acct 2301 unit 2 review

1/83

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

84 Terms

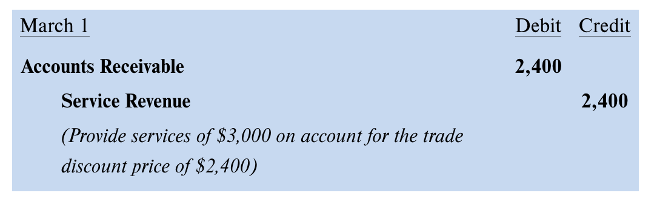

trade discount

the only one INDIRECTLY recorded by making revenue equal to discounted price

d accts receivable; c service revenue

provide services on account w/ trade discount

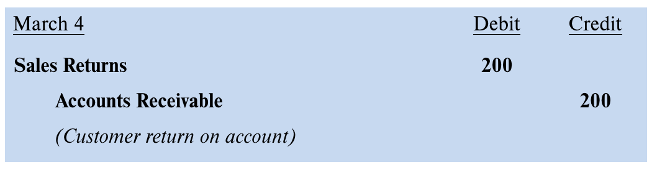

sales returns

contra revenue acct to sales revenue

d sales returns; c accts recceivable

customer returns product on acct

d sales allowance; c accts receivable

provide a sales allowance for previous credit sale

sales discount

reduction in amount to be received from credit customer if they pay within a specific time period (NOT a reduction in selling price of a good/service)

2/10: 2% discount if pay within 10 days

n/30: if no discount, full payment due in 30 days

d cash, d sales discounts; c accts receivable

collect cash on account with a sales discount

allowance method

GAAP approved method to estimate uncollectible accounts/bad debts

report accts receivable for net amt expected to be collected

estimate current accts receivable that will be uncollectible in the future (contra asset)

estimate future uncollectible accts and report those estimates in the current year

allowance for uncollectible/doubtful accts (contra asset acct, increase by credit)

bad debt expense: cost of est future bad debts reported as an expense in current year income statement

end of yr 1 find bad debt expense thru % accts receivables method, during subsequent year, write off actual bad debts as uncollectible as they occur (no net effect),

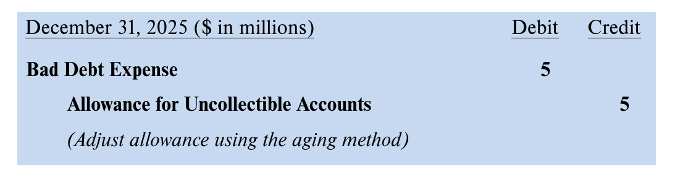

Credit Allowance Balance before adjustment- previous estimate was too high, you’ll have a smaller adjustment.

Debit Allowance Balance before adjustment- previous estimate was too low, you’ll have a larger adjustment.

total revenues

educed by sales returns, sales allowances, and sales discounts during the year AND by those expected to occur in the future but relate to the current yr.

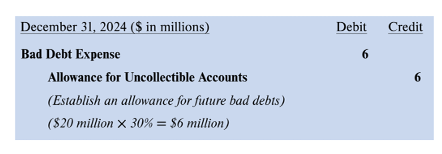

d bad debt expense; c allowance

end of yr 1 establish allowance using %age receivables and allowance method

d bad debt expense, c allowance for uncollectible accts

in subsequent est future uncollectible accts using the current balance to determine the adjusting entry. Allowance method, %age receivables.

d accts receivable, c allowance; d cash, c accts receivable

allowance method: collecting cash on an acct previously written off (not effet on net income/total assets)

reverse prior write off

collect cash

percentage of credit sales

income statementmethod

ignore existing balance in allowance and add new estimate to adjusting entry

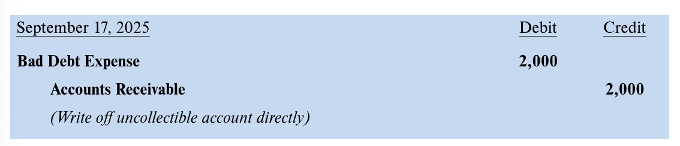

direct write off method

not GAAP

tax reporting

write off bad debts only when they actually become uncollectible

assets are overstated and operating expenses understated

d bad debt expense; c accts receivable

direct write off method (not GAAP)

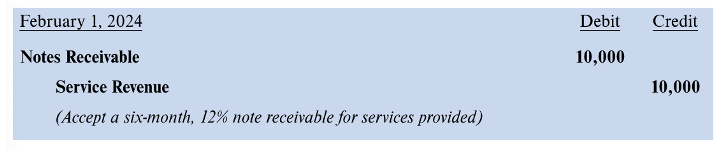

d notes receivable; c service revenue

accept notes receivable for services provided

Pay attention to dates. E.g., Jan 1- Dec 31 or Jan 1- Dec 1.

