Market Structure IV: Oligopoly

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

what is an oligopoly?

a market dominated by a few large firms

what are the four main assumptions of an oligopoly?

barriers to entry

high conc ratio

differentiated goods

firms are highly independent

what is interdependence?

each firm must take account of its rivals’ behaviour + reactions

i.e. must act strategically

either cooperatively/ non-cooperatively

real life oligopoly examples:

TESCO dominates UK petrol market, followed by BP, Shell, ESSO

Cineworld dominates UK cinema market, followed by Odeon and Vue

William Hill dominates UK betting market, followed by bet365, Ladbrokes and Paddypower

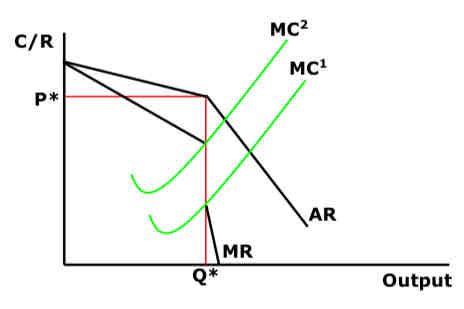

Non-Cooperative Strategy I: The Kinked Demand Curve Model

The oligopolist thinks:

If I increase my price, my competitors will leave their own price unchanged, in order to take some of my market share

But:

If I decrease my price, my competitors will follow suit in order to preserve their own market shares

So the oligopolist believes his competitors will:

'Match price reductions but ignore price increases'

This gives rise to a kinked demand curve

MR has a discontinuity at the kink...

...because MR has twice the gradient of AR

Hence Q* is seen to be the profit-maximising level of output under a wide range of cost conditions from MC1 to MC2

So the firm will leave price and output unchanged, even when costs do change

This causes sticky prices...

(Paul Sweezy, 1939; Hall & Hitch, 1939)

So the oligopolist might compete on non-price factors instead...

analysis of the KDC model

criticisms of the KDC model

The KDC model does not explain how the original price, p*, was determined

i.e. it tells us prices will be rigid, but not whether they are likely to be high or low to begin with

in practice, many oligopolists do change prices (e.g. Tesco price check) so the KDC model would seem to be outdated

what is game theory?

a method of modelling the strategic interaction between firms in an oligopoly when the firms have incomplete information about the others’ intentions

what is a dominant strategy?

a strategy which always produces the kremlin for the firm, no matter which strategy is chosen by its rivals

what is nash equilibrium?

where each player’s chosen strategy maximises the pay-offs, given the other player’s choice, so that no player has an incentive to change its strategy

what is a payoff matrix?

a grid that illustrates the possible outcomes of two players’ actions

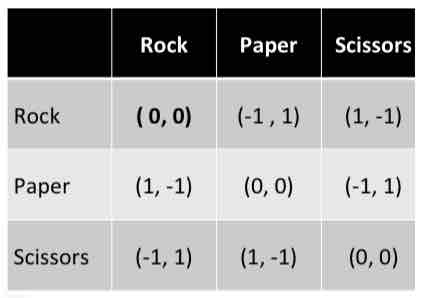

what is a zero sum game?

where a gain by one player is matched by a loss by another player

rock paper scissors - random strategy

In this game matter what both players choose, at least one of them can always improve their payoff by switching to a different choice.

If one of them wins the game, the loser can improve their payoff by switching.

If it's a tie, either player can improve their payoff by switching to a different choice.

use of game theory in analysing oligopolies

game theory examples revolve around the pay-offs that come from making different decisions.

this illustrates why firms are likely to compete if they cannot be sure that their competitor will consistently collude (& lack of communication). Even though this will not maximise returns.

illustration of interdependent decision making e.g. marketing, pricing or R&D

criticisms of game theory

assumption that firms are perfectly rational may be unrealistic

may work well as a mathematical model, but not based on behavioural evidence…and human behaviour – even that of a CEO – can be irrational as opposed to being precisely calculated

even when a game is played for multiple rounds and the players have established a ‘Nash equilibrium’, preferences can still change over time

first mover (change your strategy) advantage

gain customers

develop brand loyalty

no switching costs – costs incurred by late entrants to entice customers to switch

first mover (change your strategy first) disadvantage

free rider effects (R&D, marketing and awareness)

high marketing costs to raise awareness

second mover advantage

high financial uncertainty

examples of first mover advantage

AWS has become the biggest technology infrastructure provider in the world — and it is also the fastest growing and most profitable part of Amazon

what are the types of cooperative strategies?

cartel

collusion

tacit collusion

what is a cartel?

an agreement between so or more firms to fix price and/or output

what is collusion?

a secret agreement between firms in a cartel to fix prices and/or output

what is tacit collusion?

where firms refrain from price competition, but without any communication or formal agreement

the intention of coordinating price and output is to:

mimic the benefits of being a monopoly, hence maximising joint profits

Oligopolists will raise their prices simultaneously, each firm moving along a continuously inelastic AR curve

why are cartels inherently unstable and rarely last for long?

Cheating

Each firm now knows the other one will price high, so…

Each firm thinks it can selfishly maximise its own profit by slightly undercutting its rivals and pricing low

this situation does not last long because….

Illegality

Fines of up to 10% turnover

Leniency – heightens the instability

Jail sentences of up to 5 year

types of collusion

overt collusion

tacit collusion

overt collusion

e.g. that is spoken, open or traceable

Pricing agreements

Output quotes / market share

Information sharing such as technical data

Agreed limits to marketing expenditure

Joint R&D projects

https://www.tutor2u.net/economics/reference/oligopoly-collusion

tacit collusion

occurs where firms undertake actions that are likely to minimise a competitive response, without explicit communication and normally through repeated observations of behaviour e.g. price leadership of BA

AKA Price Leadership

one dominant firm in the industry takes the lead in setting price…

…the others simply follow suit

✔ Major mortgage lenders

✔ Petrol stations

not illegal as firms aren’t actively conspiring

common features of oligopoly

price rigidity

(to avoid price wars)

dominant strategy of low price and high output

non-price competition

(advertising and brand loyalty, sales promos, R&D, etc, to acquire new customers but without undermining revenues)

temptation to collude and form a cartel

(though these are naturally unstable and are made even more wobbly by illegality and ‘leniency’ rules)

continuously inelastic → rigid prices

leniency → more likely for behaviour to carry on.