Supply side policies

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

19 Terms

What are the Interventionist supply side policies?

Interventionist supply-side policies involve direct government intervention in markets. These policies rest on the view that the free market fails to achieve certain desirable outcomes such as low unemployment rate, adequate incentive for education and training, investment and research and development. Such limitations of the free market provide the case for government intervention to stimulate supply-side improvements.

a. Education, Training and Retraining (MOST IMPT POLICY USED)

b. R&D / Automation

c. Building infrastructure

d. Encouraging entrepreneurship

e. Protectionism

f. Nationalisation

What are the Market-oriented supply side policies?

Use of market-oriented supply side policies to achieve sustained economic growth

Market oriented supply-side policies aim to reduce the role of the government and enable the market to work more freely by putting more emphasis on market incentives and competition. They are designed to give the private sector more freedom. Such market oriented supply-side policies can be targeted at the product or labour markets.

There are Market-oriented supply-side policies for product markets

Supply-side policies in product markets are designed to increase the degree of competition and efficiency in product markets, such as privatisation pro-competition policies, deregulation or liberalisation, & promoting freer trade between nations.

And there are Market-oriented supply-side Policies for labour markets.

These policies include:

a. Labour market reforms

b. Tax reforms (Diff from EFP) (Focuses on increasing AS)

c. Pro-competition policies such as deregulation, privatisation, anti-monopoly regulation

d. Free trade agreements / encouraging free trade (MUST KNOW HOW TO WRITE FOR MKT ORIENTED SS SIDE POLICY FOR SINGAPORE)

Elaborate on Interventionist SS side policies of Education, Training & Retraining

Interventionist SS side policies eg Education, Training & Retraining (use this instead of RI’s one)

Through training and retraining,for example SkillsFuture and Continuing Education and Training (CET), this upgrades workers’ skills as well as help them with career progression and life-long employment.

This increases efficiency and labor productivity and allows retrenched workers to find jobs by equipping them with new skills which make them employable in the new sectors of growth, like petrochemicals, biochemicals. This reduces the skills mismatch and reduces structural unemployment. LRAS rises and this increases potential growth. As workers become more efficient, cost of production falls, SRAS rises, actual growth rises.

For the low-wage and low-skilled workers, the Singapore government implements the Workfare Skills Support (WSS). This scheme encourages low wage workers to undertake training that leads to more impactful employment outcomes. Eligible individuals may receive training allowance for selected courses that individuals have paid for themselves and/or cash reward for completing training. This enables the low wage and low-skilled workers to earn higher wages so consumption of this group of income earners will rise. AD rises, leading to actual growth. At the same time, as they are able to gain higher order of skill, labor productivity rises. LRAS rises, leading to potential growth and they are able to be employed in the growing sectors of the economy.

Evaluation(from lecture notes):

However, the effectiveness of skills upgrading largely depends on receptivity of workers which is dependent on a combination of factors. For instance, brain plasticity tends to fall as age increases past 25 years, hence some adults may face more difficulty in absorbing new knowledge and in learning new skills. Hence, the additional effort may deter some from actively participating in retraining and skills upgrading programmes. Older workers might also have less incentive to retrain because they have fewer working years. Furthermore, retraining entails an opportunity cost, low skilled employees may not see the need for training if they deem that their jobs do not require higher skills and if they perceive that there is little opportunity for progression. Hence such schemes may not necessarily achieve their intended effects of increasing the skills levels of such workers.

Besides, skills training and upgrading is long term in nature as it takes time to acquire new skills and to be adept at them, hence the policy may not be as effective in addressing issues in the short run as results will only materialize in the long term.

There may also be the problem of a loss in productivity of workers during training since they will not be at work and this could potentially reduce profits for the firms and hence reduce employers’ incentives to send their workers for training, defeating the purpose of such programmes.

In addition to all the above limitations, it is perhaps also important to note that the burden of financing course subsidies falls on the part of the government, eg. Skills Development Fund (SDF) - Offers subsidies of up to 90% of training costs

Elaborate on Interventionist SS side policies of R&D

B. Interventionist SS side policies eg R&D

The governments can give grants to encourage research and development.

Research & Development (R&D) refers to innovative activities undertaken by corporations or governments to develop new products, improve existing ones or lower the unit cost of production.

The biggest barriers to innovation are risk aversion, uncertainty about the outcome of R&D, a lack of high-skilled workers to carry out R&D and a lack of information on technology and markets. Though economically desirable to society, R&D may be privately unprofitable for a firm. Hence, the government may sponsor R&D in certain industries like aerospace or life sciences to spur more R&D efforts in such areas where there are potentially large external benefits. Successful R&D efforts leading to technological breakthroughs help raise productive capacity in the economy and lower unit costs of production. This results in an outward shift of the LRAS curve, leading to potential growth. Grants by govt represent govt expenditure. This increases AD which leads to a multiplied increase in real GDP, resulting in actual growth. With automation through R&D, more efficient methods of production are discovered. Efficiency and productivity rises. Cost of production falls. SRAS rises. Actual growth rises. As GPL falls, cost push inflation reduces.