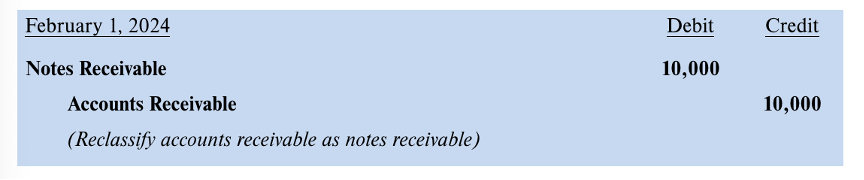

d notes receivable; c accts receivable

replace accts receivable with notes receivable

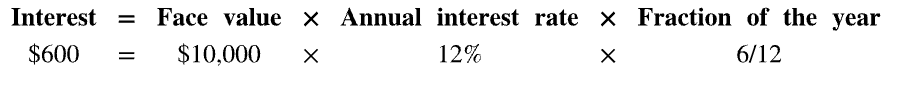

face value x annual interest rate x frac of yr

interest calculation

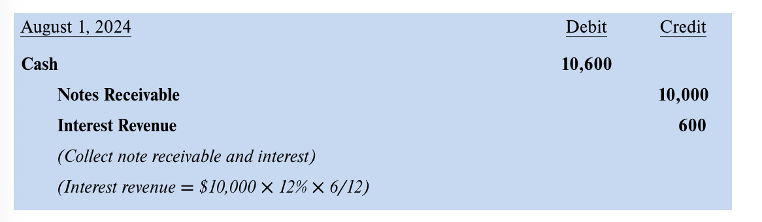

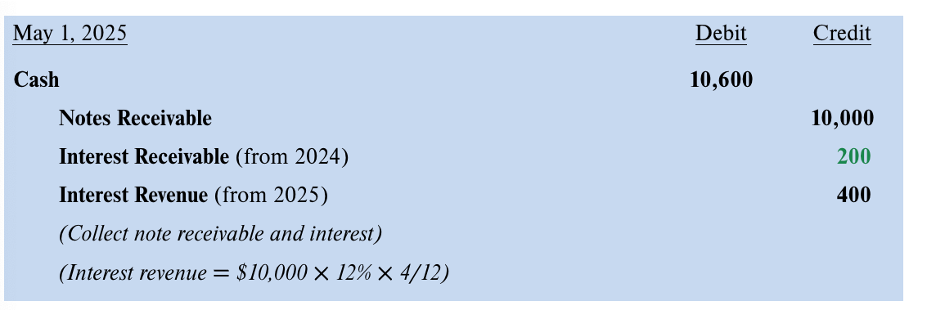

d cash; c notes receivable c interest revenue

collect notes receivable and interest revenue

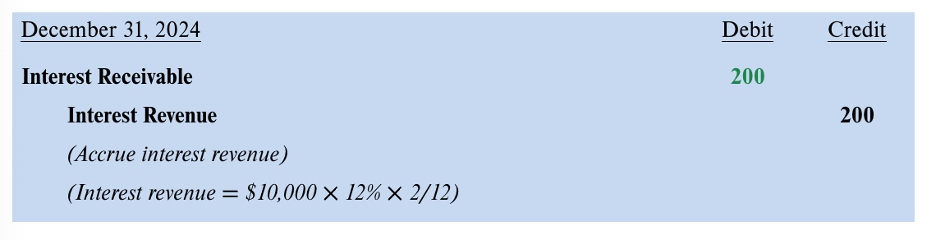

d interest receivable; c interest revenue

accrued interest when note is issued in 1 yr and maturity date is in following yr

need to record the interest revenue in the yr it was incurred

d cash; c notes receivable c interest receivable c interest revenue

on maturity date, collect notes receivable and interest receivable from previous and current yr)

