Financial Literacy ACCUMULATIVE

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

(Loans and Credit) Unsecured loans

Loans that do not have collateral, like credit cards and personal loans. Typically have HIGHER interest rates.

(Loans and Credit) Secured loans

Loans that have collateral, like mortgage and auto loans. Typically have LOWER interest rates.

(Loans and Credit) Secured vs Unsecured credit cards

Unsecured credit cards are traditional

Secured credit cards are when you make a deposit to the bank and that is the credit limit for each month. (Typically for people who want to rebuilt their credit score)

(Loans and Credit) Revolving Credit VS Installment credit

Revolving credit is when there is a credit limit but can be repeatedly used if played back each month (credit card)

Installment credit is when there is a set amount that you make regular set payments for (student loan, personal loan, etc.)

(Loans and Credit) Qualifications needed to get a loan

Credit score and history

Income and job history

Debt to income ratio

Loans with collateral (secured loans) are easier to qualify for

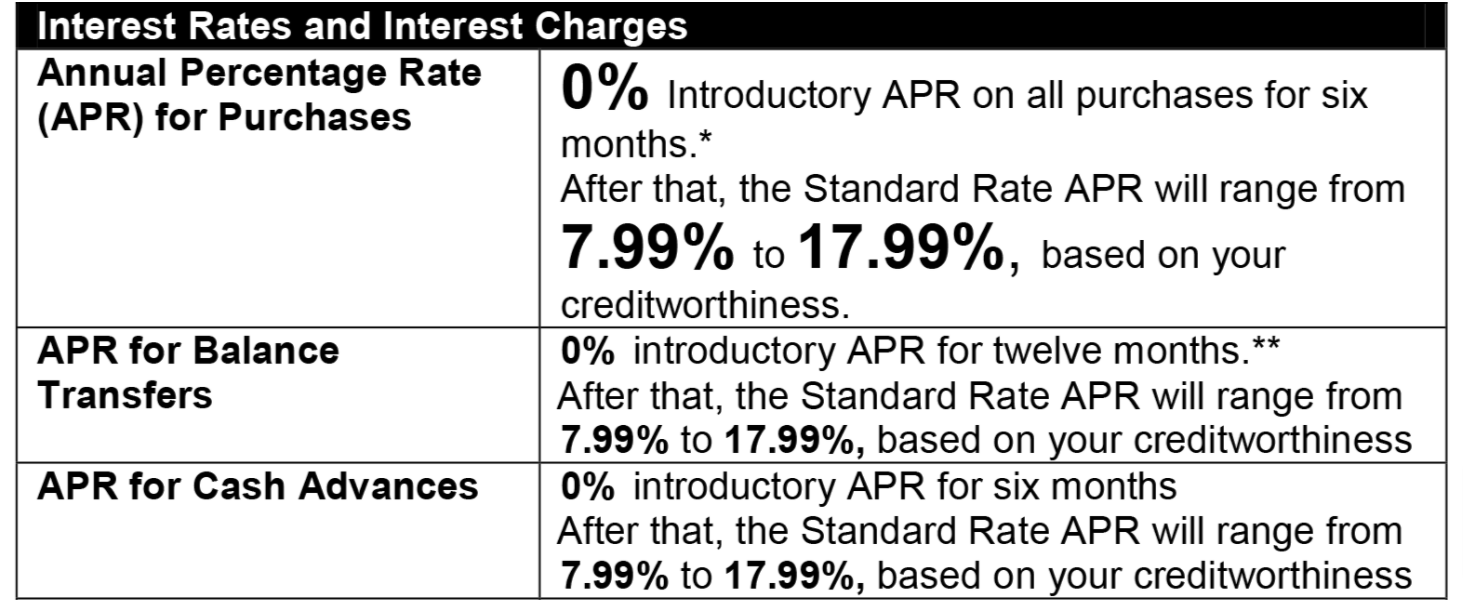

(Loans and Credit) APR

Annual Percentage Rate - the interest + other fees for a loan. Basically “the true cost” of a loan.

