Acct 2 - Fall Final - Ch 1-7

1/60

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

61 Terms

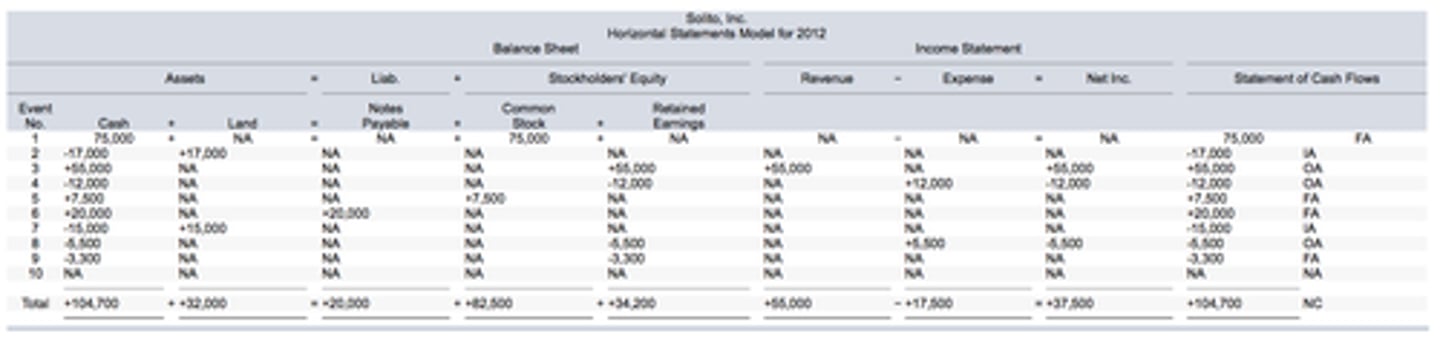

accounting equation

fiscal period

the length of time for which a business summarizes and reports financial information

sales journal

a special journal used to record only sales of merchandise on account

purchases journal

a special journal used to record only purchases of merchandise on account

general journal

a journal with two amount columns in which all kinds of entries can be recorded

cash receipts journal

a special journal used to record only cash receipt transactions

cash payments journal

a special journal used to record only cash payment transactions

order of posting special journals

sales

purchases

general

cash receipts

cash payments

contra account

an account that reduces a related account on a financial statement

accounts receivable turnover ratio

the number of times the average amount of accounts receivable is collected during a specified period

-days it takes someone to pay us back

calculating accounts receivable turnover ratio

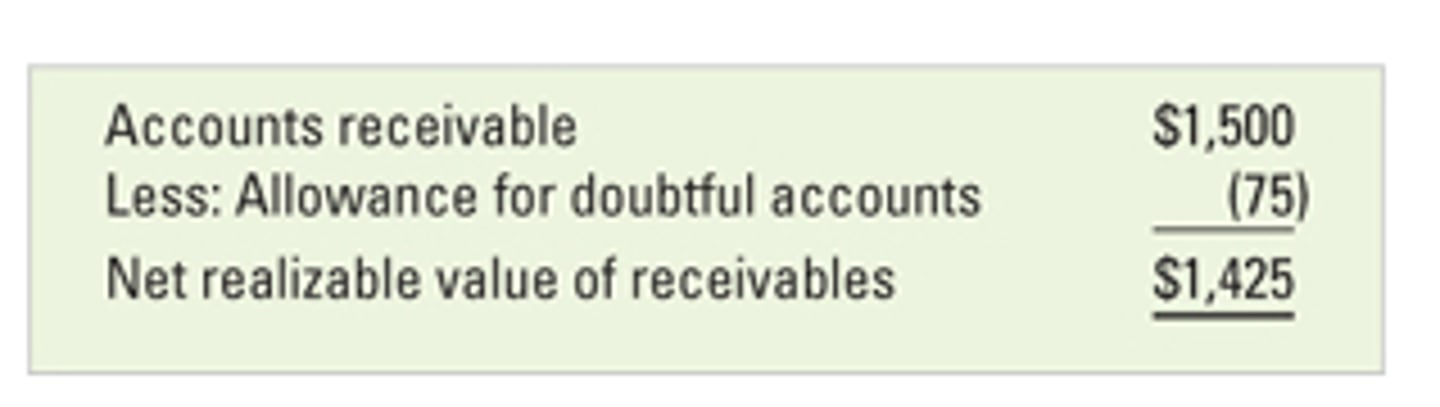

1. Total accounts receivable - allowance for uncollectable accounts = book value of accounts receivable

2. (beginning book value of accounts receivable + ending book value of accounts receivable) / 2 = average book value of accounts receivable