net credit sales/avg accts receivable

receivables turnover ratio

how quickly company can collect cash from accts receivable

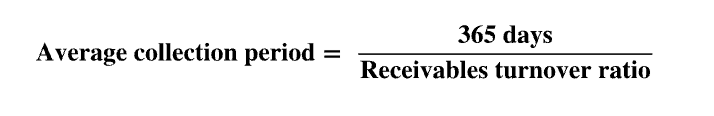

365 days/ receivables turnover ratio

avg collection period

approximate days avg accts receivable balance is outstanding

COGS= COGAS-Ending Inventory

cogs eq

gross profit= net revenues-COGS

gross profit eq

operating income= gross profit-operating expenses

operating income eq

income before income taxes= operating income + nonoperating revenues- nonoperating expenses

income before income taxes eq

nonoperating revenues/expenses

gain/loss on sale of investments

investment income

specific identification

§ ID each inventory unit with actual cost

§ Unique, expensive products with low sales volume

FIFO

§ assume beginning inventory sells first, then inventory from first purchase, etc.

§ more closely resembles actual physical flow of inventory

§ when costs rising:

· higher ending inventory

· higher gross profit

o GP= net sales-COGS (and COGS is lower)

§ “balance sheet approach”- better approximates current cost of (ending) inventory

LIFO

§ Assume last units purchased are the first ones sold

§ Calculate once at end of year

§ When costs falling:

· Higher ending inventory

· Higher gross profit

o GP= net sales- COGS (and COGS is lower)

§ “income statement approach”- COGS better approximates current cost of inventory. (however, ending inventory not realistic).

§ Tax savings

· Lower taxable income? Owe less (lower reported inventory and net income, when costs are rising)

· LIFO conformity rule- if use LIFO for tax reporting, then must also use for financial reporting

o Companies reporting LIFO must also report LIFO reserve (difference btw LIFO amount and FIFO amount)

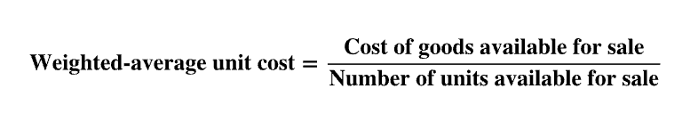

weighted avg cost

assume COGS and ending inventory is random mixture of all goods available for sale

COGAS/# available units for sale

use numbers from beginning of yr

COGAS/# units available for sale

weighted avg unit cost

use numbers from beginning of yr

perpetual inventory system

record inventory purchases and sales on continual basis

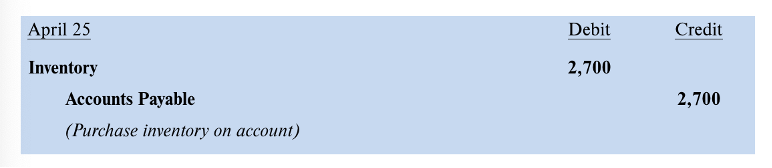

d inventory; c accts payable

purchase inventory on acct

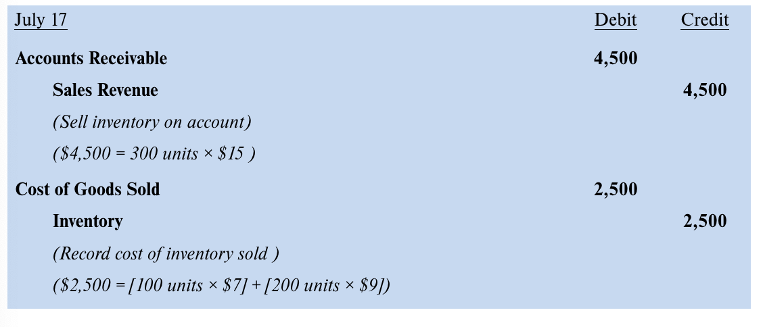

d accts receivable c sales revenue d COGS c inventory

sell inventory on acct

FOB shipping point

buyer pays for shipping

FOB destination

seller pays for shipping

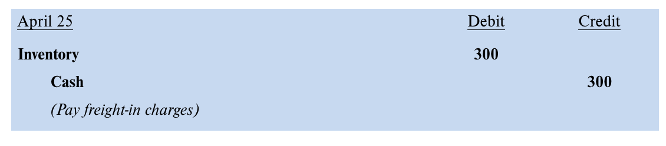

d inventory c cash

freight in: charges on incoming shipments from suppliers

add to ? balance

when inventory is eventually sold, those freight charges become a part of COGS

freight out

· Cost of freight shipments to customers

· Report in income statement as COGS, operating expense, selling expense..