(Loans and Credit) Different types of interest

Fixed Interest → The same interest rate for each payment. Ex: Mortgage, Auto Loans

Variable Interest → Variable interest rate depending on the market-based reference rate. Ex: 5-1 ARM (Adjustable-rate Mortgage), private student loans, credit cards

Introductory Interest → a short term low interest rate to attract customers Ex: 0% APR on all purchases within the first 12 months for a credit card

(Consumer Credit) Different kinds of credit cards

Standard Credit Card →A basic card with a credit limit, which you pay back along with interest. Some also have annual fees

Rewards Credit Card → You get benefits for using them, but may have higher interest rates and annual fees

Student Credit Card → Lower interest rates and credit limits for college/uni students

(Consumer credit) Credit card statements

A monthly bill from the credit card company which includes:

Statement balance (total amount owed)

Payment due date (the day you need to pay at least the minimum amount to avoid late fees)

Minimum payment due (the smallest amount you can pay—but this would cause interest)

List of transactions

Interest charges or fees (if any)

APR information

(Consumer Credit) Grace period

The time between your statement date and your payment due date. (If you pay the full statement balance by the due date, you avoid interest on purchases)

(Consumer Credit) Schumer Box

A table or chart that credit card companies are required to include that summarizes key info like:

Interest Rates

Fees

Penalty Charges

(Consumer Credit) Daily compounded APR

Credit cards are almost always compounded daily

Credit card companies calculate interest daily using a daily periodic rate, which comes from your APR. Then they add it up at the end of the billing cycle.

Daily rate= APR / 365

So each day, your balance earns that much interest (daily rate), and it compounds.

(Consumer credit) Balance transfers

When you take your existing credit card debt and move it to another card—typically one with a lower interest rate.

However, most balance transfers come with a fee (3-5% of transferred amount)

(Loans and Credit) “Good” Debt

Borrowing money to invest in assets that will improve your finances or life.

Examples: Educational loans (Investing in education, which can lead to better job and higher income) and mortgage (loan to buy a home)

(Loans and Credit) “Bad” Debt

When you borrow money for things that don’t help you grow financially or lose value over time.

Example: Using a credit card to buy a new $800 phone (when you already have one). Borrowing $800 (with the credit card) and risking paying interest on it isn’t a smart financial decision.

(Loans and Credit) Common causes and sources of debt

Medical Bills → If you don’t have health insurance, an unexpected medical issue can be expensive

Divorce → Legal fees and costs of splitting assets

Job loss → Losing a job disrupts your income

Student loans → College can be expensive, and many students take out loans to cover the costs

Car loans and mortgages → Buying a car or a home often required borrowing money

Payday, title, and cash loans → Loans with high fees/interest rates

Gambling → People go into debt if they gamble more than they can afford to lose

(Loans and Credit) The Snowball Method

A method of paying off debt by paying the smallest debt first. You will pay more interest than if you use the high rate method, but it can help with the psychological aspects of repaying debt.

(Pay as much as you can for the smallest debt while making minimum payments on all other debts. Once that smallest debt it paid off, move on to the next smallest, and so on.)

(Loans and Credit) The High Rate Method

A method of paying off debt by paying the debt with the highest interest rate first. This is the mathematically optimal way to repay debt because you pay less in interest.

(Loans and Credit) Debt collection

Debt collection starts when you miss payments for an extended period, and your creditors hire a company to recover the money.

Having a debt sent to collection can negatively impact your credit score.

(Loans and Credit) Debt Consolidation

Consolidating all your debts together into one big debt. Makes it easier to keep track of payments, could lower interest rates, and can make debt repayment faster.

There are 2 different ways to do it.

Take out a personal loan and use that money to pay the debt. Once the debt is paid, you can focus on repaying the personal loan.

Get a new credit card with 0% interest for a certain time, and move all other balances onto it. Then pay off as much as possible before the 0% period ends. (Works if your debt is mostly from credit cards)

(Loans and Credit) Amortization schedule

A table that shows how a loan gets paid off over time. It shows:

Your monthly payment

How much goes towards the interest

How much goes toward the principal (original loan amount)

The remaining balance

(Loans and credit) Bankruptcy

A situation where a person or company is unable to pay back the money they owe to others, so they ask the court for help in finding a solution. There are two main types

Chapter 7: Selling your belongings to pay off your debt. A court will look at you income, expenses, and assets. If you qualify, the court will appoint a trustee to sell your non-exempt assets to pay back your creditors. Remains on your credit report for 10 years.

Chapter 13: People who have a regular income but are struggling to pay their debts, can create a plan to repay all or some of their debt over a period of 3-5 years. You must have a regular income and your total debt must be below certain limits. Remains on your credit report for 7 years.

(Loans and Credit) Mortgage