Ch.4- Accounting for Merchandising Operations

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

37 Terms

Merchandise

Goods that a company owns and expects to sell to customers; also called merchandise inventory or inventory.

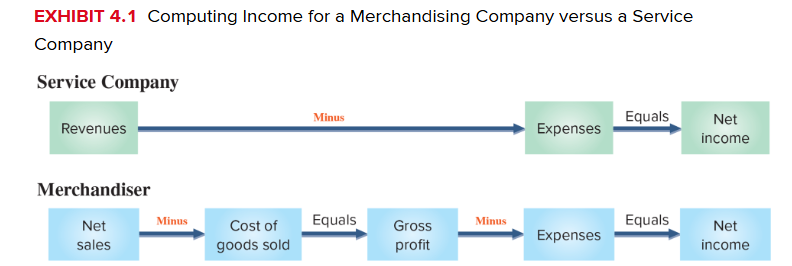

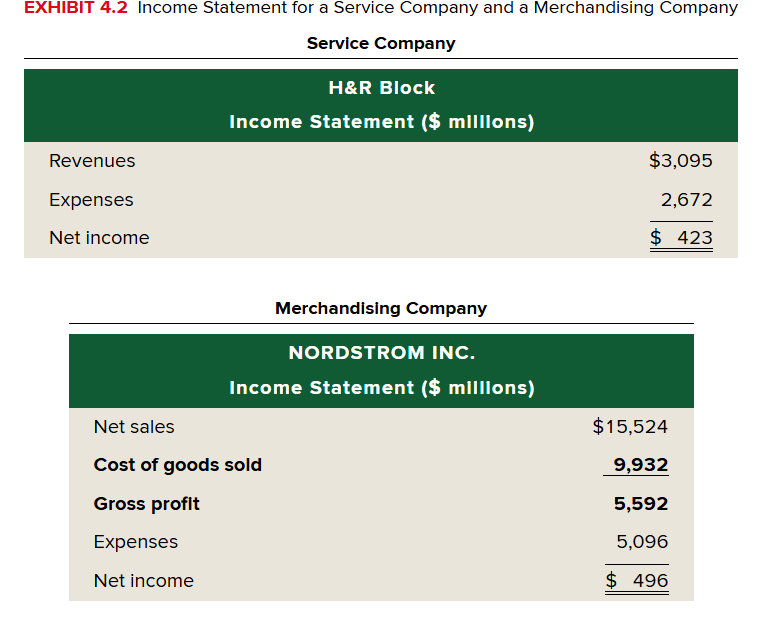

Merchandiser

Entity that earns income by buying and selling merchandise.

Wholesaler

Intermediary that buys products from manufacturers or other wholesalers and sells them to retailers or other wholesalers.

Retailer

Intermediary that buys products from manufacturers or wholesalers and sells them to consumers.

Costs of Goods Sold

Cost of inventory sold to customers during a period; also called cost of sales.

Gross Profit

Net sales minus cost of goods sold; also called gross margin.

Merchandise Inventory

Goods that a company owns and expects to sell to customers; also called merchandise or inventory.

Perpetual Inventory System

Method that maintains continuous records of the cost of inventory available and the cost of goods sold.

Periodic Inventory System

Method that records the cost of inventory purchased but does not continuously track the quantity available or sold to customers; records are updated at the end of each period to reflect the physical count and cost of goods available.

