115 Lesson 2: Present Value Models

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

41 Terms

What are the two main sources of return from stock investments?

Cash dividends received during the holding period.

Change in the stock price over the holding period.

What are cash dividends

They are cash distributions to shareholders. They are paid at know intervals.

Are dividends obligatory?

Not obligatory; authorized by the company's board of directors.

In some jurisdictions, shareholder approval may be required.

What are Bonus Issues

Is when a company issues additional common shares to shareholders instead of cash dividends → it doesn’t affect the equity value or proportional ownership.

What are stock splits and reverse stock splits

Stock split: Increases shares, decreases share price.

Reverse stock split: Increases share price, reduces shares outstanding.

What are share repurchases?

Alternative to cash dividends.

Company buys back its own shares (treasury shares).

Repurchased shares not used for dividends, voting, or earnings per share calculations.

Share repurchases impact shareholder wealth similarly to cash dividends.

What are some arguments that favours share repurchases?

Market Signal:

Share repurchases are often viewed as a positive signal to the market. When a company announces a share repurchase program, it signals that the management believes the company's stock is undervalued. This can instill confidence in investors and potentially lead to an increase in the stock price.

Cash Distribution Flexibility:

Share repurchases offer flexibility in distributing excess cash to shareholders. Unlike cash dividends, which create an expectation of ongoing future distributions, repurchases do not commit a company to regular payouts. This flexibility can be advantageous, especially in industries with variable cash flows.

Tax Advantage:

Share repurchases can be more tax-efficient for shareholders in markets with lower capital gains tax rates compared to traditional cash dividends. Shareholders can potentially benefit from capital gains treatment when they sell their repurchased shares.

Control Share Dilution:

Share repurchases can help mitigate the dilution of existing shareholders' ownership when a company issues new shares for purposes such as employee stock options or convertible securities. By repurchasing shares, the company can offset the impact of share issuance, thereby preserving the ownership interests of existing shareholders.

What happens on the "Declaration Date" in the context of dividends?

The company's board of directors announces a specific dividend, including the amount and the payment date.

The declaration date is when the company officially commits to paying a dividend.

What is the "Ex-Dividend Date," and what does it signify?

The ex-dividend date is the first day that shares of the company trade without the right to the upcoming dividend.

If you buy shares on or after the ex-dividend date, you won't be entitled to the next dividend payment.

Share prices are often adjusted downward on the ex-dividend date to reflect the value of the dividend.

What is the "Holder-of-Record Date," and what does it determine?

The holder-of-record date is the date on which the company's records determine which shareholders are entitled to receive the dividend.

To be eligible for the dividend, you must be a shareholder of record as of this date.

What is the "Payment Date," and what happens on this date?

The payment date, also known as the payable date, is when the company distributes dividend payments to shareholders.

It's the date when you can expect to receive your dividend if you're a shareholder of record.

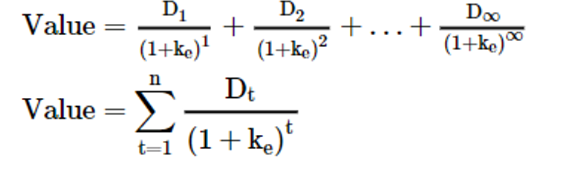

What is the Dividend Discount Model (DDM)

Values a common stock share as the present value of expected future cash flows (dividends).

When an investor sells a common stock share, the purchaser pays for the present value of future cash flows (remaining dividend stream).

The stock's value is always influenced by expected future dividends.

This value, when discounted to the present, aligns with the original dividend discount model.

What should be understood when a company has "No Dividends at Present"?

The lack of current dividends doesn't imply a worthless stock.

There is an expectation of future dividend payments.

The company reinvests earnings, anticipating larger and faster-growing earnings and dividends.

In the absence of future positive earnings, an expectation of a liquidating dividend remains.

The liquidating dividend is discounted at the required rate of return to compute the stock's current price.

How is the "Required Rate of Return on Equity (ke)" typically estimated?

Typically estimated using the Capital Asset Pricing Model (CAPM).

What alternative method can be used to calculate "ke," and how is it determined?

Alternatively, a risk premium is added to the before-tax cost of debt for calculating ke.

