healthcare system study guide

1/309

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

310 Terms

define managed care

system that integrates financing and delivery of appropriate medical care by means of the following:

-contracts with selected physicians and hospitals to provide care for enrollees, usually on a predetermined monthly premium

-utilization and quality controls that contracting providers agree to accepts

-financial incentives for patients to use providers associated with the plan

-the assumption of some financial risk by doctors

True or false: managed care provides cost effective health care

true

what three things are we trying to balance in managed care

access, quality, cost

primary reason for managed care growth

steadily rising and unsustainable health care costs

HMO Act of 1973

-feasibility grants and low-interest developmental loan programs made available to encourage interested parties to develop and build HMOs

-the establishment of procedures through which health plans could become "federally qualified HMOs"

-inclusion of preventative as well as curative health care benefits

-requirement that employers offer federally qualified HMOs to their employees under certain circumstances

what is the differentiating feature of managed care versus fee-for-service

the use of provider networks

network

group of providers, linked through contractual arrangements, supply a full range of primary and acute care services

two common physician reimbursement methods in HMOs

-capitation

-discounted FFS

risk bearing

the amount of risk borne by the provider, which can range from full risk to no risk

physician type

the relationship between the MCO and the physician(s)

relationship exclusivity

addresses whether the physician provides care to patients from one MCO only or to patients from multiple MCOs

out of network coverage

addresses whether care received from a provider who is not in the MCOs network is a covered benefit

MCO characteristics: Place providers at risk

capitation costs for given population are first estimated. providers paid prospectively to provide agreed upon services. providers take risk that the capitation rate will cover all the costs of care for the population. the provider assumes risk that was traditionally underwritten by insurance company

MCO characteristics: Gatekeepers

central component of most HMOs. Gatekeepers are typically primary care physicians. gatekeeper may be financially at risk for medical services

HMO (Health Maintenance Organization) model types

staff, group, network, IPA

Other MCO (managed care organization) models

PPO, POS, EPO, PHO

Health maintenance organizations

organized health care systems that are responsible for both the financing and the delivery of a broad range of comprehensive health services to an enrolled population

staff model HMO

physicians who provide care are employees of the HMO

staff model characteristics

-physicians typically do no see outside patients

-physicians are salaried

-physician mix of generalist and specialist

-have a good degree of organizational control

-high level of control over costs and utilization of services

-pharmacy services provided through in house pharmacies

-do not provide out of network coverage

example of staff model HMO

health partners, Harvard community health plan, group health cooperative of puget sound

group model HMO

organization that contracts with a multi specialty physician's group to provide services to an enrolled group

group model characteristics

-physicians are reimbursed through capitation or are salaried

-physicians see HMO patients only

-no out of network coverage

-pharmacy services provided through in house clinic pharmacies and contacts with network of community pharmacies and mail order

-less organization control

-group practice may be centralized-cant expand to other geographical areas easily

-group practice may be too small to provide a wide range of services

examples of group model HMOs

kaiser health plans, group health alliance plan of Michigan

network model HMO

can be visualized as a group of group practices organized to function as a single group of physicians

characteristic of network model HMOs

-physician networks bear risks

-physicians see HMO and non-HMO patients (non exclusive contracts)

-no out of network coverage

-physicians reimbursed either through capitation or discounted FFS

-pharmacy services offered through in house contracts with community pharmacy networks, and mail order pharmacies

-increases geographic accessibility, patient selection capability and breadth of practitioner expertise

-less organizational control

examples of network model HMOs

health insurance plan of greater New York, healthnet, pacificare, blue plus

IPA (independent practice association)

physicians form their own separate legal entity (usually corporation or partnership) and then contracts with MCO

characteristics of IPA

-most decentralized

-association serves as voice for physicians

-IPA shares risk with MCO

-physicians reimbursed by IPA for services t enrolled patients for a negotiated fee (either through capitation or discounted FFS)

