ECO105 CH.9: How business Price and Profit

0.0(0)

0.0(0)

Card Sorting

1/10

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

11 Terms

1

New cards

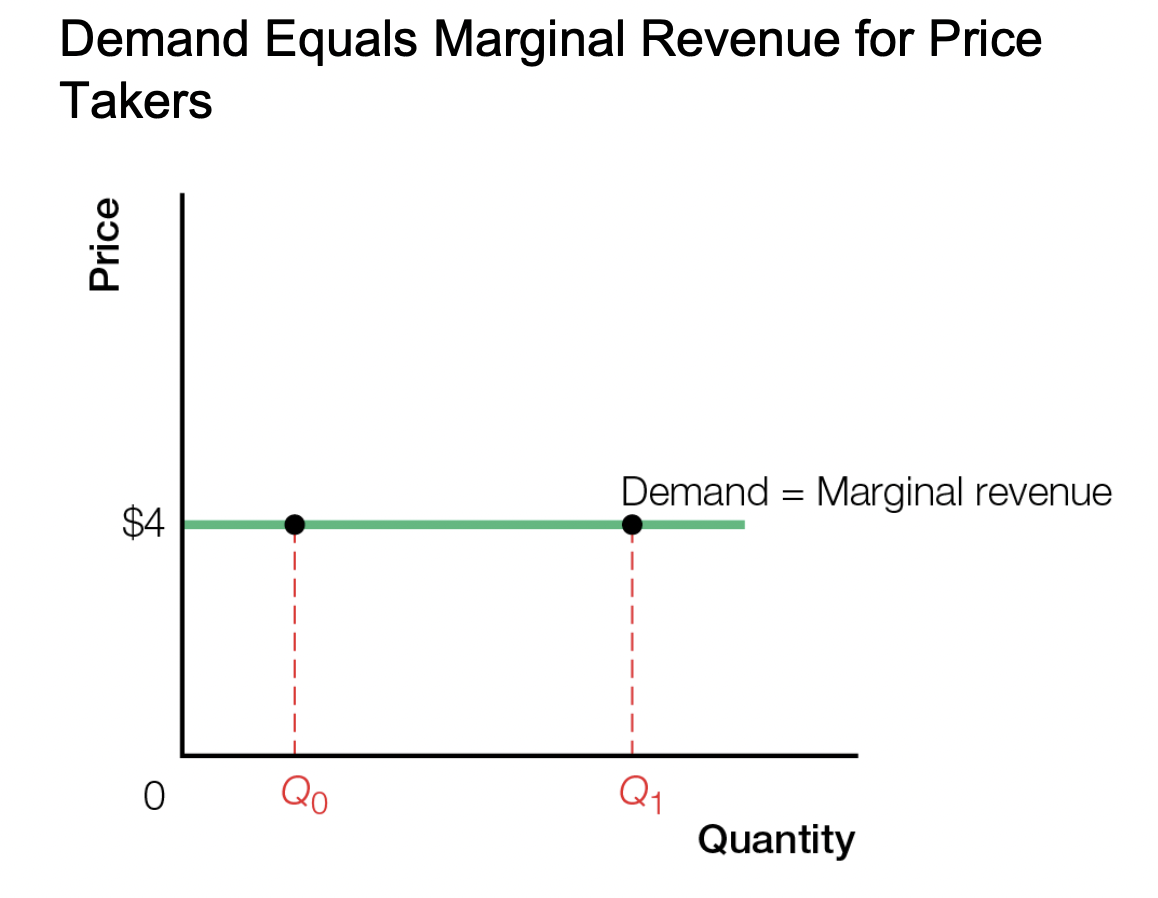

Marginal Revenue (MR)

- Additional revenue from selling one more unit (or from more sales)

- How much you get for that one product alone

- Depends on market structure (How competitive an industry is and whether business is price taker or maker)

- MR = price for price-taking businesses in perfect compeition

- MR< price for price making business in other market structure

- How much you get for that one product alone

- Depends on market structure (How competitive an industry is and whether business is price taker or maker)

