2.4 Prepare financial statements from the adjusted trial balance and prepare closing entries.

1/9

Earn XP

Description and Tags

Complete the Closing Process

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

10 Terms

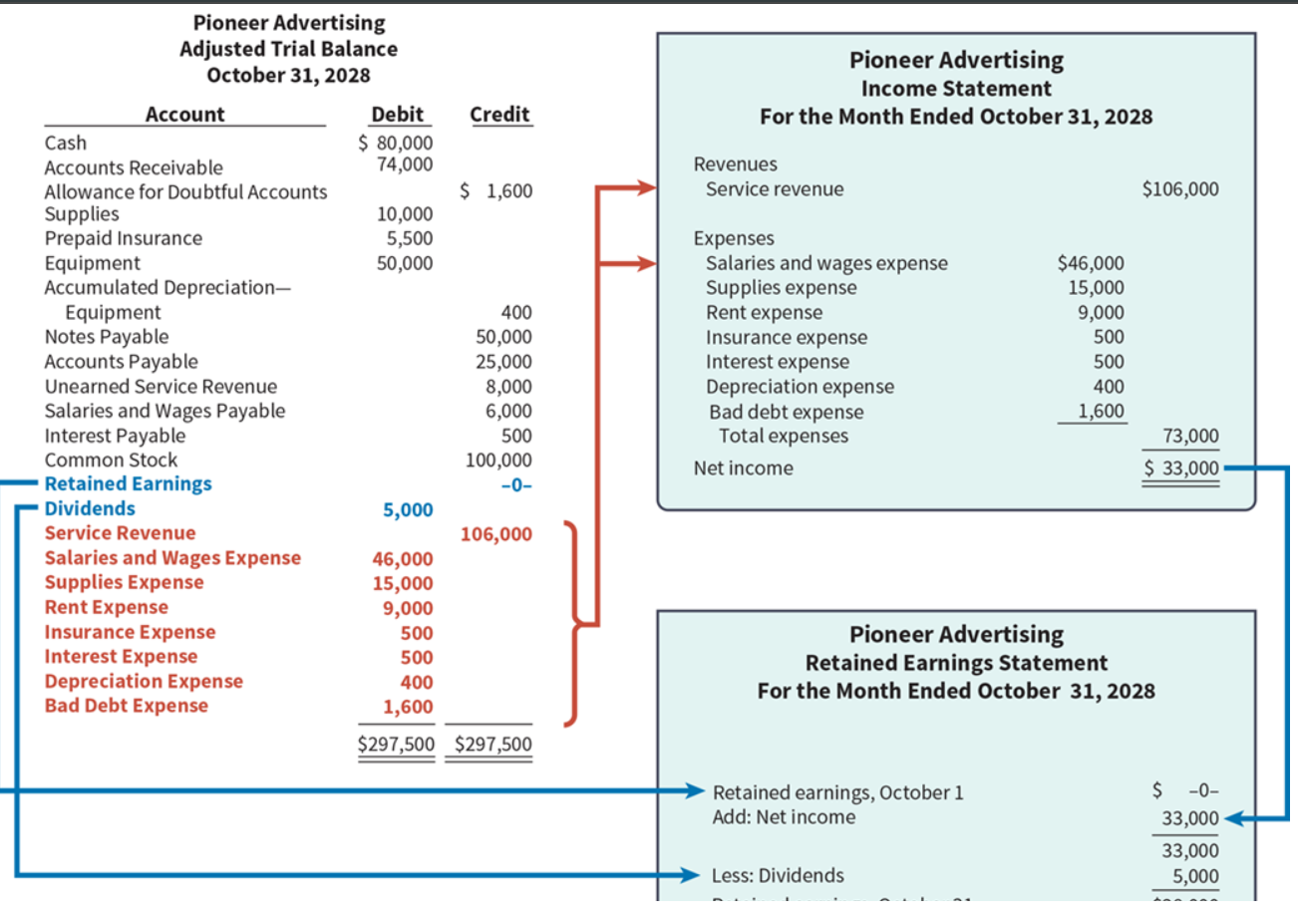

Now in this 7th step, called: Prepare the financial statements from the adjusted trial balance

We can now make the financial statements: income statement (from the revenue and expense account list), the retained earnings statement (from begg retained earnings + Net income (# received from doing the income statement prior to this one) - dividends)

Then after doing that one, we will do the balance sheet (from the assets and liability accounts, the common stock account, and the ending retained earnings balance as reported in the retained earnings statement.)

8th step: Journalize and post closing entries

What Is the Closing Process (Explained Simply)?