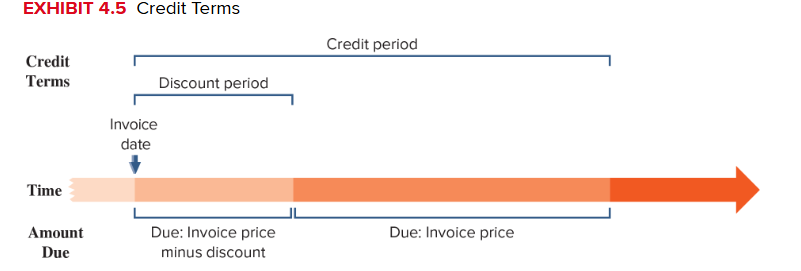

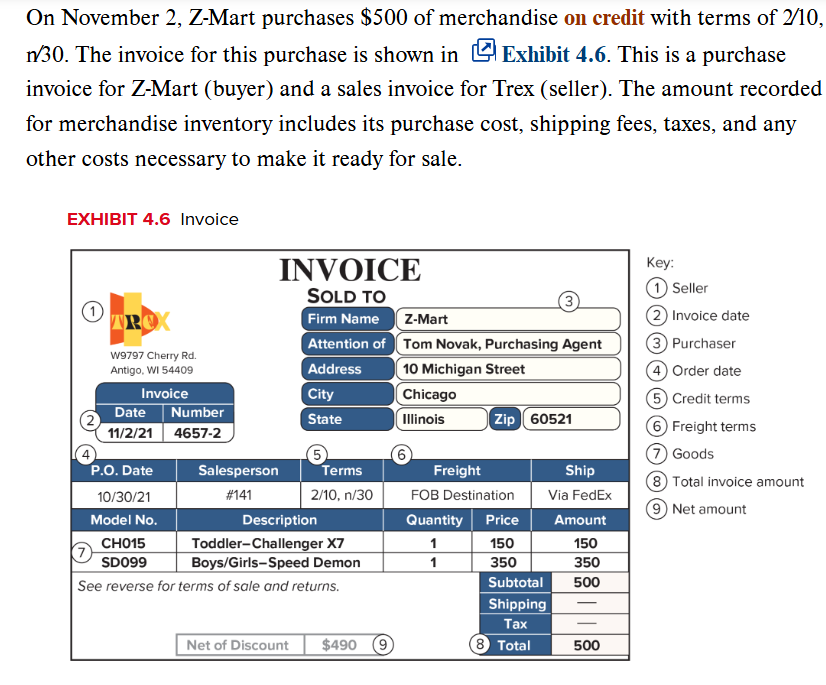

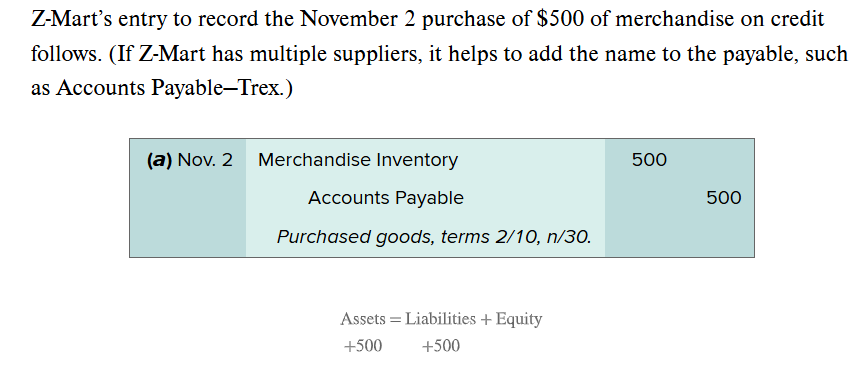

Credit Terms

Description of the amounts and timing of payments that a buyer (debtor) agrees to make in the future.

Credit Period

Time period that can pass before a customer’s payment is due.

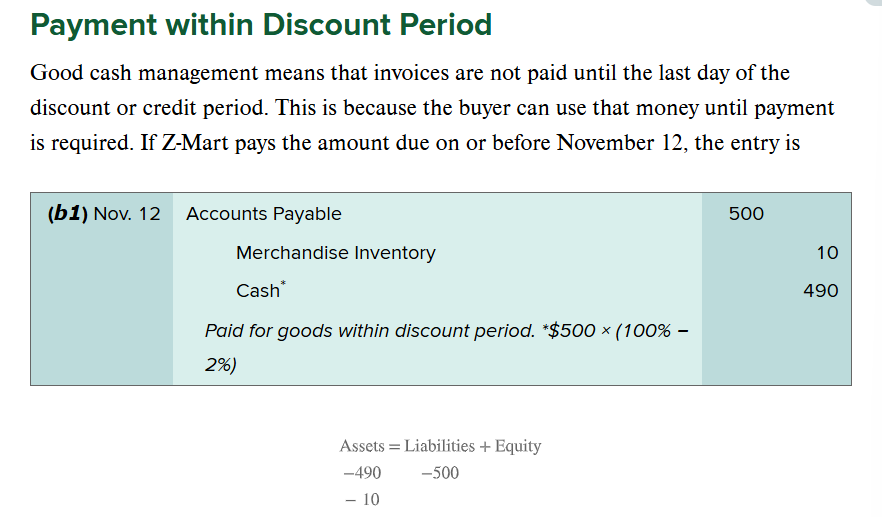

Cash Discount

Reduction in the price of merchandise granted by a seller to buyer when payment is made within the discount period.

