AP Macro Unit 3 Definitions

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

22 Terms

LRAS

Long Run Aggregate Supply

considers Aggregate Supply/productive capacity when @ FULL EMPLOYMENT no matter price level

goes vertical; called YFE

Caused by CIGNX

SRAS

Short-Run Aggregate Supply

considers productive capacity of aggregate supply based on temporary changes in price level

caused by two factors

Sticky Prices

Sticky Wages

Sticky Wages

When wages are not rising at the same rate as inflation

Will first have to wait for negotiation

In turn, companies can produce more product since wages are cut

ONLY CHANGES IN LRAS

Sticky Prices

When companies do not raise the price level in equilibrium to the rate of inflation

THEREFORE, there is an expectation that production is more rapid to meet demand, since ppl are more willing to buy with low prices

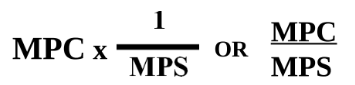

MPC

Marginal Propensity to Consume

This is how much people purchase from what they earn per dollar

*Both MPC and MPS have to add up to 1

MPS

Marginal Propensity to Save

This is how much people save in what they earn per dollar

*Both MPS and MPC have to add up to 1

Government Spending Multiplier

More effective in raising GDP over a reduction in taxes

Tax Multiplier

Fraction of dollar spent on TAXES

Lags in Fiscal Policy

They can lead to inflationary gaps withing the economy, hurting it even more

Aggregate Demand

The relationship between the Real GDP and price level of goods (indicator for a country’s economy)

IRE (in terms of Aggregate Demand)

Interest Rate Effect

Real Wealth Effect

Exchange Rate Effect

These are the outcomes when price levels increase/change, affecting GDP

Interest Rate Effect

When prices increase, money is worth less and people pull out cash, leading to banks raising interest rates to mitigate pull-outs

Real Wealth Effect

When prices increase, the money saved will be worth less, leading to less purchasing power

Exchange Rate Effect

When prices rise, a country’s goods become more expensive, so less foreigners purchase and therefore weakens the GDP

Automatic Stabilizers

Temporary action to mitigate inflation effects on the economy during a recession

Usually comes in the form of transfer payments and less taxes due to ppl getting laid off

Helps give govn’t time to implement better fiscal policies

Positive Demand Shock

A sudden demand shock in the demand for a product or service

Causes AD to move right & create new short-run equilibrium

Effects:

Higher prices

Inflationary Gap

Increased output

Causes AD to move to AD2 →SR Equilibrium

Inflationary Gap (Positive Output)

When there is a difference between how much we should be producing (YFE) and how much is actually being produced (Y1)

Recessionary Gap (Negative Output)

When the Short-Run Equilibrium is to the LEFT of LRAS

indicates a recssion

Shifters of Aggregate Demand

Consumer Spending

Investment

Government Spending

Net exports (export-import)

Shifters of Aggregate Supply (RAP)

Resource Prices

Price of Domestic + Imported Resources

Supply shocks

Inflationary Expectations

Actions of Government

Taxes

Subsidies

Regulations

Productivity

Technology

Labor Force & Capital Stock

Negative Supply Shock

Shifts in LRAS

Change in resource quantity or quality

Change in technology

SAME SHIFTERS AS PPC (RAP)