3. Net sales on account / average book value of accounts receivable = accounts receivable turnover ratio

calculating average book value of accounts receivable

accounts receivable - uncollectable accounts

cash discount on purchases

reduces purchases price

departmental margin statements

the revenue earned by a department less cost of merchandise and direct expenses

-shows net income for a department

-like an income statement except for a specific department instead

stock record

a form used to show the kind of merchandise, quantity received, quantity sold, and balance on hand

consignment

Goods that are given to a business to sell but for which title to the goods remains with the vendor

paying employer payroll taxes

in cash payments journal

-debit: each salary expense specific to the department

-credit: all of the taxes in the payroll register

recording payroll taxes

in general journal

-debit: each salary expense payable specific to the department

-credit: SS, Med, unemployment - state and federal

made a deposit using EFTPS

debit the payable accounts of federal income tax, SS, and Med.

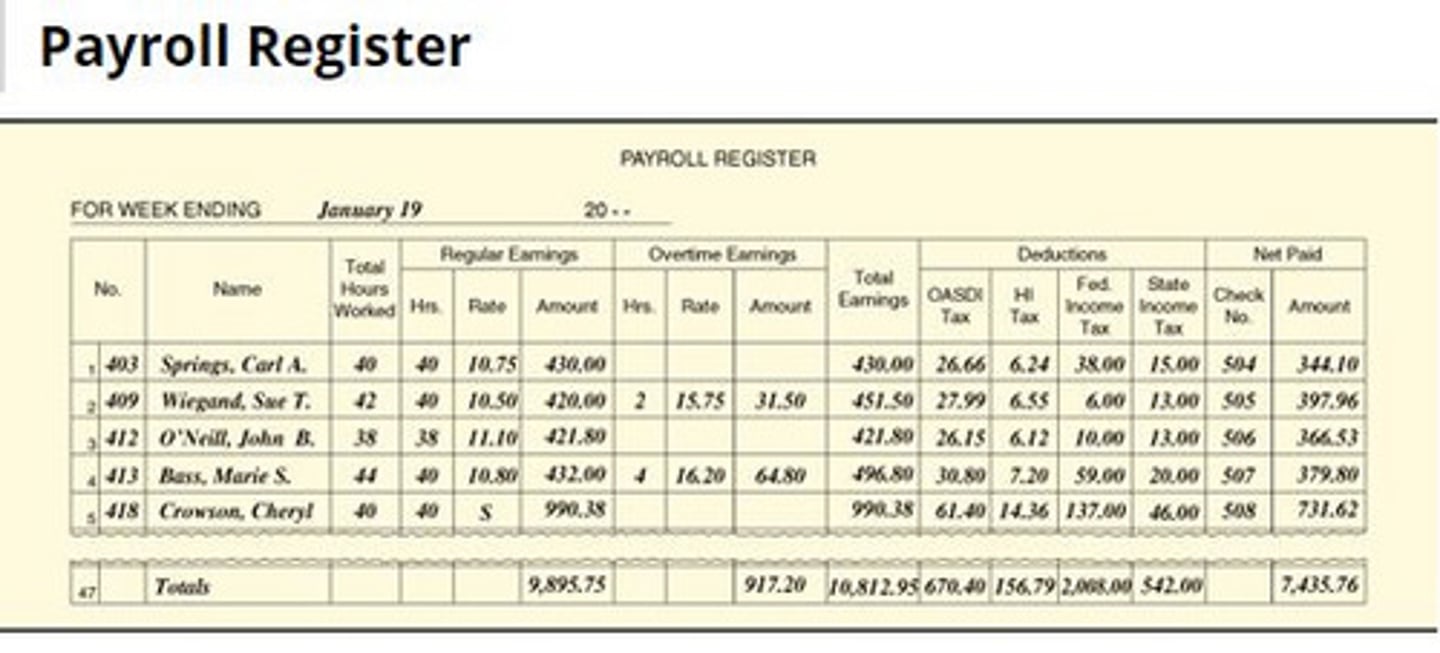

how to calculate total earnings

hours worked times the hourly wage

-overtime is then usually time and a half, so multiply the wage by 1.5 and that by the number of overtime hours. Add commission if there is any.

how to journal a sale on account and then receive payment for that sale (w/discount)

debit: accounts receivable

credit: sales discounts and allowances

sales

sales returns and allowances

refunds and price reductions given to customers after goods have been sold and found unsatisfactory

