W11: market efficiency and failures

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

17 Terms

welfare economics

How the allocation of resources affects economic well-being

consumer surplus

the amount a buyer is willing to pay for a good minus the amount the buyer actually pays for it ( low price raises this )

benefit that buyers receive from a good

( is as good ) as the buyers themselves perceive it

producer surplus

the amount a seller is paid for a good minus the seller’s cost of providing it; higher price raises this )

allocative efficiency

Resource allocation that maximizes the total surplus received by all members of society is economically efficient

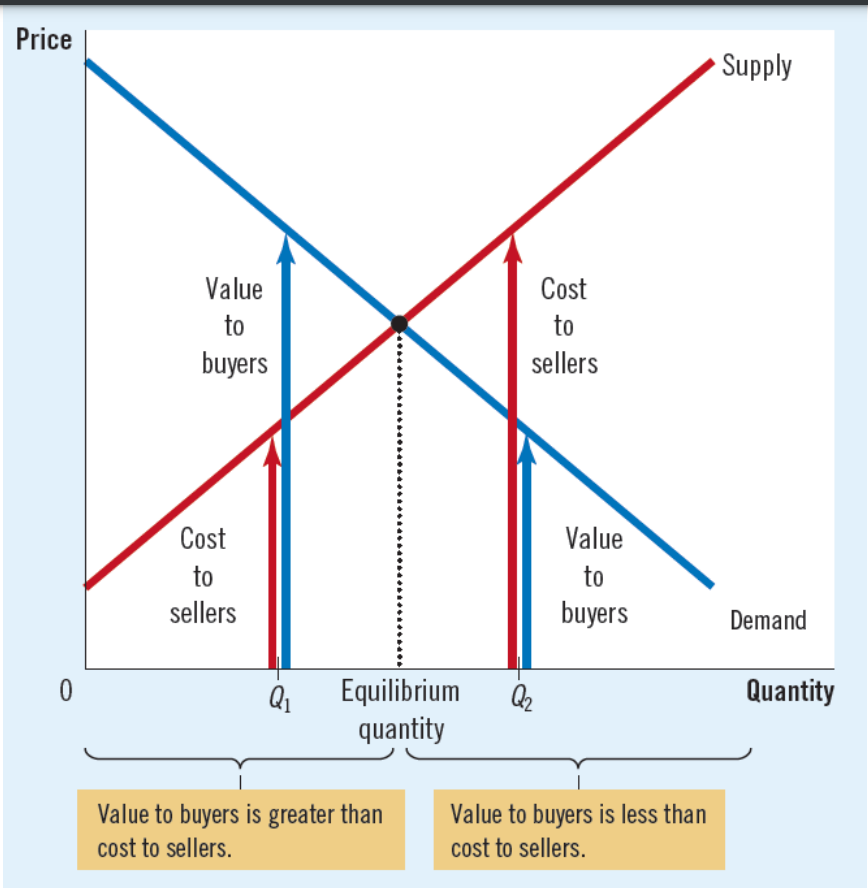

market equilibrium efficiency

allocate the supply of goods to the buyers who value them most, as measured by their willingness to pay → allocate the demand for goods to the sellers who can produce them at the lowest cost

why markets are not efficient ( distorted )