The closing process in accounting is like resetting your scoreboard at the end of a game, so you can start fresh for the next round (the next accounting period). It’s something companies do at the end of every accounting period (like every month, quarter, or year).

🧾 Why do we need to "close" anything?

Some accounts, like revenue (money earned) and expenses (costs), are only used temporarily for one period. These are called temporary (nominal) accounts.

At the end of that period, we need to:

Clear those accounts out (bring them back to zero),

Calculate the actual profit or loss, and

Move that profit or loss into a permanent account (like the company’s retained earnings — kind of like a "savings account" for profits).

8th step: Journalize and post closing entries X2

tep-by-Step Summary (In Plain English):

All revenue and expense accounts are emptied into a special holding account called Income Summary.

Think of this like gathering all your income and bills in one place to see what’s left.

The balance in the Income Summary shows whether the company made a profit or loss.

Profit if income is more than expenses.

Loss if expenses are more than income.

That final amount (profit or loss) is then transferred to a permanent account:

For corporations, this is called Retained Earnings (it keeps track of profits the company has kept over time).

For small businesses like sole proprietorships or partnerships, it goes into a capital account (the owner's stake in the business).

Now, the temporary accounts (revenues and expenses) are ready to start fresh in the next period — just like a clean slate.

Why Is This Important?

It keeps the books accurate and separates each accounting period clearly.

It helps track how much the business really earned or lost in a given time.

It ensures revenues and expenses don’t carry over into the next period, which could mess up financial reports.

Vital/closing entries:

For example, revenue and gain accounts have a normal credit side balance, so to zero out the temporary revenue accounts, you must debit revenue and credit the temporary income summary account

The accounting cycle:

The process done at the end of the accounting period (quartely, monthly, or yearly) where all of our transactions (financial history) is set in place to be reported to shareholders.

"The accounting cycle is the process completed at the end of an accounting period to record, organize, adjust, and summarize all financial transactions, so accurate financial statements can be prepared and reported to shareholders and other users."

Posting closing entries:

Once they are recorded in the general journal, they are then posted to the general ledger,

The accounting cycle steps summarized:

Analyze Transactions

Look at all the receipts, invoices, bank statements, etc., and figure out what happened financially.

🔍 Example: You paid rent? That’s a rent expense. You made a sale? That’s revenue.

2. Journalize

Record each transaction in the journal (like a diary for money) in date order.

✍ Example: "Sold $1,000 of goods on Sept 5" → write it down with a debit and credit.

3. Post to the Ledger

Move the journal entries into the ledger, where we organize everything by account (e.g. Cash, Rent Expense, Sales).

📚 Think of this like organizing notes into folders.

4. Prepare Trial Balance

Add up all the debits and credits from the ledger to make sure they match.

⚖ This checks if the books are “in balance.”

5. Make Adjusting Entries

At the end of the period, adjust for things that happened but weren’t recorded yet.

🛠 Examples:

You owe employees 3 days of salary → record it.

A customer paid in advance → adjust to show you've “earned” some of it.

6. Adjusted Trial Balance

Prepare a new trial balance after adjustments to make sure everything still balances.

📊 This is the final version used to make reports.

7. Prepare Financial Statements

Use the adjusted numbers to create:

📄 Income Statement (profit)

📃 Balance Sheet (what you own/owe)

💸 Cash Flow Statement (money in/out)

8. Closing Entries

Close (reset) temporary accounts like revenue and expenses back to zero, and move the net income into Retained Earnings.

🔁 So you're ready to start fresh next period.

📌 End Result:

You now have accurate, organized records that show the company’s financial health. These are used by:

Shareholders

Lenders

The IRS

Managers

"Record → Organize → Adjust → Report → Reset"

