Discounting Future Values- Week 9

1/7

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

8 Terms

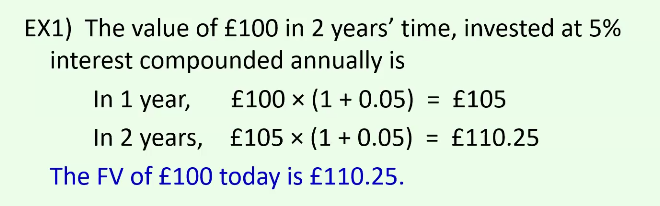

Compounding of interest (annual)

A process to obtain the future value (FV) of a monetary value that is invested today

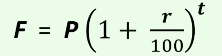

Future Value Formula

F = P(1+ r/100)^t

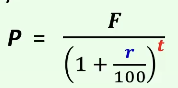

Discounting

A process to obtain the present value (PV) of a monetary value that realises in the future

Discount rate

Given an FV of £F that is to realise t years from now, the relationship between the relationship of PV of £P and the annual discount rate r% is given by:

P = F/ (1+r/100)^t

Savers

The price and quantity supplied (amount saved) are positively related. Savers compare r with their personal discount rates. Relates to the supply side of this market

Investors

The price and quantity demanded (amount borrowed) are negatively related. Investors compare r with the rate of return on their investment activities, for each additional £ to be invested (Marginal Rate of Return)

If you borrow money, you have to pay back both the principle amount and rate of interest on top of that. Hence of curve is downward sloping.

Social discount rates

Discount rates employed for the purpose of evaluating public- sector investments

Factors affecting discount rates

time preference = time pressure of individual vs society ie. climate change policies or how long does a society continue?

Riskiness = some business opportunities might fail. Firms may be unable to pay back what they borrowed due to failure