FINE 442 - The Central Bank (3)

1/82

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

83 Terms

Overall, what is the central bank

Job 1: Conducting monetary policy

• Set the «right» quantity of money

• Impact on (i) inflation and (ii) economic output

Job 2: Being the lender of last resort

• Lend money to financial institutions in crisis times

• Done very rarely

Three attributes of money

The three attributes of money • Medium of exchange (versus barter economy) • Unit of account (compare prices) • Store of value (financial asset)

Anology

Imagine an irrigation system...

• Water flows into the system

• Question: how much water to put in?

Too much: the field is flooded

Too little: the field gets dry

Now, consider the financial system...

• Money flows into the system

• Question: how much money to put in?

Too much: you have inflation

Too little: you have deflation

Objectives of monetary policy

Price stability

• Stabilize inflation around its target level (typically 2% per year)

Output stability

• Stabilize short-term fluctuations in output around its normal (natural) level

The relative importance of each objective is given by the mandate of the central bank

Mandate of the Federal Reserve System (aka the Fed)

«The Fed must maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote the goals of maximum employment and stable prices.»

Mandate of the European Central Bank (aka the ECB)

«The primary objective of the ECB shall be to maintain price stability. Without prejudice to the objective of price stability, the ECB shall support the general economic policies in the Community. »

Mandate of the Bank of Canada

«Promote the economic and financial welfare of Canada. »

What is the first objective

Price Stability

What is price stability

Commonly viewed as the most important goal among central banks

Why price stability?

