ecawns market failure

1/42

Earn XP

Description and Tags

-VE EXT AND PETDQQD (+ve and -ve)

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

43 Terms

what is market failure

failure of the free market to allocate resources efficiently

-ve ext?

spillover costs to third parties who are not directly involved in the consumption/production of the good or service itself

MEC

additional cost to third parties (con/prod) ++ unit of g/s

MSC

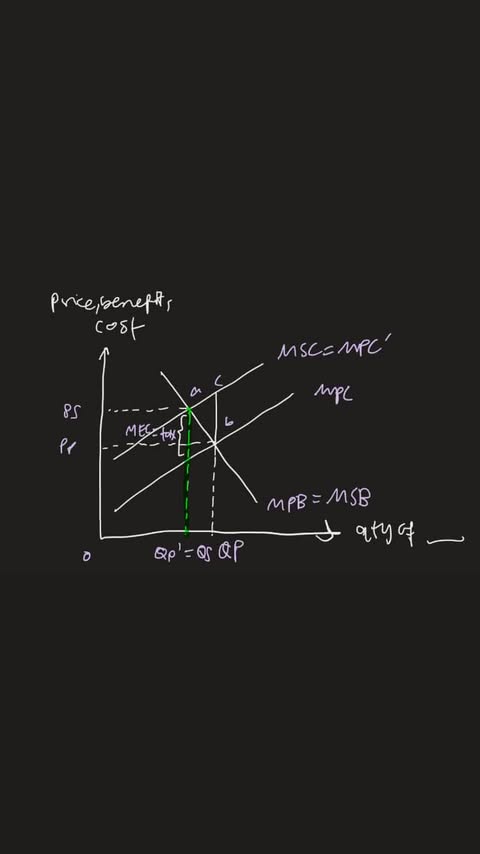

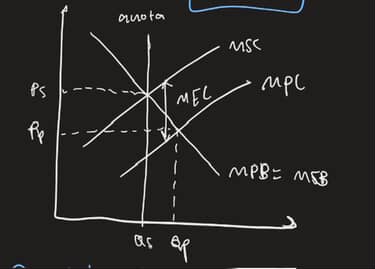

MPC + MEC

MSC>MPC

over allocation

ext (PETDQQD) P

priv benefit and cost

ext (PETDQQD) E

externalities → what isit

ext (PETDQQD) T

third parties - who?

ext (PETDQQD) D

divergence

—> presence of MEC/B create divergence between MSC/B and MPC/B

—> (MSC><MPC)

—> diagrammatically, MS curve lie above MP by amt of ME

—> assuming no ( ) ext, MP=MS

ext (PETDQQD) Qp

left to free market, firms prod/consumers consume Qp units

MPB=MPC, only consider priv costs and benefits

ext (PETDQQD) Qs

-social optimal lvl of prod/cons = Qs units

- msb=msc

- QP>QS, over production/consumption + over allocation of resources

-QP<QS< under

ext (PETDQQD) Dwl

Deadweight loss

at Qp, MSC>MSB/MSB>MSC

add more to costs/benefits

from Qp to Qs units, TSC>TSB/ TSB>TSC

welfare loss to society when output not prod at social optimal lvl

market failure —> Qp is allocative ineff, social welfare NOT maximised

ext (PETDQQD) conc

ext costs/benefits not factored in decision making

distortion of price signals

price mech fail to bring socially optimal allocation of resources

over allocation

(Govt Int) —> -ve ext (4)

indirect taxes

rules and regulations

tradable pollution permits

key SG transport policies

-ve ext: indirect taxes (use)

generate ext costs on third parties

make prod/con internalise the -ve ext

-ve ext: indirect tax —> for producers (8pt)

levy indirect tax = MEC @ QS (social opt)

increase in MPC, force producers internalise MEC to third parties

increase shift of MPC curve by amt of tax (MPC to MPC’)

new QP’ (mpc=mpc’) coincide with QS (msb=msc)

fall in prod from Qp to Qp’ —> eliminate dwl

reduce -ve ext —> incentivise both con and prod to reduce + internalise

allocative eff

social wf

-ve ext: indirect tax —> consumers

govt levy

thru producers —> pass to consumers in terms of higher prices

directly at consumers

indirect tax —> govt unintended conseq

opp cost of implementation

inequity (PED)

indirect tax —> govt intended conseq

1 . revenue from tax (address ext damages from prod/cons of g/s)

loss aversion (pain of losing > pleasure of gaining)

indirect tax —> govt limitations (4)

info gap

high admin costs —> unsustainable in long term

uncertainty and time lag

sunk cost fallacy

indirect tax —> govt limitations - info gap

over/under est of MEC

-over: govt levy excessively high tax

mpc higher than msc

wf loss >gi

govt failure

-under:

tax rate lower than necessary

new mpc lower than msc

indirect tax —> govt limitations- high admin

manpower and resources (monitoring)

indirect tax —> govt limitations- time lag

-govt need time to determine amt of ext costs

-prod and con need to fully respond to the dis incentives

indirect tax —> govt limitations- sunk cost

time and money alr invested, too much to quit

-ve ext - rules and regulations (types) 3

quota

ban

production/consumption methods

-ve ext - rules and regulations - quotas

def: legal limits on output/pollution lvl

set at QS (prevents c/p beyond that lvl)

yay allocative eff

for pollution:

limit amt of emissions

directly limits ext cost generated

red mec and msc

qs increase, reduce extent of overproduction and wf loss

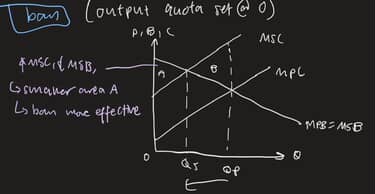

-ve ext - rules and regulations - bans

2 types

mechanism

complete + partial

def: output quota set at 0

def

social optimal when MEC very large

MSB intersect MSC —> social opt qty QS @/close to 0

no prod/cons

eradicate all -ve ext + benefits generated from p/c of g/s

area A: wf loss (MSB>MSC for output between 0 and Qs)

A<B (initial wf loss)

NOTE: better to ban when extent of MEC vv large —> social welfare improves overall

-ve ext - rules and regulations - productn/consumptn methods

ext cost decrease

social optimal qty QS increase to QS1

closer to Q- (QSQP to QS1QP)

reduce extent of overconsumption and dwl

increase allocative eff

-ve ext - rules and regulations

-ve ext - rules and regulations - govt considerations - limitations

info gap

—> govt dk lvl of penalty/consequence harsh enough to deter firms

—> bans: mec not significant

high admin costs —> unsustainable

—> inspection, monitoring, prosecution

-ve ext - rules and regulations - govt considerations - unint conseq

high costs to firms

(firms incurring increasing pollution abatement costs —> same limit on emissions as lower ones)

trade off with macroeconomic aims

(chase firmsaway to other countries cuz penalty too harsh)

opp cost of implementation

-ve ext - rules and regulations - govt considerations - intended con

laws compel ppl to take action

certain and faster outcomes

-ve ext: tradable pollution permits (def)

govt issue firms with permits on max lvl of pollution they are allowed to emit (set quotas)

→ firms buy and sell to eachother in carbon market

-ve ext: tradable pollution permits - example

European Union Emissions Trading System (EU ETS)

—> cap and trade principle

—> price det by mkt dd and ss of such permis

pollution abatement costs exceed current permit price

—> cheaper to buy more permits than reduce pollution lvl

firms facing lower pollution abatement costs

—> sell permits + reduce pollution

-ve ext: tradable pollution permits - outcome

cleaner production techniques

avoid increase cop, yay revenue

ext cost reduced

msc shift downwards towards MPC in long run

reduce DWL

-ve ext: tradable pollution permits - govt considerations - limitations

info gap

high admin costs

increased pollution in certain regions

—> one region buy permit from another

—> lower non material SES

-ve ext: tradable pollution permits - govt considerations - unintended conseq

trade off with macro aims

opp cost

-ve ext: tradable pollution permits - govt considerations - unintended conseq - trade off

-need purchase permits

—> increase firm COP

→ decrease in investment, employment and econ growth

—> if heavy polluting firms find permits to costly, might relocate

-ve ext: tradable pollution permits - govt considerations - unintended conseq - opp cost

increase admin cost outweigh benefit from reducing extent of mf (govt failure)

opp cost: implementation and enforcement financed thru reduction of spending in other areas

wf loss for 1 market > wf gain for other market —> GOVT FAILURE

-ve ext: tradable pollution permits - govt considerations - intended conseq

incentives (r&r no incentive to futher reduce emissions once they meet the limit by govt)

lower total cost

more certain outcome

key sg transport policies - govt int (2)

target problem on market of road usage

target problem of rising car ownership

key sg transport policies - govt int - road usage

reduce congestion and pollution —> TAXES

electronic road pricing (ERP)

diagram;

indirect tax=MEC @ Qs

increase MPC by amt of indirect tax

increase cost of road usage, motorists compelled to internalise ext

mpc shift to mpc’, traffic vol reduced to Qs, decrease congestion

decrease amt of emissions, decrease pollution

@Qs, dwl eliminated

allocative eff (MSB=MSC)

key sg transport policies - govt int - rising car ownership

reduce congestion and pollution

quota: vehicle quota system (VQS)

tax: additional registration fee (ARF)