National Economic Challenge: Theories and Terms

1/68

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

69 Terms

Invisible Hand

Adam Smith; individuals seeking their economic self-interest actually benefit society more than they would if they tried to benefit society directly.

Money illusion

Tendency of people to think in nominal terms rather than real

Money neutrality

Changes in money supply only affects nominal variables not real variables

Quantitative easing

Introduction of new money into money supply by central government

Liquidity preference

Keynes; an investor demands a higher interest rate, or premium, on securities with long-term maturities, which carry greater risk, because all other factors being equal, investors prefer cash or other highly liquid holdings.

Classical Economics

(Liberal Economics) Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Robert Malthus, and John Stuart Mill; markets function best with minimal government interference; 18th/19th century

Keynesian Economics

John Maynard Keynes; Great Depression; optimal economic performance could be achieved - and economic slumps prevented - by influencing aggregate demand through activist stabilization and economic intervention policies by the government; Demand-side

Neoclassical

William Stanley Jevons, Carl Menger, Leon Malras; 19 century; consumer's number-one concern is to maximize personal satisfaction, and that everyone makes decisions based on fully informed evaluations of utility; Rational Behavior Theory; Competition leads to an efficient allocation of resources

Neo-Malthusian

Human population growth is exponential and can outstrip its food resources if not held in check

Marxian Economics

Karl Marx; the specialization of the labor force, coupled with a growing population, pushes wages down, and that the value placed on goods and services does not accurately account for the true cost of labor; Das Kapital, 1867;

Laissez Faire Capitalism

the less the government is involved in free market capitalism, the better off business will be, and then by extension society as a whole; France

Market Socialism

(Liberal Socialism) a compromise between socialist planning and free enterprise, in which enterprises are publicly owned but production and consumption are guided by market forces rather than by government planning.

Monetarism

inflation depends on how much money the government prints; Associated with quality theory of money; 1980s

Solow Model

(Neoclassical Growth Model) Robert M. Solow; there are three factors: technology, capital accumulation and labour force that drive economic growth; predicts that the gap between rich and poor countries will narrow, a concept called the catch-up growth; explains why Germany and Japan, despite losing in the Second World War, managed to grow faster than the US and UK during 1950-1960 period;

New Growth Theory

humans' desires and unlimited wants foster ever-increasing productivity and economic growth; argues that real GDP per person will perpetually increase because of people's pursuit of profits; As competition lowers the profit in one area, people have to constantly seek better ways to do things or invent new products in order to garner a higher profit

Institutions and Growth

Efficient Market Hypothesis

(EMH) , stocks always trade at their fair value on stock exchanges, making it impossible for investors to either purchase undervalued stocks or sell stocks for inflated prices

Permanent Income/ Life Cycle Hypothesis

people will spend money at a level consistent with their expected long term average income

Rational Expectations

people make choices based on their rational outlook, available information and past experiences; the current expectations in the economy are equivalent to what people think the future state of the economy will become

Rational Choice Theory

individuals always make prudent and logical decisions; These decisions provide people with the greatest benefit or satisfaction — given the choices available — and are also in their highest self-interest

Behavioral Economics

Gary Becker, Herbert Simon, Daniel Kahneman, George Akerlof; explores why people sometimes make irrational decisions, and why and how their behavior does not follow the predictions of economic models

Adverse Selection

sellers have information that buyers do not, or vice versa, about some aspect of product quality

Moral Hazard

one party in a transaction has the opportunity to assume additional risks that negatively affect the other party

Tragedy of the Commons

Garret Hardin, 1968; individuals tend to exploit shared resources so the demand greatly outweighs supply, and the resource becomes unavailable for the whole

Property Rights

theoretical and legal ownership of specific property by individuals and the ability to determine how such property is used

Game Theory

John von Neumann, John Nash, Oskar Morgenstern; human conflict and cooperation within a competitive situation

New Trade Theory

(NTT) a critical factor in determining international patterns of trade are the very substantial economies of scale and network effects that can occur in key industries.

The Trilemma

(Mundell-Fleming Trilemma, Impossible Trinity) Robert Mundell, Marcus Fleming; a country cannot achieve the free flow of capital, a fixed exchange rate and independent monetary policy simultaneously. By pursuing any two of these options, it necessarily closes off the third.

Washington Consensus

refers to the level of agreement between the International Monetary Fund (IMF), World Bank, and U.S. Department of the Treasury on economic policy recommendations for developing countries, and Latin America in particular; neoliberal, that the operation of the free market and the reduction of state involvement were crucial to development in the global South.