In 2016, the Singapore government unveiled the new Research Innovation Enterprise (RIE) 2020 Plan with a $19 billion commitment to support R&D efforts over the next five years. The Research Incentive Scheme for Companies (RISC), launched by the Singapore Economic Development Board (EDB), is aimed at encouraging companies in Singapore to conduct or expand their research and development (R&D) activities in science and technology. This includes co-funding project costs such as manpower, training, consultancy and software. The government will also sustain R&D spending at about 1% - 2% of GDP. This is more than the UK, but comparable to the US and public spending in other research-intensive economies.

OR

Progress in biomedical sciences is accelerating, presenting significant opportunities to Singapore. To reduce the aversion to high costs of research and development, Biopolis, a research and development hub was constructed at a cost of S$500 million to attract biomedical firms.

Evaluation:

However, investment often involves risks too. The projects that claim to be developing "breakthrough" or "revolutionary" technologies get approval quickly. The results of R&D are not guaranteed and there is a possibility that R&D efforts might not yield any results despite aggressive government support. There is also a long gestation period before R&D efforts are able to yield tangible and impactful results. At the national level, though, the benefits of investment might well have substantially outweighed the costs and thus it would be socially desirable for firms to have taken the risk.

Elaborate on interventionist SSP of Building infrastructure

C. The govt can embark on building infrastructure especially for developing countries.

Examples: Expressways, Airport Terminals (5th Terminal), Ports (Relocation of Tanjong Pagar Port Terminal to Tuas), MRT (Cross-Island line)

Building Infrastructure leads to an increase in government expenditure. AD rises. This leads to a multiplied increase in real GDP. Actual growth rises in the SR. Infrastructure increases the capital accumulation in the economy. Productive capacity increases. With an excellent transport network system in Singapore, movement of people and goods are faster. With 4 airport terminals, it makes Singapore more accessible and interconnected, so productivity rises, LRAS rises. Potential growth occurs in the LR. Domestic production increases, more jobs are created. Demand for labour increases because demand for labour is a derived demand. More workers are employed. Thus, reducing cyclical unemployment. An excellent infrastructure network that connects Singapore to the rest of the world makes it easier for Singapore firms to export goods, improving the surplus in Singapore’s current account balance. It also makes Singapore attractive as a destination for foreign direct investments. Long term capital inflow increases. This reduces the deficit in Singapore’s capital and financial account. The rise in capital stock and in productive capacity increases the LRAS. When the increase in AD, arising from the increase in government expenditure (G) on building infrastructure, is matched by an increase in LRAS. This helps to mitigate inflationary pressures and reduce cost-push inflation. Non-inflationary growth (sustained EG) is achieved.

(the part that’s crossed out, because its on UE but this section of notes is on EG)

Evaluation:

However, building infrastructure in Singapore is limited by availability of land. Moreover, construction of infrastructure can result in environmental externalities which leads to a lack of sustainable growth.

Elaborate on interventionist SSP of the govt can encourage small business start ups / entrepreneurship.

D. The govt can encourage small business start ups / entrepreneurship.

This can be done through the extension of loans and provision of technical expertise and support for new start-ups and small businesses. Governments may also choose to remove bureaucratic red tape to increase the ease of doing business. The entry of such innovative new firms inject more competition into the industry. Furthermore, start-ups often bring with them new technology and new methods of production which increase productivity (thus reducing per unit costs), raising SRAS and actual growth. As GPL falls, cost push inflation is reduced. Moreover, this boosts the productive capacity of the economy so LRAS rises, leading to potential growth.

In Singapore, the government helps SME through statutory border and trade associations and chambers (TAC) examples of Statutory board include SPRING, IE Singapore and IDA, while trade association includes the Singapore Manufacturing Federation (SMF), specifically SPRING offers tax incentives and grants for productivity improvement expenses, for example, the productivity and innovation credit scheme. Local banks also offer loans at attractive interest rates under the Local Enterprise Financing Scheme. As more SMEs invest and expand their business, the capital accumulation in Singapore increases, productive capacity increases, LRAS increases, leading to higher potential growth in the long run. The rise in I also increases AD which leads to actual growth.

OR

An example would be the Productivity Solutions Grant in Singapore’s 2022 Budget where firms are given grants to implement digital and automation solutions to raise productivity. The Grow Digital initiative (part of the same budget) also provided 70% co-funding to onboard cross-border digital platforms.

Another example would be the enhanced Enterprise Grow Package in 2020, aiming to help enterprises grow and create jobs, through provision more aid to enter new markets, innovate and adopt digital solutions through a new, multi-platform package. As more SMEs invest and expand their business, the capital accumulation in Singapore increases, productive capacity increases, LRAS increases, leading to higher potential growth in the long run. The rise in I also increases AD which leads to actual growth.

Evaluation:

However, despite the fiscal boost in terms of government subsidies and grants available to new start-ups in Singapore, the high expense and effort of starting a business, the high risk involved and the high number of failures often deter potential entrepreneurs from taking the plunge. An average of 30% of Singaporean start-ups fail within the first 3 years.

