Unit 2: Economics Indicators

1/52

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

53 Terms

Factor payments

The income earned by the owners of factors of production, such as wages of labor, rent for land, interest for capital, and profits for entrepreneurship

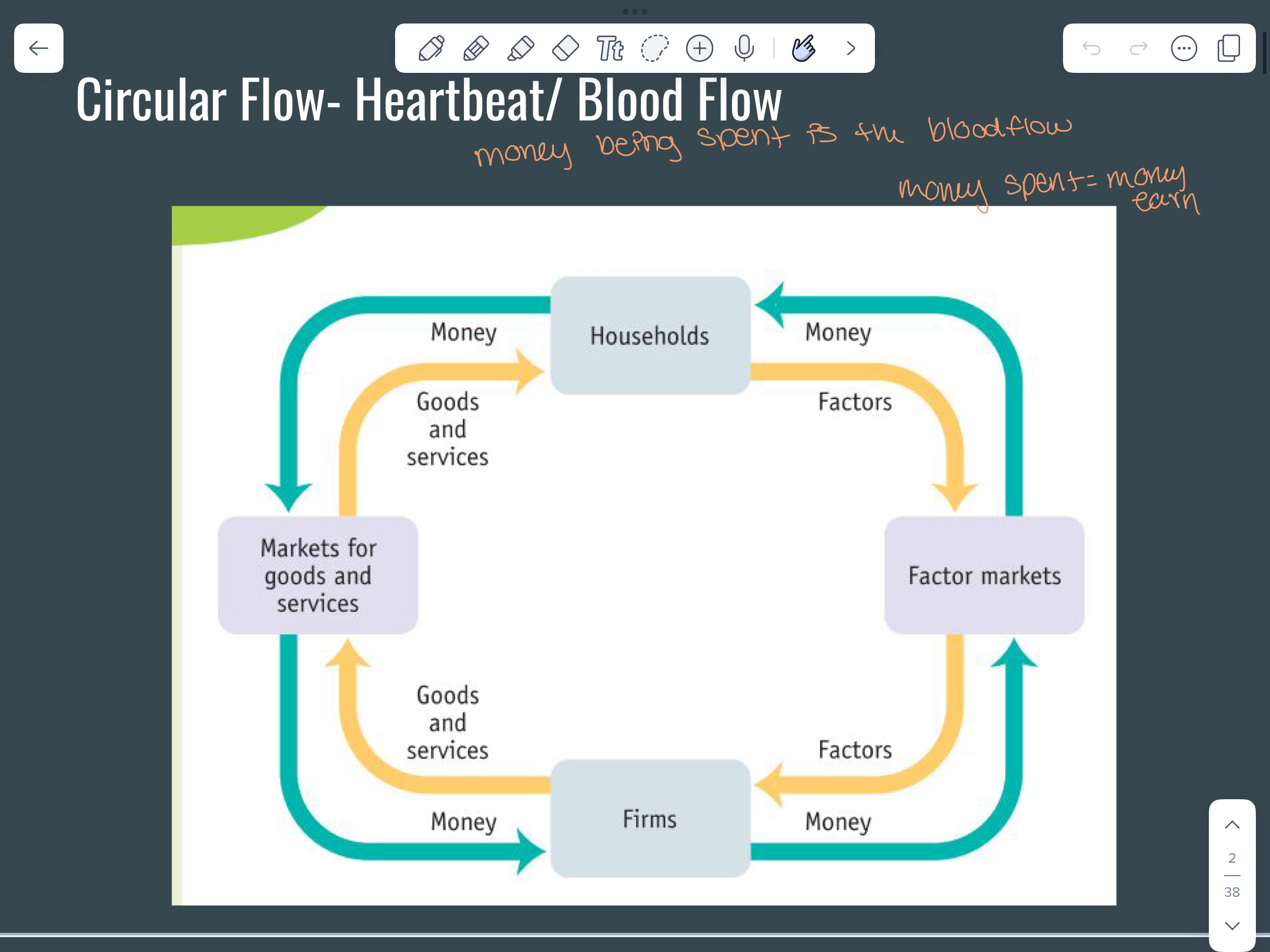

Circular flow model

Shows how goods and services, resources, and money all flow in the economy

Transfer payments

Payments made by the government without any goods or services being exchanged, such as welfare, unemployment compensation, social security, stimulus checks, or subsidies, etc

Gross Domestic Product (GDP)

The dollar value of all final goods and services produced within a country in one year

3 ways to measure GDP

Expenditures approach

Income approach

Value added approach

Expenditures approach

A method of calculating a country’s total economic output (GDP) by summing all spending on final goods and services

GDP=C+I+G+Xn

Expenditures approach equation

GDP=C+I+G+Xn

Income approach

A method for calculating a country’s total economic output (GDP) by summing all income earned in the production of goods and services.

wages+rent+interest+profit

Income approach equation

wages+rent+interest+profit

Value added approach

A method of calculating a country’s total economic output (GDP) by summing the additional value created at each stage of production.

