AP Macroeconomics Flashcards Unit 1-5

1/42

Earn XP

Description and Tags

Flashcards covering basic economic concepts for AP Macroeconomics.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

43 Terms

Economics

The study of how people satisfy their unlimited wants with scarce resources.

Scarcity

Limited goods and services available for an unlimited amount of wants; leads to choices in satisfying the most important wants.

Macroeconomics

The study of the economy as a whole, including inflation, price levels, GDP, economic growth, national income, and unemployment.

Opportunity Cost

The loss of potential gain from other alternatives when one alternative is chosen.

Trade-offs

Involve losing all other options when a choice is made.

Factors of Production

Land, Labor, Capital, and Entrepreneurship

Capital Goods

Goods made not directly for consumption, used in production (e.g., oven to bake cookies for sale).

Human Capital

Human skills and knowledge that enhance production (e.g., education, training).

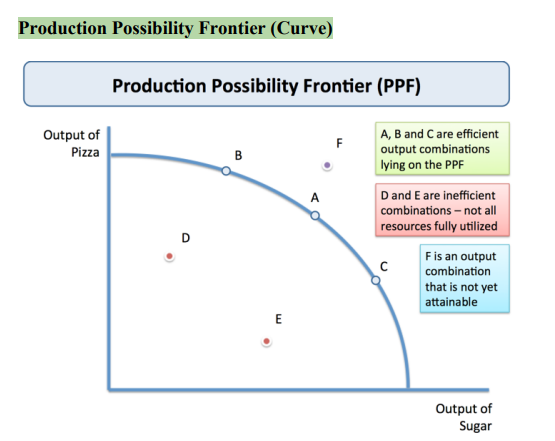

Production Possibility Frontier (PPF)

A curve illustrating the possible quantities that can be produced of two products if there is limited resources.

Comparative Advantage

The ability to produce a product at a lower opportunity cost compared to another producer.

Absolute Advantage

The ability to produce more of a product than another producer, using the same amount of resources.

Law of Demand

The inverse relationship between price and quantity demanded; as price increases, quantity demanded decreases.

Law of Supply

The direct relationship between price and quantity supplied; as price increases, quantity supplied increases.

Shifters of Supply

Cost of inputs, change in productivity/technology, number of sellers, government actions (taxes, subsidies, regulations), expectations of future profit.

Shifters of Demand

Number of consumers, change in tastes & preferences, change in income, change in price of substitute goods, change in the price of complementary goods, future expectations.

Equilibrium

The point where market supply and demand balance each other, resulting in stable prices.

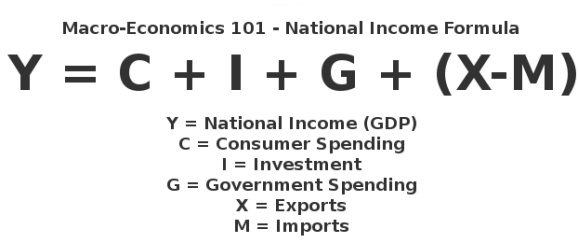

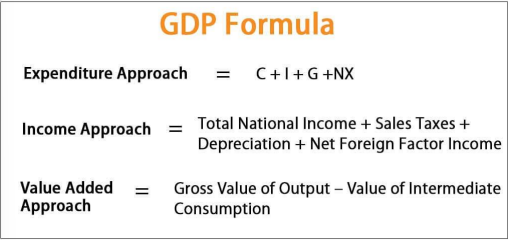

Gross Domestic Product (GDP)

Monetary total value of all final goods and services produced in one country in a period of time.

Expenditures Approach to GDP

Types of Approaches to GDP

Not Counted in GDP

The sale of something that is not new or does not produce a new product; Intermediate products; illegal activities. (ex: stock and used products and flour used in bakeries)

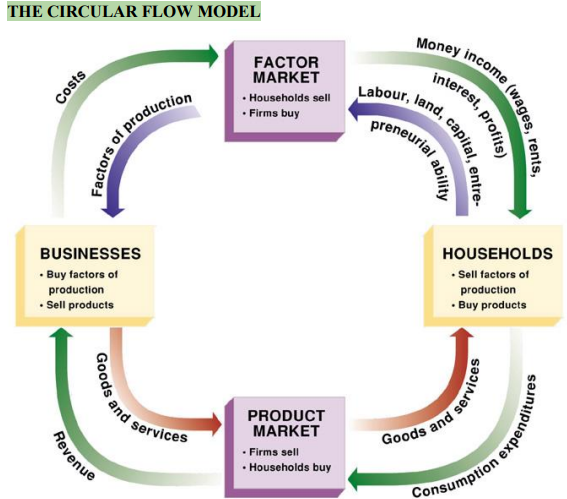

Circular Flow Model

How many and transactions travel and form our society

Factor Market

Buy labor from households, sell resources to businesses

Households

Sell labor to factor market, buy products from product market

Product Market

Buy product from businesses, sell product to households

Businesses

Buy factors of production from factor market, sells product to product market

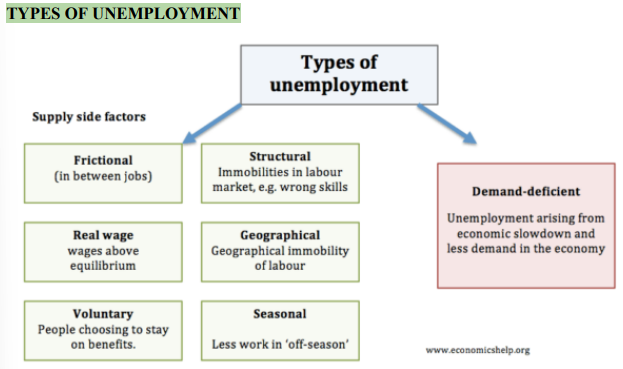

Unemployment

A person capable of working and searching for work, but unable to find a job

Types of Unemployment

Frictional Unemployment

In between jobs

Structural Unemployment

Replaced by advancement in tech and can’t convert skills into other work

Seasonal Unemployment

Unemployment based on time of year (like lobster fishermen in the winter seaso)

Unemployment Rate Formula

Unemployed (able and looking for work); Labor force (working + unemployed)

Consumer Price Index (CPI)

How the price of a specific product changes over a period of time

CPI Formula

Inflation

General increase of a product’s price; When the price increases, the purchasing power decreases

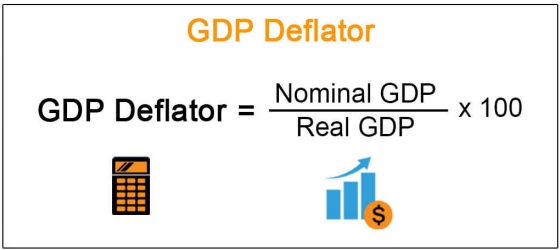

GDP Deflator

Measure of the Economy’s prices of final goods in a period of time

GDP Deflator Formula

Real GDP

Market value of the final production of goods and services within a country in a given period adjusted for price changes that may have occurred over time.

Nominal GDP

Market value of the final production of goods and services within a country in a given period evaluated at current market prices

Aggregate Demand Curve

Shows relationship between aggregate price level and quantity of aggregate demand

Why is Aggregate Demand Downward Sloping

Real balance effect (increase price level decreases purchasing power); Interest rate effect (increase in interest rate decreases borrowing and spending); Open economy effect (higher price levels decreases net exports

Aggregate Demand Shifters

Changes in expectations, changes in wealth, size of existing physical capital

Fiscal Policy

Government spending increase or tax cuts increase demand

Monetary Policy

Quantity of money increases demand