Elaborate on interventionist SSP of Nationalisation

Nationalisation refers to the government taking over strategic industries like the transport and telecommunications industries into public ownership. Through nationalisation, having certain key industries under public ownership may result in higher investment than if they were under private ownership. This could be because governments’ greater financial abilities relative to a poorly performing private company, or because of better coordination within the industry and greater internal economies of scale reaped as a result of nationalisation. The higher investment results in increased productive capacity, causing a rightward shift of the AS curve, leading to potential growth.

In Singapore, public utilities and port operations are nationalised industries controlled by the Public Utilities Board (PUB) and the Port of Singapore Authority (PSA) respectively. The PUB was nationalised due to the various levels of coordination required in the collection, production, distribution and reclamation of water in Singapore. There are also significant internal economies of scale to be reaped in both industries, as their operations involve large and indivisible machinery and equipment that are more efficiently used when larger outputs are produced. Cost of production falls, SRAS rises, leading to actual growth. As GPL falls, cost push inflation is reduced.

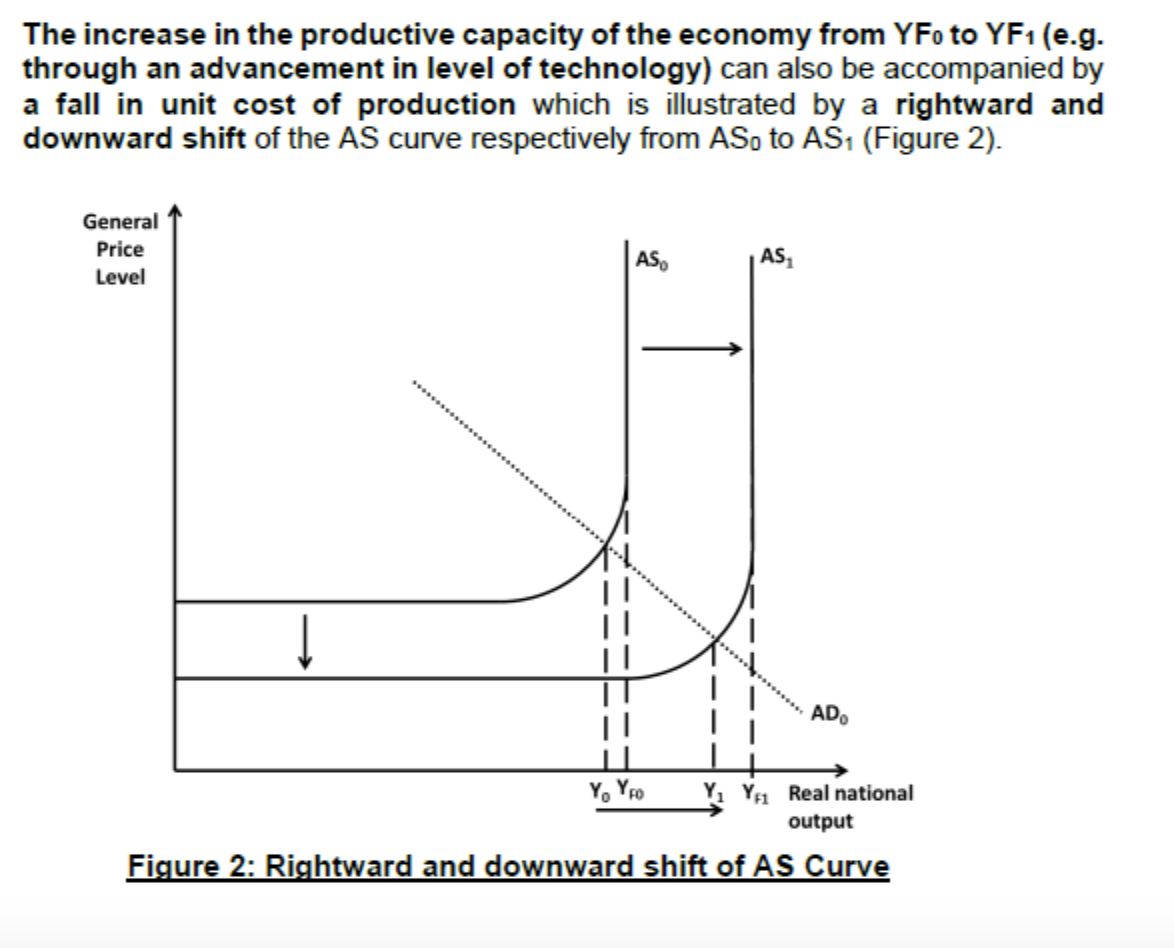

(diagram is AS shifting out only)

Evaluation:

However, there is an opportunity cost of spending tax revenue on the nationalised industry. Furthermore, inefficiencies may arise from government ownership as there is a lack of incentive to reduce costs and diseconomies of scale that arise from overstaffing.

Elaborate on market oriented supply side policy for product markets on privatisation.

Privatisation

Privatisation is defined as the sale, in whole or in part, of public enterprises to the private sector. Thus, it involves the transfer of state-owned assets from the public sector to the private sector. Supporters of privatisation believe that the private sector and the discipline of free market forces are a better incentive for businesses to be run efficiently and thereby achieve improvements in economic welfare. Privatisation is regarded as an important supply-side policy designed to drive competition and reduce X-inefficiency while improving dynamic efficiency. This is because private companies have a profit incentive to be more efficient.