Financial Accelerator

a small change in financial markets can produce a large change in economic conditions and create a feedback loop;Great Depression

Bagehot Theory

Walter Beghot; Lombard Street; in times of financial crisis central banks should lend freely to solvent depository institutions, yet only against sound collateral and at interest rates high enough to dissuade those borrowers that are not genuinely in need

Creative Destrustion

Joseph Schumpeter; Capitalism, Socialism and Democracy, 1942; economic development was the result of forces internal to the market and created by the opportunity to seek profit and property; innovation deconstructs long-standing arrangements and frees resources to be deployed elsewhere

Ricardian Equivalence

(Barro-Ricardo equivalence proposition) David Ricardo, revised by Robert Barro; when a government tries to stimulate an economy by increasing debt-financed government spending, demand remains unchanged; government cannot stimulate spending since people assume that whatever is gained now will be offset by higher taxes in the future

Dynamic Inconsistency

a decision-maker's preferences change over time in such a way that a preference can become inconsistent at another point in time; game theory, dynamic game where a player's best plan for some future period will not be optimal when that future period arrives; Behavioral economics, each different self of a decision-maker may have different preferences over current and future choices

Capital Asset Pricing Model

(CAPM) investors need to be compensated in two ways: time value of money and risk; describes the relationship between systematic risk and expected return for assets, particularly stocks

Option Pricing Theory

Black-Scholes Model, Binomial Model; approach for calculating the fair value of an option

Austrian Economics

Carl Menger, Follower- Hayek; liberalism and laissez-faire-economics

Speculative Bubbles

a spike in asset values within a particular industry, commodity, or asset class; caused by exaggerated expectations of future growth, price appreciation, or other events that could cause an increase in asset values

Liquidationist View

Governments should not interfere in a recession

Time Value of Money

(TVM) money available at the present time is worth more than the same amount in the future due to its potential earning capacity; provided money can earn interest, any amount of money is worth more the sooner it is received

Public Choice

James Buchanan; although people acting in the political marketplace have some concern for others, their main motive, whether they are voters, politicians, lobbyists, or bureaucrats, is self-interest

Arrow's Impossibility Theorem

a clear order of preferences cannot be determined while adhering to mandatory principles of fair voting procedures

Welfare Theorems

1. (Invisible Hand Theorem) any competitive equilibrium leads to a Pareto efficient allocation of resources

2. any efficient allocation can be attained by a competitive equilibrium, given the market mechanisms leading to redistribution.

Conspicuous Consumption

Thorstein Veblen; The Theory of the Leisure Class, 1889; purchase of goods or services for the specific purpose of displaying one's wealth

Polluter Pays Principle

(PPP) firms or consumers should pay for the cost of the negative externality they create

Heckscher-Ohlin Trade Theory

countries export what can be most efficiently and plentifully produced; exportation of goods requiring factors of production that a country has in abundance and the importation of goods that the country cannot produce as effectively

Optimal Currency Areas

Robert Mundell; The geographic area in which a single currency would create the greatest economic benefit; However, a common currency results in a loss of each country's ability to direct fiscal and monetary policy interventions to stabilize their economies.

Purchasing Power Parity

(PPP) two currencies are in equilibrium or at par when a market basket of goods (taking into account the exchange rate) is priced the same in both countries; measurement of exchange rate

Rubinomics

Robert Rubin-Sec. of Treasury under Clinton; the government concentrate on reducing the deficit instead of spending money on infrastructure

Supply-Side Economics

(Reaganomics)(trickle-down) greater tax cuts for investors and entrepreneurs provide incentives to save and invest, and produce economic benefits that trickle down into the overall economy

