4.2.3.4 - Possible Conflicts Between Macroeconomic Objectives

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

26 Terms

Policy Conflict

Occurs when two policy objectives cannot both be achieved at the same time

Trade-Off (between policy objectives)

When the improvement of one policy objective leads to a worsening of another policy objective.

Macroeconomic Conflicts:

- High Economic Growth vs Low Inflation

- Low Unemployment vs Low Inflation

- High Economic Growth vs Satisfactory BoP (current account)

- High Economic Growth vs Reducing Income Inequality

- High Economic Growth vs The Environment

Memory Hook (PUBE)

PU BE

P E

High Economic Growth vs Low Inflation Analysis

- To achieve EG (y1 to y2), gov uses expansionary policies to stimulate AD

- This causes an extension of SRAS

- As nearing the PP, resources become scarcer so less efficient inputs are used --> increases CoP for firms

- Firms only w&a to produce at higher prices so average price level rises (PL1 to Pl2)

- Therefore, inflationary pressures occur

- Furthermore, EG --> average disposable income increases --> increased consumption --> AD shifts right --> demand-pull inflationary pressures

High Economic Growth vs Low Inflation Eval (IDO's)

IDO:

- Size of Output Gap

- Size of the Increase in EG

- Whether SRAS increases as well - if SRAS increases, keeps CoP down so negates inflationary pressures

However:

- Lower inflation can increase international competitiveness --> increased exports --> increased AD --> can achieve EG

Low Unemployment vs Low Inflation Analysis

- As u/e falls (y1 to y2)

- This causes an extension of SRAS

- As nearing the PP, labour become scarcer --> wages rise --> increases CoP for firms

- Firms only w&a to produce at higher prices so average price level rises (PL1 to Pl2)

- Therefore, inflationary pressures occur

- Furthermore, as u/e decreases--> average disposable income increases --> increased consumption --> AD shifts right --> demand-pull inflationary pressures

Low Unemployment vs Low Inflation Eval (IDO's)

IDO:

- Size of Output Gap

- Size of the Reduction in Unemployment

- Whether SRAS increases as well - if SRAS increases, keeps CoP down so negates inflationary pressures

However:

- Lower inflation can increase international competitiveness --> increased exports --> increased AD --> can increase employment

High Economic Growth vs Satisfactory BoP Analysis

- To achieve EG (y1 to y2), gov uses expansionary policies to stimulate AD

- Extension of SRAS

- Demand-pull inflation

- Average PL increased --> less internationally price competitive

- Reduced exports, increased imports --> Reduced X-M

- Current Account Position worsens

- Furthermore, increased EG --> average disposable income increases --> level of imports rise --> reduced X-M --> current account position worsens

High Economic Growth vs Satisfactory BoP Eval

IDO:

- Size of the Increase in EG

- Initial Current Account Position

- Marginal Propensity to Import - if country has low propensity, additional income may not be spent on rising imports

- Cause of EG - e.g. a NET EXPORTER country like China may have driven EG through export growth, so their current account position actually improves

- Exchange Rate - currency might depreciate at same time to negate worsening CAP

High Economic Growth vs The Environment Analysis

- Higher EG means more output of goods & services

- This means there is:

- Increased use of finite resources (deforestation, mining) --> visual blight/flooding/fires --> reduction of natural resources

- Increased manufacturing --> pollution from factories --> air pollution, noise pollution --> damage to natural environment (global warming, acid rain)

- Increased transportation of goods --> burning of fossil fuels --> air pollution --> global warming

- Therefore, leads to a spiral

High Economic Growth vs The Environment Eval

IDO:

- Size of Output Gap - may have enough resources so less damage to environment

However:

- EG could lead to investment into more sustainable practices and shift PP/LRAS right as firms have more money

High Economic Growth vs Reducing Income Inequality Analysis

- Benefits of EG (higher national income) not evenly distributed

- Individuals & firms that already own capital can take advantage of new opportunities better so their wealth grows faster than those who rely solely on income (rich get rich faster than the poor)

- EG may widen the wealth/income gap

- As productivity rises, high-skilled workers & owners of capital see disproportionate gains

- Policies to reduce income inequality (progressive tax, capital gains tax..) --> reduced incentives for economic agents to work hard, be innovative, take risks, be entrepreneurial

- This reduces productivity in the long-run

- Reduced increase in productive potential

- Reduced SREG & LREG

High Economic Growth vs Reducing Income Inequality Eval

IDO:

- Strength of trade unions

However:

- Gov's Progressive Taxation and other income & wealth redistribution schemes (capital gains tax, universal credit, inheritance tax)

- EG may have risen through the inclusion of a segment of the workforce not previously being utilised/paid

Negative Output Gap (NOG)

The level of actual real output in the economy is lower than the trend (potential) output level

NOG impact on Unemployment

- NOG = actual output is lower than potential output

- This means there are idle resources / spare capacity in the economy

- These spare resources may be workers who are w&a to work but can't find work

- Therefore, the bigger the NOG, the higher the unemployment

NOG impact on Inflationary Pressures

- NOG = actual output is lower than potential output

- This means there are idle resources / spare capacity in the economy

- As a result, the excess supply of these idle resources (CELL) means that the price of these inputs will be kept lower

- Thus, CoP are lower so the price level is kept down

- Therefore, the bigger the NOG, the lower the inflationary pressures

Positive Output Gap (POG)

The level of actual real output in the economy is higher than the trend (potential) output level

POG impact on Unemployment

- POG = actual output is higher than potential output

- This means there are no idle resources / spare capacity in the economy, and FoP are working overtime

- Therefore, the bigger the POG, the lower the unemployment

POG impact on Inflationary Pressures

- POG = actual output is higher than potential output

- This means there are no idle resources / spare capacity in the economy, and FoP are working overtime

