Financial Accounting Final Exam

1/56

Earn XP

Description and Tags

CH 1-12

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

57 Terms

Assets

Probable furute economic benefits owned by the business as a result of past transactions

Liabilities

Probable debts or obligations of the entity that result from past transactions, which will be fufilled by providing assets or services

Stockholders’ Equity

The financing provided by the owners and the operations of the business

Balance Sheet

Reports the amount of assets, liabilities, and stockholders’ equity of an accounting entity at a point in time

Separate Entity Assumption

states that business transactions are seperate from and shouylf exclude the personal transactions of the owners

Financial Statement Heading Format

Who: Name of the Business

What: Title of the Statement

When: Accounting Period

Formatting of Journal Entries

Debit first, credit second. Debits and credits must equal each other.

Date Account Titles Debit Credit

Title $

Title $

Expenses

decreases in assets or increases in liabilities arising from providing goods or services during the current period

Expense Recognition Principle

Expenses are recorded when incurred in earning revenue: also called matching

Revenues

Increases in assets or settlements of liabilities arising from providing goods or services

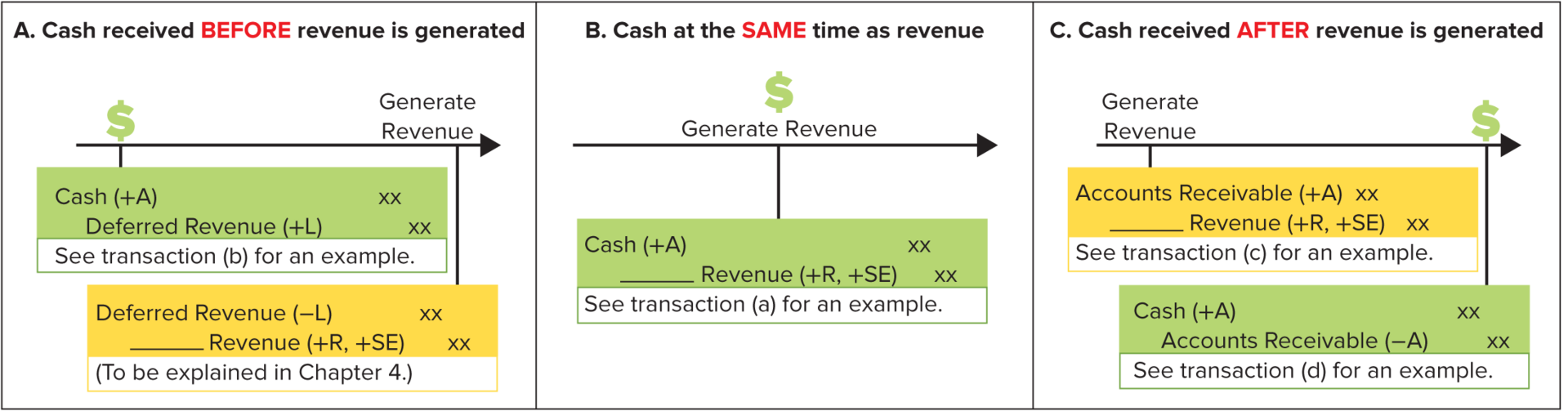

Revenues Journal Entry

Revenue Recognition Principle

revenues are recorded when (or as) the seller provides goods or services to customers, in the amount the seller expects to be entitled to receive

Adjusting Journal Entries

Entries necessary at the end of each accounting period to report revenues and expenses in the propor period and assets and liabilities at appropriate amounts

Adjusting Journal Entries Record

1. Accruals Accrued Revenues (Revenue earned but not yet received)

Debit: Accounts Receivable

Credit: Service Revenue

Accrued Expenses (Expense incurred but not yet paid)

Debit: Expense (e.g., Salaries Expense)

Credit: Payable (e.g., Salaries Payable)

2. Deferrals Prepaid Expenses (Previously recorded asset now used)

Debit: Expense (e.g., Rent Expense)

Credit: Prepaid Asset (e.g., Prepaid Rent)

Unearned Revenues (Previously recorded liability now earned)

Debit: Unearned Revenue

Credit: Revenue (e.g., Service Revenue)

3. Depreciation To allocate cost of long-term assets over time

Debit: Depreciation Expense

Credit: Accumulated Depreciation

4. Interest Accrued Interest Expense

Formula:

Principal × Rate × TimeDebit: Interest Expense

Credit: Interest Payable

5. Supplies Used If supplies were purchased earlier and now used up:

Debit: Supplies Expense

Credit: Supplies

Adjusting entries ensure that:

Revenues are recorded when earned

Expenses are recorded when incurred

Closing Journal Entries

Temporary Accounts to Close:

Revenues

Expenses

Gains & Losses (if any)

Dividends (if declared)

1. Close Revenue Accounts to Income Summary

Debit: Each Revenue account

Credit: Income Summary

2. Close Expense Accounts to Income Summary

Debit: Income Summary

Credit: Each Expense account

3. Close Income Summary to Retained Earnings

If Net Income:

Debit: Income Summary

Credit: Retained Earnings

If Net Loss:

Debit: Retained Earnings

Credit: Income Summary

4. Close Dividends to Retained Earnings

Debit: Retained Earnings

Credit: Dividends

Order matters: Revenues → Expenses → Income Summary → Dividends

Permanent Accounts

The balance sheet accounts that carry their ending balances into the next accounting period