-contra account of sales

schedule of accounts payable

A listing of vendor accounts, account balances, and total amount due all vendors

schedule of accounts receivable

a listing of customer accounts, account balances, and total amount due from all customers

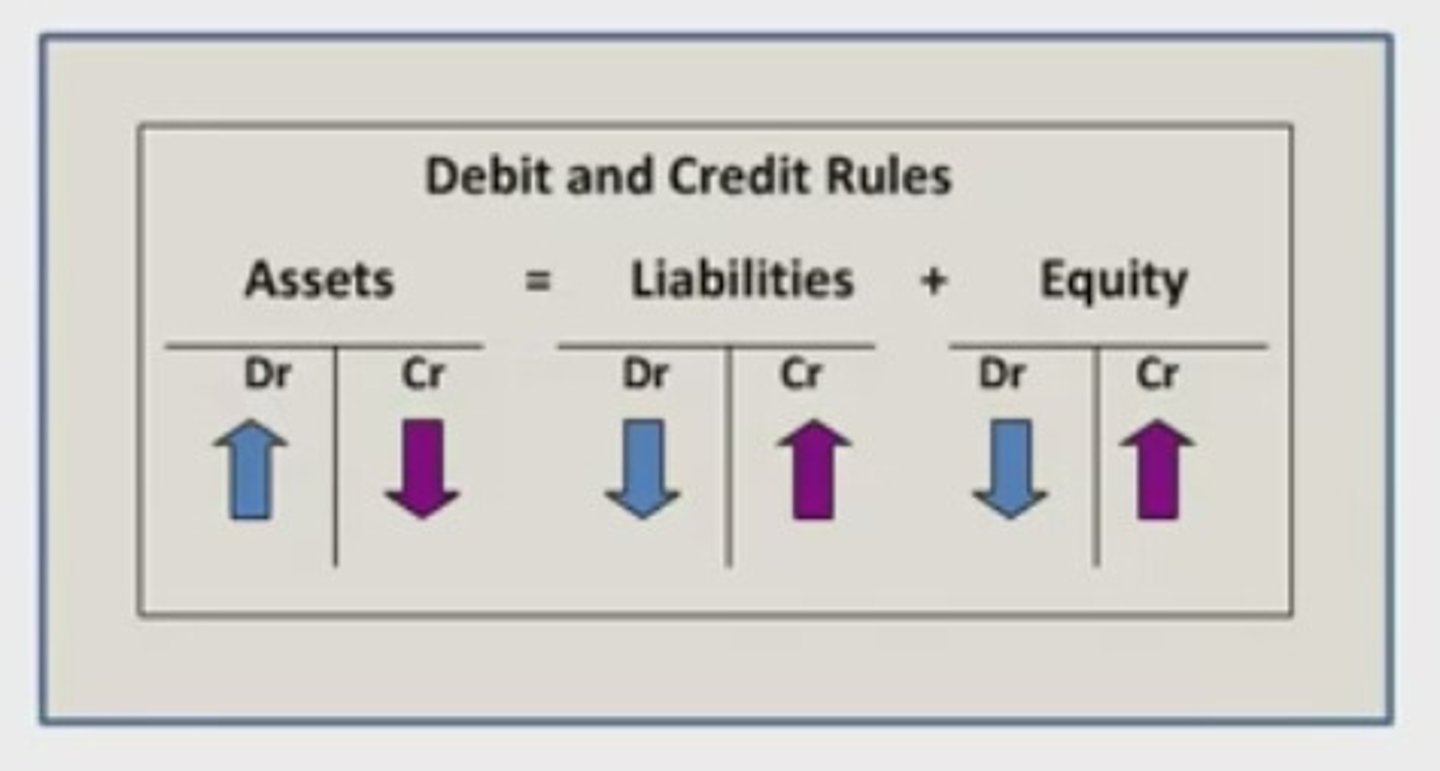

double entry accounting

the process of recording equal debits and credits for a single business transaction

post-closing trial balance

prepared to make sure total debits equal total credits after the closing entries are posted

