Beak even

0.0(0)

0.0(0)

Card Sorting

1/25

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

26 Terms

1

New cards

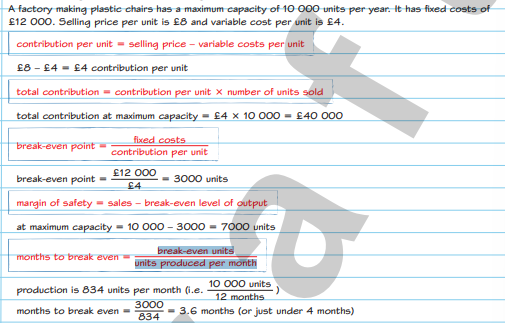

contribution per unit =

selling price – variable costs per unit

2

New cards

total contribution =

contribution per unit × number of units sold

3

New cards

break-even point =

fixed costs/contribution per unit

4

New cards

margin of safety =

sales – break-even level of output

5

New cards

months to break even =

break-even units/units produced per month

6

New cards

example of one

7

New cards

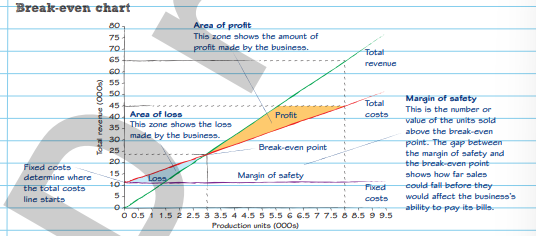

Break- Even chart

8

New cards

Area of profit

This zone shows the amount of profit made by the business

9

New cards

Margin of safety

This is the number or value of the units sold above the break-even point. The gap between the margin of safety and the break-even point shows how far sales could fall before they would affect the business’s ability to pay its bills.

10

New cards

Area of loss

This zone shows the loss made by the business

11

New cards

Fixed costs

Determine where the total costs line starts

12

New cards

Using Break-Even

Break-even is a valuable management tool used by businesses to plan, monitor, control and set targets. As part of break-even, contribution per unit has both limitations and benefits.

13

New cards

Planning

break-even helps the business to work out how many items it needs to sell over a certain period to cover its costs and to use this information to set a price that will enable it to make a profit

14

New cards

Monitoring

break-even alerts the business to potential problems, e.g. increased fixed or variable costs or a fall in sales, allowing it to take steps to fix them in good time

15

New cards

Control

break-even can be used to identify where costs are increasing, allowing the business to take action to control this.

16

New cards

Target -Setting

Break-even helps a business to set targets for sales, unit costs, contribution, and profit.

17

New cards

Contribution benefits

A business is able to see whether the products it produces actually cover its own variable costs.

This is used to set the price of the product in relation to direct production costs.

Contribution per unit may be very low, so the business will need to sell a large number to cover the fixed costs.

This is used to set the price of the product in relation to direct production costs.

Contribution per unit may be very low, so the business will need to sell a large number to cover the fixed costs.

18

New cards

Contribution limitations

Contribution per unit on certain products may be extremely high.

\

In each case the contribution per unit is distorted and may not be valuable.

\

In each case the contribution per unit is distorted and may not be valuable.

19

New cards

Variable costs

The variable costs relate to the additional costs incurred per unit

20

New cards

Total Costs

Total costs are the total of these two figures.

21

New cards

Total Revenue

is calculated by multiplying the number of units sold by the price the business received for them.

22

New cards

selling price

if the selling price is increased total revenue will be greater and rise more quickly. If it falls then total revenue will drop

23

New cards

Fixed costs

total costs will increase if fixed costs increase

24

New cards

Variable costs

these will affect the total costs line, shifting it up if unit costs increase and down if they fall.

25

New cards

Break-even may have to be recalculated when there is a change in…

Selling price, fixed costs, variable costs.

26

New cards

Stages necessary to work out break-even

The variable costs, to Total costs, to Total Revenue.