-physicians can see HMO and non-HMO patients

-pharmacy services provided through contracted network of independent and chain community pharmacies and mail order pharmacies

-difficult to adopt policies

examples of IPA

HMO PA-US HealthCare, Medica

advantages of IPA

-maximizes patient choice -low start-up financial requirements -geographic dispersion -community based

disadvantages of IPA

-difficult to standardize policies -difficult to manage utilization -less efficient communication

HMO- summary

-provider network -no out of network coverage -PCP is gatekeeper -prior authorization -most restrictive type of health plan -give least choice to members -lowest out-of-pocket expenses

Preferred Provider Organization (PPO)

-affiliations of providers that seek contracts with insurance plans

-Less restrictive than HMOs in their choice of health care providers. However, they require greater "out of pocket" payments from members

characteristics of PPOs

-patients have more choice of providers

-channeling through differential cost-sharing

-no gate-keeper PCP; no prior authorization

-financial incentives to use in-network physicians

-DISCOUNTED FEES FOR PROVIDERS

-utilization review (case by case utilization management)

-physicians do not bear any risk

-PPOs exert less control over providers than do HMOs

-grown popular network in recent years

How is PPO different from an HMO?

-physicians bear no risk

-availability of out of network coverage

-don't have "gatekeeper" PCP

Exclusive Provider Organization (EPO)

a form of PPO in which no coverage is provided for care received outside of the provider network

POS (point of service) plan

allows patients to select providers at the same time the service is needed rather then they join the plan. When care is received from a provider outside of the network, some coverage is provided

characteristics of POS

-hybrid of HMO/PPO -has contracted provider network -encourages members to choose PCPs. higher copays for those not choosing to go through PCPs -out of network coverage available

what is a healthcare report card?

a published document that measures and compares the quality of care delivered by health care providers

what is a healthcare report used for?

used to disseminate information on quality MCOs

who uses health care report cards?

employers, government and consumers to compare and understand the performance of the health plan for the purpose of selecting a plan

what is included in a health care report card?

info on both cost and quality

NCQA (National Committee for Quality Assurance)

-independent, not for profit organization dedicated to evaluating and reporting on the quality and performance HMO

-played a major role in the development of standardized report cards

how does NCQA accomplish its mission

through accreditation and performance measurement programs

HEDIS HealthCare Effectiveness Data Information Set

NCQA performance measurement program

What does HEDIS collect?

performance measurements that reflect the achievements of health plans across relevant domains

examples of performance measurements

use of breast cancer screening, availability of providers, member disenrollment rates, average length of stay for maternity care

True or false: more than 90% of HMOs are providing some HEDIS measures

true

Who does NCQA estimate have used HEDIS and accreditation in deciding which plan to purchase

over half of the large employers in the US

why did Pharmacy Benefit Manager (PBM) come into existence

in response to managed care environment

why were PBMs created?

to develop, promote, maintain, and integrate pharmacy and medical benefit programs

carve-out (benefit plan)

payer removes, or carves out, a specific benefit from the internal health plan delivery system and offers the benefit through and external company

What do PBMs provide?

delivery and financing of pharmacy benefits for a defined population

characteristics of PBMs

-have a provider network -offer mail service -negotiate discounts with providers, generic substitution, and rebates -offer electronic claims adjudication -use formularies, prior to authorizations and step protocols to control costs -perform drug utilization review -cost sharing -provider and patient education

two types of employer sponsored health insurance

full insured, self-funded

Define health insurance exchanges

online health insurance marketplace, either state, federal, or jointly run, depending on the state

define self insurance

assume the risk of potential loss rather than purchase insurance

who can self insure?

large companies

list benefits of self insurance

ability to customize benefits, ability to focus on employee health problem trends, improved cash flow, federal employer income tax exclusion