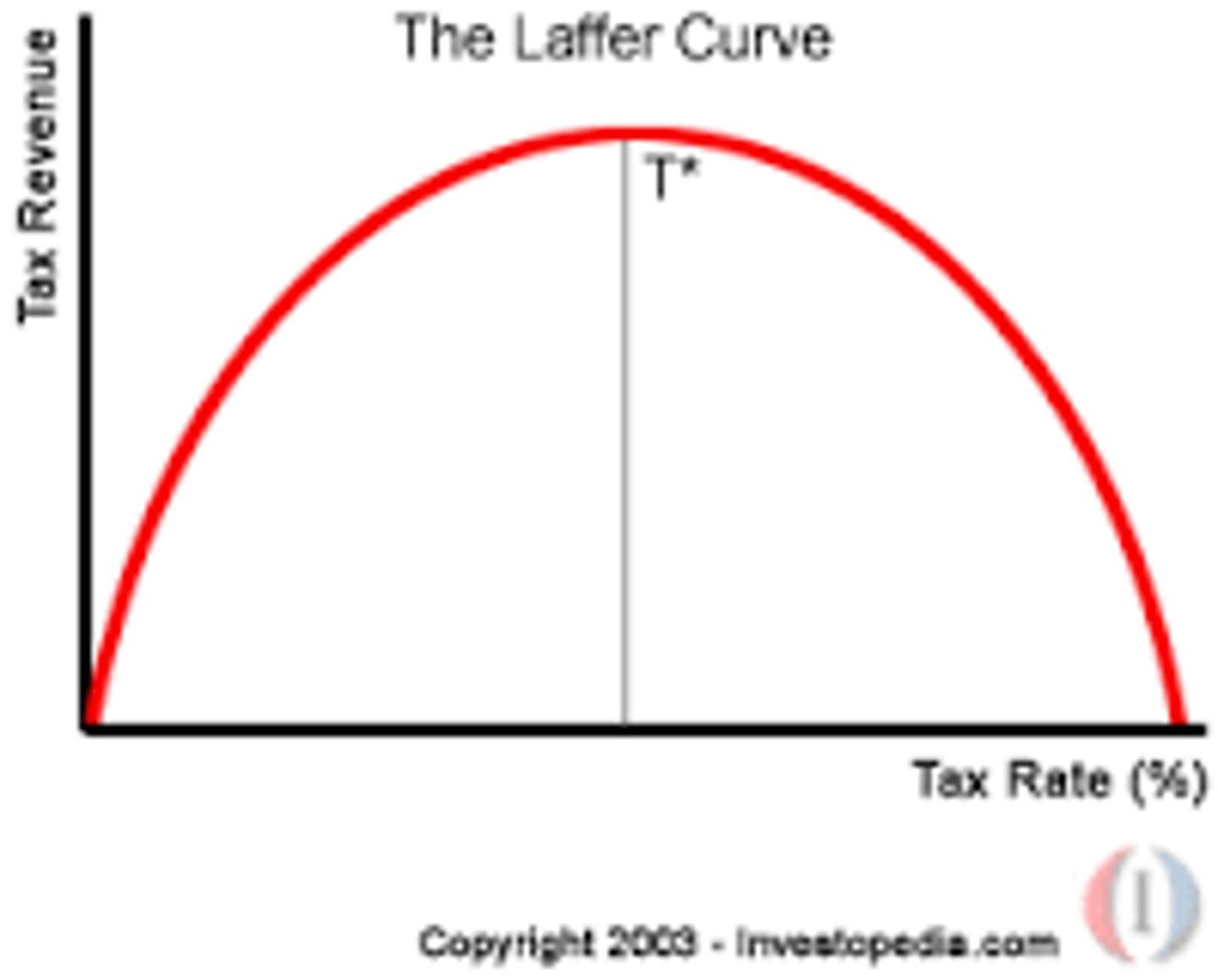

Laffer Curve

Arthur Laffer (supplyside economists); show the relationship between tax rates and the amount of tax revenue collected by governments

Theories of Economic Geography

Paul Krugman; location, distribution and spatial organization of economic activities across the world

Fisher Theory of Interest Rates

Irving Theory; the real interest rate equals to the nominal interest rate minus the expected inflation rate

Liquidity Traps

prevailing interest rates are low and savings rates are high, making monetary policy ineffective

Resource Curse

the difficulties faced by resource-rich developing countries, including dependence on exporting one or a few commodities whose prices fluctuate, as well as potentials for corruption and inequality

Exchange Rate Overshooting

When an exchange rate's immediate response to an disturbance is greater than its long-run response.

Mechanism Design

An area of economics that explores how contract or transaction structures can overcome asymmetric information problems

Principal-Agent Problem

Michael Jensen, William Meckling; when a principal creates an environment in which an agent's incentives don't align with its own

Theory of Optimal Taxation

Adam Smith; implementing a tax that reduces inefficiency and distortion in the market under given economic constraints

Economic Theory of Regulation

1) the government is interested in overcoming information asymmetries with the operator and in aligning the operator's interest with the government's interest,5 2) customers desire protection from market power when competition is non-existent or ineffective, 3) operators desire protection from rivals, or 4) operators desire protection from government opportunism.

New classical

Reject Keynesian economics; 1980s; limited government involvement and free market; supported by IMF and World Bank

National Income

all net incomes, net of consumption of fixed capital, earned in production

Say's Law

states that aggregate production necessarily creates an equal quantity of aggregate demand

ability-to-pay tax rate system

progressive taxation principle that maintains that taxes should be levied according a taxpayer's ability to pay. This progressive taxation approach places an increased tax burden on individuals, partnerships, companies, corporations, trusts and certain estates with higher incomes.

moral hazard

lack of incentive to guard against risk where one is protected from its consequences

Herfindahl Index

commonly accepted measure of market concentration

adverse selection

Adverse selection refers generally to a situation where sellers have information that buyers do not have, or vice versa, about some aspect of product quality

Horizontal Equity

economic theory that states that individuals with similar income and assets should pay the same amount in taxes

Vertical Equity

method of collecting income tax in which the taxes paid increase with the amount of earned income