Unit 3 personal and business finance

1/395

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

396 Terms

internal finances

internal sources of finance are those available from within a business. these include:

Sale of assets

selling an item worth owned by a business in order to achieve an immediate cash injection.

Retained profit

this is the profit kept in the company rather than being paid out by shareholders as a dividend sales revenue - total cots

Net current assets

current assets - current liabilities shows the money available in the business to fund day-to-day expenditure

Mortgages

is a legal agreement that is made by you and the bank/building society to lend money at interest in order to buy a house

Owner's capital

is where the owner puts his/hers own money to invest into the business

Loans

is money that is borrowed, especially a sum of money that is expected to be paid.

Hire purchase

way a buying goods gradually. You make regular payment until you have paid the full price and the goods belong to you

Crowdfunding

practice funding a project or venture by raising money from a large number of people who contributes a relatively small amount

Debt factoring

This involves the selling of a business’s debt to a third party in order to receive cash quickly.

Peer to peer lending-

matches up people who are looking for to invest their money who want to borrowing it, paying higher interest to savers to savers and lower rates for borrowers. Find out how it works

Invoice discounting

a way for businesses to borrow money based on amount due for customers

Leasing

its a contract on paper that states that you own the property

Grants

is an amount of money given by the government to a person or organization for a special purpose

Straight line depreciation

Formula= asset purchase price-estimated salvage value/ Estimated useful life of an asset

Sstraight line deprecation is most commonly used due to…

its simplicity and consists of allocating depreciation evenly over the useful life of the asset

External sources of finances:

external sources of finance are those available from outside the business. this includes:

Advantage of sales of assets

A good way of raising funds from assets that are not needed any longer.

Disadvantage of Sales of assets

Not all businesses have surplus assets that they can sell. May be a slow method of raising funds as some assets may take time to sell.

Advantage of retained profits

Does not have to be repaid and has no interest payable.

disadvantage of retained profits

Not available to new businesses and many

advantage of net current assets

A quick way of raising money. Selling off inventory reduces the costs related to holding it.

disadvantage of net current assets

May have to accept a lower price for its inventory.

Gross profit =

GR

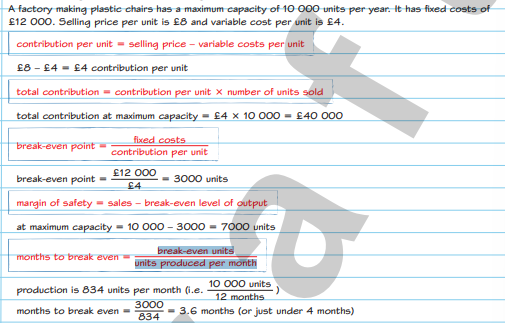

contribution per unit =

selling price – variable costs per unit

total contribution =

contribution per unit × number of units sold

break-even point =

fixed costs/contribution per unit

margin of safety =

sales – break-even level of output

months to break even =

break-even units/units produced per month

example of one

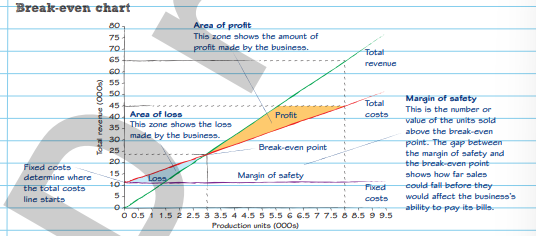

Break- Even chart

Area of profit

This zone shows the amount of profit made by the business

Margin of safety

This is the number or value of the units sold above the break-even point. The gap between the margin of safety and the break-even point shows how far sales could fall before they would affect the business’s ability to pay its bills.

Area of loss

This zone shows the loss made by the business

Fixed costs

Determine where the total costs line starts

Using Break-Even

Break-even is a valuable management tool used by businesses to plan, monitor, control and set targets. As part of break-even, contribution per unit has both limitations and benefits.

Planning

break-even helps the business to work out how many items it needs to sell over a certain period to cover its costs and to use this information to set a price that will enable it to make a profit

Monitoring

break-even alerts the business to potential problems, e.g. increased fixed or variable costs or a fall in sales, allowing it to take steps to fix them in good time

Control

break-even can be used to identify where costs are increasing, allowing the business to take action to control this.

Target -Setting

Break-even helps a business to set targets for sales, unit costs, contribution, and profit.

Contribution benefits

A business is able to see whether the products it produces actually cover its own variable costs.

This is used to set the price of the product in relation to direct production costs.

Contribution per unit may be very low, so the business will need to sell a large number to cover the fixed costs.

Contribution limitations

Contribution per unit on certain products may be extremely high.

In each case the contribution per unit is distorted and may not be valuable.