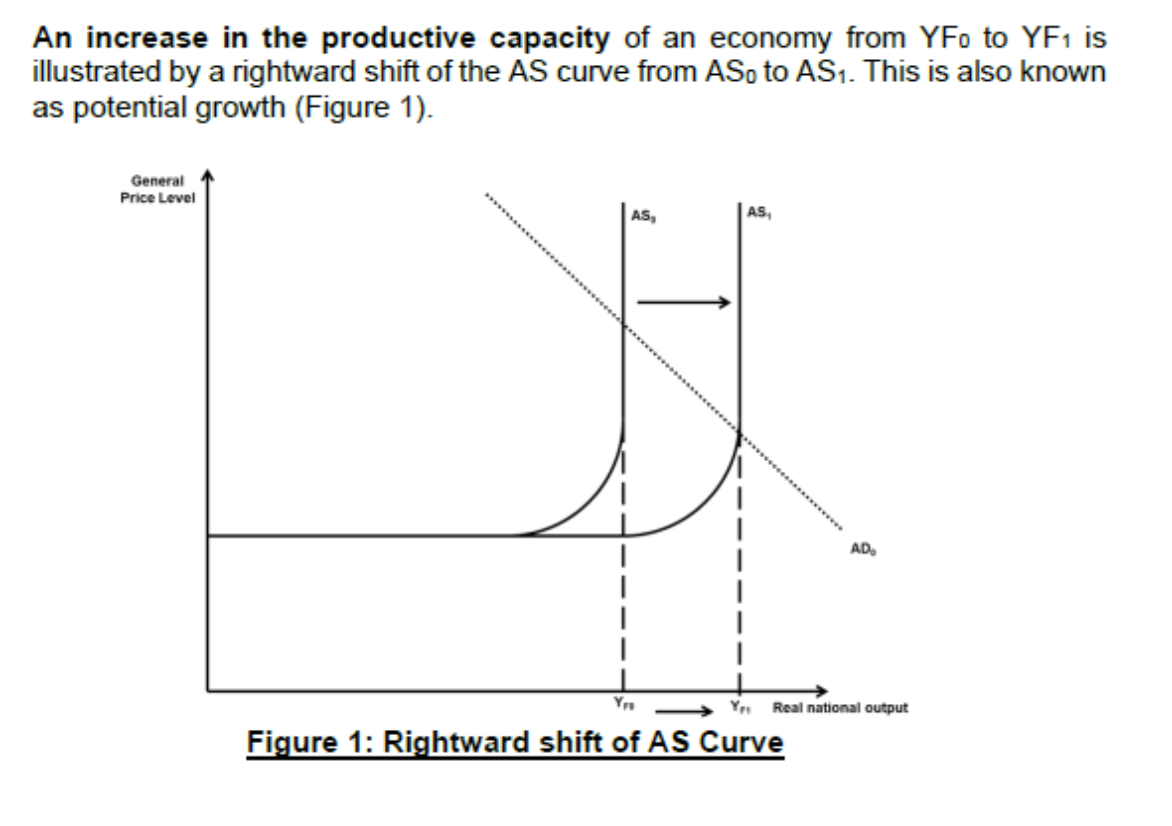

With private ownership of resources and without government funding, the firm must survive on its own while subjected to competitive pressures. This gives the firm the incentive to be less X-inefficient by cutting costs in order to be profitable and survive the competition. As a result, the unit cost of production falls and there is a downward shift of the SRAS curve. Actual growth increases. GPL falls, cost push inflation reduces. The profit-maximising firm will also have greater incentive and ability to be dynamically efficient by innovating to develop new or better products and finding better ways of producing goods and services. For instance, innovation and investment in new machines and technology may enable an increase in labour productivity (meaning an increase in output per worker in a given time period) which can cause the LRAS curve to shift to the right. Productive capacity rises leading to potential growth. Hence privatisation can lead to a rightward and downward shift of the AS curve from AS0 to AS1 (Figure 2).

Over the last 30 years, many former state-owned businesses have been privatised across many countries. In the UK, the process has led to a sizeable reduction in the size of the public sector. State-owned enterprises now contribute less than 2% of GDP and less than 1.5% of total employment.12 In Singapore, Singapore Telecommunications (Singtel) was privatised in 1992, while the Singapore Mass Rapid Transit Corporation became private in 1998. In both cases, the rationale was for more efficient operations by the private sector.

Evaluation:

However, some may argue that the transfer of ownership merely replaced a public sector monopoly with a private sector monopoly that then required regulation. Moreover, there have been instances of state assets that were sold off by the government and that the consequences of privatisation have been a decrease in investment and large-scale reductions in employment as privatised businesses have sought to cut their operating costs.

However, competition in some sectors must be weighed against the benefits of economics of scale. With competition, output of each firms become smaller, reduces ability of firms to reap economies of scale and pass cost savings to consumers in the form of lower prices. Widens income disparity, as the lower income people are unable to afford the increased prices of taking public transport, as privatized firms tend to profit maximize, without care for the local populace, i.e. the lower income group.