Describe self funded payments

the employer does not pay premiums: instead, it pays fixed costs (administrative fees and stop loss premium) and variable costs (employee health care claims)

self funded: assumption of risk

the employer assumes the risk

self funded: plan design

employers have more control and freedom in their plan designs

Self insured: compliance payments

The Employee Retirement Income Security Act of 1947 (EIRSA) pre-empts state regulations

Fully insured: payments

the employer pays monthly premiums to an insurance carrier

assumption of risk: fully insured

the insurance company assumes the risk

Plan design: fully insured

employers are more limited by the insurers' plan design options

compliance payments

the plan must comply with state regulations

list payment methods to physicians

salaries, fee for service, capitation

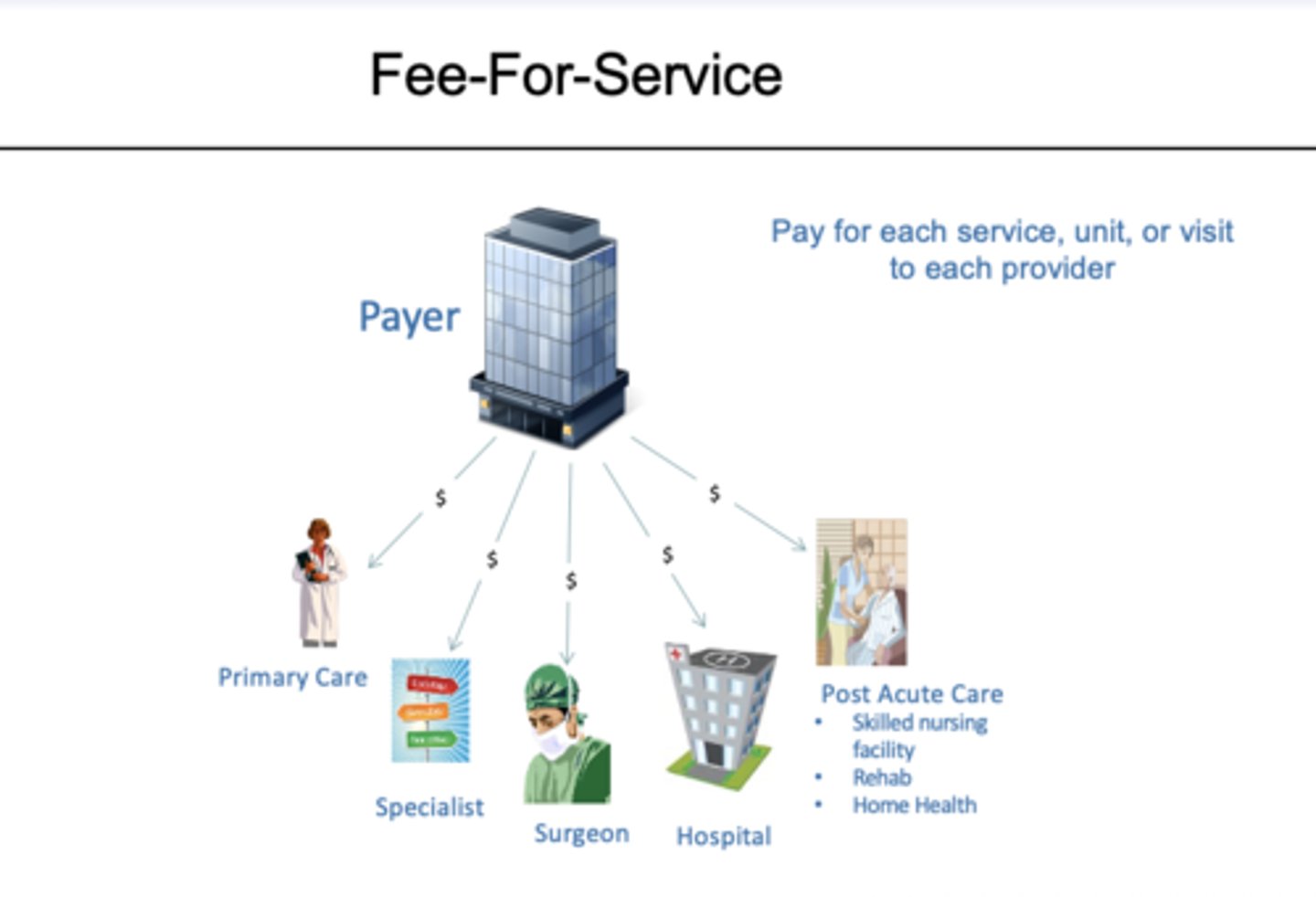

Define fee for service

-payment PER SERVICE

-no risk to providers

-no incentive for efficient production or utilization

define capitation

-payment PER SUBSCRIBER

-provider receives a set dollar amount per person per time period and assumes responsibility for delivery of all needed services during that time

List alternative payment models

P4P, ACOs, Medicare Advantage Plan bonuses, Bundled payments

Define P4P

newer form of payment structure. Providers paid only if they meet certain goals. Provides bonus (or imposes financial penalties) if providers meet or exceed (or fail to meet) quality or performance measures

define ACOs

groups of providers that agree to coordinate care and to be held accountable for quality and costs (group of providers agree to P4P

Define medicare advantage plan bonuses

-bonus payments to medicare advantage plans that achieve at least a four star quality rating

Bundled payments or episode of care payments

Single payment for all clinical services provided during a clinical episode.

What percentage of health care expenditures do physician payments make up

20%

Two methods of reimbursement (if physicians are not salaried or paid by capitation)

-U&C charges

-Fee Schedule (RBRVS)

Define U&C charges

based on actual charges-profiles of charges for each procedure are established by specialty are and geographical area

usual charge

amount typically charged by a physician for a procedure.

customary charge