• Inflation is costly for the economy

• The central bank has an impact on inflation

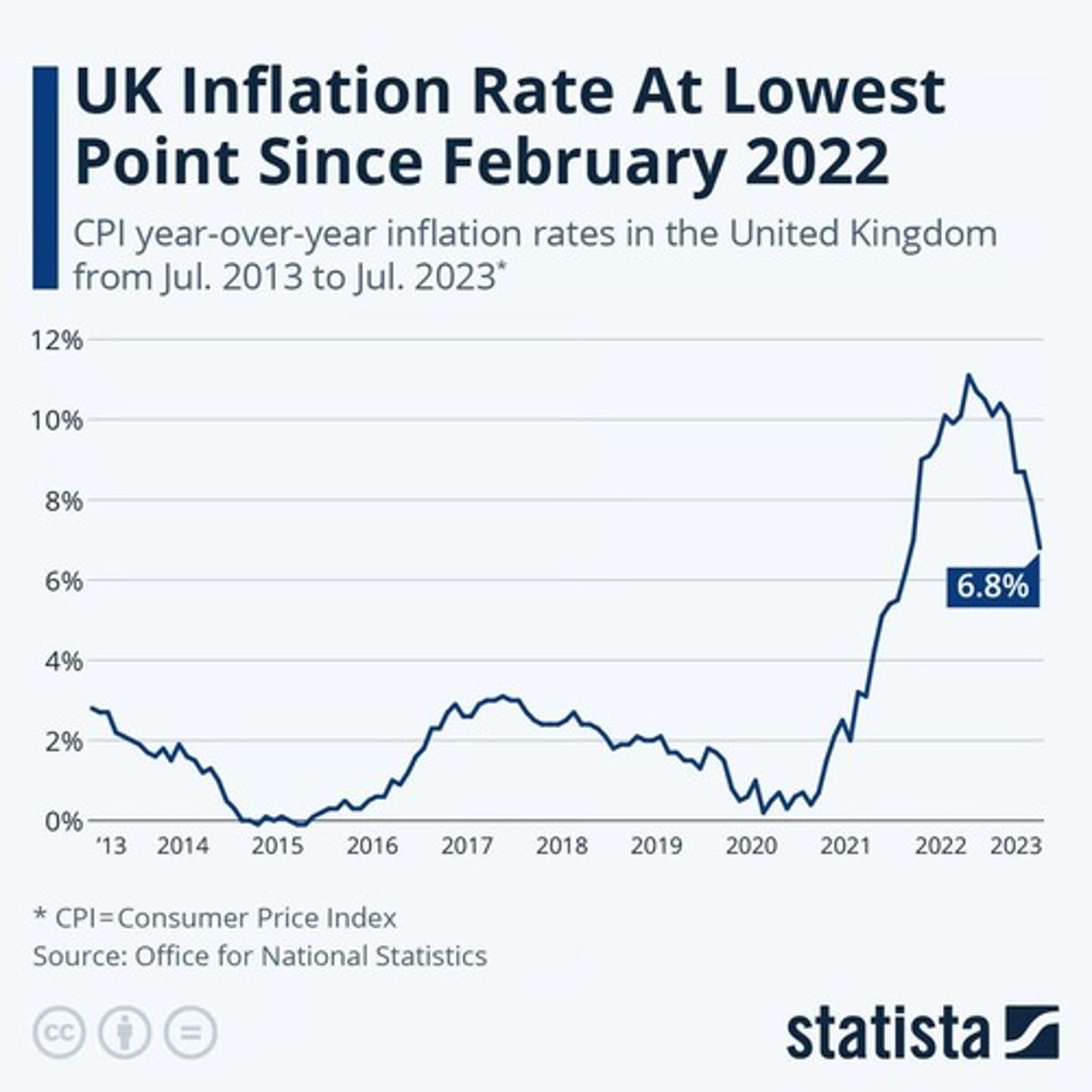

Inflation recently

everywhere ex: UK

Expected inflation — core idea

Prices are expected to rise (e.g., +5%/yr). People and firms plan for that, which creates costs.

"Inflation tax" — what is it?

Cash loses buying power over time, so people work to hold less of it (move money, make extra transfers). That time/effort/fees = a real cost.

"Inflation tax" — tiny example

Keep $100 for a year at 5% inflation → it buys what $95 used to. You spend effort shifting into interest-earning accounts.

Menu costs

Firms must change nominal prices more often (reprint labels/menus, update systems, fix mistakes) → real resources spent.

How big are these costs?

Small at low/moderate inflation (2-5%); huge in hyperinflation (constant repricing, people race to spend cash).

Inflation volatility

• Typically comes with higher expected inflation

• It creates unexpected wealth transfer between lenders and borrowers

• Uncertainty lowers welfare and makes firms reluctant to invest

• Symptom that the government functions badly and use bad policies (e.g., confiscatory taxation)

Impact of the central bank on inflation

• Inflation is determined by the interaction between the supply and demand for money

• The central bank can affect inflation by changing the supply of money

• In the long term, this supply change is commonly considered as the main driver of inflation

Impact of the central bank on inflation (number ex)

M x V = P x Y

• V = velocity of money (nb. of times 1$ is used to buy goods and services)

• M = money supply • Y = output (q. of goods and services)

• P = price level

If we assume a constant V, we obtain: Inflation rate π ≈ (∆M/M) - (∆Y/Y)

Impact of the central bank on inflation

• So, inflation is determined by the growth in the money supply

Objective 2

Output stability

Output stability

A lot of attention on economic activity (general public, financial press, politicians...)

Why output?

• The case for this objective is obvious: higher growth, lower unemployment

• Big question: can the central bank increase output?

What key assumption allows monetary policy to affect output in the short run?

Nominal rigidity: prices are not completely flexible, so when the central bank changes interest rates, quantities/output can change, not just prices.

What happens if prices are fully flexible (no nominal rigidity)?

Monetary policy only changes the price level.Real output stays the same → money is "neutral".

Does monetary policy have a short-term or long-term impact on output? Explain.

Short term: can affect output because prices are sticky (nominal rigidity).

Long term: has no impact on output. Prices become flexible, and output is determined by real factors (technology, productivity, resources), not by the central bank.

What is the standard description of monetary policy?

A two-step process where:

The economy is hit by a shock.

The central bank reacts to stabilize inflation and output.

Step 1 of monetary policy: what is a "shock" to the economy? Give examples.

A shock is a sudden change that affects the economy, for example:

Recession

Change in consumer behaviour

New technology

New regulation

Change in input prices (e.g., oil price)

Step 2 of monetary policy: how does the central bank react to a shock?

The central bank adjusts monetary policy (interest rates, etc.)→ to stabilize inflation and keep output close to normal.

Why is the exact response of the central bank to a shock complicated?

Because it depends on:

The structure of the economy (how demand and supply react)

The type of shock

People's expectations about inflation

Give examples of the factors that affect how the central bank responds.

- Structure of the economy: how quickly prices/wages change, how sensitive spending is to interest rates

- Types of shocks: demand shock vs supply shock, etc.

- Inflation expectations: do people expect high or low future inflation?

When is there no policy conflict for the central bank?