Elaborate on market oriented supply side policy for product markets on deregulation/liberalisation.

b. Deregulation / Liberalisation refers to the opening up of markets to greater competition. Removing barriers to entry to new firms through lifting existing legal restrictions to entry such as patents for certain regulated industries induces incumbent firms to become more efficient to survive the competition arising from newer and more innovative firms entering the industry. This could lead to a downward and rightward shift of the AS curve. As a result, the unit cost of production falls and there is a downward shift of the SRAS curve. Actual growth increases. GPL falls, cost push inflation reduces. This may enable an increase in labour productivity (meaning an increase in output per worker in a given time period) which can cause the LRAS curve to shift to the right. Productive capacity rises leading to potential growth. Liberalisation of markets also encourages greater levels of entrepreneurship, potentially enabling productive capacity to expand. This leads to potential growth.

Examples in Singapore include the deregulation of the telecommunications industry in 2000, which terminated Singtel’s monopoly on the domestic market, and allowed other telcos to operate. The Energy Market Authority has progressively opened the retail electricity market to competition, greatly reducing the monopoly power of the Singapore Power (SP) Group. Since 1 April 2018, the launch of the Open Electricity Market has enabled households and businesses to exercise their choice in buying electricity from a retailer at a price plan that best meets their needs.

Evaluation:

However, competition in some sectors must be weighed against the benefits of economics of scale. With competition, output of each firm becomes smaller, reduces ability of firms to reap economies of scale and pass cost savings to consumers in the form of lower prices. Widens income disparity, as the lower income people are unable to afford the increased prices of taking public transport, as privatized firms tend to profit maximize, without care for the local populace, i.e. the lower income group.

Summary of privatisation and deregulation:

Summary of privatisation and deregulation:

In the short run, markets are made more competitive, thus spur firms to be more dynamic efficient, i.e. searching for innovative ways to engage in extensive cost controls. The reduction in costs increases SRAS, supporting actual economic growth and price stability in Singapore. In the long run, there will be more new firms entering deregulated markets, aiding in a rise in private investments. These investments would play a role in capital stock accumulation or further improving quality of resources, translating to an increase in LRAS, creating potential growth. It will also increase AD through an increase in investments.

(General effects of): Privatization and deregulation attracts higher investment and makes exports more competitive, thereby raising export revenue.

- AD increases, leads to actual growth and reduced cyclical unemployment.

- The increase increases productive capacity and hence potential growth in the long run.

- Increase in long-term capital inflow improves the capital and financial account, and the rise in export revenue improves the current account balance, hence BOP position improves.

Elaborate on market oriented supply side policy for product markets on free trade.

Engage in free trade (will cover in globalisation) KIV

Elaborate on Market-oriented supply-side Policies for labour markets of labour market reforms on:

Reducing the power of trade unions

Overly aggressive trade unions are a barrier to the free working of a labour market as these unions tend to push the wage above the market equilibrium, and, in the 70s especially, were quite disruptive in terms of going on strike.

By reducing the ability of trade unions to unilaterally raise wages, firms now face lowered labour costs and thus their profits will probably rise. If the monopoly power of labour is reduced, the extent of wage-push inflation will also be reduced because wages rise in tandem with rise in productivity. This could encourage and enable more investment and hence increase the productive capacity of the economy (Figure 2). LRAS rises leading to potential growth. Moreover, as investment rises AD rises, leading to actual growth.

At the same time, imposing restrictions on their ability to take industrial action helps to reduce / eliminate the incidence of work stoppages or industrial strikes so that loss of output due to strikes is prevented. Overall, this increases efficiency of firms as less time is lost to strikes. Cost of production falls, SRAS rises. Actual growth rises. As GPL falls, cost push inflation reduces.

Improved partnerships between trade unions and employers can make a big contribution to raising productivity and improving the flexibility of workers in their jobs. In Singapore, the tripartite policy ensures harmonious industrial relation between the employers (represented by the Singapore Employers Federation), the workers (represented by NTUC) and the government (represented by the Ministry of Manpower). Representatives from all 3 parties sit on the National Wage Council (NWC).

Tripartism:

Tripartism in Singapore refers to the collaboration among unions, employers and the Government. The tripartite partners are the Ministry of Manpower (MOM), the National Trades Union Congress (NTUC) and Singapore National Employers Federation (SNEF). This model differs from other countries – where the unions in Singapore have a close partnership with the government, instead of an adversarial relationship.

The key tripartite issues include:

Job re-creation

Raising the effective retirement age

Training and upgrading the workforce

Fair and progressive employment practices

A flexible wage system

Elaborate on Market-oriented supply-side Policies for labour markets of labour market reforms on:

Cuts in Welfare benefits

Cuts in welfare benefits

The existence of a wide variety of income redistribution programmes has eroded the incentives to work in welfare states. Overly comprehensive unemployment compensation or benefits and welfare programmes reduce the incentive of unemployed labour to re-join the workforce and become economically active again. Thus, cutting such programmes may in fact stimulate some of the unemployed to find a job, thereby increasing the willingness of these people to work and accept jobs at lower wages. This increases the effective labour supply, thereby causing a rightward shift of the AS curve (Figure 1).