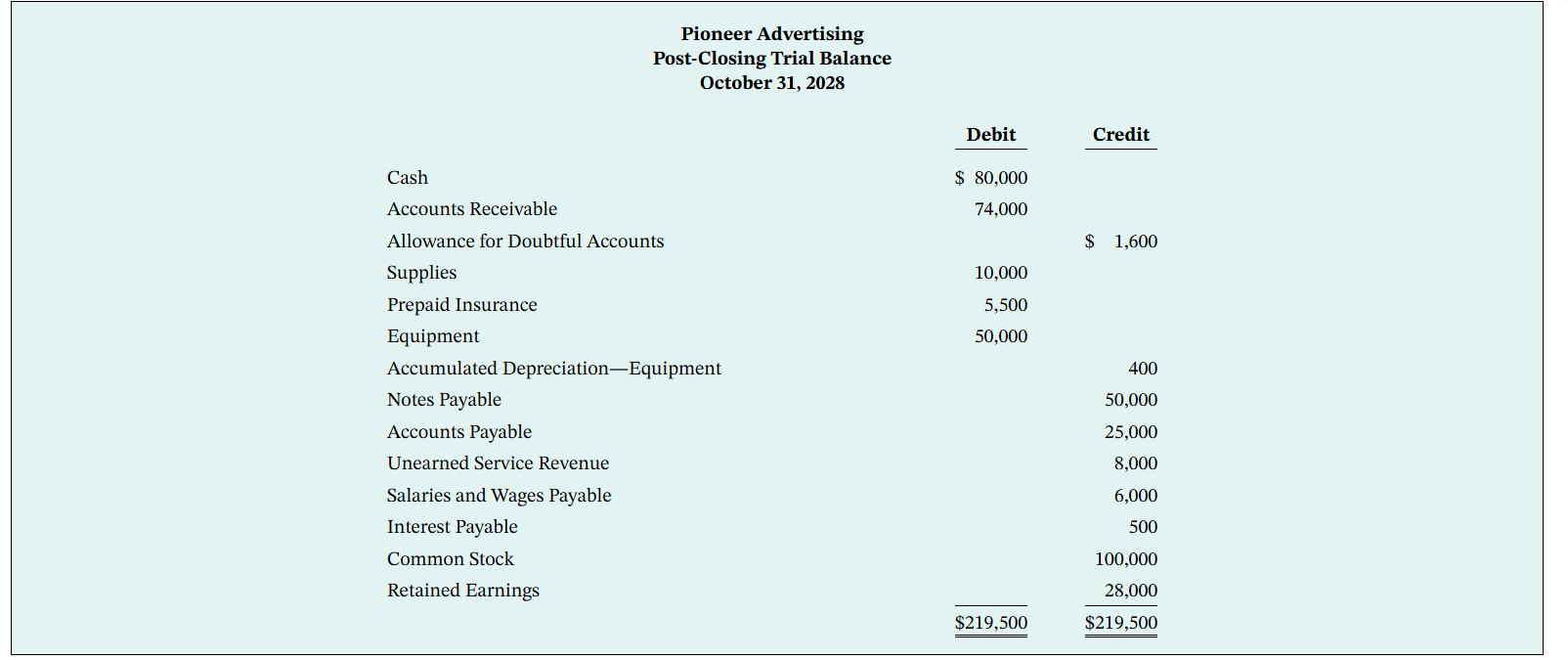

Step 9# Post-Closing Trial Balance

A post-closing trial balance provides evidence that the company has properly journalized and posted the closing entries. It also shows that the accounting equation is in balance at the end of the accounting period. However, like the other trial balances, it does not prove that the company has recorded all transactions or that the ledger is correct.

Step 9# Post-Closing Trial Balance X2

What Is a Post-Closing Trial Balance?

After all the accounting work is done — transactions recorded, adjustments made, and financial reports created — there’s one last check called the post-closing trial balance.

✅ Here’s the full picture, step by step:

First, you make a regular trial balance:

📋 This just lists all account balances before any adjustments are made.

Then, you make an adjusted trial balance:

🛠 This is after fixing/adjusting anything that needs to be updated (like unpaid salaries or depreciation).

After that, you close the temporary accounts (like revenue, expenses, dividends) to get ready for the next period.

🔒 This means setting them back to zero.

Now, you make the post-closing trial balance:

✅ This only includes permanent accounts (like cash, assets, liabilities, and retained earnings).

🎯 Why is this done?

To make sure your books still balance (debits = credits) after closing the temporary accounts.

To check that you’re ready to start the next accounting period with a clean slate.

📌 Important Notes:

Temporary accounts = zeroed out (not shown here anymore).

🗑 These are: revenue, expenses, dividends.

Only permanent accounts remain, like:

💵 Cash, 🏠 Equipment, 📉 Accumulated Depreciation, 💳 Liabilities, and 📈 Retained Earnings.

🧠 One-line summary:

The post-closing trial balance is a final check that only shows the real (permanent) accounts you carry into the next period — after resetting everything else.

Reversing Entries—An Optional Step

Some accountants prefer to reverse the effects of certain adjusting entries by making a reversing entry at the beginning of the next accounting period. A reversing entry is the exact opposite of the adjusting entry made in the previous period. Use of reversing entries is an optional bookkeeping procedure; it is not a required step in the accounting cycle. Accordingly, we have chosen to cover this topic in Appendix 2B.