Final Exam Intro to business CH 10-16 kms

1/114

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

115 Terms

Human Resource Management

determining the organization's needs for Human Resources and acquiring, maintaining, and developing an organization's human resources

Job Analysis

procedure through observation and the study that determines the pertinent information about the job

job description

a written description of the basic tasks, duties, and responsibilities required of an employee holding a particular job

job specification

a description of the qualifications necessary for a specific job, in terms of education, experience, and personal and physical characteristics

what is not performed by the human resources managers?

selling

what is a reason internal recruiting has advantages over external sources?

1. improved employee morale

2.cultural understanding

Title VII of the Civil Rights Act of 1964

1. prohibits discrimination (equal employment opportunity commission (EEOC) )

what can not be asked on an employment application?

1. race, sex, age, religion

(FSLA) Fair Labor Standards Act of 1938

1. established minimum wage

turnover

replacement of employees (quit, fired)

to avoid legal problems, before firing an employees, companies should ensure what?

have documented all problems and warnings in the employees work records.

who investigates sexual harassment in the workplace?

Equal Employment Opportunity Commission (EEOC)

What is having a diverse work force have on a company?

1.a greater ability to serve the needs of a diverse customer base.

2.increased innovation and creativity

3. better decisions on complex problems

To achieve its objectives, labor may not use what type of activity? and why?

Lockout- management version of a strike where employees cannot work

what is the first step in developing a marketing strategy?

selecting a target market

what is the goal of the marketing concept?

customer satisfaction

what is the most flexible element of the marketing miz and can be changed ?

price

now that someone had identified their target market, what must be done next?

develop an appropriate marketing mix

distribution

making products available to customers in the quantities desired.. also referred as place.

in the context of the marketing concept. what is the first step that a business must take?

find out what consumers desire

what is the central focus of the marketing mix. It includes the size,color, features, branding, packing , quality

product

target market

refers to a specific group of consumers on whose needs and wants a company focuses it marketing efforts.

promotion

a persuasive form of communication that attempts to expedite a marketing exchange by influencing individuals, groups, and organizations to accept goods, services, and ideas

Marking strategy

a plan of action that consists of selecting a target market and developing a marketing mix to satisfy it.

Marketing

the process by which companies try to satisfy customers' need through activities.

Marketing Orientation

considers the needs of customers when developing a marketing mix

Market Segmentation

the process of dividing a market into meaningful, relatively similar, and identifiable segments or groups

what are the 4ps in marketing mix and what do they mean?

1. Product- good or service

2. price- the value placed on the product

3. place (distribution)- making products available

4. Promotion- informing customers

Marketing Research

collect info about potential customers

primary data vs. secondary data

1. primary- directly from respondents (surveys)

2. secondary- infor compiled inside or outside organization (U>S Census Bureau)

what are the various types of market segmentation?

1. demographic- (people based differences) age, sex, family size, income, race

2. Behavioral- habits, loyalty, benefits looking for

3. Geographic- location. climate

4. Phychographic- motives, lifestyles, personality

marketing statement

description of the target market,and sales and profit goals

consumer products

products intended for household or family use

convenience products

items bought frequently with no planning

shopping products

purchased after consumers have "shopped around"

speciality products

items that the consumer makes a special effort to search out and buy (cars, designer purse)

business products

Used directly or indirectly in the operation or manufacturing processes of businesses

product line

a group of closely related products that are treated as a unit because of similar marketing strategy, production, or end-use considerations.. (toothpaste, mouth wash)

product mix

all the products offered by an organization

Product Life Cycle and differences.

1. introduction- make customers aware

2. growth- strengthen its market position

3. Maturity- severe competition and heavy costs

4. Decline- firms eliminate models, cut costs, and phase out products

manufacture products

owned by the manufacturer (kelloggs's)

generic products

products that have no brand aname and come in simple packages and carry only their generic name (peanut butter, tomato juice)