Purchase Discount

Term used by a purchaser to describe a cash discount granted to the purchaser for paying within the discount period.

Sales Discount

Term used by a seller to describe a cash discount granted to buyers who pay within the discount period.

Discount Period

Time period in which a cash discount is available and the buyer can make a reduced payment.

Gross Method

Method or recording purchases at the full invoice price without deducting any cash discounts.

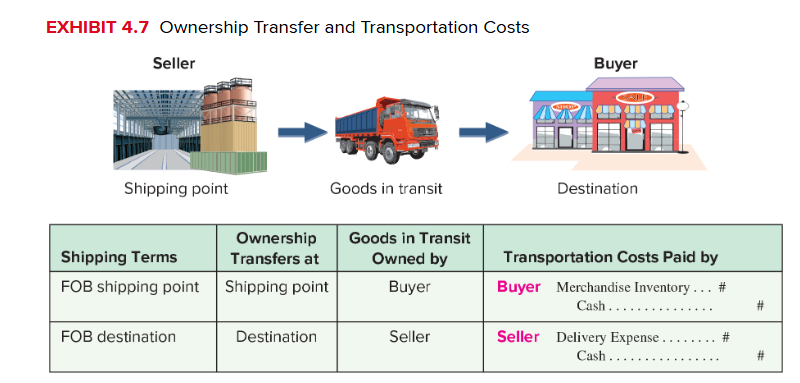

FOB

Abbreviation for free on board; the point when ownership of goods passes to the buyer; FOB shipping point (or factory) means the buyer pays shipping costs and accepts ownership of goods when the seller transfers goods to the carrier; FOB destination means the seller pays shipping costs and the buyer accepts ownership of goods at the buyer’s place of business.

Supplementary Records

Information outside the usual accounting records; also called supplemental records.

Sales Returns and Allowances

Refunds or credits given to customers for unsatisfactory merchandise are recorded (debited) in sales returns and allowances, a contra accounts to sales. In addition, estimates of future sales returns and allowances (related to current-period sales) are made with an adjusting entry that debits sales returns and allowances this results in sales being recorded net of expected returns and allowances. Sales returns and allowances is a temporary account that is closed each period.

Shrinkage

Inventory losses that occur as a result of theft or deterioration.

Multiple-step Income Statement

Income statement format that shows subtotals between sales and net income, categorizes expenses, and often reports the details of net sales and expenses.

Selling Expenses

Expenses of promoting sales, such as displaying and advertising merchandise, making sales, and delivering goods to customers.

General and Administrative Expenses

Expenses that support the operating activities of a business.

Single-step Income Statement

Income statement format that subtracts total expenses, including cost of goods sold, from total revenues with no other subtotals.

Acid-test Ratio

Ratio used to assess a company’s ability to settle its current debts with its most liquid assets; defined as quick assets (cash, short-term investments, and current receivables) divided by current liabilities.

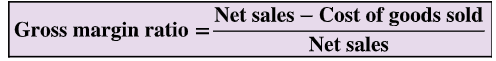

Gross Margin Raito

Gross margin (net sales minus cost of goods sold) divided by net nales; also called gross profit ratio.

Allowance for Sales Discount

Contra asset account that is reported on the balance sheet as a reduction to Accounts Receivable; this allowance account had a normal credit balance.

Net Method

Method of recording purchases at the full invoice price less any cash discounts.

Gross Method

method of recording purchases at the dull invoice price without deducing any cash discounts.

Discounts Lost

Expenses resulting from not taking advantage of cash discounts on purchases.