imperfect competitetion, externalities, nature of goods

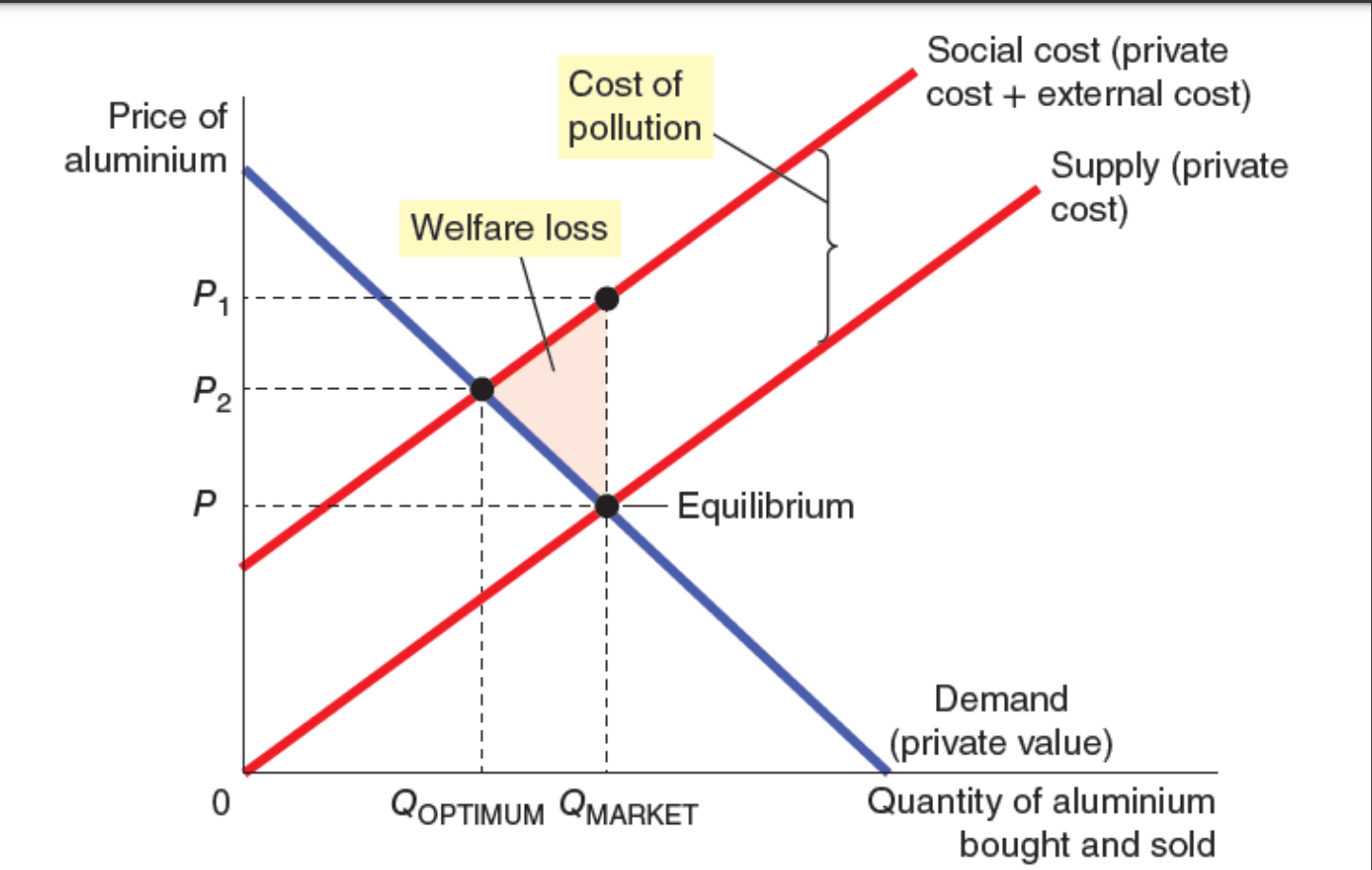

negative externalities for market efficiency

higher social cost, adverse affect on 3rd party;

Laissez faire

positive externalities for market efficiency

benifical to 3rdp, social value higher than private

dealing with high social cost

taxes ?? tax should reflect social cost

internalizing externalites in ME

altering incentives so that people take account of the external effects of their actions. taxes and subsidies

soultion for negative externalities in ME

private- social norms, charity,

public- regulation, corrective taxes( aka Pigouvian taxes aka excises), tradable pollution permit

government failure

benefits of government decision-making accrue to a small number of people but the costs are spread across large sections of the population