Labor force

Individuals aged 16+ who are either employed or actively seeking employment but currently unemployed, excluding those who are retired, full-time students, homemakers, or otherwise not seeking work.

Labor force participation rate (equation)

(number of people in the labor force/ working age population)x100

Unemployment rate

and its formula

The percentage of the labor force (those working or actively seeking work) that does not have a job

(number of people unemployed/number of people in the labor force)x100

Discouraged workers

given up looking for jobs so they’re no longer counted as unemployed because they’re no longer in the labor force

Frictional unemployment

A person chooses to leave their job for another or between jobs or is searching for the first time, they have skills

Structural unemployment

Changes in demand in an economy cause other skills and abilities to become unneeded or obsolete.

Caused by a fundamental shift in the economy, such as when a new technology removed the need for a worker or when an industry is no longer needed

Cyclical unemployment

Demand for a certain good or service decreases, leading to unemployment.

A decrease in spending overall in the economy

Connection to the business cycle is unemployment due to a recession

Natural rate of unemployment

The level of unemployment that exists when the economy is at full employment, including only frictional and structural unemployment, but not cyclical unemployment

What unemployment types are present when an economy is in a recession?

Frictional, structural, and cyclical

What unemployment types are present when an economy is at full employment?

Only frictional and structural unemployment

When can a economy actually be outside of the PPC graph in terms of unemployment?

Economy can only be here when there’s really low structural and frictional unemployment

Consumer Price Index (CPI)

Measures the average change over time in the prices paid by consumers for a basket of goods and services commonly purchased by households

(value of a basket in a given year/value of the basket in the base year)x100

Consumer price index (CPI) equation

(value of a basket in a given year/value of the basket in the base year)x100

Inflation

increase in average level of prices

Deflation

decrease in average level of prices

Disinflation

prices are still going up but at a slower rate so basically a decrease in the rate of inflation

Unanticipated infaltion hurts lenders that lends at ___ interest rates and ppl with ____ incomes

fixed

fixed

People who benefit from unanticipated inflation are borrowers who borrow at a ____interest rate

fixed

GDP Deflator

An economic metric that measures the changes in prices of all goods and services produced within a country, providing a broad indicator of inflation

(Nominal GDP/Real GDP)x100

GDP Deflator formula

(Nominal GDP/Real GDP)x100

Key expenditures in GDP

Personal consumption (C)

Government Purchases (G)

Private investment(buying capital)(I)

Net exports (Nx)

Personal Consumption (C)

-the biggest one

Household consumption

2/3 of US economy

Must be purchases of NEW items

Government purchases (G)

-Purchases by all levels of government: national, state, county, city, etc

-Must be purchases of goods and services, not all government spending

-Does not include transfer payments

Private investment (I)

-Goods produced for use in the production of other goods and services (capital)

-Gross Private Investment includes 3 categories: 1(Firms’ spending on new buildings, plants, tools, capital) 2(purchases of new residential housing) 3(additions to firms; resources)

-Must be new items

-Investment is a highly volatile component of GDP

-How businesses think consumers will buy in the future.

-Not stocks and bonds

Net exports (Nx)

Net exports=Exports-Imports

Negative net exports= trade deficit

Positive net exports= trade surplus

Nominal GDP

just total number

Real per capita GDP equation

Real GDP/Population

Real GDP formula

Real GDP = Nominal GDP/Deflator

GDP and GNP

GDP refers to the total monetary value of all goods and services produced within a country, while GNP includes the value of all goods and services produced by a country's residents, regardless of location.

Higher (per capita) GDP correlates with

Higher literacy rate

Higher life expectancy

Lower infant mortality

Higher standard of living

Full employment

level of employment when the economy is operating exactly at its full potential

Seasonal unemployment

unemployment caused by the weather or calender

Underemployment

when workers take on work that is beneath their skill level or for fewer level or for fewer hours than full-time employment

Disguised employment

when “true” unemployment is not visible to statistics, such as when companies are overstaffed

Unemployment

when workers who are able and willing to work cannot find jobs

NAIRU

Non Accelerating Inflation Rate of Unemployment

Price index

number whose movement reflects movement in average level of prices

Core CPI

excludes energy and food

Who wins when inflation is higher than expected— borrower or lender?