Phychological pricing

based on emotional rather than rational responses (2 cans for 1$)

fixed costs

the cost incurred no matter how many units are produced or sold. (rental lease, property tax)

marketing channel

organizations that moves products from their producer to customers

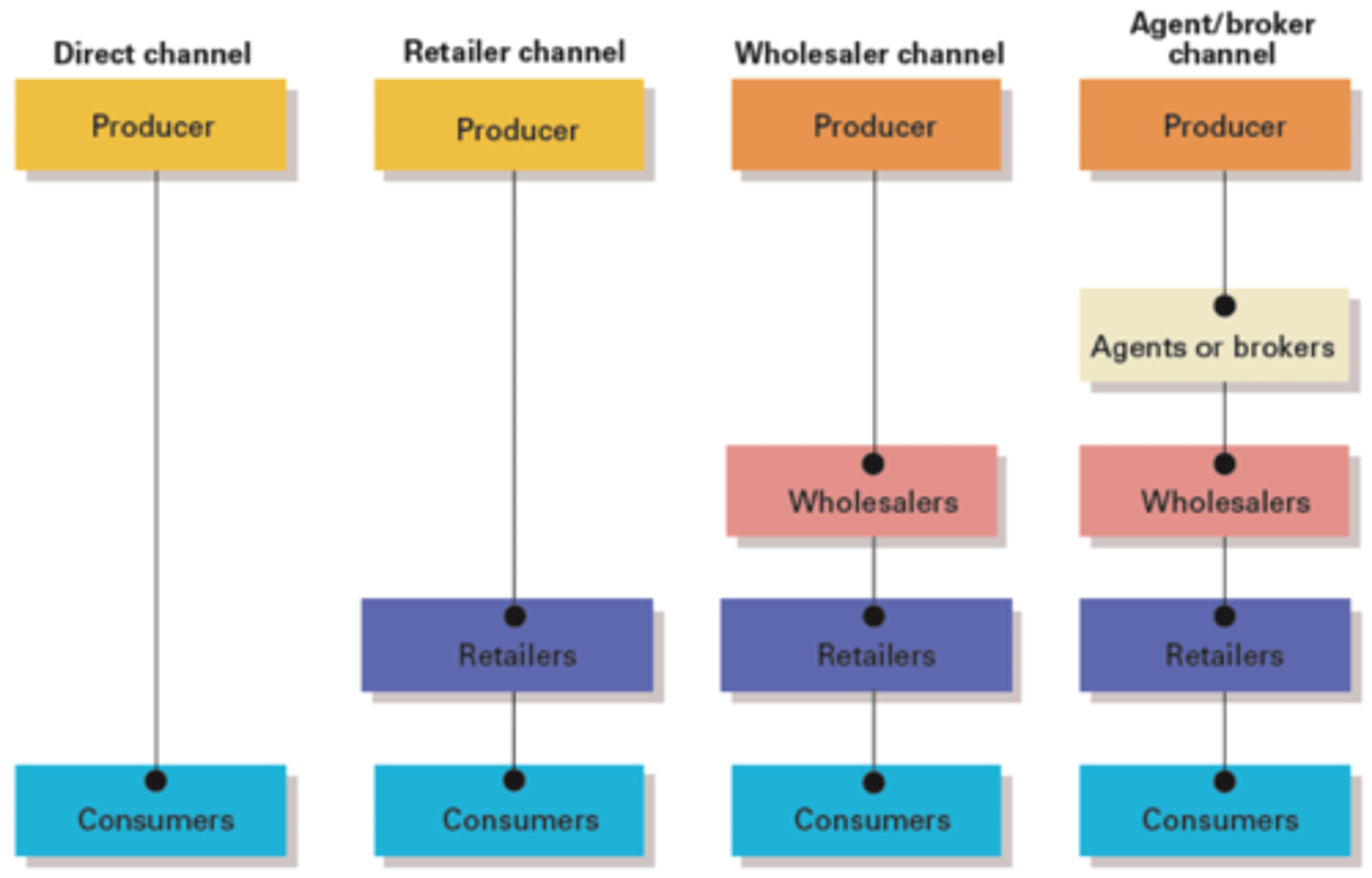

Different Channels of Distribution

In Channel A, the product moves from the producer directly to the consumer. (fruits on side road)

In Channel B, the product goes from producer to retailer to consumer. (college textbooks)

In Channel C, the product is handled by a wholesaler and a retailer before it reaches the consumer. (tv, watches)

In Channel D, the product goes to an agent, a wholesaler, and a retailer before going to the consumer. (candy)

retailer

intermediaries who buy products from manufacturers and sell them to consumers for household use

wholesalers

intermediaries who buy from producers or from other wholesalers and sell to retailers (large quantities)

what kind of form can promotion take?