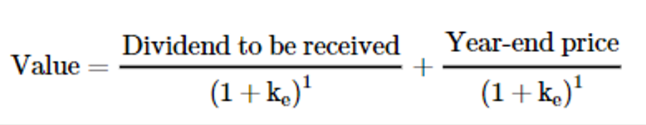

How do you calculate the DMM for one period

If our holding period is just one year, the value that we will place on the stock today is the present value of the dividends that we will receive over the year plus the present value of the price that we expect to sell the stock for at the end of the holding period.

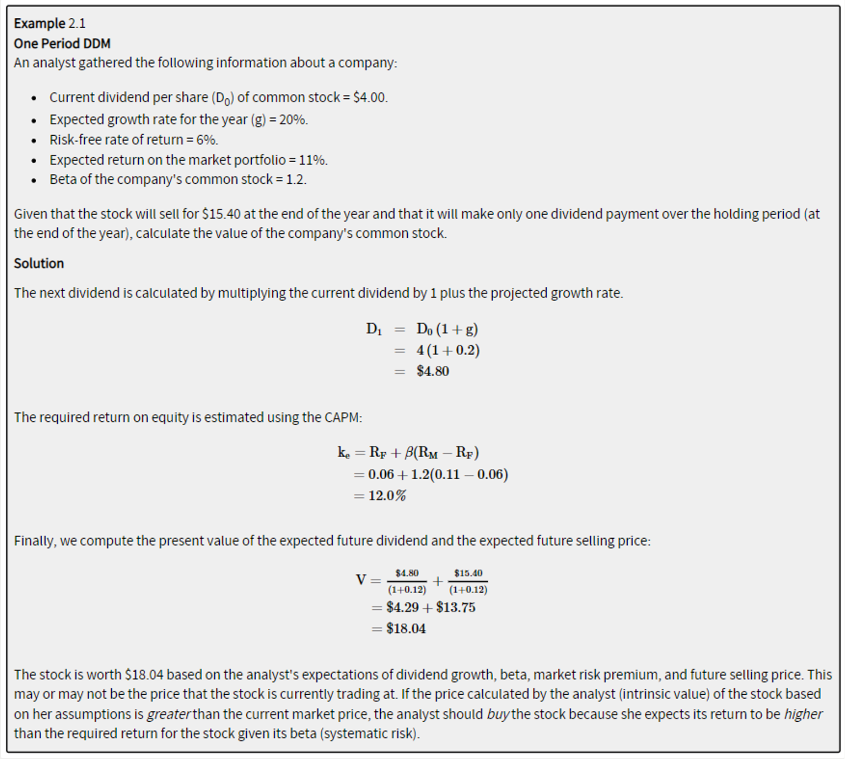

Give and example of the calculation of one period DDM

The assumption here is that the stock only pays a dividend at the end of the year.

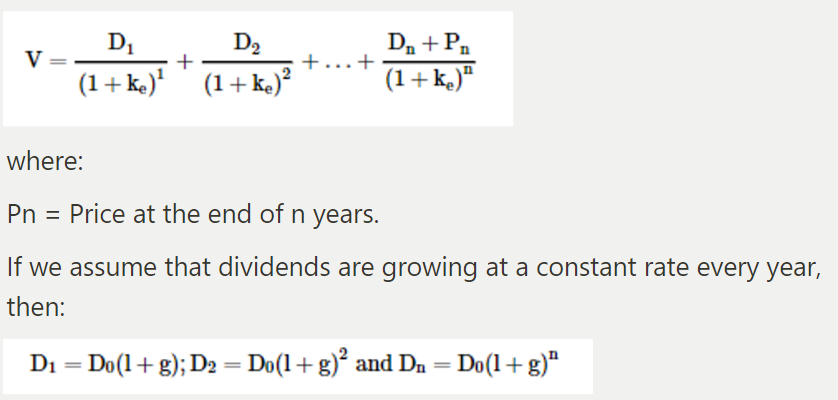

How do we calculate the value of a stock using the DDM for a multiple-year holding period?

In order to estimate the intrinsic value of the stock, we first estimate the dividends that will be received every year that the stock is held and the price that the stock will sell for at the end of the holding period. Then we simply discount these expected cash flows at the cost of equity (required return).

