Understanding Inflation: Causes and Effects

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

29 Terms

Inflation

Increase in overall price levels of goods.

Deflation

Decrease in overall price levels of goods.

Inflation Rate

Average 3-5% over the past 80 years.

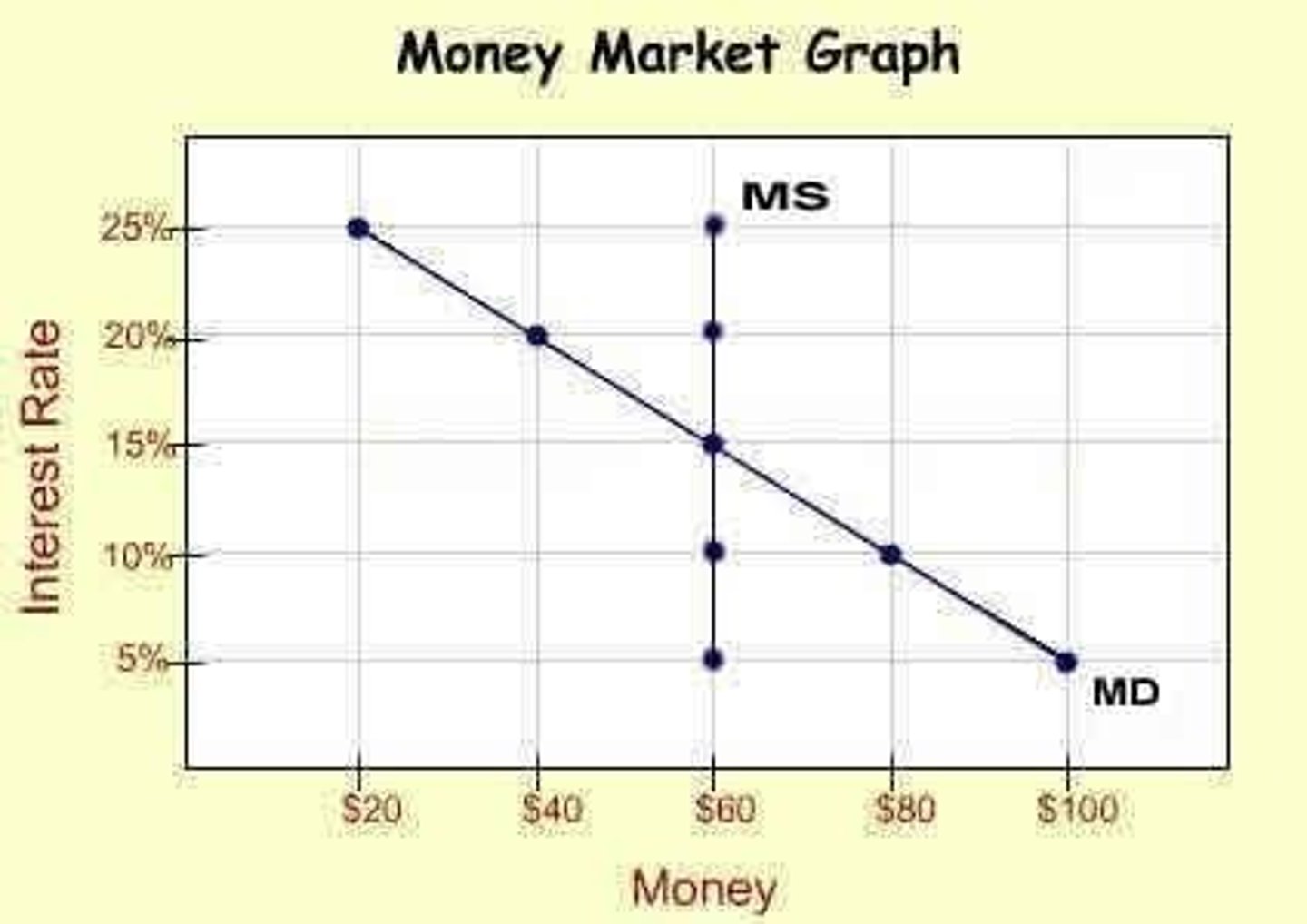

Money Supply (MS)

Controlled by the Fed; fixed quantity in circulation.

Demand for Money (MD)

Depends on personal preference and interest rates.

Monetary Equilibrium

Balance between money supply and demand.

Short-Run Effects

Interest rates influence money supply and demand.

Long-Run Effects

Prices adjust to equilibrium over several years.

Debtors

Borrowers who benefit from inflation.

Creditors

Lenders who lose value during inflation.

Real Interest Rate

Nominal interest rate adjusted for inflation.

Home Equity Loan

Loan based on the home's increased value.

Nominal Variables

Money and price levels without real impact.

Shoeleather Costs

Costs from frequent bank trips due to inflation.

Menu Costs

Costs of changing prices for businesses.

Relative Price Changes

Misinterpretation of price increases affects spending.

Demand-Pull Inflation

Caused by excessive demand for goods/services.

Cost-Push Inflation

Caused by rising production costs from suppliers.

Built-In Inflation

Inflation from wage demands to match rising prices.

Price Per Unit Cost (PUPC)

Total input cost divided by units of output.

Supply Shocks

Unexpected increases in production costs.

Home Value Appreciation

Increase in home value exceeding inflation rates.

Equilibrium Level

Point where money supplied equals money demanded.

Inflation's Costs

Negative impacts include confusion and resource misallocation.

Confusion and Inconvenience

Inflation distorts perceptions of value and earnings.

Economic Health Indicator

1-2% inflation signals a healthy economy.

Real Value

Actual purchasing power of money after inflation.

Homeowner Delight

Homeowners benefit from increased home equity.

Nominal Interest Rates

Interest rates not adjusted for inflation.