3.4.5 monopoly

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

38 Terms

pure monopoly

single seller of a product or service in a market,faces limited competition due to high barriers to entry

working monopoly

a firm with 25% or more total sales within a market

close example to pure monopoly

google who has 88% of market

legal monopoly example

tesco 28%

regional monopoly

when only one company can supply an essential produt or service in a region because of significant barriers to entry for any competitor

example of regional monopoly

TFL

characteristics of monopoly

barriers to enter

few compeitors in market

price makers

lgal monopoly

The UK Competition and Markets Authority defines a legal monopoly as any firm having more than 25% market share

objective of monopoly

profit maximise

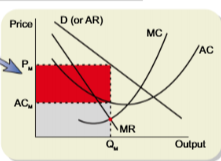

monopoly in short run and long run with diagram

makes supernormal profits even in long run

level of output is at mc=mr

if firm produces a quantity Qm the demand curve shows the price the firm can set -Pm

at this output the AC of producing each unit is ACm

difference between ACm and Pm is the supernormal profit per unit so total is red area

in a monopoly market barriers to entry are total so no new firms enter the market and this supernormal profit is not competed away

so situatuon remains as it is

price discrimination

occurs when a firm charges a different price for the same good/servise in order to maixmise revenue e.g cinema tickets kids and adults

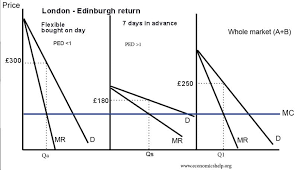

third degree price discrimination

occurs when a firm charges different prices to different consumers for same good/service e.g rail fares are priced differently depending on time of travel

Markets are often sub-divided based on time, age, income and geographic location

conditions for 3rd degree price discrimination

market power-ability to change prices

varying consumer PED-some consumers must be willing to pay more and the firm must be able to identify these grops

ability to prevent resale f tickets-It must be able to prevent consumers from buying in the low-price elastic sub-market and reselling in the higher price inelastic market.

first degree price discrimination

each individual customer is charged the maximum they would be willing to pay

second degree price discrimination

often used in wholesale markets where lower prices are charged to people who purchase large wuantities

third degree price discrimination diagram

marginal cost is constant throughout

for inelastic AR and MR are stee

for elastic ar and mr are shallow

profit maximise for both

lower rice for elastic

costs and benefits of 3rd degree price discrimination to consumers

Many price inelastic consumers will lose out as they pay higher prices, lowering consumer surplus

Other price elastic consumers will benefit as they will be able to take advantage of the lower prices, increasing consumer surplus

Some consumers will gain as a higher price decreases the quantity demanded and in some markets this canincrease consumer utility e.g. on train services; it helps limit over-crowding

costs and benefits of 3rd degree price discrimination to firms

The total revenue of producers increases, leading to higher profits assuming there is no change in costs

Firms increase their producer surplus at the expense of a decrease in consumer surplus

Setting up and enforcing price discrimination can increase average costs. The costs of price discrimination must not outweigh the additional revenue gained

advantagrs of monopoly power to firm

Supernormal profits generate finance for continued investment in technology and product innovation

Market power enables the firm to increase its global competitiveness

Economies of scale can increase, thereby lowering the average cost

Producer surplus increases

Price discrimination can increase total revenue

disadvantagrs of monopoly power to firm

Due to a lack of competition, there is a reduced incentive to be efficient

Cross subsidisation can create inefficiencies

Monopolies lead to a misallocation of resources as P > MC. The price is above the opportunity cost of providing the product

Due to a lack of competition, innovation sometimes lacks effectiveness

advantages of monopoly power to employees

Supernormal profits often result in higher wages and greater job security

disadvantages of monopoly power to employees

Having only one supplier in the industry limits the opportunity to change employers

advantages of monopoly power to consumers

Product innovation due to the firm's supernormal profits may result in a better-quality product

Cross subsidisation can lower prices on some products that the firm provides

Prices may fall If firms pass on their cost savings (due to economies of scale) in the form of lower product prices

disadvantages of monopoly power to consumers

A lack of competition is likely to result in higher prices as no substitute goods are available

A lack of competition may result in no product innovation and worse product quality over time

May experience worse customer service as the incentive to improve it is limited

Cross subsidisation is likely to increase prices on some products offered by the firm, e.g. First class air ticket prices are used by some airlines to subsidise lower economy ticket prices

Consumer surplus decreases

advantages of monopoly power to suppliers

Increased sales volume for some suppliers as they are able to supply products that are distributed nationally or internationally with a secure contract

disadvantages of monopoly power to suppliers

There is less competition for their products and a monopoly often has the power to dictate what price they will pay to suppliers (monopsony power)

This price may not be profitable in the long run

natural monopoly

occurs when a single firm can produce a particular product or service at a lower average cost than multiple firms could e.g.national grid,network rail,thames water

why can natrual monopoly happen

This is often due to associated infrastructure issues e.g. delivery of utility services like water, where it does not make sense to have multiple pipelines

It can also be due to the significant cost that is generated when entering or exiting the industry, e.g. the sunk costs

It can also be due to the ability of economies of scale to lower prices for consumers, e.g. it makes sense to have one firm building five nuclear power stations as opposed to five firms, as average costs will be lower with one firm constructing

Even one firm in the industry cannot achieve an output at the lowest average cost where AC=MC, productive efficiency. More competition would simply increase average costs, further increasing prices for consumers

industries usually have high fixed costs and karge economies of scale

regulation of natural monopoly

Government to ensure that consumers are not charged higher monopoly prices

exxamples of gov regulation

ofgem,ofwhat

examiner trick for evluating monopolies

When evaluating monopolies, demonstrate critical thinking by acknowledging the positives as well as the negatives. For example, Amazon has partly become a monopoly by being very good at what it does, with consumers benefiting from lower prices and a greater choice. However, its power means that it can also exploit the suppliers on its platform

examiner trick for evluating natural monopolies

When evaluating natural monopolies, consider the government failure that may occur with the regulation and the imposition of maximum prices. There is a lot of disagreement about the level of profits that natural monopolies should be allowed to make. It is a normative issue

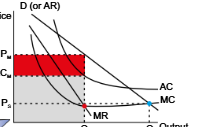

natural monopoly digram

A natural monopoly will have continuous economies of scale so MC and AC are downwards sloping . A profit maximising natural monopoly will restrict output to where MC = MR (at Qm).

A government will regulate to make sure it produces at AR=MC which will lead to subnormal profits so government will subsidise this is Qs. This will reduce prices to Ps (from Pm).

issues with natural monopoly

gov failure - issues with regulation and max prices

lack of dynamic efficiency

heavily subsidised by gov - opportunity cost

thames water natural monopoly example

debt of 22 billiom

regulatory pnalties

infrastructure

serve 15 million cstomers

fined 122.7 million by ofwat for sewage spills and improper dividend payouts and has faced criticism for its handling of leaks and outdated infrastructrue

potential investor kkr pulled out of 4bn reserve deal as risky

government couldpotentially takeover - nationiolisation

efficiency in monopoly

not productively efficient since they dont produce at mc=ac

not allocative efficient as P>MC

since likly to make supernormal profits they will be dynamically efficient however if there is no competition they may have no incentive to invest

monooly examle

Google. Formed in 1998, it has over the years seized control of 70% of the market share for search engine use.

rice discrimination example

Major UK cinema groups offer reduced prices for students and seniors, while charging full prices to adults at peak evening showings. This third-degree price discrimination extracts more consumer surplus from price-insensitive groups while still selling to more elastic groups