- MR = price for price-taking businesses in perfect compeition

- MR< price for price making business in other market structure

2

New cards

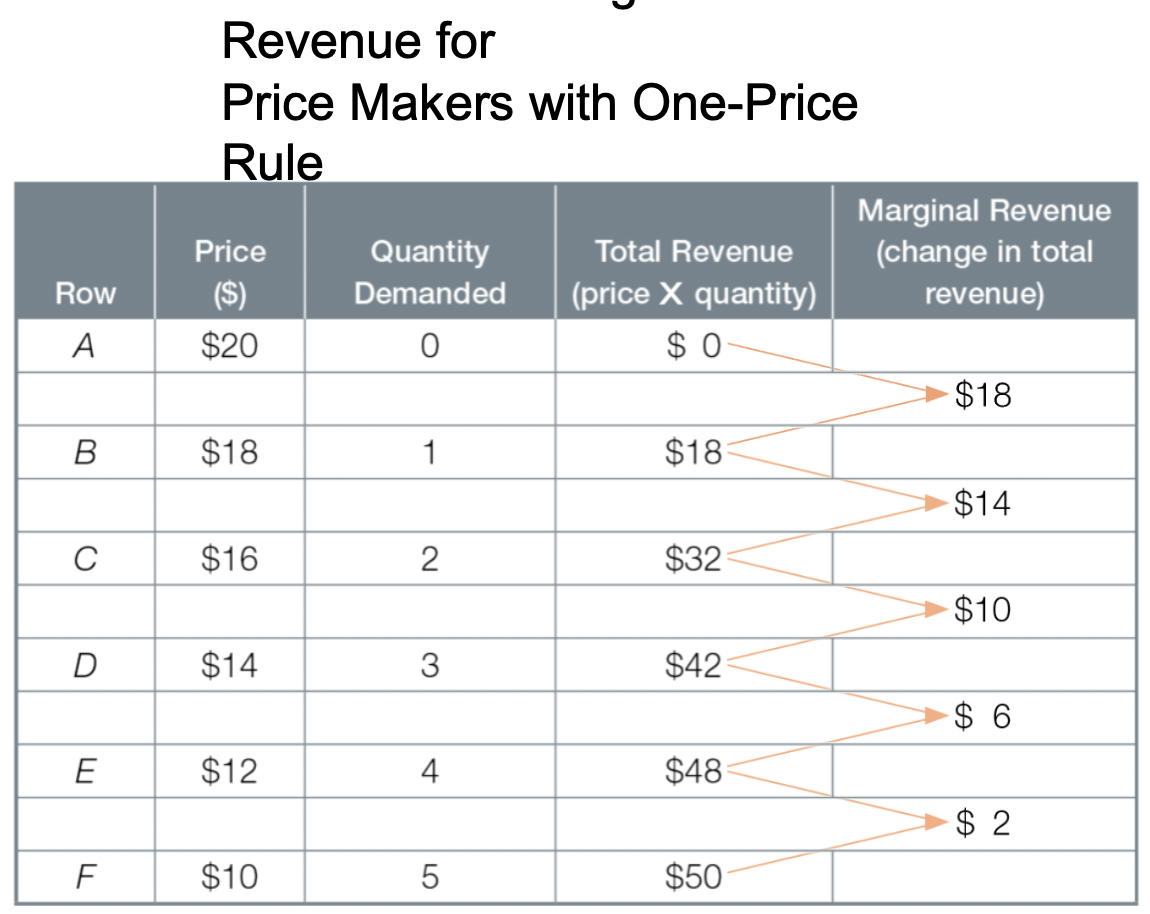

One-price rule

- Monopolist: MR increase, Price increase; MR decrease, Price decrease

- Product easily RESOLD have a single price in the market

- When a price-making business lowers price, must lower price on all units sold, not just new sales (not just the last unit sold)

*Reason why MR < Price for price maker

- Product easily RESOLD have a single price in the market

- When a price-making business lowers price, must lower price on all units sold, not just new sales (not just the last unit sold)

*Reason why MR < Price for price maker

3

New cards

Marginal Cost

Differentiate both by looking at the relationship of a business' output relative to its capacity

4

New cards

Diminishing returns

- As output increase, decreasing productivity, increases marginal cost

- Businesses operating near capacity of shifting to more expensive inputs, have increasing marginal cost to increase output

(If all worker full-time, want to increase output, but need to pay overtime, obviously increase marginal costs)

- Businesses NOT operating near capacity have constant marginal costs to increase output

(Workers are not busy)

- Compare marginal revenue with marginal cost = quantity of

- Businesses operating near capacity of shifting to more expensive inputs, have increasing marginal cost to increase output

(If all worker full-time, want to increase output, but need to pay overtime, obviously increase marginal costs)

- Businesses NOT operating near capacity have constant marginal costs to increase output

(Workers are not busy)

- Compare marginal revenue with marginal cost = quantity of

5

New cards

Maximum profits

1) Quantity decision:

a) increase quantity yield increase profit if MR>MC

b) Stop Increase quantity when MR

2) Price decision

a) Set highest price that allow sale of target quantity

- Intersection of MR and MC is the key to the recipe for max profit

- MR and MC are generally unrelated (except when firm is max profit, pick a quantity which sets them equal to each other)

a) increase quantity yield increase profit if MR>MC

b) Stop Increase quantity when MR

2) Price decision

a) Set highest price that allow sale of target quantity

- Intersection of MR and MC is the key to the recipe for max profit

- MR and MC are generally unrelated (except when firm is max profit, pick a quantity which sets them equal to each other)

6

New cards

Fixed costs

- Total costs (Graph/table) = fixed cost + Sum of MC

- Do not change with quantity of output produced

- Rent + insurance are examples

- Include normal profits

- Do not change with quantity of output produced

- Rent + insurance are examples

- Include normal profits

7

New cards

Economic Profits

- Total revenue - total costs

- Total revenue - (obvious cost + normal profit)

- Total revenue - (obvious cost + normal profit)

8

New cards

Price discrimination (Dynamic Pricing)

- Charging different customers different prices for the same product or services

- Eg. Coupons

- Set price for each group allowing scale of all quantities with MR>MC

- Continuously adjusts for many variables affecting willingness to pay

- Eg. Coupons

- Set price for each group allowing scale of all quantities with MR>MC

- Continuously adjusts for many variables affecting willingness to pay

9

New cards

Efficient Market Structures

1) Perfect competition; with price-taking businesses is an efficient market structure

- Total surplus is max (CS+PS)

-Businesses earn normal profit, economic profits are zero

- Total surplus is max (CS+PS)

-Businesses earn normal profit, economic profits are zero

10

New cards

Inefficient market structure

- Price making business are inefficient

- With same inputs, business reduce output and raise prices

- Businesses earn economic profits

Total surplus is less than perfect competition because dead weight loss from reduced output

- With same inputs, business reduce output and raise prices

- Businesses earn economic profits

Total surplus is less than perfect competition because dead weight loss from reduced output

11

New cards

Benefits to market structures with price-making power and economics profits

1) Product variety

2) Economic profits finance innovation and creative destruction, improve living standards for all

3) Differential pricing creates some more affordable option

4) Trade-off: compare additional costs and benefits

2) Economic profits finance innovation and creative destruction, improve living standards for all

3) Differential pricing creates some more affordable option

4) Trade-off: compare additional costs and benefits