Unit 5.3 : Money Growth & Inflation ; Unit 5.4 : Gov Deficits & Nat Debt; Unit 5.5 : Crowding Out

0.0(0)

0.0(0)

Card Sorting

1/19

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

1

New cards

MV = PY

Quantity Theory of Money

2

New cards

money supply

M

3

New cards

velocity of money

V

4

New cards

velocity of money

the average times a year money is spent and re spent in a year; ex. if Real GDP is $400B but amount of money in economy is $100B

5

New cards

price level

P

6

New cards

quantity of output

Y

7

New cards

V; Y

Assume ____ is relatively constant because people's spending habits aren't quick to change and ____ isn't affected by quantity of money because it's based on production, not value of stuff produced

8

New cards

the price level increases unless we can increase Y

If the government increases amount of money (M), what will happen to P?

9

New cards

Short-run spending eventually leads to higher resource prices and inflation. If inflation is bad enough, banks don't lend and economy tanks

What happens in the long-run when the central bank increases in money supply?

10

New cards

Monetary policy can increase real output in short-run

If the last question is true, why do many economists support expansionary monetary policy?

11

New cards

deficit spending

What's the trade off of increasing government spending without increasing taxes to close a recessionary gap?

12

New cards

budget deficit

when annual government spending and transfer payments are greater than tax revenue

13

New cards

budget surplus

when annual government spending and transfer payments are less than tax revenue

14

New cards

National Debt

the accumulation of all budget deficits over time

15

New cards

annual deficit; national debt

If the government increases spending without increasing taxes they'll increase the _____ and the _____

16

New cards

entitlements

a federal program that requires payments to any eligible person or unit of government; this mandatory spending must be paid (ex. Social Security)

17

New cards

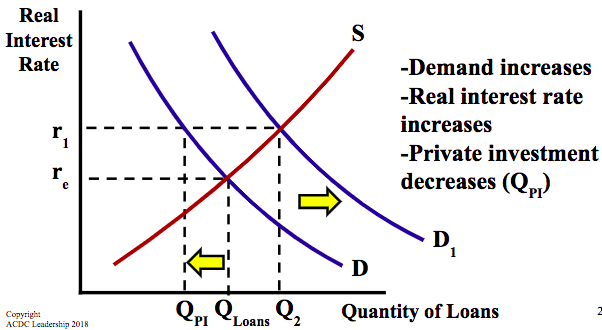

crowding out

adverse effect of government borrowing on interest-sensitive private sector spending

18

New cards

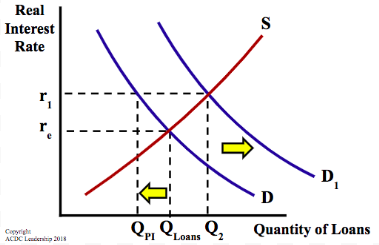

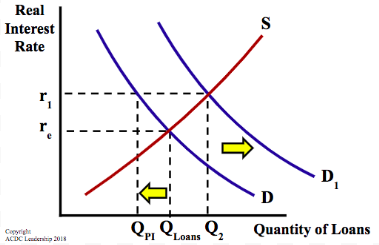

demand increases, real interest rate increases, and investment decreases (Qpi)

Assume government increases deficit spending, what happens to demand of loanable funds, real interest rate, and private domestic investment?

19

New cards

falls

the total number of loans increases to Q2, but that was due to public borrowing; private borrowing ____ to Qpi

20

New cards

less economic growth because investment decreases ... less capital stock

What is the long run impact of a higher real interest rate?