order of closing entries

1) Temporary accounts with credit balances

2) Temporary accounts with debit balances

3) Income Summary

4) Dividends

Why do we calculate accumulated earnings on the employee earning record

to keep track of overall earnings

-this is the amount that is taxed and can't go over the standard to be taxed on

earnings record

only used for one employee for one quarter

-there are 4 a year

payroll register

covers one pay period for all employees

-12 per year

net pay

on payroll register it is the total earnings minus total deductions equals

payroll checks

checks written to each employee for amount due

ledger

group of accounts

Calculating and journalizing depreciation expense

debit depreciation expense

credit accumulated depreciation

how to journalize disposing of a plant asset

1) journalize any additional depreciation

2) debit total accumulated depreciation

3) journalize loss/gain or nothing if broke even

4) credit original cost of plant asset

Calculating book value of a plant asset

the original cost of a plant asset minus accumulated depreciation

double-declining method

type of accelerated depreciation that multiples the book value of an asset by a constant depreciation rate to determine annual depreciation

depletion

reduction in the number or quantity of something

reversing entry

the exact opposite of the adjusting entry made in the previous period

-done if you debit an asset or credit a liability

-this follows on everything except for federal income tax payable which you leave alone

adjusting entry for uncollectable accounts

Debit: Uncollectible Accounts Expense

Credit: Allowance for Uncoll. Accounts

Direct write-off method

recording uncollectible accounts expense only when an amount is actually known to be uncollectible

Journal: General

-Debit: Uncollectible Accounts Expense

-Credit: Accounts Receivable/Company

allowance method

Journal: General

-Debit: Allowance for Uncollectable Accounts

-Credit: Accounts Receivable/Company

income statement

a financial statement showing the revenue and expenses for a fiscal period

balance sheet

a financial statement that reports assets, liabilities, and owner's equity on a specific date