Variable costs

The variable costs relate to the additional costs incurred per unit

Total Costs

Total costs are the total of these two figures.

Total Revenue

is calculated by multiplying the number of units sold by the price the business received for them.

selling price

if the selling price is increased total revenue will be greater and rise more quickly. If it falls then total revenue will drop

Fixed costs

total costs will increase if fixed costs increase

Variable costs

these will affect the total costs line, shifting it up if unit costs increase and down if they fall.

Break-even may have to be recalculated when there is a change in…

Selling price, fixed costs, variable costs.

Stages necessary to work out break-even

The variable costs, to Total costs, to Total Revenue.

Cash inflows/receipts

-The money coming into the business

-Money flows into the business when income is received.

Cash outflows/payments

-The money going out of the business

-Money flows out of a business when payments are made.

Cash sales

when customers paid for it at the time of the purchase

Credit sales

paid for the products however it takes time for it to be paid for

Value added tax

Value Added Tax is charged on most goods and services. A business must be registered for VAT if its sales go over the VAT threshold (£82 000 in 2015). The business adds VAT to the cost of its goods and services.

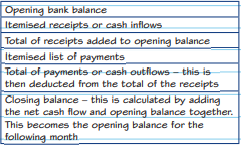

Cash flow forecast

a prediction of the expected cash balance at the end of each month in the future

Opening balance

the amount of cash the business has the start of the month

Total cash inflow

the total cash the business expect to receive during the month

Total cash outflow

the amount of cash the business expects to spend during the month

Inflow-outflow

the difference between the cash coming in and out of the business

Closing balance

the opening balance + the difference between the cash coming in and the cash coming out.

Purchase of assets

These are small and large expenditures on items, from computer printers and telephones to vehicles and expensive machinery and buildings

Rent, rates, salaries, wages and utilities

These are all regular outflows. The business must have the cash to cover these.

Cash and credit purchases

Anything a business buys is an outflow whether it is for use by the business or resale, e.g. raw materials, stationery.

loan outflow

Money borrowed by the business from an external source

capital introduced

Funds invested in the business by the owner or shareholders

sales of assets

Money received from selling an asset, e.g. machinery

bank interest received

the business may store money in a savings account on which the bank will pay interest

four profitability ratios

gross profit margin mark up net profit margin return on capital employed

ratio: gross profit margin

gross profit/revenue x 100

ratio: markup

gross profit/cost of sales x 100

ratio net profit margin

net profit/ revenue x 100

interfirm

between different firms, for example, comparing the performance of two different house builders

intrafirm

within the firm, for example, comparing this year's results with last year's, or the performance of the Leicester branch of a retail store.

Stakeholder

anyone with an interest in the activities of a business, whether directly or indirectly involved.

return on capital employed ROCE

net profit before interest and tax/ capital employed x 100

measuring liquidity

liquidity ratio measures how solvent a business is

Types of liquidity ratio

current ratio acid test ratio/ liquidity ratio (liquid cap)

current ratio

current assets/ current liabilities

Cash flow forecasts

Cash flow forecasts are used by businesses to identify potential problems with cash flow. This will enable them to plan, monitor and control spending more effectively.

format of forecast

entering data

Use of cash flow forecast

The flow of cash into and out of a business has to be carefully managed. Having too little cash means that suppliers, and even employees, may not be paid on time.

profit and cash

Businesses selling lots of products and services may have major cash flow problems. If the business is selling products and services and recording them as being sold they may be short of cash if they have sold them on credit as they will not have yet received the money. They will need to replace the inventory but as they have not been paid for items they have already sold, they may not have funds to do this.

Benefits and limitations

Cash flow forecasts should help the business predict when they might have cash flow problems. If the business has predicted and planned for its financial needs, then banks may extend overdrafts or offer loans. Cash flows fail to consider that a business can delay payments to increase its net cash inflows and that it can buy using a leasing arrangement to avoid using cash.

ways to improve cash flow

what does break-even analysis identify?

it identifies the point at which a business’s costs are matched by the money it receives from sales.

Types of costs are?

Fixed, variable and semi-variable

Fixed costs

These are incurred by the business regardless of how well it is doing, e.g. business rates.

Variable costs

These increase when the business increases its activity or output, e.g. raw materials. total variable costs = variable cost per unit × quantity

Semi-variable costs

These are a combination of fixed costs and costs which become variable once a certain level of activity or output is reached, e.g. fixed phone line rental plus a variable charge based on the number of calls made.

Total costs (TC) =

fixed costs + variable costs + semi - variable costs

Types of sales are?

Selling price per unit, Sales in units, Sales in value.

Selling price per unit

Amount paid by each customer for each item bought

Sales in units

Quantity of sales, i.e. number of items sold