In many cases, the same policies that stabilize inflation also stabilize output → the bank doesn't have to choose between the two goals.

What is a negative shock to the economy / negative output gap?

Output is below potential → Yt−Y∗<0

This creates downward pressure on prices (inflation πt falls).

When there is a negative output gap, what does the central bank need to do?

It needs to "stimulate" the economy by increasing the money supply (usually → lower interest rates).

What are the expected outcomes when the central bank increases the money supply after a negative shock?

1. Increase economic activity (raise output toward potential).

2. Prevent prices from falling too much (avoid deflation / very low inflation).

What is a positive shock / positive output gap?

Output is above potential → Yt−Y∗>0

This creates upward pressure on prices (inflation πt rises).

When there is a positive output gap, what does the central bank need to do?

It needs to "cool down" the economy by decreasing the money supply (usually → raise interest rates).

What are the expected outcomes when the central bank decreases the money supply after a positive shock?

1. Decrease economic activity (bring output back toward potential).

2. Prevent prices from increasing too much (control inflation).

What are the two main goals of monetary policy?

The central bank manages the money supply in order to:

1. Stabilize prices (control inflation)

2. Stabilize output (keep the economy close to its potential)

How do central banks actually conduct monetary policy in practice?

They mainly use open market operations (buying or selling government bonds) - the standard tool used by central banks around the world.

What is the Federal Open Market Committee (FOMC)?

The decision committee for U.S. monetary policy inside the Federal Reserve. (they meet 8 times a year)

Who has a key role in the FOMC?

The chairman (Fed Chair) - they "run the show" and are the public face of Fed decisions.

Why are FOMC meeting days so important for financial markets?

Because the FOMC decides and conducts open market operations, which affect interest rates, money supply, and asset prices.

What is the monetary base?

Monetary base = Currency + Reserves

Currency = dollars held by individuals

Reserves = dollars held by banks at the central bank

Who controls the supply of the monetary base?

The central bank controls the supply of the monetary base (it is central bank money).

Who creates the demand for the monetary base?

Individuals demand currency (cash).

Banks demand reserves (the most important part).

Why do banks want to hold reserves?

Because they need reserves when they issue deposits to customers (to meet payments and regulations).

What are open market operations?

Operations where the central bank trades government securities with the banking sector, effectively swapping government securities for bank reserves.

How do open market operations change the money supply?

To increase money → the central bank buys government securities (adds reserves).

To decrease money → the central bank sells government securities (drains reserves)

Which Fed branch executes open market operations in practice?

The Federal Reserve Bank of New York (NY Fed).

Who are the counterparties in open market operations?

Primary dealers - selected banks/securities firms that trade directly with the central bank.

What two main roles do primary dealers play?

1. Act as counterparties in open market operations.

2. Help with the new issuance of government bonds.

On what basis are primary dealers chosen?

They are chosen by the central bank based on reputation and reliability.

Where are reserves held and why do they matter for the monetary base?

Reserves are held by banks at the central bank. By changing aggregate reserves, the central bank can change the monetary base.

What happens in an open market purchase of $1 T-bill by the Fed? (T-account view)

Fed's balance sheet:

Assets: + $1 Treasury bills

Liabilities: + $1 bank reserves

Banking system:

Assets: - $1 T-bills, + $1 reserves

Result → aggregate reserves increase by $1.

What is the money supply (simple definition used here)?

Money supply = Currency (held by individuals) + Deposits (held by individuals).

Why are reserves not the same thing as money?

Reserves are held by banks at the central bank, but money is what individuals use to make payments (currency + deposits).

Who supplies and who demands reserves?

Supply of reserves → controlled by the central bank.

Demand for reserves → comes from banks, who need reserves to back deposits and meet liquidity/requirement needs.

What equilibrium condition links reserves and deposits?

In equilibrium: Reserves = γ × Deposits,where γ depends on reserve requirements, banks' liquidity needs, and the opportunity cost of holding reserves.

How does an increase in reserves affect deposits and the money supply?

Banks try to get rid of excess reserves by making more loans.

New loans turn into new deposits.→ Δreserves ↑ ⇒ Δdeposits ↑ ⇒ Δmoney supply ↑(or: Δmonetary base ↑ ⇒ Δmoney supply ↑).

What is the link between open market operations and the ultimate goals of the central bank?

Open market operations → change monetary base (currency + reserves) → change money supply (currency + deposits) → affect price stability and output stability.