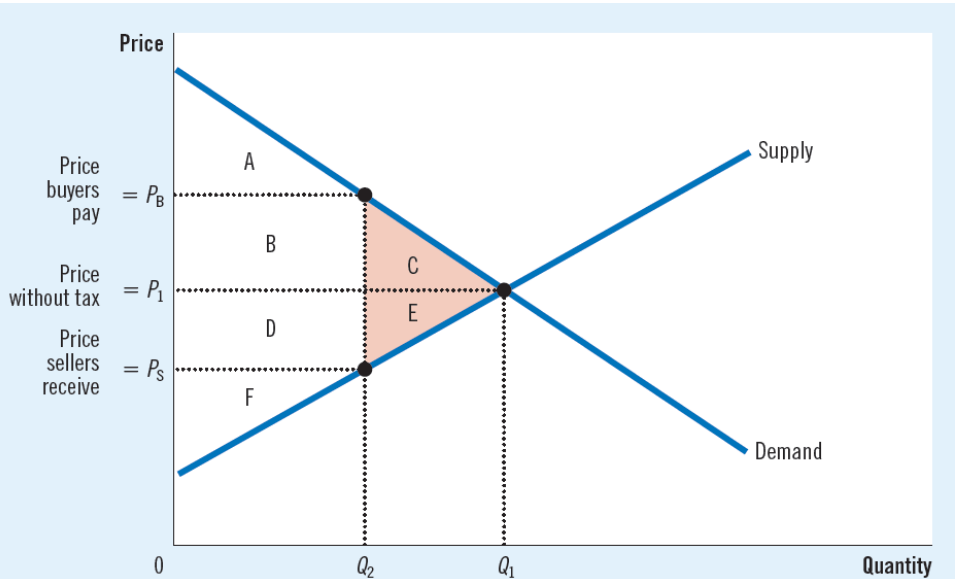

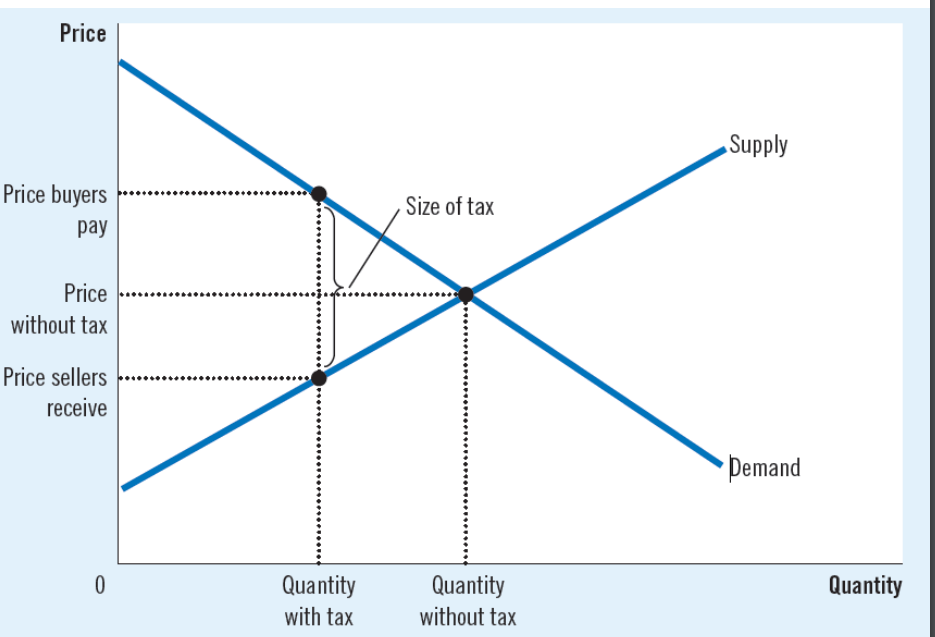

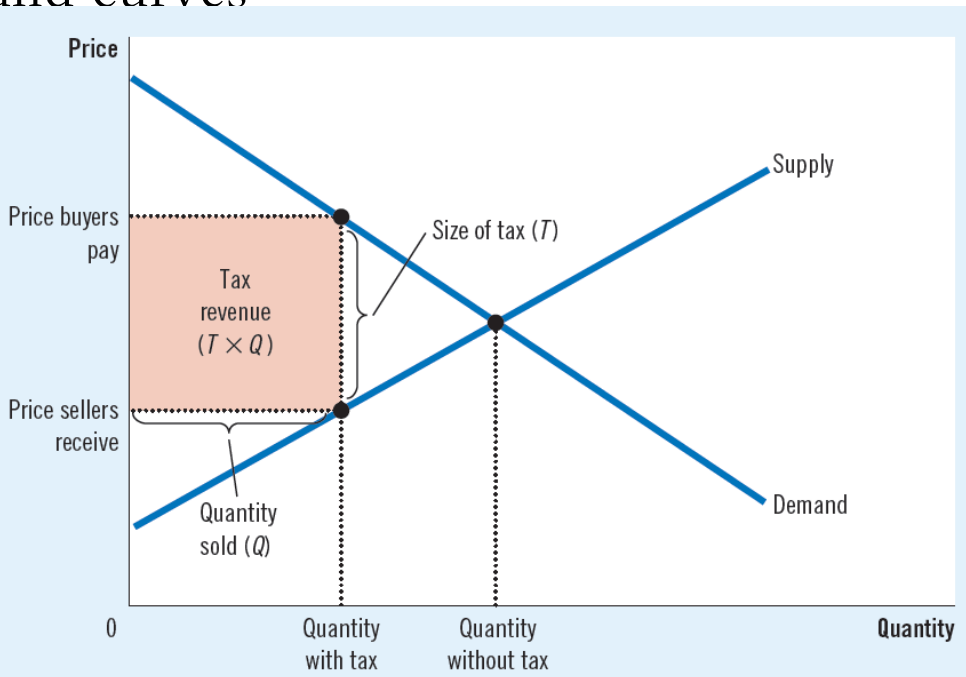

welfare side of taxation

A tax on a good places a wedge between the price that buyers pay and the price that sellers receive

The quantity of the good sold falls

tax revenue

area of the rectangle between the supply and demand curves

T * Q (tax T, the quantity sold Q)

deadweight loss of taxation

economic inefficiency resulting from taxes that distort market transactions, leading to a reduction in overall economic welfare.