Earnings per Share

1/8

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

9 Terms

What are the three ways to measure return to shareholders? (per share)

Dividend per share

uncontroversial and easy to calculate

no need for an accounting standard#

Cash flow per share

not much used or understood in Europe

no standard yet

Earnings per share

the standard measure

the profit each ordinary share earns (in cents)

What is the importance of EPS?

Largest (or most powerful) group of users of financial statements - stock market analysts & institutional investors

They (sadly) don’t have time to read financial reports

Need indication of return

To compare companies and decide on prices

Focus on the “Bottom Line” - profit after tax

Since they buy shares, they want profit expressed on a per share basis.

Company profits or earnings per share is not directly comparable

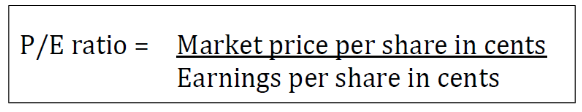

P/E ratio

Dividing the share price by the earnings per share

Allow for a “same size”/“common size” analysis

What is the P/E ratio?

indicates stock market sentiment towards a share.

represenst the multiple/number of times future earnings investors are willing to pay for the company now/today.

P/E Ratio Formula

What are the Problems with EPS?

Abuses by reporting entities

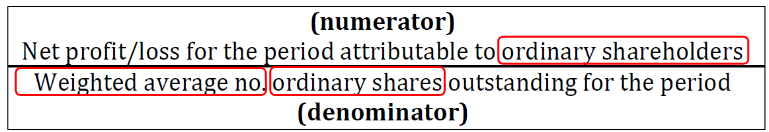

Numerator (earnings)

Excluding “exceptional” profits and losses (pre-SSAP), treating gains and losses as reserve movements

Excluding “extraordinary” profits and losses (pre FRS 3) from the earnings per share calculation

Denominator (number of shares)

Hiding potential “dilution” of EPS by not accounting for share options

Using unclear bases to calculate shares in issue

Abuses by analysts and brokers

Calculating a “house” EPS

Recalculating EPS on different bases to suit their

recommendation

Generally

No clear basis for EPS

unreliable and non-comparable figures

some companies use year-end share number, while others use averages to calculate EPS

Who calculates EPS?

The entity itself

What profit is it based on?

EPS is calculated based on the earnings available to ordinary shareholders ONLY

EPS Formula