What variable does the central bank typically target when doing open market operations?

A short-term interest rate (e.g., the federal funds rate) rather than a fixed level of reserves.

What is the federal funds market and the federal funds rate?

Federal funds market: overnight market where banks lend reserves to each other.

Federal funds rate: the interest rate on these overnight reserve loans.

In the Fed's diagram, what do these stand for: i_d, i_ff, i_oer?

i_d → discount rate (rate on discount loans from the Fed).

i_ff → federal funds rate (interbank rate for reserves).

i_oer → interest rate on excess reserves.

What happens to the federal funds rate when there is excess supply of reserves?

With excess supply, competition among lending banks pushes the federal funds rate down toward the lower bound (near i_oer).

What happens to the federal funds rate when there is excess demand for reserves?

With excess demand, banks bid up the price of reserves, so the federal funds rate rises toward the upper bound (near i_d).

What is the "bottom line" relationship between the money supply and the federal funds rate?

"Fed is increasing the amount of money" ⟺ "Fed is decreasing the federal funds rate."(Open market purchase → more reserves → lower fed funds rate.)

What is the second major job of the central bank besides monetary policy?

Acting as lender of last resort.

When does the central bank act as lender of last resort?

Only in times of financial crisis, when there is a shortage of liquidity in markets.

Why are financial crises often linked to liquidity problems?

Crises often feature market illiquidity, which can:

Increase systemic risk,

Cause market freezes and fire-sale price spirals,making the crisis more severe.

What does the central bank do as lender of last resort?

Lends to banks when no one else will,

Provides liquidity to the system,

Sends a signal that can calm markets and reduce panic.

How did the Fed respond as lender of last resort after the 9/11 attacks?

Announced that the discount window was open to meet liquidity needs.

Provided about $45 billion in loans to banks, around a 200-fold increase over the previous week.

What was Northern Rock and what was its basic business model?

A UK bank (founded 1997) that grew rapidly, funding mortgage lending mainly with short-term wholesale funding + deposits, and securitizing some mortgages.

What did the regulator say about Northern Rock in September 2007?

The FSA judged Northern Rock solvent, with adequate capital and a good quality loan book, but it still struggled to obtain funding.

Why did Northern Rock need help from the Bank of England?

Private markets became reluctant to lend (concerns about the mortgage market).

Northern Rock relied heavily on short-term funding, so funding stress quickly became a liquidity crisis.

It requested assistance from the Bank of England (central bank).

What was the stigma issue when Northern Rock asked for central bank help?

Once the BBC broke the news, depositors saw central bank support as a negative signal, creating stigma and amplifying fears.

What happened during the Northern Rock bank run?

Queues formed outside branches; about £1bn (5% of deposits) withdrawn on one day.

Withdrawals continued, stock price fell ~60%.

The run was driven not only by retail depositors but also by wholesale investors pulling funding.

How did the Northern Rock crisis end?

UK government extended deposit insurance to cover all Northern Rock deposits, calming the run.

Provided about £25bn in emergency funding.

Bank was nationalized, bad loans moved to a "Bad Bank".

In 2011, the "good bank" was sold to Virgin Group.

What is the difference between an illiquid bank and an insolvent bank?

Illiquid bank: Assets > liabilities, but cannot meet short-term payments (cash-poor).

Insolvent bank: Assets < liabilities; negative capital, so even with time it cannot repay all creditors.

What is the main challenge for the central bank as lender of last resort?

To distinguish between illiquid but solvent banks (should be helped) and insolvent banks (should be allowed to fail).

What is the purpose of the central bank's lending facility?

To provide liquidity support to solvent but illiquid institutions, not to keep insolvent ones alive.

Why is it hard to separate illiquidity from insolvency in a crisis?

Because asset prices are depressed by illiquidity, making healthy assets look weak and blurring the line between liquidity problems and real losses.

What are discount loans (US perspective)?

Loans that the Fed makes to banks through the discount window; the interest rate is the discount rate.

What are the main characteristics of discount loans?

1.Short maturity (often overnight).

2.Can be rolled over.

3.Interest rate above the market rate.

4.Collateralized (banks must pledge assets).

How does a discount loan change the Fed and banking system balance sheets?

Fed:

Assets: + discount loan

Liabilities: + reserves

Banking system:

Assets: + reserves

Liabilities: + discount loan to Fed