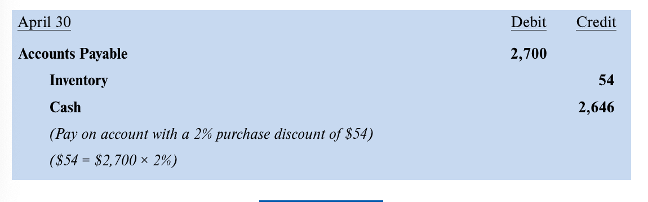

d accts payable; c inventory c cash

pay on acct with a purchase discount

Ex., when buyer pays off 2/10, n/30 (2nd journal entry)

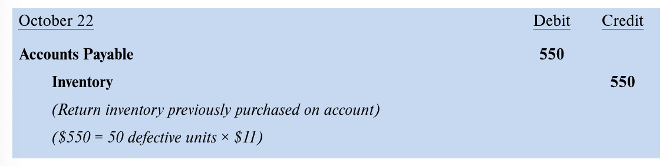

d accts payable; c inventory

purchase return on inventory previously purchased on acct

periodic inventory

o Calculate inventory balance once per period (at the end) based on physical count on hand

o Record purchases, freight in, purchase returns, and purchase discounts to temporary accts instead of Inventory directly.

o Period end adjusting entry

§ Adjust inventory balance

§ Record COGS

§ Zero out temporary purchases accounts (Purchases, Freight In, Purchase Discounts, Purchase Returns)

net realizable value

report INVENTORY at lower of cost and net realizable value

Net amount a company expects to realize in cash from inventory sale (est selling price of inventory less costs of completion, disposal, and transportation)

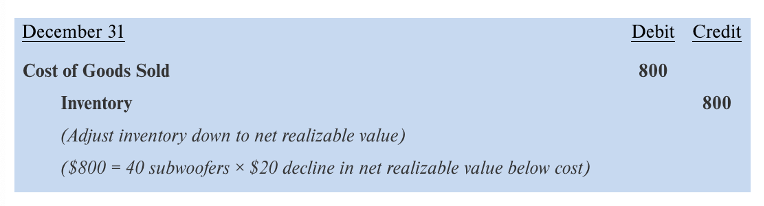

d COGS c Inventory

adjust inventory down to net realizable value

decrease total assets, net income, and retained earnings

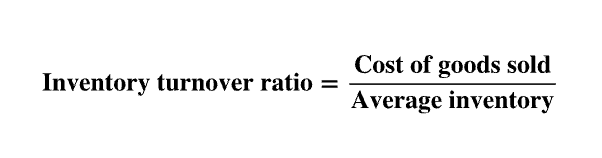

COGS/avg inventory

inventory turnover ratio

number of times firm sells its avg inventory balance during reporting period

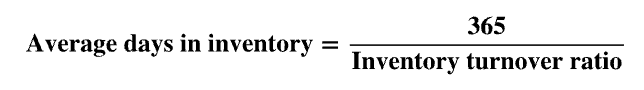

365/inventory turnover ratio

avg days in inventory

# days avg inventory is held

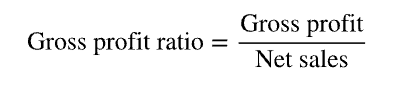

gross profit/net sales

gross profit ratio

amount by which sale of inventory exceeds its cost per dollar of sales

overstate ending inventory

understate COGS

overstate gross profit

overstate net income

overstate retained earnings

understate ending inventory

overstate COGS

understate gross profit

understate net income

understate retained earnings

long term assets

record ? at its purchase price + all expenditures necessary to get asset ready for use

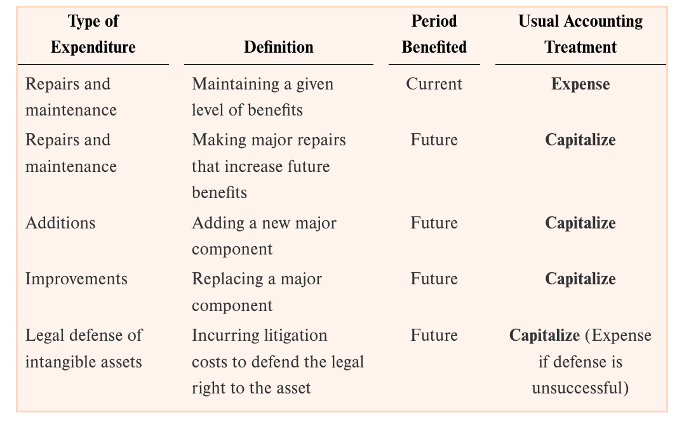

capitalize

record expenditure as an asset (expensed over time)