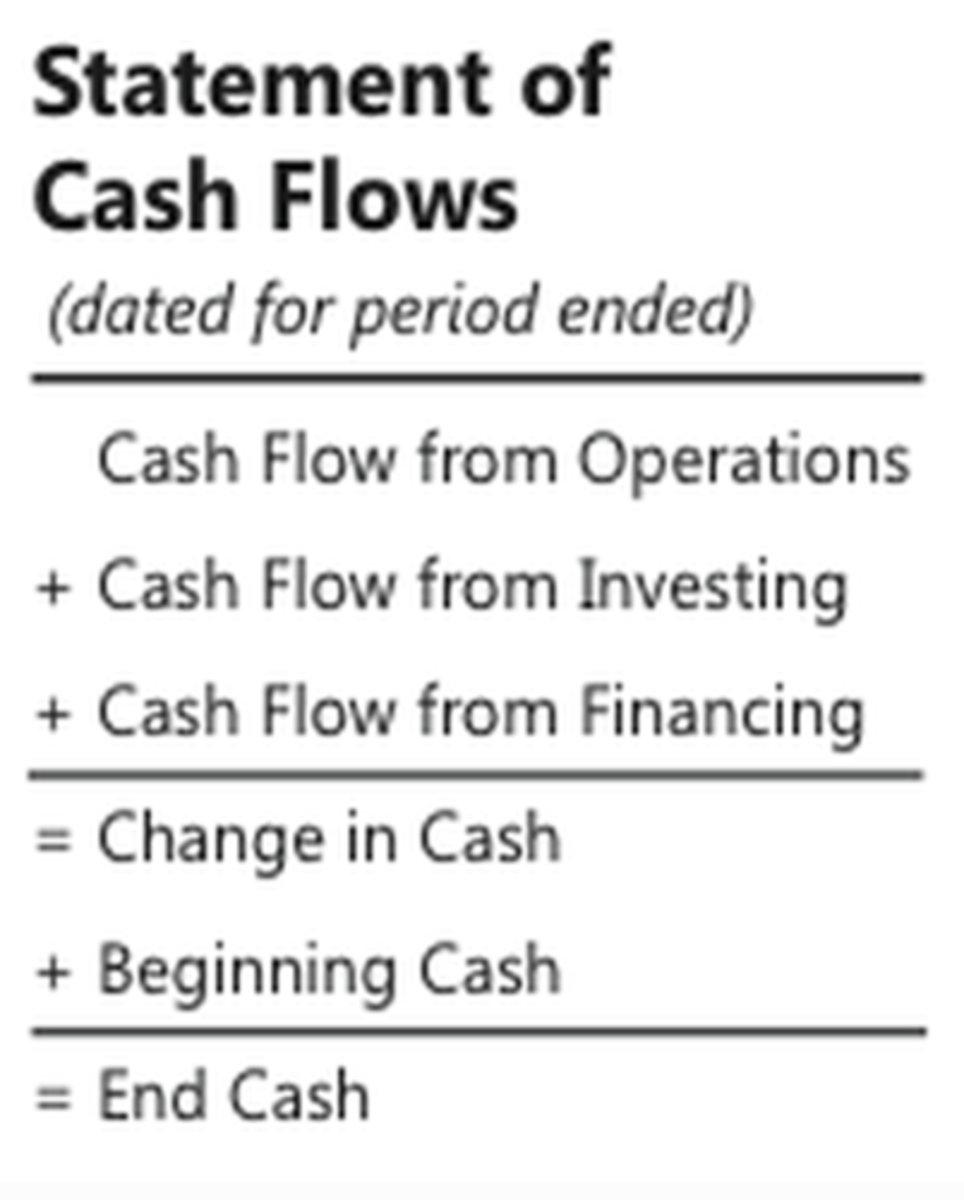

statement of cash flows

reports on a business's cash receipts and cash payments for a specific period

statement of retained earnings

the statement that summarizes the income earned and dividends paid over the life of a business

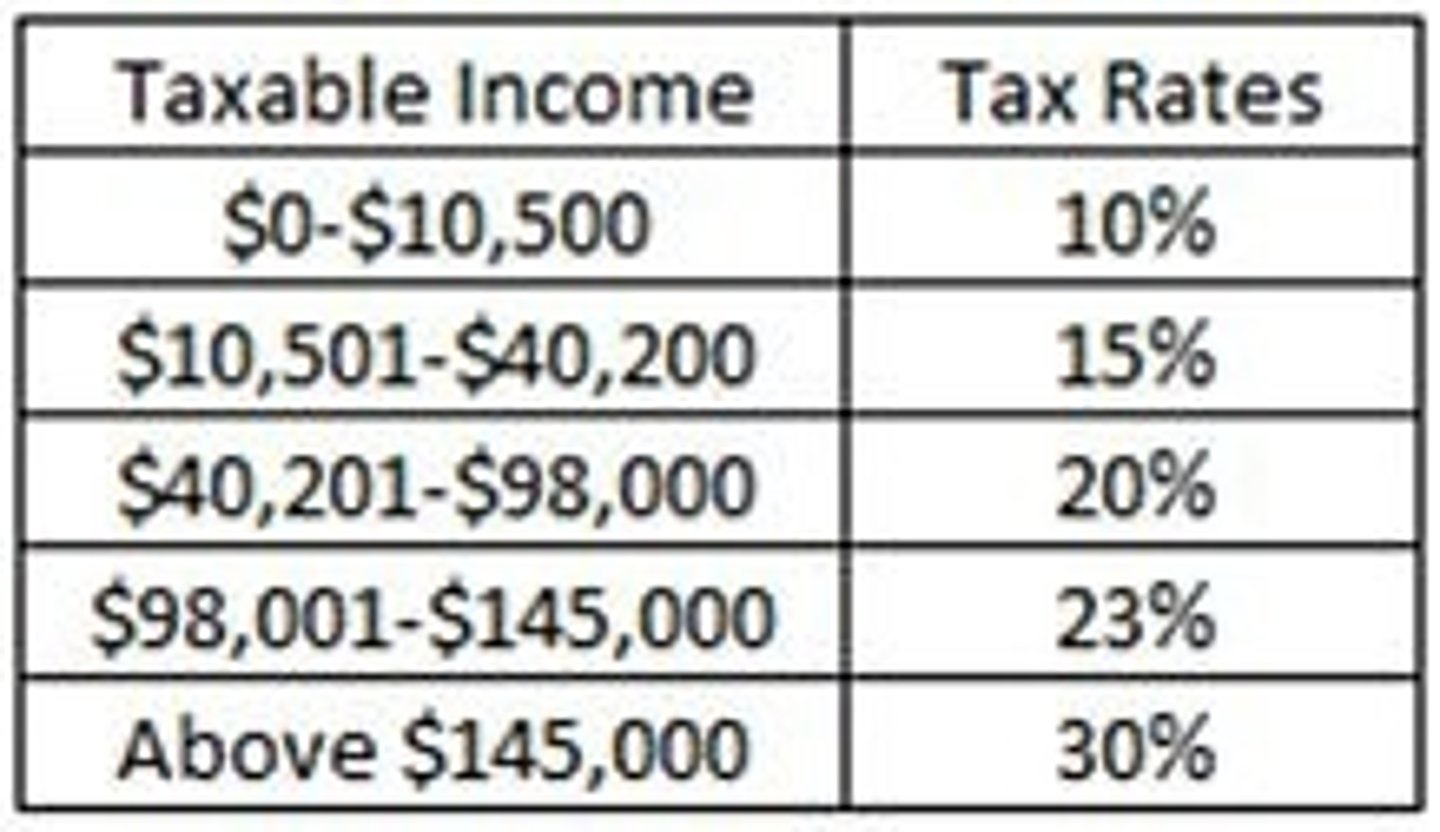

tax bracket

a range of taxable income that is taxed at the same rate

capital stock

total shares of ownership in a corporation

dividends

Company's share profits to the shareholders based on the corporation's performance.