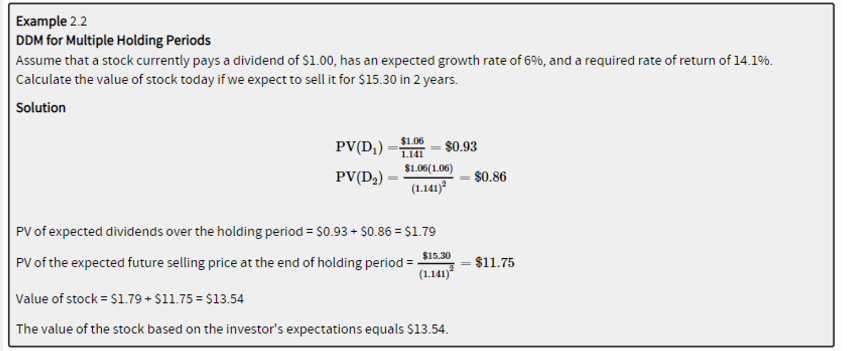

Give and example of the calculation of the DDM for a multiple holding period

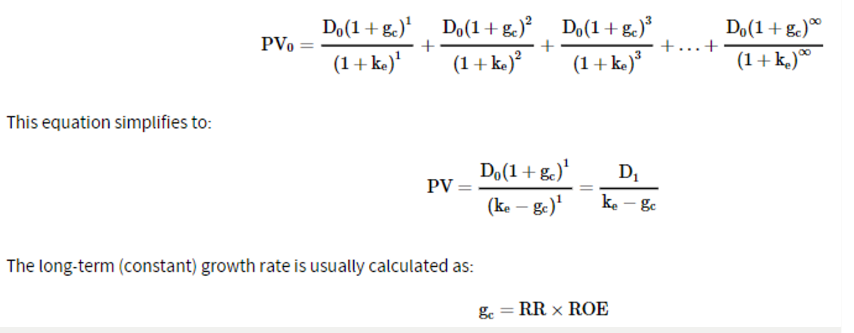

How do we calculate the value of a stock using the DDM for an infinite period (Gordon Growth Model)?

The infinite period dividend discount model assumes that a company will continue to pay dividends for an infinite number of periods. It also assumes that the dividend stream will grow at a constant rate (gc) over the infinite period.

What is RR?

RR is the firm's earnings retention rate, which equals 1 minus the dividend payout ratio (Recent Dividends per share/Earnings per share)

What are some challenges face’s when a company doesn’t pay dividends?

Possible reasons:

Lucrative investment opportunities.

Insufficient excess cash flow.

Forecasting for such companies is uncertain.

Analysts may use alternative valuation models, supplementing DDM.

What are some extension of the DDM for different stages?

Three-Stage DDM:

Valuing young companies entering growth phase.

Stages: Growth (high growth rates), transition (decent growth rates), maturity (lower growth).

Two-Stage DDM:

Valuing companies with moderate current growth.

Growth rate expected to improve, reaching long-term growth rate.

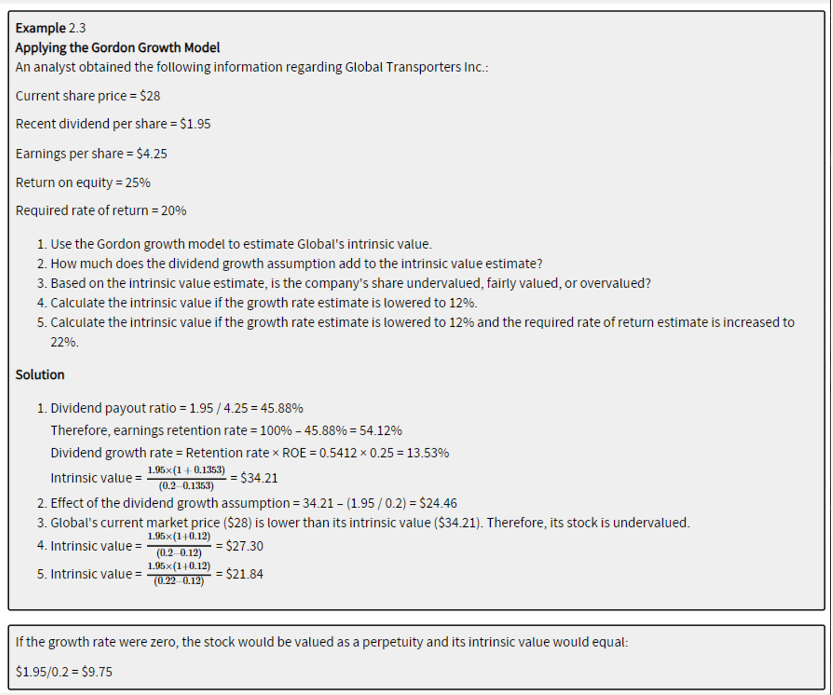

Give and example of the Gordon Growth Model

Suitable for valuing dividend-paying stocks:

Immune to the business cycle.