E.g., Land (purchase price + closing costs, back taxes, clearing, filling, leveling, demolition; if receive cash from selling salvaged building materials, reduce land cost by that amount

DONT INCLUDE LAND IMPROVEMENTS

expense

record full expenditure as expense immediately

buildings

purchase price + realtor commissions + remodeling costs

equipment

purchase price + sales tax+ shipping + deliver insurance, assembly, installation, testing, legal fees to est title

don’t include recurring costs like annual property insurance or property tax since we expense them as we incur them

basket purchases

o Purchase more than one asset at same time for one purchase price

o Allocate total purchase price based on est fair values of each of the individual assets

o Allocation percentage * amount basket purchase= recorded amount

§ Allocation percentage: est fair value of X / est total fair value

allocation percentage*amount basket purchase= recorded amount

for basket purchases how to find the recorded amount

allocation percentage= est fair value of X/ est total fair value

allocation percentage in basket purchase

expensed

internal R&D costs are ? as incurred

patent

Purchase price + legal and filing fees

§ 20 years

§ Externally purchased patent would higher valued intangible asset, while internally developed would be lower (only legal and filing fees)

copyright

life of creator + 70 yrs

trademark

e.g., Apple< name

§ Word, slogan, or symbol distinctly ID’ing a company, product, or service

§ 10 years (can indefinitely renew)

§ + attorney fees, registration fees, design costs, successful legal defense (legal, registration, design fees are recorded, NOT est value of trademark)

§ Advertising costs are expensed

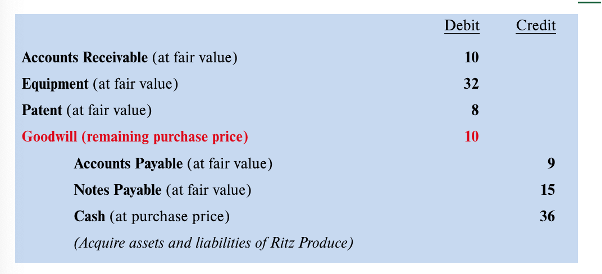

goodwill

§ Only record when one company acquires another company

§ Amount purchase price exceeds fair value of acquired company identifiable net assets

d assets d goodwill; c liabilities c cash

JE for goodwill

capitalize

? an expenditure if it increases future benefits

addition

improvement

legal defense of intangible (successful)

repairs and maintenance if MAJOR and increasing future benefits

expense

? an expenditure if it only benefits current period

repairs and maintenance

legal defense of intangible (unsuccessful)

not material

depreciation

o Allocation of an asset’s cost to an expense over time

o Book/carrying value= cost of asset- current balance in Accumulated Dep

Straight line method

delcining balance

activity based

book value= cost of asset- current balance in accum dep

book value calc

asset cost- RV/service life

straight line dep

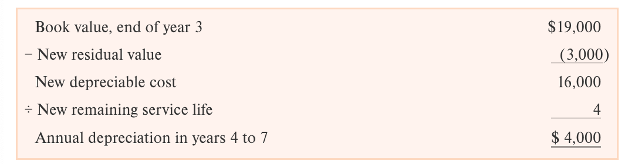

change in dep estimate

subtract new RV from book value at end of yr

divide value by new remaining service life to get annual dep from no until expected end

don’t go back and change previous dep calculations

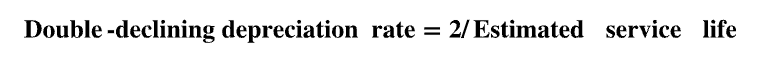

declining balance method

more dep expense in earlier years

tax

multiply rate by book value (cost- acumm dep) NOT by depreciable cost (cost-RV)

2/est service life

RV doesn’t come into play until last year

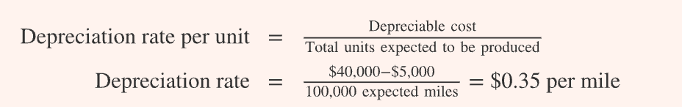

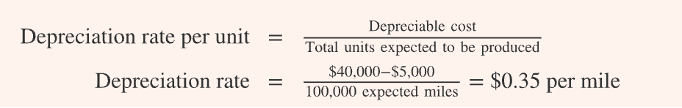

activity based method of depreciation

depreciable cost/ total units expected to be produced

dep cost: cost- RV

zero

amortization of intangibles. expected RV of most intangibles is ?

