profit maximising

3) Assume there are high barriers to entry

What are the 5 barriers to entry

1) Legal barriers such as patents, copyrights and trademarks which prevent other firms from using the firms ideas to enter the market

2) Sunk costs, such as specialist machinery or marketing, which are costs which can’t be recovered. High sunk costs deter firms from entering as it increases risk.

3) Large firms use internal economies of scale to increase efficiency and lower prices. Smaller firms are unable to compete.

4) Brand loyalty can make it difficult for consumers to switch from their prefered brand

5) Anti competitive practices, such as predatory pricing or vertical integration

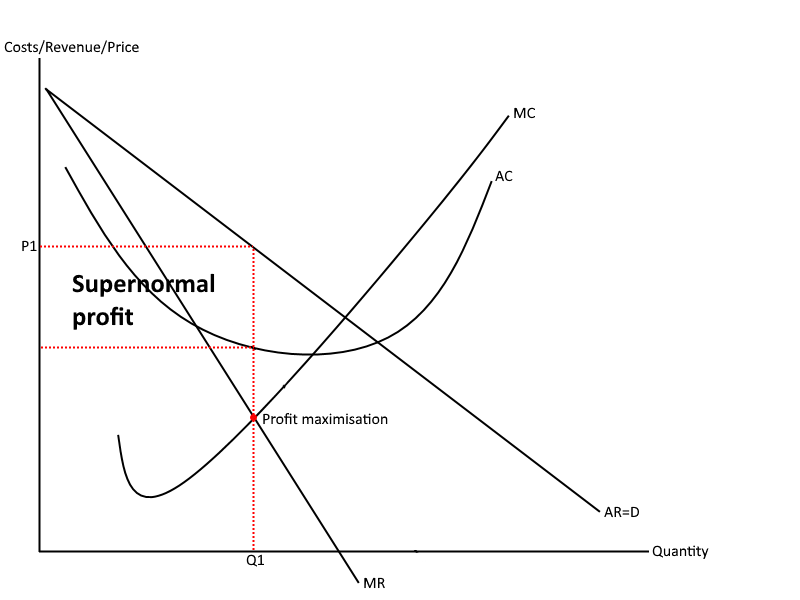

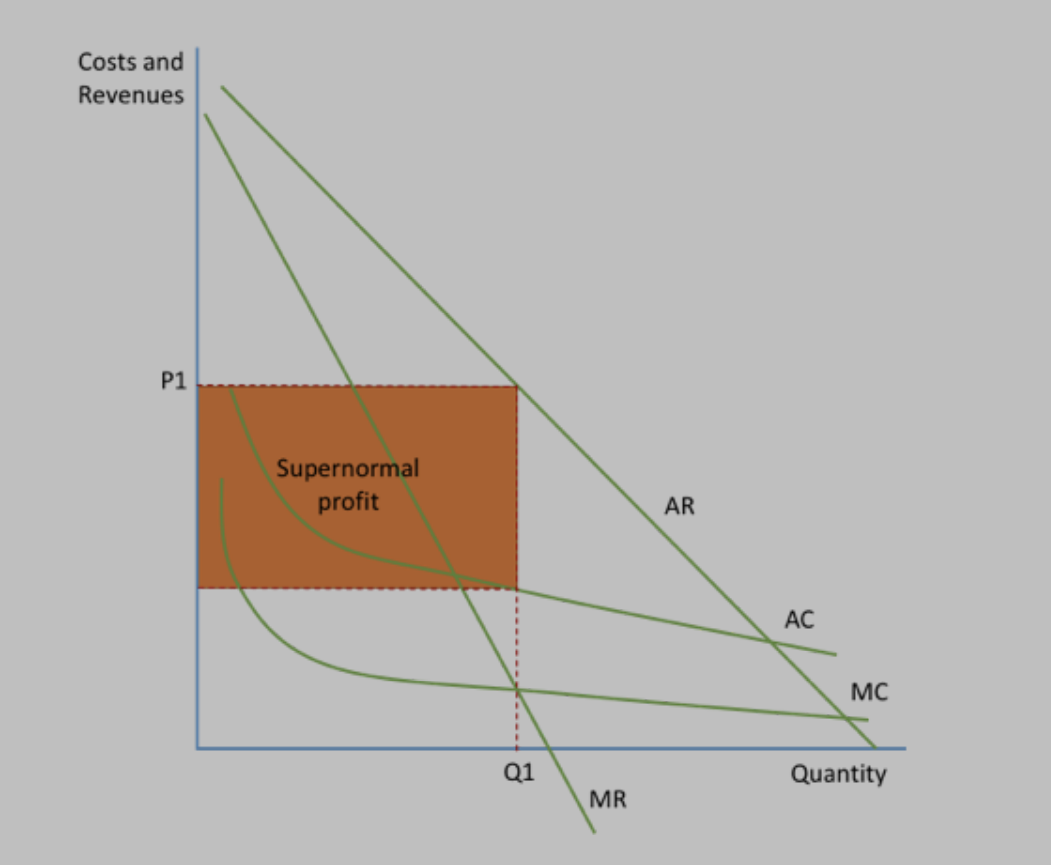

What is the diagram for a monopoly?

How efficient are monopolies?

Productive efficiency - As they produce at MC=MR, they are not producing for productive efficiency

Allocative efficiency - They are not producing at MC=AR, so aren’t allocatively efficient

X-efficiency - Monopolies lack competition, so lose motivation to keep costs low. They are therefore X-inefficient

Dynamic efficiency - Monopolies make supernormal profit, so can potential reinvest this into R&D and be dynamically efficient

Why do natural monopolies exist?

1) In an industry, there may be very high sunk costs such as in the railway industry. Therefore it is inefficient for another firm to enter the market and pay these costs

2) Natural monopolies have extremely high internal economies of scale. They won’t be able to fully utilise all of these economies of scale, but the more control they have in the market the closer they will be to their MES (Minimum Efficient Scale)

What does the natural monopoly diagram look like and why?

Because of the high economies of scale, their AC and MC will became very low in the long run.

What is price discrimination?

Price discrimination is when a firm charges different groups of consumers different prices for the same good.

What 3 conditions are needed for a firm to be able to price discriminate?

1) A firm must have price setting power, which is when a firm is able to change its prices without a big change in consumption (Which monopolies have).

2) Must have information to separate the market based on which groups they are dividing to price discriminate.

3) Firms must be able to limit reselling.

What is 1st degree price discrimination?

When consumers are charged the exact price they are willing to pay for a good/service, eliminating consumer surplus and turning it into profit.

What is 2nd degree price discrimination?

When a firm changes its prices based on the quantity purchased or the time that it was purchased, for example discounts for bulk purchases.

