Rating manual and Rating making data and Exposure

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

25 Terms

Rating Manual

Rules: Contain definitions, particularly how to classify a risk

Rates pages: contain base rates, rating tables, etc.

Rating Algorithm: describes how to combine the components to determine the premium for a specific insured

Underwriting guidelines: a set of company-specific criteria that can affect decisions made prior to calculating a rate.

Deciding whether to accept or reject a risk, or to refer it to a more senior underwriter.

Company placement (deciding in which of several companies in the group to place the insured)

Tier placement (decide in which of several underwriting tiers to place the insured)

Schedule rating credits/debits

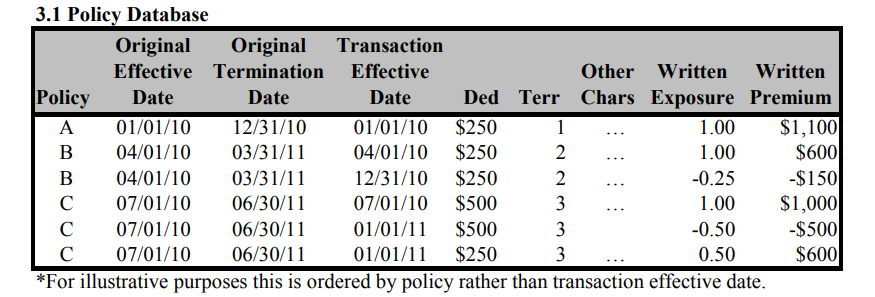

Policy Database

Policy Identifier

Risk identifier(s)

Relevant dates

Premium

Exposure

Characteristics: rating variables, underwriting variable, etc

Claim Database

Policy Identifiers

The risk identifier(s)

Claim identifier

Claimant identifier

Relevant loss dates: the date of loss, the report date, and the transaction date

Claim status: open, closed, or reopened

Reopened date

Claim count

Paid loss

Event Identifier: for example a catastrophe

Case reserve

Allocated loss adjustment expense

Salvage/subrogation

Characteristic

Accounting Information

Underwriting expenses

Unallocated loss adjustment expenses (ULAE)

Data Aggregation

Calendar year (earned premium from this year; losses paid in this year (losses from years ago))

The advantage of calendar year aggregation is that data is available quickly once the calendar year ends. This information is typically collected for other financial reporting so it represents no additional expense to aggregate the data this way for ratemaking purposes.

The main disadvantage of calendar year aggregation is the mismatch in timing between premium and losses. Premium earned during the calendar year come from policies in force during the year (written either in the previous calendar year or the current calendar year). Losses, however, may include payments and reserve changes on claims from policies issued years ago.

Calendar year aggregation for ratemaking analysis may be most appropriate for lines of business or individual coverages in which losses are reported and settled relatively quickly, such as homeowners

Accident year (earned premium from this year; loss associated with accident year (losses from accident year, but may not close at the end of the year. need to estimated ultimate loss by using LDT))

Accident year aggregation represents a better match of premium and losses than calendar year aggregation.

Losses on accidents occurring during the year are compared to premium earned on policies during the same year. Since accident year is not closed (fixed) at the end of the year, however, future development on those known losses needs to be estimated.

Selecting a valuation date several months after the end of the year allows the emergence of some development in the data and therefore may improve estimation of ultimate losses.

Policy year (earned premium from this year, loss from policy year)

Policy year aggregation represents the best match between losses and premium. Losses on policies written during the year are compared with premium earned on those same policies.

Given that policy year exposures are not fully earned until after the end of the year (e.g., policy year exposures for a product with an annual policy term are not fully earned until 24 months after the start of the policy year), data takes longer to develop than both calendar year and accident year.

Report year

NCCI

Annual Financial Call Data : Aggregate premium and loss data (experience by state) primarily used to calculate overall loss cost and rate level changes

Workers Compensation Statistical Plan (WCSP) Data: Individual policy loss and exposure (payroll) information collected with detail by classification, primarily used to calculate classification relativities and experience rating modifications.

Desirable Properties of an Exposure Base

Proportional to expected loss

Practical

Historical Precedence

Proportional to expected loss

exposure base implies a uniform and continuous multiplicative relationship between the variable and the expected losses

the exposure base should be responsive to any change in exposure to risk

the exposure base is not a rating variable, although the dividing line between the two is somewhat arbitrary at times

Practical

objective and well defined

relatively easy and inexpensive to obtain

relatively easy and inexpensive to verify

consistently measured

Not subject to manipulation by insureds, agents, or underwriters.

Historical precedence

exposure bases are rarely changed once they have been established

one would only change an exposure base if one thought the new base was significantly better

Personal Automobile Exposure base

Earned Car year

Amount of Insurance Coverage

Worker Compensation Exposure Base

Payroll

Worker Compensation Exposure base: Hour worked vs, Payroll

In early 1980, limitation on payroll was removed.

in 1984 - 1985, the perceived inequity resulting from the workers compensation exposure base (payroll) became a matter of national debate of the varying wage scales that appeared as a result of deregulation in many industries.