goodwill and some trademarks

don’t amortize intangibles with indefinite useful life

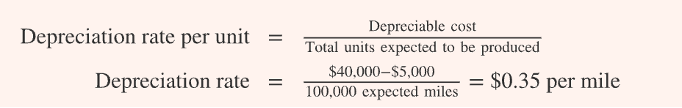

d cash, d accum dep; c equipment, c gain

gain on an asset (sell for more than book value)

note: credit equipment at purchase price

d cash, d accum dep, d loss; c equipment

loss: sell asset for less than book value

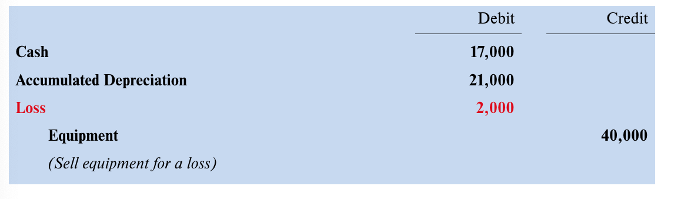

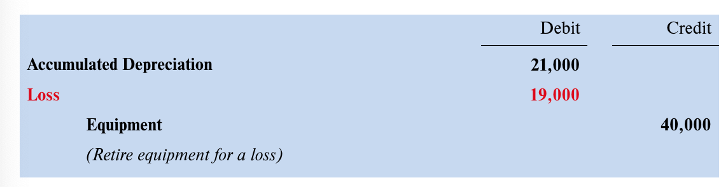

d accum dep, d loss; c equipment

retirement of long term asset

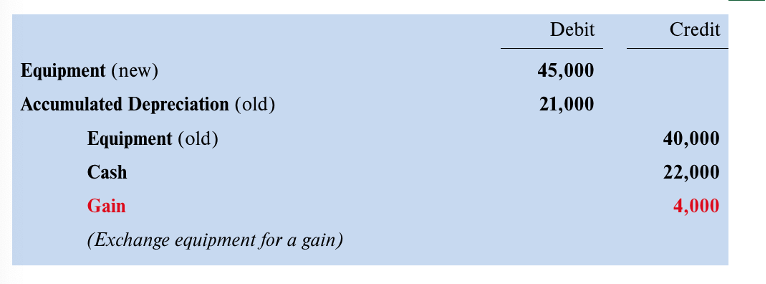

d new asset, d accum dep; c old asset, c cash, c gain

exchange of longterm assets for a gain

impairment

expected future cash flows/benefits generated for a long term asset fall below book value (og cost-accum dep)

Q1: are future cash flows less than book value

omit step 1 for goodwill and certain trademarks w/ indefinite useful lives

Q2 loss= book value-fair value

permanent, can’t write them back up

o future cash flows/benefits generated for a long term asset fall below book value (og cost-accum dep)

d loss; c trademarks

record impairment of trademarko future cash flows/benefits generated for a long term asset fall below book value (og cost-accum dep)

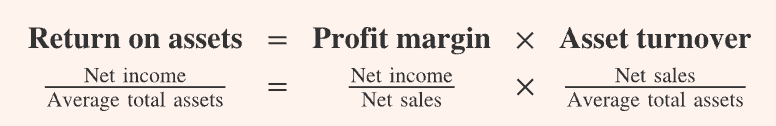

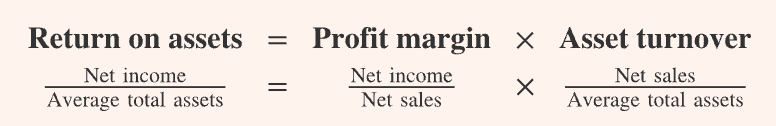

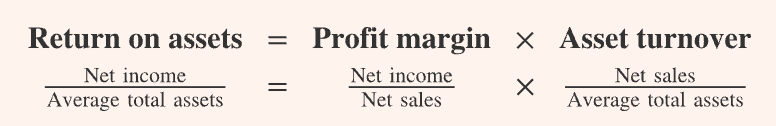

net income/avg total assets

return on assets

compare profitability

amt of net income generated for each dollar invested in assets

net income/net sales

profit margin

earnings per dollar of sales

higher thru product differentiation and premium pricing

o future cash flows/benefits generated for a long term asset fall below book value (og cost-accum dep)

net sales/avg total assets

asset turnover

sales per dollar of assets invested

higher thru lower sales prices (increase sales volume)