However, cutting benefits is a very dramatic solution which may not be well-received by the populous. Maintaining an appropriate level of social welfare spending is important in helping the economically disadvantaged and building social cohesion. This is all the more important in light of the widening income inequality experienced by countries all over the world14. In Singapore, the government has been trying to ensure that there exists a social safety net so that those who are disadvantaged will not be left behind.

Elaborate on Market-oriented supply-side Policies for labour markets of labour market reforms on:

Imposition / Removal of minimum wage

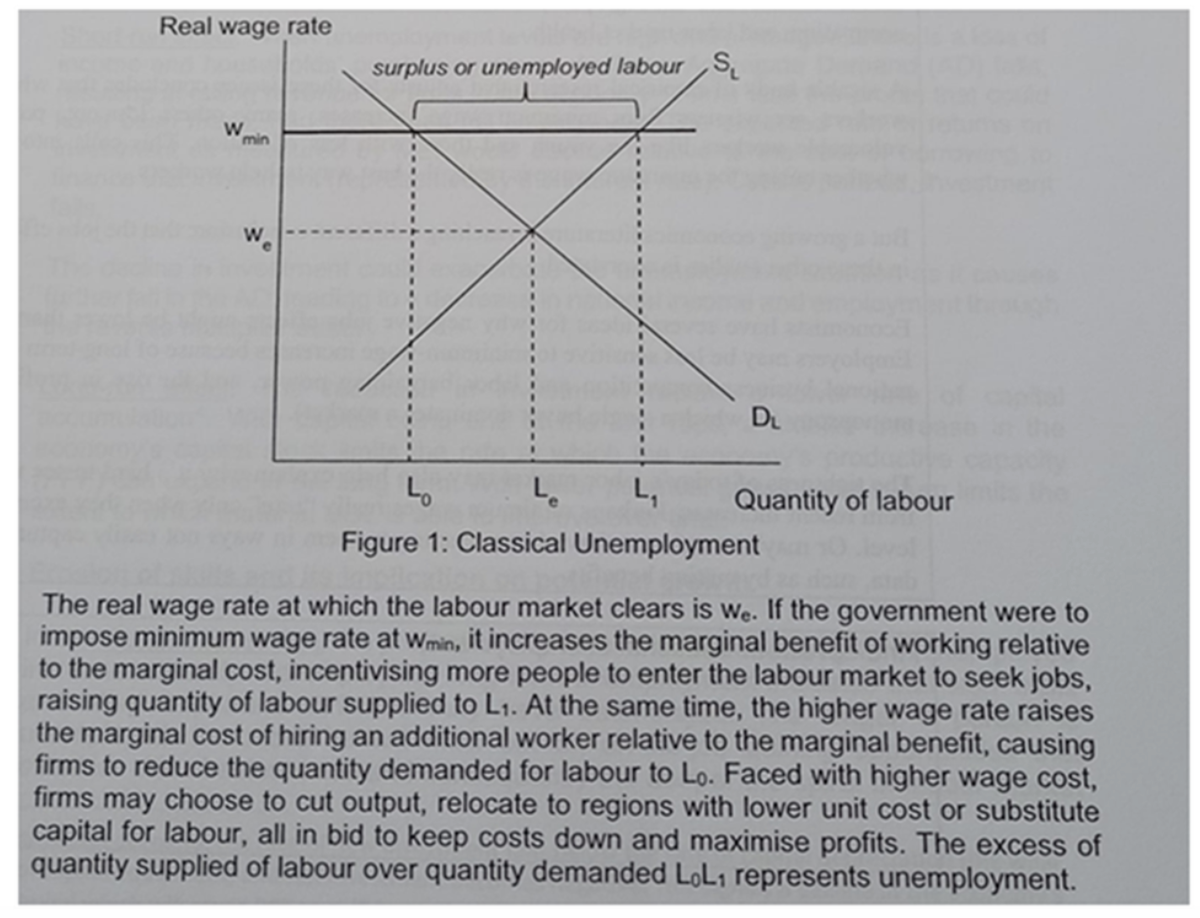

Imposition / Removal of minimum wage

(economic growth and unemployment are very related)

To raise economic growth, remove minimum wage.

Minimum wage is imposed at Wmin. When the minimum wage is removed, real wage rate falls to We. This reduces the marginal benefit of working relative to the marginal cost. Less people are incentivised to enter the labour market to seek jobs, reducing the quantity of labour supplied to L3. At the same time, the lower wage rate reduces the marginal cost of hiring an additional worker, relative to the marginal benefit, causing firms to increase the quantity demanded for labour to Le. Faced with a lower wage cost, firms will increase output to maximise profits. The labour market reaches an equilibrium at We, with Le quantity of labour. It also eradicates real wage unemployment, previously shown as L0L1.

As a result of a fall in wage rate, cost of production falls. SRAS rises, leading to actual growth. As GPL falls, cost push inflation is reduced.

Strengths:

Proponents argue that removing minimum wage limitations could lead to increased job opportunities, particularly for entry-level and low-skilled workers, as businesses might be more willing to hire if labor costs are lower.

Businesses could potentially lower costs, leading to increased competitiveness and potentially lower prices for consumers

Businesses could be more flexible in adapting to changing market conditions and could choose to hire more part-time or seasonal workers.

