Long Run Fiscal Policy

1/65

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

66 Terms

2 key elements of government spending (denoted as Govt)

G in national income: expenditure on consumption and public capital

transfer payments eg pensions (affects C through change in disposable income)

page 2

how has Gov spending in OECD countries changed over last 100 years

grown a lot: increases in health, edu, social security along traditional spending like infrastructure

how does Gov spending redistribute resources

over lifetime (taxes when young, benefits when old)

across hh (progressive tax)

across generations (state pension system)

difference between Gt in national accounts and total Gov spending Govt

Gt only includes spending on GNS & public capital

Govt also includes transfer payments (that affect C through change in disposable income)

what are LRFP concerns related to population ageing

rising health/pension expenditures →.

how do debt crises manifest (3 reasons)

higher cost of borrowing

harder to borrow in financial markets

sell assets in home currency = depreciation of currency

Government per period budget constraint

page 8

what happens if Dt+1 > Dt (what does this mean in terms of debt, tax and govt

real debt increases due to the budget deficit the gov ran in period t+1

page 9

what is a primary budget deficit

Govt+1 > Taxt+1

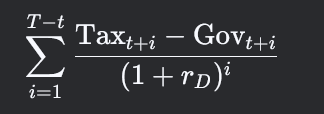

how to obtain the Gov Intertemportal Budget Constraint (GIBC)

paeg 10

what does the present value of all primary surpluses mean in fiscal policy

measures whether future revenues can cover future spending

tax revenues - non interest gov spending from time t+1 onward using the borrowing rate rD as the discount factor

what happens if the present value of primary surpluses is too low relative to Dt

the gov is fiscally unsustainable→ cannot repay debt without:

raising future taxes (Taxt+i)

cutting spending (Govt)

defaulting

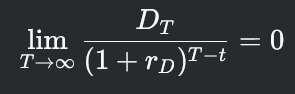

what is the no-ponzi condition definition

a rule that prevents the gov from perpetually rolling over debt without repaying it

value of the debt must eventually shrink to zero, meaning debt cant grow faster than the interest rate indefinitely

what happens if no ponzi condition is violated

gov engages in ponzi scheme and issues new debt to pay interest on old debt indefinitely

DT > Dt(1+rD)T−t

results in loss of creditor confidence, higher borrowing costs

why is the no ponzi condition economically necessary (3 reasons)

prevents explosive debt: debt can’t grow faster than GDP indefinitely

credibility: ensures lenders are repaid, maintaining market trust

sustainable: ties current debt to future fiscal capacity, not infinite borrowing

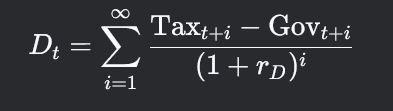

simple explanation of the GIBC

if debt today, need budget surplus in future

flexible in SR, disciplined in LR

interdependence of FP over time (borrow now = higher future taxes or lower future spending in future)

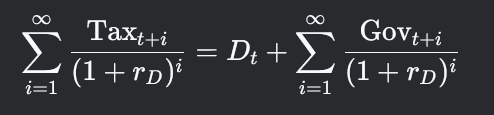

alternative way to write GIBC & what does it say

total tax revenues (present value of future planned taxes) must equal current debt + all future government spending (PV of future planned gov spending)

what’s happened to debt/gdp ratio (D/Y = d) for many countries since the FC

seen d increased above 100%

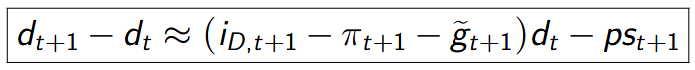

derive budget constraints from gov per period budget constraint using debt to gdp ratios

page 13

what happens to primary surplus to gdp ratio when government runs a balanced primary budget (spending = tax)

pst+1=0

what needs to happen to primary surplus to gdp ratio, real interest, growth for debt to gdp ratio to rise over time

primary surplus to gdp ratio = 0

real interest > economy growth rate

then dt+1 > dt

approximating r and g tilda (real interest rate and economy growth rate)

top of page 15

using approximations for i and r in debt to gdp ratio equation

page 15

show debt to gdp ratio if debt is stable & what does it show

page 15

all rates and ratios constant

when rD>econ growth rate, stabilising debt requires primary surplus

if econ growth rate>rD, can run a small deficit without debt growing

when is it easier to reduce d (look at change in debt to gdp ratio equation)