advertising, personal selling, sales promotion, publicity, social networking

Advertising

paid form of non-personal communication through mass media

advertising campaign

a series of related advertisements focusing on a common theme, slogan, and set of advertising appeals

personal selling

direct two-way communication with buyer

publicity

non-personal communication, and is presented as a news story, and not from originator

sales promotion

Short-term incentives to encourage the purchase or sale of a product or service

(CPA) certified public accountant

an individual who has been state certified to provide accounting services ranging from the preparation of financial records and the filing of tax returns to complex audits of corporate financial records

Sarbanes-Oxley Act

A law passed by Congress that requires the CEO and CFO to certify that their firm's financial statements are accurate. It required firms to be more rigorous in their accounting and reporting practices

bookkeeping

the recording of business transactions..day to day

cash flow

The movement of money through a business on a daily, weekly, monthly, or yearly basis.

annuel report

summary of a firm's financial information, products, and growth plans for owners and potential investors.

liability

debts a firm owes to others

assets

A firm's economic resources, or items of value that it owns, such as cash, inventory, land, equipment, buildings, and other tangible and intangible things.

Owner's Equity

doesnt have to be paid back.

O'E=assets-liabilities

double-entry bookkeeping

a system of recording and classifying business transactions that maintain the balance of the accounting equation

Accounting Cycle

the process by which companies produce their financial statements for a specific period

what is the four step procedure for the accounting cycle?

1. examining source documents (receipts)

2. recording transactions in journal (dated)

3. "posting" transactions into ledger

4. preparing financial statements

what are the three financial statements?

1. Income Statement

2. Balance Sheet

3. Statement of Cash Flows

Income Statement

"The bottom line" profitability over a period of time. profit or loss statement

Revenue (Sales)

The total amount of money received from the sale of goods or services, as well as from related business activities.

Cost of Goods Sold

the amount of money a firm spent to buy or produce the products it sold during the period to which the income statement applies

what consist of the income statement?

for company

1. revenue (sales)

2. costs of goods

3. profit

4. expenses

5. net income (net earnings)

Gross Income (profit / earnings)

earnings before interest and taxes...

profit= revenue - the cost of goods sold

expenses

The cost of assets consumed or services used in the process of generating revenues.

Net Income (earnings)

total profit after all expenses and taxes.

Balance Sheet

A "snapshot" of a company's financial position at a given moment.. ability to meet financial obligations

what consist of the balance sheet?

1. current assets

2.fixed assets

3.intangible assets

4.current liabilities

5. long-term liabilities

6. owners equity

assets

A firm's economic resources, or items of value that it owns, such as cash, inventory, land, equipment, buildings, and other tangible and intangible things.

order of assets and what they consist of

1. current assets- year or less (cash)

2. fixed assets- longer than one year (building)

3. intangible assets- value based on rights (patents)

Accounts Receivable (current assets)

money owed to company by clients promising to pay later

Liabilities

debts that you owe

Current Liabilities

a firm's financial obligations to short-term creditors, which must be repaid within one year.

Accounts Payable

A short-term liability that will be paid in the future and arise as a result of making credit purchases

long-term liabilities

liabilities owed for more than a year. (mortgages)

accrued expenses

all unpaid financial obligations incurred by an organization.

Depreciation

The process of spreading the costs of long-lived assets such as buildings and equipment over the total number of accounting periods in which they are expected to be used.

Statement of Cash Flows

the financial statement that identifies a firm's sources and uses of cash in a given accounting period. "cash in/out"

ratio analysis

measures financial health of organization

Profitability Ratios

Measures of the operating success of a company for a given period of time.

Financial Ratios

relationships determined from a firm's financial information and used for comparison purposes

profit margin

net income/net sales

Return on Assets (ROA)

Net Income/Total Assets

Return on Equity (investment) (ROI)

net income/ owners equity

Receivable Turnover

revenue / receivables

collect credit sales in year

Inventory Turnover

sales/ inventory

sells and replaces inventory

total assets turnover

sales/total assets

uses assets in creating sales

asset utilization ratios

ratios that measure how well a firm uses its assets to generate each $1 of sales

Liquidity Ratios

measure speed turn its assets into cash to meet short-term debt

current ratios

current assets/current liabilities

quick ratio (acid test)

(Current Assets - Inventory) / Current Liabilities

debt utilization ratios

ratios that measure how much debt an organization is using relative to other sources of capital, such as owners' equity

debt to total assets ratio

total liabilities/total assets