prevailing amount charged among all physicians in the area.

Disadvantage of U&C charges

great deal of maintenance, profile of each physician needed ,physicians can keep increasing charges in the area and U&C charges will go up

Who uses RBRVS?

Center for medicare and medicaid services and other payers

Relative values of Resource-Based Relative Value Scale (RBRVS)

-depend on length, intensity, and complexity of procedure. Also reflects economic factors like inflation

Elements of Resource-Based Relative Value Scale

-physician work -practice expense -professional liability insurance -geographic practice cost index

Medicare conversion factor of RBRVS

$35.8

Advantage of RBRVS

easy to maintain once relative values have been established

Issues with RBRVS

the issue of balancing billing has arrived

Paying Hospitals: DRGs

-brought financial risk to hospital management

-redefined the unit of production or output to encompass clinical decisions by physicians as well las operation decisions by administrators

-DRGs have reduced medicare expenditures for hospital services: these savings have exceed out of hospital expenses

How are pharmacies paid?

prepaid drug programs

define prepaid drug programs

the only out of pocket payments are copayments per each prescription

Third party programs involve 3 entities

-insurer or underwriter -third party administrator (TPA) -the pharmacy

example of TPA

PAID & PCS

Why are TPAs important

-they adjudicate many claims that represent relative small dollar amounts

-they maintain atomization for verifying insurance

-they maintain pharmacy networks

-they maintain databases for utilization review

What is the cost of a prescription made up of

1. Product cost (AWP-specified %)

2. dispensing or professional fee

Total healthcare expenditures

4.3 trillion dollars

Healthcare expenditures per capita (person)

almost 13000

Total health care expenditures as a percent of GDP

18.3%

Why are rising healthcare costs are a concern?

-not good for the fiscal and economic well-being of the country

-high health spending associated with poor care

-affects affordability and access

two primary reasons health care costs are rising

-high healthcare prices

-aging population (medicare costs expected to increase)

why is the price of healthcare rising?

-innovate healthcare technology

-complexity of the healthcare system leading to administrative waste