Based on these differences. the insureds proposed both hours worked and mixed hours-worked/payroll as exposure bases, while the NCCI preferred to retain unlimited payroll. because it is easy to verify and it reduces the size of the annual rate revisions needed

NCCI’s analysis of the Oregon data found no bias against either union or high wage paying employers among the small employers, but it did show that high wage paying and union employers in the medium sized group developed lower loss costs per premium dollar.

Payroll won out in the exposure base arena, but concessions were made on the classification side

Commercial General Liability Exposure base

Sales Revenue

Payroll

Square Footage

Number of Units

General Liability: Area vs. Receipts

Mercantile (Retail Stores)

Previous Exposure Base: Area (square footage)

Retail stores were traditionally rated based on their physical size, assuming larger spaces attract more customers and pose greater liability risks.

Change to Receipts:

ISO recognized that gross receipts (revenue) more accurately reflect the level of business activity and customer interaction, which are stronger indicators of liability risk.

Example: A small, high-end jewelry store with $10 million in sales poses more risk than a large thrift store with minimal sales, even if the latter has greater square footage.

Rationale for the Shift:

Receipts capture customer volume and transactions, which directly correlate with potential liability claims.

1. Manufacturing and Mercantile: Sales (Receipts)Why Sales (Receipts)?

Sales Reflect Customer Interaction and Product Output:

Mercantile: The volume of sales is a proxy for the number of customers and transactions, which directly impact liability risks (e.g., slip-and-fall accidents in a retail store).

Manufacturing: Sales are tied to the number of products made and distributed, which directly impacts the likelihood of product liability claims.

Examples:

Mercantile: A high-end jewelry store with $1 million in annual sales has higher liability exposure (more customers visiting) than a larger thrift store with $50,000 in sales.

Manufacturing: A small plant producing $5 million in goods has more exposure to product liability risks than a larger plant producing $1 million.

Key Reasons for Using Sales:

Direct Correlation with Risk:

Higher sales typically indicate higher activity levels, more products in circulation, and more customer interactions.

Scalable Metric:

Sales fluctuate with business activity, allowing premiums to align with operational scale year-over-year.

Physical Size Doesn’t Always Reflect Risk:

A large but low-activity retail space or manufacturing plant may have less exposure than a smaller, high-output operation.

Contracting: Payroll

Why Payroll?

Payroll Reflects the Workforce's Exposure to Risk:

Contracting work involves manual labor, physical activity, and on-site operations, where the number of workers and their tasks are the primary sources of liability.

Payroll is a good proxy for the scale of operations since larger payrolls often indicate more workers or higher wages for skilled labor.

Examples:

A construction company with a $1 million payroll for 10 workers has a higher liability risk (e.g., injuries, accidents) than one with a $500,000 payroll for 5 workers.

Key Reasons for Using Payroll:

Labor-Intensive Nature:

Liability risks in contracting (e.g., injuries, third-party property damage) are closely tied to the number of workers and their activities.

Project Complexity:

Higher payrolls often indicate larger or more complex projects, which increase exposure to risks.

Not Tied to Revenue:

Revenue doesn’t always correlate with risk in contracting. A contractor might work on high-value projects but involve minimal physical exposure (e.g., consulting vs. on-site work).

Commercial Business Property Exposure base

Amount of Insurance coverage

Physician’s Professional Liability Exposure base

Number of Physician Years

Professional Liability Exposure base

Number of Professionals (e.g., Lawyers or Accountants)

Personal Articles Floater

Value of Item

Property Coverage

Rating Variables

Construction

Occupancy

Location (territory)

External Hazards

Internal Protection (Sprinklers, smoke alarms)

External Protection (Local fire department and police)

Amount of Insurance

Automobile liability

Rating Factors

driver’s age

gender

marital status

driving record

school record

business or pleasure use

mileage or distance to work

radius of operation

location (territory of principal garaging)

truck weight

insurance limit

number of vehicles

claims experience (safe driving credit (personal) or experience modification (commercial)).

Automobile physical damage Rating Factors

car make

model and year for private passenger auto, or vehicle age

original cost new for commercial autos

number of vehicles; territory

deductible

claims experience.

Workers compensation Rating Factors

location (territory)

occupation

claims experience (experience modification)

payroll.

General liability Rating Factors

classification

territory

insurance limit

type of coverage (claims-made or occurrence)

claims experience

square footage or acreage

payroll or receipts

new/discontinued businesses

Indicated rate improvement

adjust premium to the current rate level. We need to take into account any rate changes have been made over the historical periods.

Determine a premium trend. trend the premiums for each CY to policy effective period. The premiums are affected by shifts in the mix of business and inflation acting on the exposure base

determine a loss trend. trend the losses and ALAE for each AY to policy effective period. Losses and ALAE are affected by inflation and there may be changes in frequency.

trend fixed expense since it’s affected by inflation.

Develop the loss and ALAE to ultimate. We need to estimate the total cost of providing coverage. Report losses develop as they mature, due to unreported claims, reopened claims and difference between reported and ultimate paid

Include a provision for ULAE. we need to included all losses.

take weighted average of loss ratio rather than a straight average. One could weight years by their premium volume, in order to take into account that different volumes of data by year. It may also make sense to weight more recent years more heavily, since they are more similar to policy effective date.