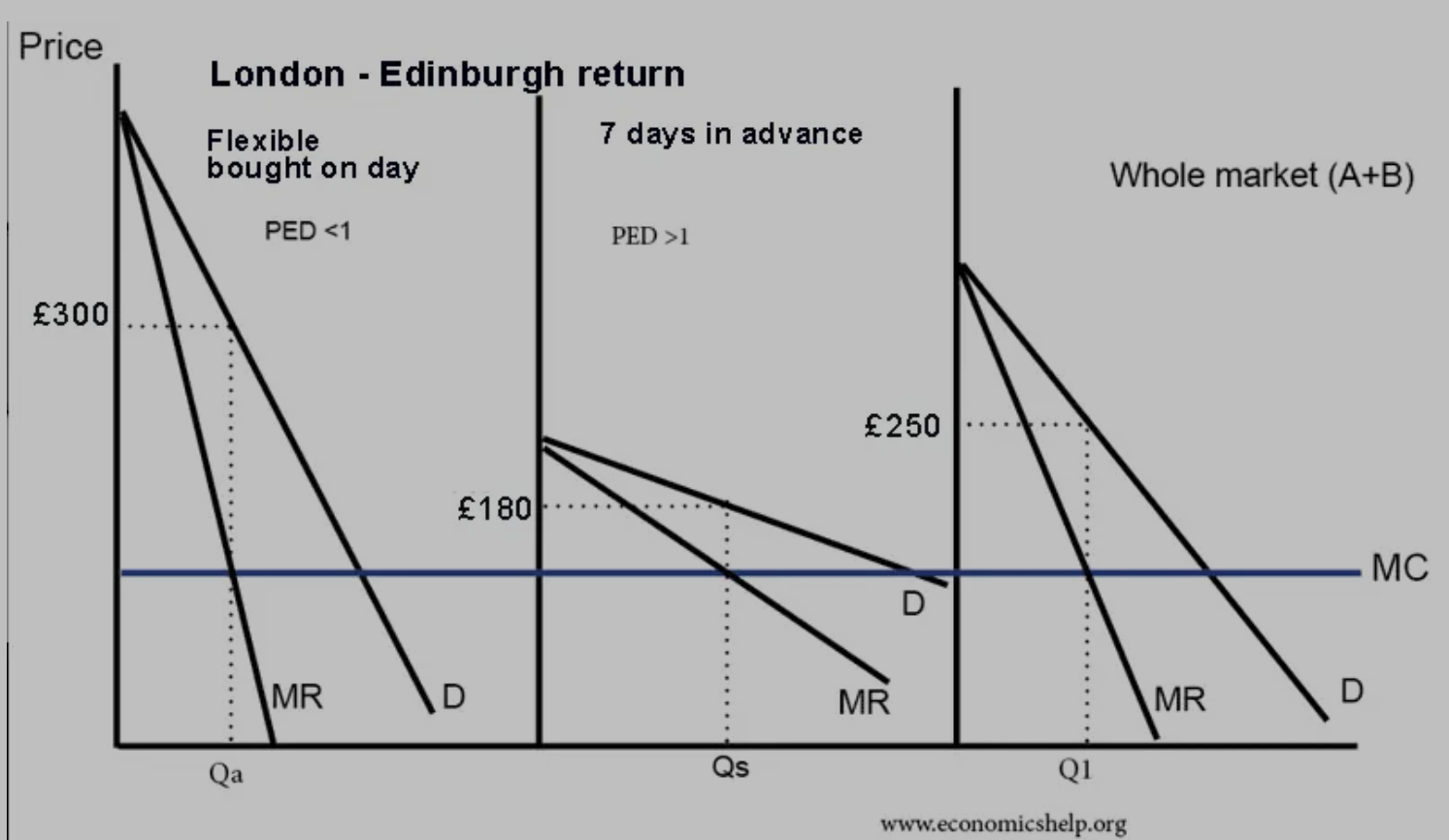

What is 3rd degree price discrimination?

3rd degree price discrimination is when a firm is able to segment the market based on different PED, based on age, income etc, and charge different prices to these groups.

What are the 3rd degree price discrimination diagrams?

It shows that, by setting 1 price for all consumers, a firm will earn less money than if they set different prices based on the consumers elasticities.

Evaluation of price discrimination

+ Increased profits allow increased dynamic efficiency

+ With greater output using PD, firms can achieve economies of scale.

- Allocative inefficiency, charging prices above marginal cost decreases consumer surplus and social welfare, as some consumers may pay more than they would in a competitive market.

What are the features of a perfectly competitive market?

1) Many small buyers and sellers

2) No barriers to entry or exit

3) Homogenous (identical) goods

4) Perfect information

5) All firms are price takers

What is the PED in a perfectly competitive market?

All firms produce goods which are perfectly elastic. This means that consumers will only buy at one price, and any increase will lead to a QD of 0.

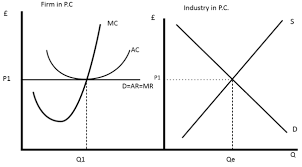

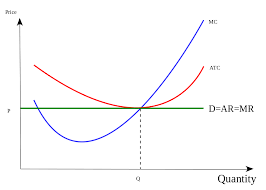

What is the perfect competition diagram and why?

As all firms are price takers, they all produce at the market price. Producing at a higher price would lead to them having 0 demand, and producing at a lower price would lead to them making subnormal profits.

How does a supernormal firm profit in a perfectly competitive market?

In the short run, firms have the ability to earn supernormal profits. This could be through an increase in market demand, or decrease in market supply. However, as there is perfect information, and no barriers to entry, new firms will enter the market to make supernormal profit. This means that, in the long run, all firms will end up making normal profits.

How efficient are perfectly competitive firms?

Perfectly competitive firms produce at both MC=AC, and at AR=MC, meaning that they are productive, allocative and x-efficient.

However, as they make normal profit, they are unable to invest into R&D, meaning that they can’t be dynamically efficient.