Relatively mature (e.g., utilities).

Historically stable dividend growth.

Describe the relationship between ke and gc

As the difference between ke (required rate of return) and gc (dividend growth rate) widens, intrinsic stock value decreases.

When the difference narrows, intrinsic stock value rises.

Small changes in either ke or gc can have a significant impact on stock value.

What are the assumptions of the infinite-period DDM model

Dividends grow at a stable rate (gc).

ke (required rate of return) must be greater than gc.

Otherwise, the model fails due to a negative denominator.

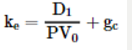

How can we rearrange de DDM formula to calculate ke

This expression for the cost of equity tells us that the return on an equity investment has two components:

The dividend yield (D1/P0).

Growth over time (gc).

What are the characteristics of "Growth Companies" in terms of their returns on investment and earnings retention?

Earn returns on investment consistently exceeding required rates of return.

Retain a high proportion of earnings for reinvestment.

High retention rates lead to high growth rates (Sustainable Growth Rate = Retention Rate x ROE).

What challenges are associated with using the Infinite-Period Dividend Discount Model (DDM) for valuing growth companies?

No constant dividend growth rates.

The growth rate of dividends is impressively high but only temporary.

During high growth, the growth rate may exceed the cost of equity (ke).

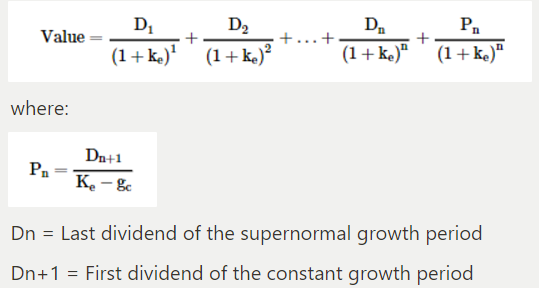

What is the appropriate valuation model for "supernormal growth" companies, and how does it address their growth patterns?

Multistage Dividend Discount Model:

Combines multi-period and infinite-period DDM.

Suits "supernormal growth" companies.

Accounts for temporary high growth followed by a slowdown due to competition.

Explain the Multistage Dividend Discount Model:

Estimate dividends amount and duration during supernormal growth phase.

Forecast the normal, constant growth rate in dividends (gc) after supernormal growth ends.

Project the first dividend post supernormal growth.

Calculate stock price at the end of supernormal growth using the infinite-period DDM (first dividend after normal growth is the numerator).

Determine the cost of equity, ke.

Calculate present value of supernormal growth-period dividends and terminal stock price (end of supernormal growth).

For Companies with Multiple Supernormal Growth Stages:

Calculate dividends for each year during supernormal growth separately.

Compute terminal value using the constant growth DDM when the growth rate stabilizes below the required rate of return.

