Economics 1.5

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

31 Terms

Examples of goods not (completely!) distributed by the free market mechanism in the UK…

Education (places at schools)

Guns

Public transport (busses, trains, cars)

Illegal drugs

Healthcare, treatment for illness/disease

Roads

National security

Market Failure

Market failure occurs when the free market mechanism fails to allocate resources efficiently.

Efficiently meaning in the context of market failure

For resources to be allocated ‘efficiently’ would mean that everyone’s welfare is maximised - everyone is as well off as they can be.

What are externalities

production or consumption of a good may actually impact other people - not just those buying or selling the good

Why might the free market fail

The free market acknowledges private benefits to consumers and costs to firms, and bases prices on these. External costs and benefits to third parties are ignored. This can lead to market failure!

External costs

- costs which impact third parties

External benefits

- gains which impact third parties.

Private costs

- the costs paid by a supplier of a good/service

Private benefit

a buyer’s gains from consumption of a good/service.

Social cost

the total cost to individuals and third parties associated with supply of a good

Social benefit

-the total benefit to consumers and third parties associated with supply of a good.

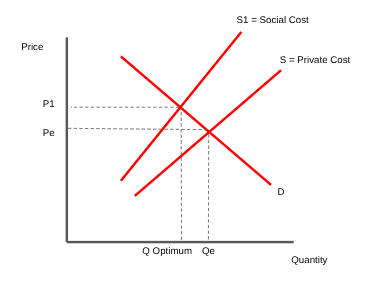

How does a good with a high social cost look

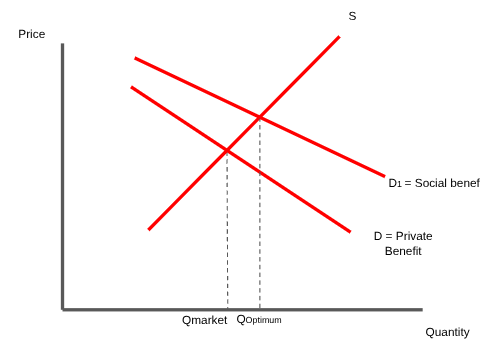

How does a graph with a high social benefit look

How do we draw externalities on the demand and supply graph

we always reflect costs in the supply curve and benefits in the demand curve

Advantages of the free market

greater efficiency, driven by competition and the profit motive; increased consumer choice as businesses create goods and services to meet demand; higher innovation as firms compete to develop new and better products; and potential for economic growth as resources are allocated efficiently and investment is encouraged

Disadvantages of the free market

wealth inequality,market failure

Whats government provision

when a government directly provides goods and services, often to correct market failures like under-provision of public goods and merit goods

what are merit goods

goods and services that are under-consumed in a free market, despite being beneficial for individuals and society

What are public goods

a commodity or service that is provided without profit to all members of a society, either by the government or by a private individual or organization

Why are private goods, goods which cant be sold by a private firm

they are non-excludable-cant be bought without others benefiting

non rivalrous-it cant be used up by an individual consumer

Types of government intervention

Legislation

Regulation

Indirect taxation

Grants & subsidies

Tax breaks

voluntary agreements

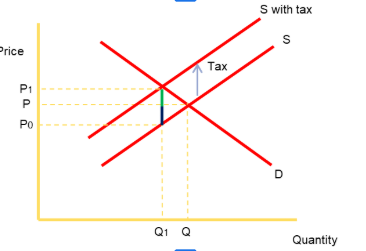

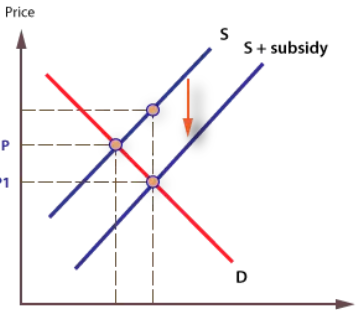

How do taxes and subsidies affect graphs

taxes-shift left in the supply curve

subsidies-shift right in the suply curve

Graph of indirect taxes

Graph of subsidies

How does direct provision work +disadvantages

the government provides as much of the good as people need and sets a fair price or provides it for free, funded by taxation.

Government management can be less efficient due to lack of profit incentive

Funding from taxation mean it is difficult to provide enough of a service without raising taxes which people dislike

How does Bans work +disadvantages

Prevents harmful products reaching consumers

Some may argue that the government shouldn’t be able to decide if people want to consume harmful goods

How does regulation work +disadvantages

Government sets rules or targets that businesses must comply with

unnecessarily restrictive and compromise personal freedom

Complying with regulation may increase legal or production costs for firms, which they will pass onto consumers leading to higher prices.

How do indirect taxes work +disadvantages

Prices are increased which is tantamount to an additional ‘cost’ for suppliers

Some taxes may punish certain groups unfairly

High taxes could lead to an increase in illegal imports and black market activity

Voters may dislike high taxes and punish governments who introduce them, making it harder for governments to place taxes on certain goods

How do subsidies work +disadvantages

Reduces effective costs of production for firms and shifts supply curve downwards, leading to lower prices and high quantities produced

Subsidies may be difficult to sustain in long run and firms may not be able to keep up production when subsidy is removed

Can encourage firms to become less efficient as they have less reason to reduce costs since government is giving them money to cover a portion of their costs

How do voluntary agreements work +disadvantages

Encourages firms to sign up to rules they are able to keep and monitor themselves,

Firms may set the bar low for quality or word agreements vaguely to avoid firm commitments

Reason for government failure and examples

Government failure occurs when a public sector activity or government intervention, intended to correct a market failure, makes the situation worse instead.

High administrative costs

The law of unintended consequences

Information gaps

Distorting market signals