Borrower

Who wins when inflation is lower than expected— borrower or lender?

Lender

Price index formula

(Current cost of basket/ base period cost of basket)

Rate of inflation formula

(change in index/ initial value of idex)x100

(new-old)/old x100

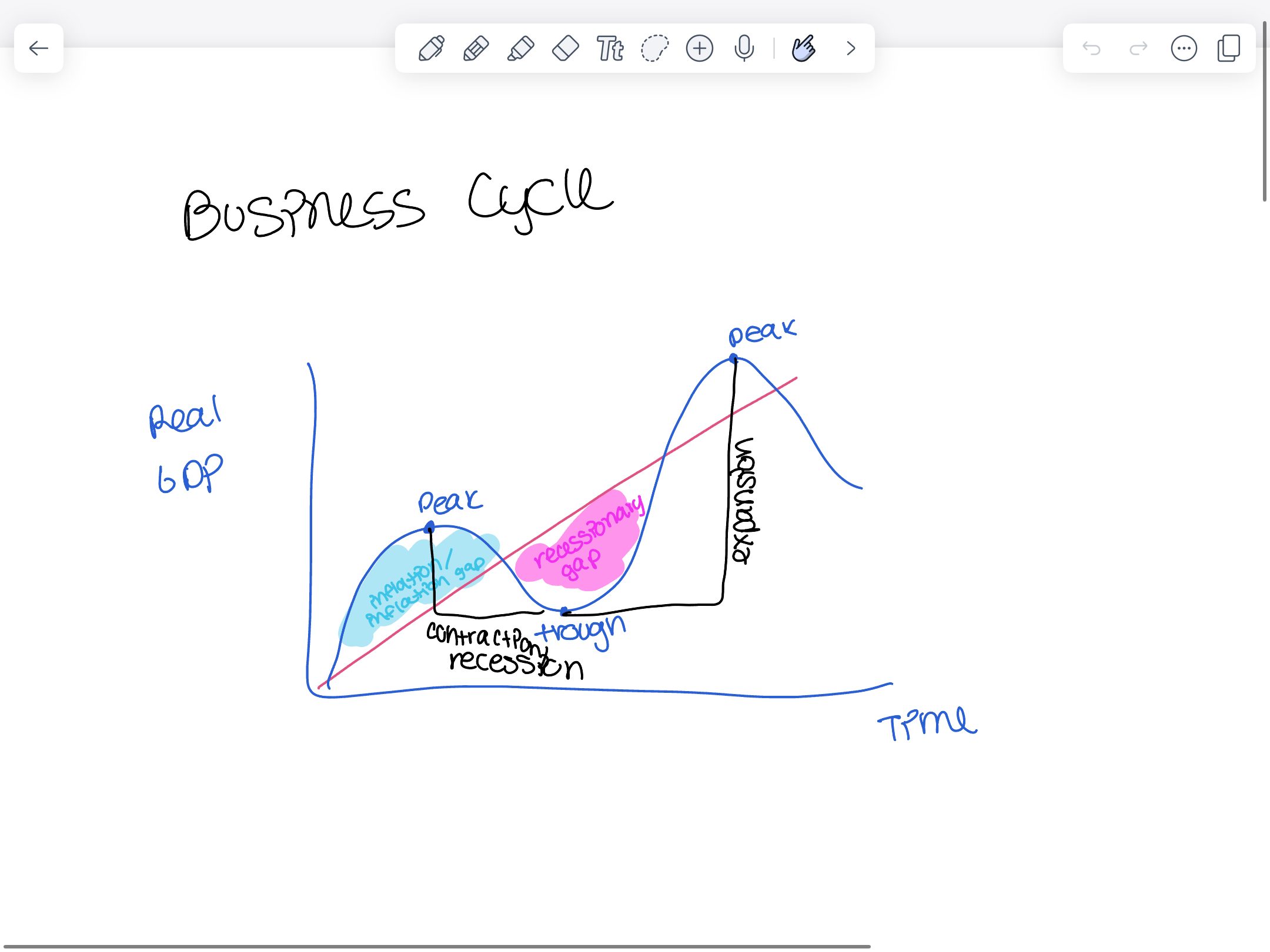

Business cycle graph