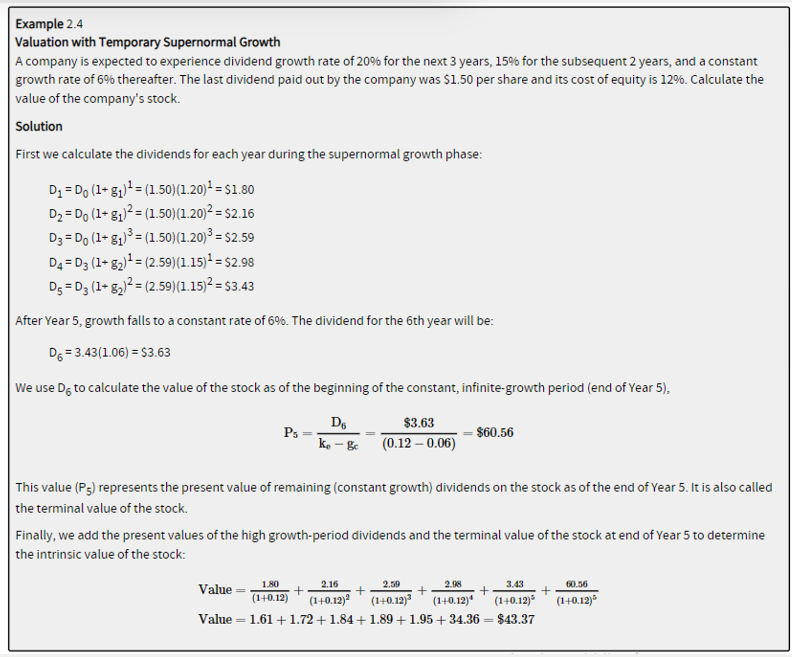

Give and example of valuation with temporary supernormal growth

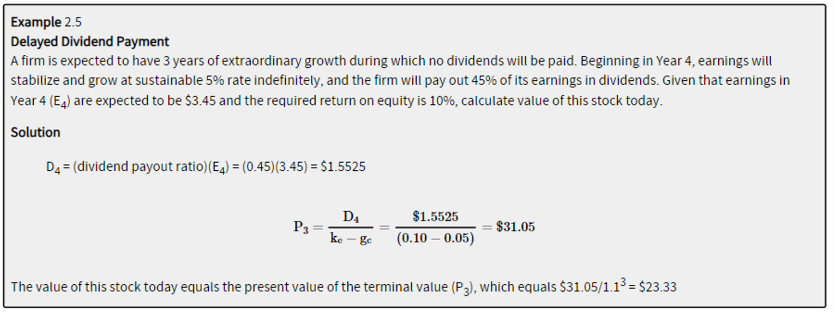

Give and example of delayed dividend payment

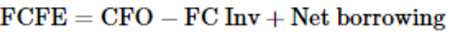

How is FCFE calculated?

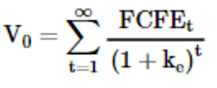

How can we calculate the intrinsic value of the company’s stock using FCFE?

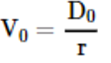

How can we calculate the value of a preferred stock that is noncallable, nonconvertible, has no maturity date, and pays dividends at a fixed rate?

We use the perpetuity formula

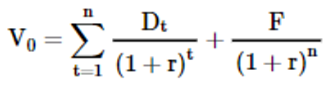

How can we calculate the value of a preferred stock that is noncallable, nonconvertible preferred stock with maturity at time, n?

where:

V0 = value of preferred stock today (t = 0)

Dt = expected dividend in year t, assumed to be paid at the end of the year

r = required rate of return on the stock

F = par value of preferred stock

What is "Callable Preferred Stock," and how does it work?

The issuer has the right to call (redeem) the stock before maturity.

The price for the call is set at the stock's inception.

Call options favor the issuer, reducing the value for investors.

What is "Putable Preferred Stock," and how does it work?

The holder has the right to sell (put) the stock back to the issuer before maturity.

The price for the put is set at the stock's inception.

Put options favor the holder, increasing the value for investors.

What are "Retractable Term Preferred Shares," and what options do shareholders and the issuer have in this context?

Shareholders have the option to sell back their shares to the issuer at par value (retractable or putable) at a specific date.

The issuer has the option to redeem the preferred issue at predetermined prices at predetermined dates prior to the retraction date (always at or above par level).

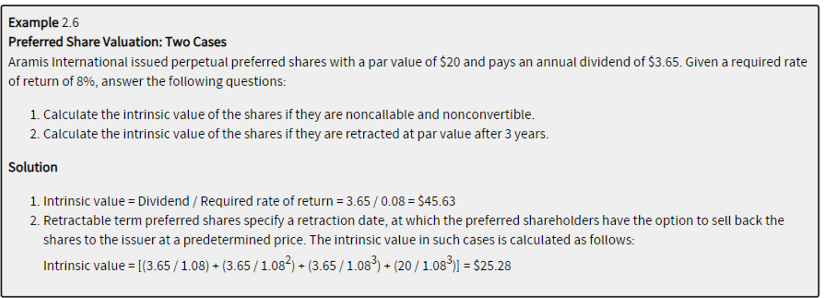

Give and example of preferred share valuation