{DIAGRAM}

Limitations:

Low wage/low-skill workers experience lower income, so they are able to buy and consume less goods and services. This reduces the material standard of living. Removal of minimum wage exacerbates wage inequality, as the gap between the high skilled and low skilled workers widen. Lower wages could lead to decreased worker morale and productivity.

Some argue that removing minimum wage limitations could lead to job losses for some workers if businesses choose to automate or replace them with lower-cost labor.

Elaborate on Market-oriented supply-side Policies for labour markets of labour market reforms on:

Incomes policy

Incomes Policy

The National Wages Council (NWC) was formed in 1972, in response to rising wage expectations during a rapid period of industrialisation in Singapore. The government was concerned that rising wage expectations could cause industrial disputes, which could lower business confidence and investment, that in turn could adversely affect our economic growth. Hence, the NWC was mandated with formulating wage guidelines to be in-line with long-term economic growth. It is useful to note that the NWC is a tripartite body comprising representatives from the employers, the trade unions, as well as the government. It meets every year to derive at a national consensus on wage and wage-related matters, and issues guidelines on them.

The basic wage guidepost is that wage rates in all industries should be flexible, i.e. rise in accordance with the rate of increase in labour productivity in different industries. Wages are allowed to rise but should lag behind or at best, keep pace with the rate of productivity growth. This is to ensure that increase in unit labour cost is not higher than increase in labour productivity. This prevents AS from falling due to rising cost of production.

In recommending wage adjustments for the year, the NWC takes into consideration factors like productivity growth, employment situation, international competitiveness, and economic growth and prospects. A guiding principle established and observed by the NWC is that real wage increases should be in line with productivity growth over the long term. This is so that wage increases are closely linked to the performance of the economy, as well as that of the company and individuals. An overall flexible wage system also allows companies to adjust wage costs more responsively to changing business conditions, so as to remain competitive in the global market.

In Singapore, the NWC was designed to bring wage increases in line with national productivity growth. The NWC improved the flexibility of the labour market as it was willing to accept various wage recommendations that have helped the economy to get out of the recessions of 1985, 2001 and 2003. Voluntary wage restraints such as the 2-year wage freeze for civil servants and the reduction in employers’ CPF contribution rate from 25% to 20% were used during the 1985–86 recession.

The wage structure in Singapore has variable components that allow for flexibility of wages. The Annual Wage Supplement (“13th month payment”) and bonuses allow for firms to vary the annual wages of employees. In 1999, the Monthly Variable Component (MVC) was also introduced to allow wages to vary from month to month.

Hence, government intervenes through limiting the extent to which wages can rise in the labour market. This can be achieved through legislating a wage freeze, wage reduction, or imposing limits on how fast wages can rise. These serve to mitigate the fall in SRAS, thus alleviating cost-push inflation. At the same time, with rising SRAS, actual growth rises.

Evaluation:

However, wage guides are voluntary while variable wage components are negotiable. Voluntary wage guides face the issue of non-compliance, especially since trade union leaders would have to abandon their primary objective of negotiating for higher labour wages. Thus, voluntary cooperation from trade unions may be limited. For policies such as flexible wages and wage freeze to work, workers themselves much be convinced of the necessity of such policies and accept them in view of the long-term benefits, even at short term cost. The employers must also show willingness to reinstate or increase wages in times of economic growth or improved company performance. Clear communication and cooperation among the government, employers and trade unions are essential. Singapore is one of few countries in which the above policies have been fairly successful, again due to the tripartite partnerships led by the NWC.

Advantages and Limitations of incomes policy to address cost-push inflation

a. Side effects

• Wage controls also distort market mechanism in the labour market, such that firms are unable to attract certain types of labour they want through higher wages.

• Freezing wages distort market forces in the labour market and results in a shortage of labour (quantity demanded exceeds quantity supplied if wages are kept below the market equilibrium wage). Expanding sectors will find it difficult to attract labour while contracting sectors will hang on to labour for too long. Hence, this will result in inefficiency in resource allocation.

• Moreover, the policy is unlikely to be effective once the labour market is deregulated (i.e., government stops intervening), since wages will revert to their initial levels.

b. Feasibility

Wage controls may not be feasible due to lack of political acceptability. This is especially so if the policy involves wage freeze and wage reduction. They can lead to government’s conflict with labour unions whose aim are to protect their workers’ rights, and in extreme cases lead to strikes, erode investors’ confidence and create adverse impacts on the economy.

Elaborate on Market-oriented supply-side Policies for labour markets of labour market reforms on:

Wage subsidies

Wage subsidies can be defined as any transfer from the government that is able to reduce the cost of labor and/or increase take-home pay. In the market for labour, a wage subsidy increases the demand for labour which causes the wage received by workers to increase. Although the wage paid by firms fall, the workers receive a higher wage because of the wage subsidy given by the government.