retained earnings

an amount earned by a corporation and not yet distributed to stockholders

matching revenue with expenses

accurately reflecting the results of operations for a fiscal period

consistent reporting

the same accounting procedures are followed in the same way in each accounting period

full disclosure

providing all information necessary for consumers to make an informed decision

marginal tax rate

the extra taxes paid on an additional dollar of income

calculate inventory turnover ratio

number of times the average amount of merchandise is sold during a specific time period

cost of goods sold/average inventory

-how often inventory is changing

-want this number to be high

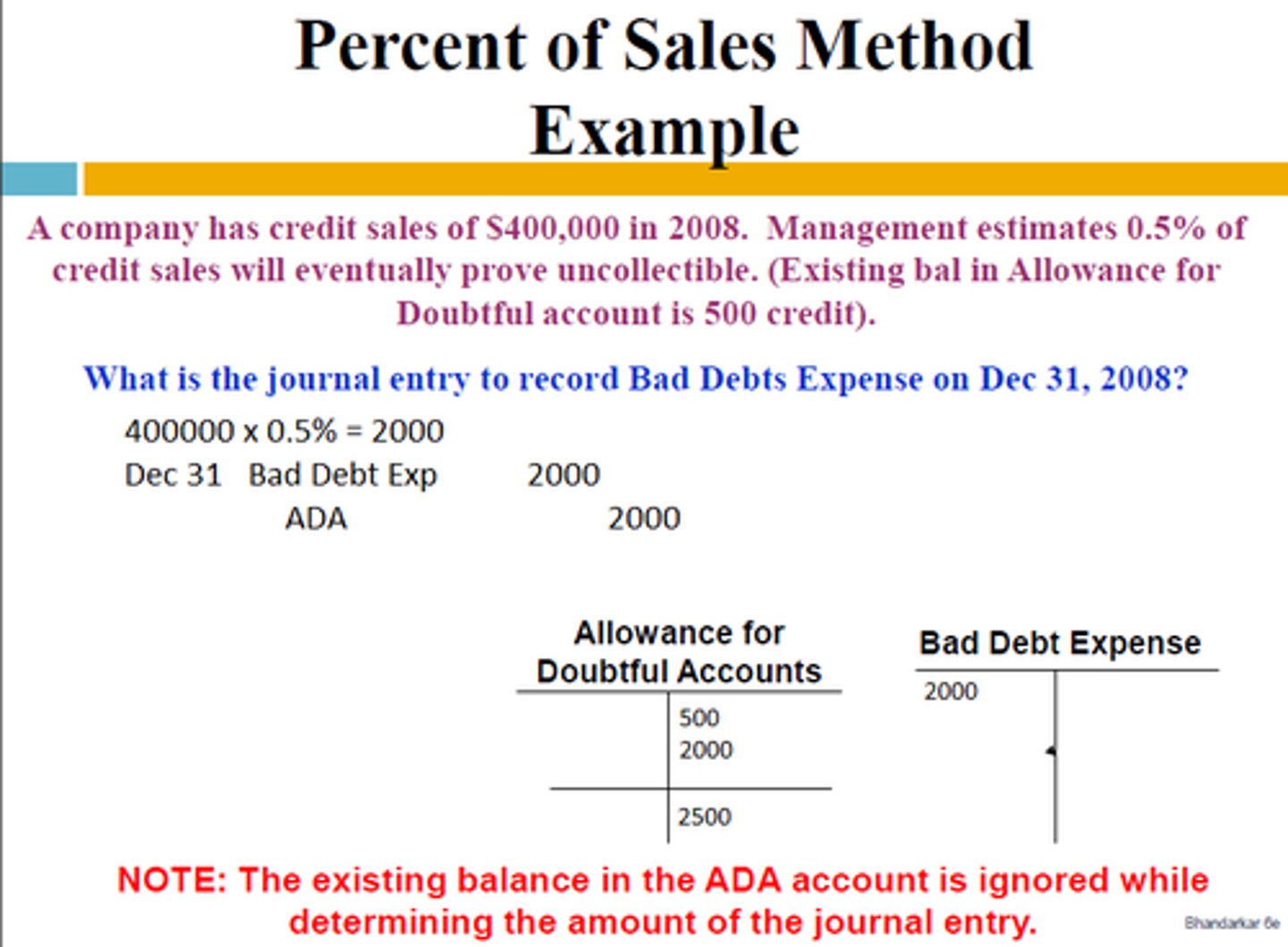

Percent of Sales Method

Estimated Uncollectable Accounts Expense = Net Sales x Percentage

-Answer is the amount of adjusted entry that you will use

-Debit: Uncollectible Accounts Expense

-Credit: Allowance for Uncoll. Accounts

how to write off and reopen an account using direct write off method

*all in general journal

-write off:

Debit: Uncollectible Accounts Expense

Credit: Accounts Receivable/Company

-reopen:

Debit: Account Receivable/Company

Credit: Uncollectable Accounts Expense

how to write off and reopen an account using the allowance method

*all in general journal

-write off:

Debit: Allowance for Uncollectable Accounts

Credit: Accounts Receivable/Company

-reopen:

Debit: Accounts Receivable/Company

Credit: Allowance for Uncollectable Accounts

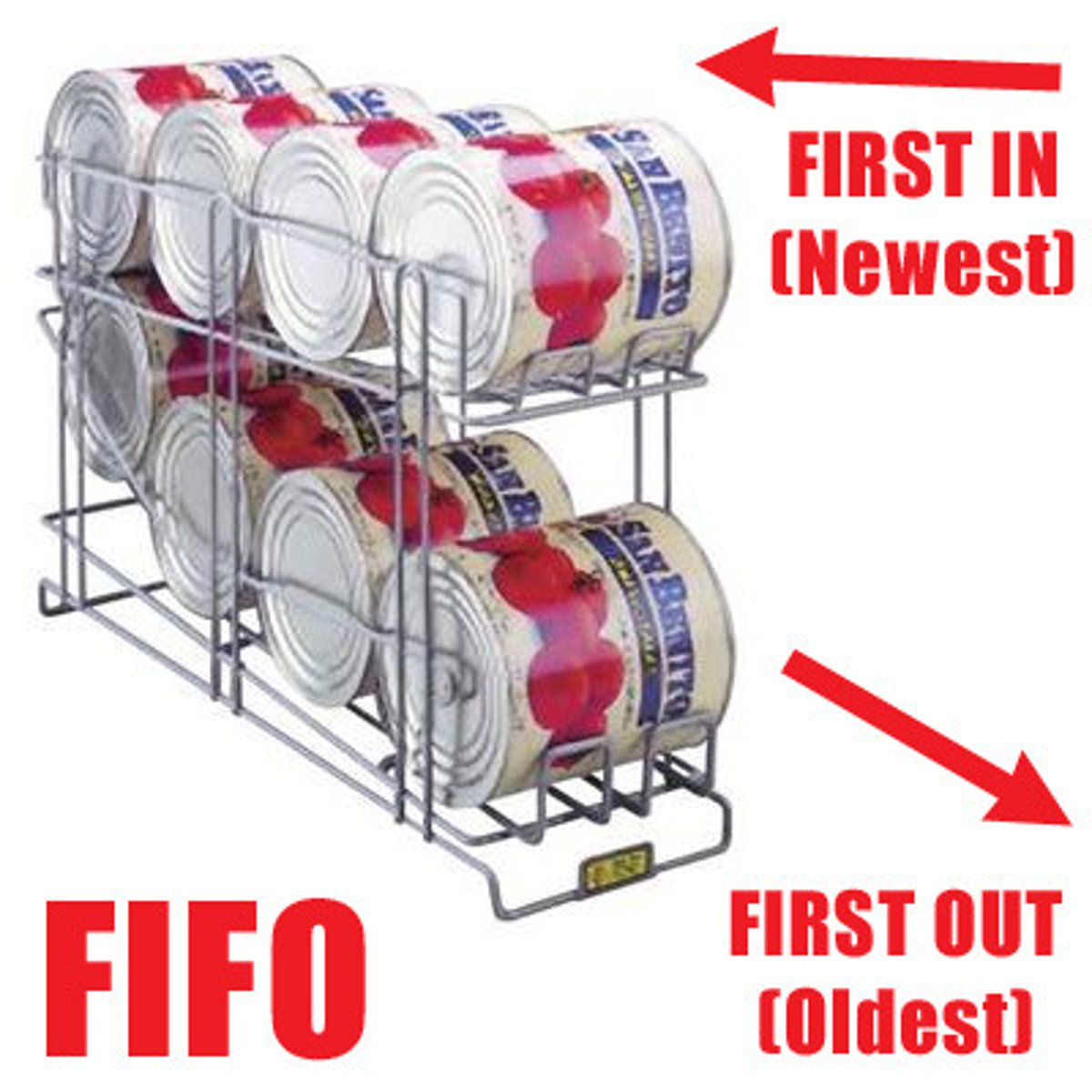

FIFO

using the price of merchandise purchased first to calculate the cost of merchandise sold first