nominal interest is low

inflation is high

economy growing strongly

large primary surplus

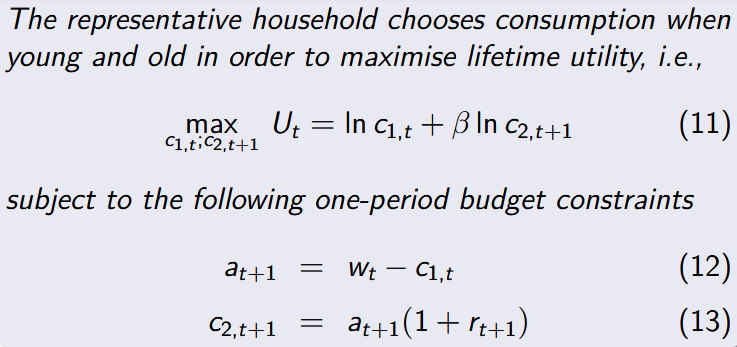

HH problem in basic 2 period Overlapping Generation model (OLG model)

max lifetime utility over 2 periods

p18

get lifetime budget constraint from subbing constraints into each other

page 18

solve hh problem (max utility s.t. LBC) using lagrangian

page 19

maximising OLG on diagram

page 20

no adjustment costs meaning

firms maximise profits by choosing Kt and Lt, taking prices (rt + δ, wt) as given → rental cost of capital and wage rate respectively

work out MPLt and MPKt from cobb douglas production function

page 22

using no adjustment costs to find marginal products = to input prices equations

MPK = rt+δ

MPL = wt

page 22

what is the aggregate supply of capital

total assets held by young + total assets held by old

page 23

equilibrium supply of capital expression

page 23

obtain transition equation of OLG model

page 23

what does the transition equation of the OLG model show

equation links today’s capital (kt) to tomorrow’s (kt+1) through:

household savings into next period

firm investment

capital share, patience, growth rate of effective workers

OLG model on diagram (kt, kt+1 space)

page 26

how do gov fund spending

income tax

NICs = national insurance → funds state pensions

VAT

OLG model but giving workers a choice between labour/leisure & introducing taxes (and what are the constraints)

page 28

combining the constraints to get the LBC in the OLG model with tax and worker choice

page28

interpretation of LBC for OLG model with taxes and worker preferences for leisure (look at total effects for capital income tax & tax on wages)

page 29

LRFP with no debt and balanced budgets optimisation method

page 32

LRFP with no debt and balanced budgets obtaining transition equation

page 33

LRFP with no debt and balanced budgets - what does the transition equation tell us and what shifts it (and k*)

page 34

how do OLG model steady states differ with government and without government

with government = lower steady state due to tax rate

government spending and crowding out takeaways

crowding out: higher taxes reduce private savings and capital

but can improve welfare and even help private sector grow (eg roads make them more efficient)

what are the two types of government expenditure

Gt: make people happy but dont boost production (enter through hh utility)

Public capital KG,t: help businesses produce more (enter production function)

how does government finance spending (tax revenue)

page 37

results of the LR impact of Gov expenditure on consumption and public capital spending

consumption: crowding out but people get extra utility

public capital: can make capital more productive, but lower disposable income

page 37

what changes with LRFP with debt

government can now finance spending by accumulating debt

now, the capital equilibrium is Kt+1 + Dt = Lt at+1

means capital stock available in period t+1 equals total national net wealth (private sector wealth - government’s outstanding debt)

3 key points about debt

debt crowds out capital accumulation

debt has redistributional impact across generations

under certain circumstances, debt and taxes may be equivalent

page38

5 reasons for PAYG pension system

market failures

behavioural issues

free riding

redistribution across generations

redistribution within generations

pension systems by funding structure

fully funded system - pensions come from invested savings from fund - less burden on future taxpayers but market risks

PAYG - workers pay taxes to fund today’s retirees - no market risk but may struggle if population ages (less workers per retiree)

pension structures by payout rules

defined contribution - save fixed % of salary

defined benefit - pension based on salary/years worked

balanced & sustainable PAYG system

total amount of contributions by young = total amount of benefits received by old

paGE 40

households maximisation problem + constraints (PAYG Pension System)

p40

steady state PAYG system (economy growth rate needs to keep up with pensions)

page 40

what do aging populations force upon pension systems

increased tax for young, lower pensions for old

solve hh maximisation problem with pensions (combine constraints and use bt+1 = (1+gtilda)tax x wage

page 41

what do pension taxes do to consumption in period 1,2, savings and capital accumulation

page 41

why is PAYG inefficient if r> gtilda (explain what r>g tilda means as well)

page 42

why do govs still use PAYG when r>g tilda

redistribution: transfers wealth to low earners who wouldn’t save enough privately

private pensions might not protect against longevity risk

how funded systems are different to PAYG

pension is bt+1 = (1+r)θbwt

(no dependency on g tilda and no crowding out because savings earn r but expose retirees to market risk)

page 43

tax wedge from payg

page 42

challenges in reforming PAYG

transaction costs

risk: demographic shocks eg aging population

risks of funded pension systems

market volatility

complicated

but better in LT → shift PAYG to funded where possible