One of the main reasons for providing wage subsidies include giving job opportunities to workers who would otherwise be unemployed. In the absence of wage subsidies, these workers might face long spells of inactivity or unemployment that reduce their human capital, or take on jobs that will not realize their potential productivity. Wage subsidies, in this case, have the potential to increase workers’ employability through “learning by doing” and by training opportunities associated with having a job. Workers could acquire both “hard” (occupational) skills and “soft” skills, such as motivation and appropriate workplace behavior. These dynamic effects could make a temporary subsidy have a permanent effect on workers’ productivity and through this channel the structure of employment and the unemployment rate. (Reduces cyclical unemployment)

To safeguard the livelihoods of local workers amidst the economic disruptions caused by COVID-19, the Singapore government implemented the Jobs Support Scheme (JSS). Under the scheme, wage subsidies were provided to help reduce business costs and to help viable companies tide over the crisis and minimise unemployment. Recently announced at Budget 2020, the Jobs Support Scheme (JSS)16 will help enterprises retain their local employees during this period of uncertainty. Employers will receive an 8% cash grant on the gross monthly wages of each local employee for the months of October 2019 to December 2019, subject to a monthly wage cap of $3,600 per employee. During the 2008-2009 Financial Crisis, the government launched a similar programme called the Jobs Credit Scheme which provided businesses with a cash grant. This helped to defray labour costs and encouraged businesses to retain their workers instead of laying them off in the downturn. This helps to moderate increases in the unemployment rate during severe economic recessions. (Reduces cyclical unemployment)

Elaborate on Market-oriented supply-side Policies of tax reforms

C. Tax reforms (cannot write in the expansionary fiscal policy way, which emphasised on AD. must emphasise on AS)

Tax cuts

(i) Effects on labour supply

Besides increasing aggregate demand, reducing personal income tax has the supply-side effect of encouraging workers to work and save. This is based on the belief that high tax rates are disincentives to hard work and induce people to work less. A cut in marginal tax rates increases the attractiveness of work and simultaneously increases the opportunity cost of leisure. Hence, individuals will substitute work for leisure. This may lead to people working longer hours, an increase in the number of workers entering the workforce, a greater incentive to be more productive in their work, a rise in employment (assuming wages are flexible) and a rise in productive capacity, leading to a rise in aggregate supply (Figure 1).

(ii) Effects on capital accumulation

Lower corporate tax provides an incentive for entrepreneurs to increase investment. If gross investment is greater than replacement investment, net investment will be positive which will increase the capital stock in the economy. As a result, productive capacity can increase. In addition, with greater accumulation of machineries, there will be an improvement in the capital-labour ratio. As a result of capital deepening, labour will become more productive, meaning output per worker increases, hence productive capacity increases as reflected by a rightward shift of the AS curve. (Figure 1)

Hence, with the acquisition of more fixed capital assets, the ability of the economy to produce goods and services in the future will increase. As such, it will allow the AD to increase continuously without fueling rising GPL. Hence, the economy can enjoy sustained economic growth as a result of both actual and potential economic growth when the productive capacity expands. The potential economic growth is reflected by the increase in the full employment level of national income in the economy when the productive capacity expands.

For example, Singapore reduced corporate tax in 2010 to 17%, making it cheaper to invest in Singapore. The government encourage foreign firms for example, MNCs, to relocate their design and research and development centres to Singapore. Lower personal income tax also help to attract foreign talent and prevents brain drain. With globalisation, such tax reforms are deemed necessary to attract human capital with talent and expertise, as well as investments. This tends to shift away from countries with tax burdens. This increases the productive capacity of the economy, and productivity also rises. LRAS rises, resulting in potential growth in the LR. Moreover, the rise in investment creates jobs. This reduces cyclical unemployment. With lower corporate tax, FDI increases, long-term capital inflow increases. Capital and financial account improves. When firms increase their production, they are able to export more price competitive goods to other countries. PED of exports >1, a fall in price leads to a more than proportionate rise in quantity demanded of exports. Export revenue of a country rises. Net exports rise and this improves the current account. Overall, BOP increases. With the rise of I + X-M, AD rises. This leads to a multiplied increase in real national income. Actual growth increases in the short run.

Evaluation:

However, having a low tax rate as well as a range of tax and financial incentives alone are not sufficient to encourage foreign direct investment to raise a country’s productive capacity. ‘Tax incentive wars’13 between countries may arise as they compete fiercely for foreign investment and talent. Thus, other factors such as political stability and having a conducive business environment (transparency in government regulations, ease and availability of credit, protection of intellectual property rights etc.) are just as critical, if not more so. In addition, despite the cuts in marginal rates of income tax in many countries, it has been commonplace for these to be offset by significant increases in other taxes.

Lower tax revenue collected by the government. This is bad for Singapore, especially since we have an aging population, which necessitates higher expenditure, example, healthcare. To broaden the tax base, the government raises the GST. However, GST makes the poor worse off. Thus, there is an income disparity. Furthermore, as more foreign talents arrive in Singapore there may be social tensions as the locals may feel that these foreigners are stealing their jobs.

(can be used for conclusion) However, having a low tax rate as well as a range of tax and financial incentives alone are not sufficient to encourage foreign direct investment to raise a country’s productive capacity. ‘Tax incentive wars’ between countries may arise as they compete fiercely for foreign investment and talent. Thus, other factors such as political stability and having a conducive business environment (transparency in government regulations, ease and availability of credit, protection of intellectual property rights etc.) are just as critical, if not more so. In addition, despite the cuts in marginal rates of income tax in many countries, it has been commonplace for these to be offset by significant increases in other taxes.