- As a result, the shortage of supply of these resources (CELL) means that the price of these inputs will increase

- Thus, CoP will increase so the price level will increase

- Therefore, the bigger the POG, the higher the inflationary pressures

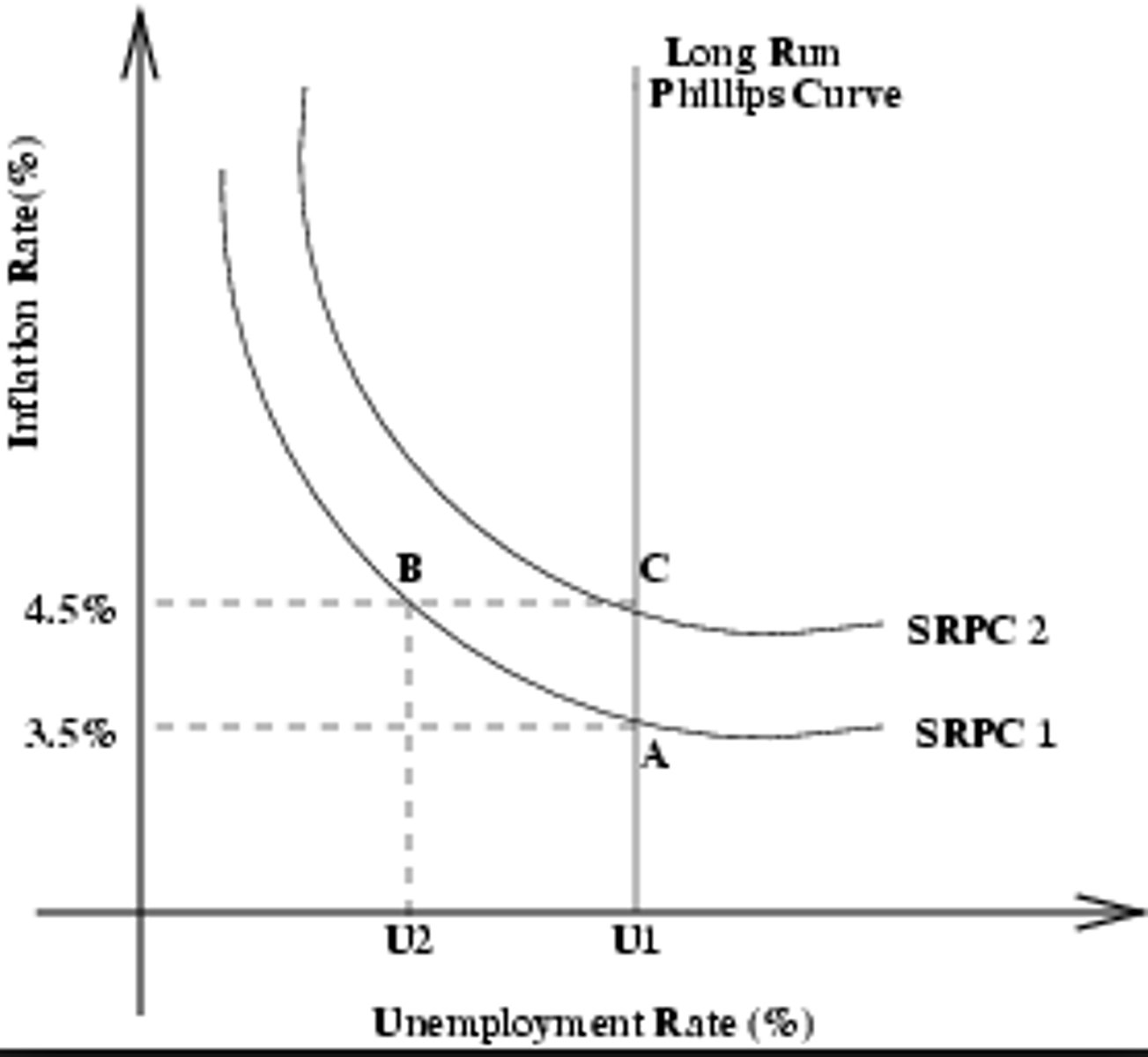

Phillips Curve

SRPC shows that

As unemployment decreases, there is a trade-off of higher inflation (inverse relationship)

LRPC shows

The natural rate of unemployment (NRU), consisting of Structural + Frictional U/E

Conflict between Low Unemployment vs Low Inflation using Phillips Curve (short-run & long-run)

In the short run:

- Gov uses expansionary policies to stimulate AD

- As AD increases, unemployment rate decreases

- But with a trade-off of higher inflation as resources become more scarce so more inefficient FoP used so higher CoP so PL increases

- This is shown by movement from A to B on SRPC1

However, in the long run:

- The rise in inflation locks in at the higher rate

- Workers see their real wages fall and a higher inflation rate is now expected

- So workers will demand higher wages due to inflation expectations

- This increases CoP for firms so SRAS shifts left shown by SRPC shifting right from SRPC1 to SRPC2

- Unemployment will increase back to its natural rate (NRU) at point C, but now at a higher inflation rate

- Therefore, there is no trade-off and the only impact of an increase in AD in the long run is a higher rate of inflation, as u/e rate always returns to the NRU

SRPC Policy Implications

SRPC says that AD management policies can be used to trade-off between increasing employment and reducing inflation.

LRPC Policy Implications

LRPC says that any AD management will only increase inflation rate in the long-run. Therefore, need to reduce inflationary expectations and reduce the NRU.

1) Reduce inflationary expectations by Bank of England - transparent, credible, active monetary policy to convince workers & firms that inflation is only temporary and they are in control.

2) Reduce NRU through supply-side policies - Shift NRU to left