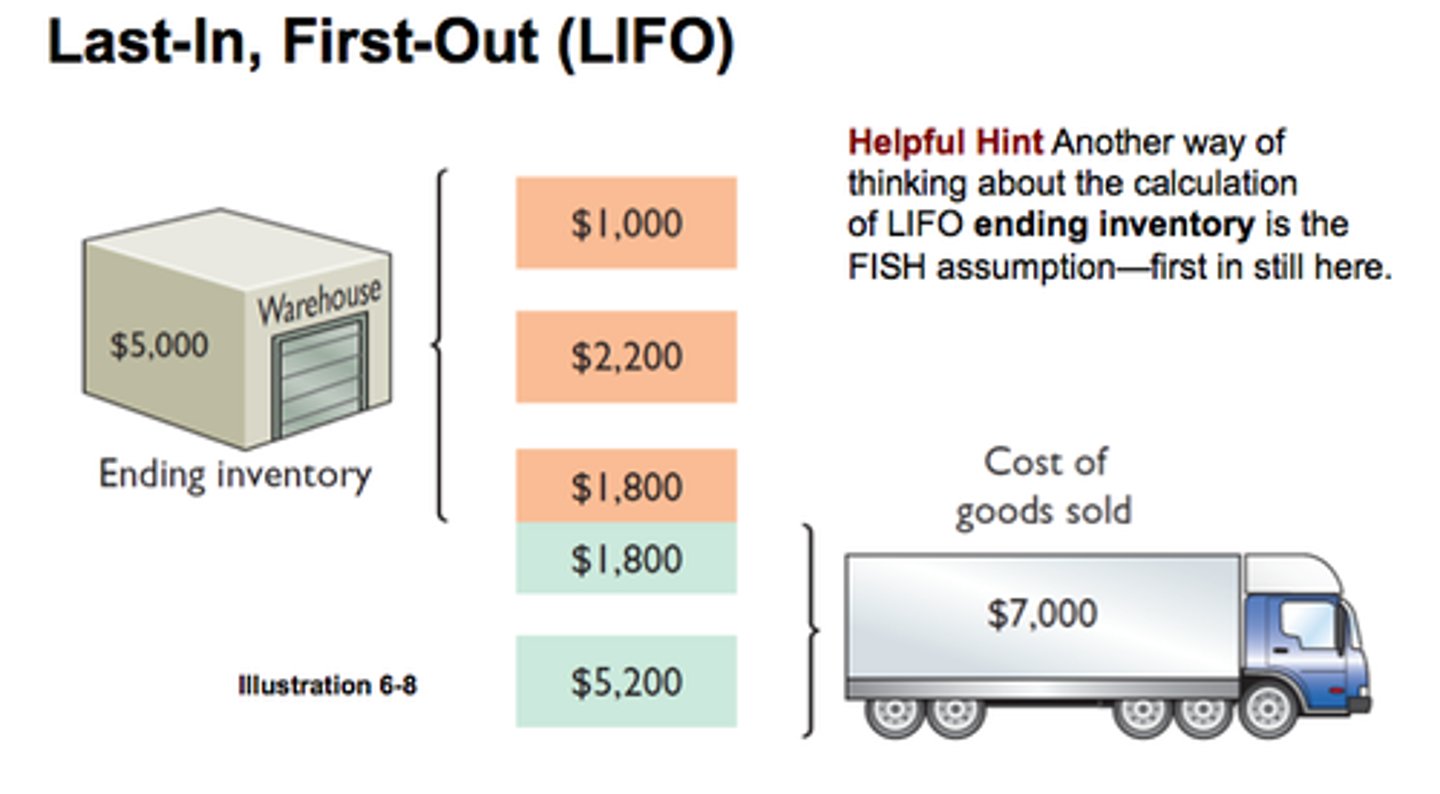

LIFO

using the price of merchandise purchased last to calculate the cost of merchandise sold first

weighted-average method

using the average cost of the beginning inventory plus merchandise purchased during a fiscal period to calculate the cost of merchandise sold