Theme 2

1/57

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

58 Terms

What is working capital?

The capital used by a business in it's day-to-day operations --> calculated as current assets - current liabilities

What does limited liability mean?

Business owners are only responsible for the debts up to their initial investment

What does unlimited liability mean?

Finances of the business are treated inseparable from the owner's finances. If the business goes into debt the owner needs to sell their own personal assets

Name 3 sources of external finance

Bank loans

Share capital

Venture capital

Government grants

Overdrafts

Name 3 sources of internal finance

Retained profit

Selling assets

Owner's capital

What is a monthly balance?

Cash inflow for a month - cash outflow

What are the advantages and disadvantages of cash flow forecasts?

Advantages:

Improves financial planning

Ensures liquidity (cash in the business)

Ensures budget control

Disadvantages:

Based on estimates (overoptimistic)

Unpredictable for external factors

What are fixed costs? Give examples

Any costs that do not vary directly with the level of output e.g. rent, salaries, insurance

What are variable costs? Give examples

Costs that directly vary due to the level of output e.g. raw materials, fuel, wages

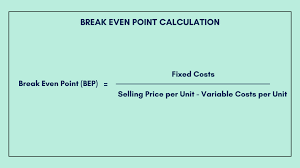

What is a break even point?

The level of output when revenue equals total costs

What is a budget?

A target set for costs or revenue in a given time - income budgets set a minimum target, expenditure budgets set a maximum costs

What is the formula for break even points?

Explain the types of budgeting

Historical budget - based on historical data

Zero-based budget - budget set on zero and each cost is justified and added to total (very time consuming)

What is variance in budgeting?

The amount the actual result differs from the budgeted figure

How are positive and negative variances referred to as?

Favourable and adverse

What are the reasons for using a budget?

Controlling finance

Spending power delegated to managers

Motivate staff

What are the factors affecting sales forecasts?

Consumer trends

Economic variables

Actions of competitors

What required document do plcs have to publish containing annual profits?

Statement of comprehensive income

What are the 3 types of profit and how do you calculate each?

Gross profit = revenue - costs of sales

Operating profit = gross profit - fixed costs

Net profit = operating profit - taxing and financing

What is liquidity?

The ability of a firm to find the cash to pay bills

What does the statement of financial position contain?

Company's assets and liabilites at the end of the year

What are the 2 types of calculating liquidity, how do you calculate each?

Current ratio = current assets/current liabilities

Acid test ratio = (current assets - stock)/current liabilities

How can you improve liquidity?

Selling under used assets

Raising more share capital

Increasing long term borrowing

What are some internal causes of business failure?

Marketing failure (low market share and no new products)

Poor management of cash flow

Systems failure (IT)

What are some external causes of business failure?

Changes in technology

New competitor

Economic change

Bank’s behaviour

What does production and productivity measure?

Production = quantity of output

Productivity = efficiency --> dividing output by time period

Describe the different methods of production

Job production - producing a one off product for a one time customer

Batch production - producing a set number of identical items

Flow production - continuous production of a single item

Cell production - small group processes so that items can be made flexibly

What is labour-intensive production?

Labour costs are highest percentage of total costs

Low financial barriers to entry

Highly flexible

What is capital-intensive production?

Large percentage of total costs is machinery costs

High financial barriers to entry

Inflexible

What is capacity utilisation?

A measure of a firm's current output level as a percentage of their maximum output level.

What is the consequence of under-utilisation of capacity?

Fixed costs are spread over the fewer products outputted.

What is the consequence of over-utilisation of capacity?

You cannot fulfil orders if demand increases

Struggle to train staff/service machinery

What are 2 ways to improve capacity utilisation?

Increase demand

Cut capacity

What is the objective of stock control?

Minimising the costs of holding stock

What are the different stock levels?

Maximum stock level - largest amount of stock a firm can hold

Reorder level - when stock falls to this level new stock is ordered

Minimum stock level (buffer stock) - minimum stock in case supply chain is affected

What are the consequences of poor stock control?

Cash flow problems

Higher storage costs

Increased wastage of stock

What is JIT production?

Ensures that inputs are only added to the production process when needed.

Reduces waste and storage costs

Inflation

The rate at which the general prices of goods and services rises, reducing the purchasing power of money

Effects of inflation on businesses

Reduces profitability as costs increase

Higher repayments on loans

Reduced consumer demand

Uncertainty

Exchange rates

Value at which one currency can be exchanged for another

Appreciation

When the value of a currency rises and strengthens

Depreciation

When the value of a currency decreases and weakens

SPICED

Stronger

Pound

Imports

Cheaper

Exports

Dearer

WPIDEC

Weaker

Pound

Imports

Dearer

Exports

Cheaper

Interest rates

The cost of borrowing money or the return on savings

Effects of high interest rates

Encourage savings

Reduced borrowing

Lower disposable income

Effects of low interest rates

Encourage borrowing

Reduced savings

Increased disposable income

Taxation

Money collected by the government from businesses and individuals to fund public services and infrastructure

Gross domestic product (GDP)

Total value of all goods and services produced in a country in a specific time period

Stages of the business cycle

Boom - highest levels of consumer spending and low unemployment

Recession - economy declines

Trough - low consumer spending and high unemployment

Recovery - economy begins to grow again

Types of business legislation

Consumer protection

Employee protection

Environmental protection

Competition policy

Health and safety

Impact of consumer protection legislation

Increases costs (compliance)

Improves quality

Improves customer satisfaction/reputation

Impact of employee protection legislation

Increased costs (e.g. minimum wage)

Penalties for non-compliance

Improved motivation among staff

Impact of competition policies

Prevents monopolies (dominating markets)

Reduces barriers to entry

More competitive pricing for smaller firms

Impact of health and safety regulations

Increased costs

Potential fines/penalties

Safe environment —> motivation (Maslow)

Margin of safety formula

Lean production

Manufacturing approach maximising efficiency and minimising waste

Kaizen

A continious improvement approach where small, ongoing changes are made to improve the efficiency and quality of the process