Temporary Accounts

Income statement accounts that are closed to retained earnings at the end of the accounting period

Reconciling Items on a Bank Reconciliation

Start with Bank Statement Balance:

Add:

Deposits in Transit (you recorded, bank hasn’t)

Subtract:

Outstanding Checks (you wrote, bank hasn’t cleared)

Start with Book Balance (Cash account):

Add:

Interest earned

EFT collections

Bank errors (if bank deducted too much)

Subtract:

NSF (bounced) checks

Bank service charges

EFT payments

Book errors (if you over-recorded deposits)

Internal Controls

control environment, risk assessment, control activities, information and communication, monitoring activities

Common Activities of Merchandising Companies

A company that sells goods that have been obtained from a supplier

Common Activities of Manufacturing Companies

A comapny that makes, not buys the prducts they sell

Common Activities of Service Companies

A company that sells services rather than physical goods

Periodic Method

A system in which ending inventory and cost of goods sold are determined only at the end of the accounting period based on a physical inventory count

Perpetual Method

A system in which a detailed inventory record is maintained by recording each purchase and sale of inventory during the accounting period

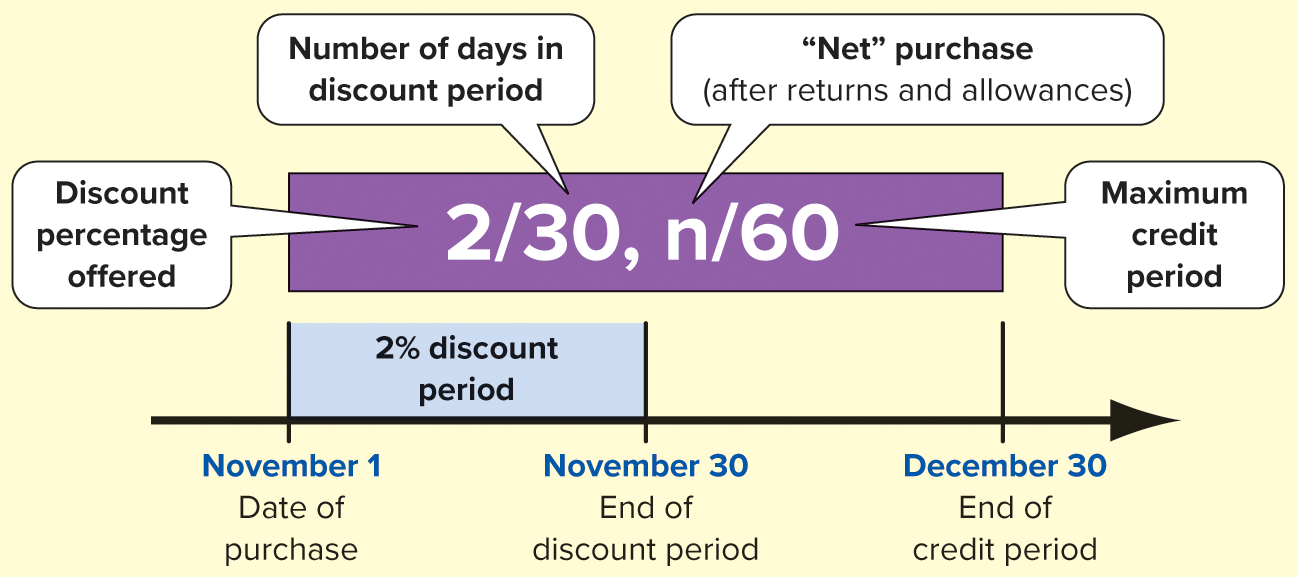

Credit Terms

Cost of Goods Sold Formula

Beginning Inventory + Purchases — Ending Inventory

COGS using FIFO

Identify units sold.

Assign cost starting from beginning inventory and oldest purchases.

Remaining units are the ending inventory, valued at the most recent purchase costs.

Ending Inventory: Composed of the most recent purchases.

COGS: Sum of the oldest costs for units sold.

COGS using LIFO

Identify units sold.

Assign cost starting from the most recent purchases backward.

Remaining units (oldest) are the ending inventory.

Ending Inventory: Composed of the oldest inventory.

COGS: Sum of the most recent purchase costs for units sold.

COGS using Weighted Average Method

Calculate total cost of goods available for sale (beginning inventory + purchases).

Calculate total units available for sale.

Weighted average cost per unit = Total cost / Total units.

Multiply by units sold for COGS and units remaining for ending inventory.

Ending Inventory: Units on hand × weighted average cost per unit.

COGS: Units sold × weighted average cost per unit.

Allowance for Doubtful Accounts

Type:

Contra-Asset account

Paired with Accounts Receivable on the balance sheet

Normal Balance:

Credit

Purpose:

To estimate and record expected uncollectible receivables

Matches bad debt expense to the same period as related sales (per Matching Principle)

Write-Offs and recovery of bad debt

1.To Record Bad Debt Expense:

Debit: Bad Debt Expense

Credit: Allowance for Doubtful Accounts

2. To Write Off an Uncollectible Account:

Debit: Allowance for Doubtful Accounts

Credit: Accounts Receivable

3. To Record Collection of a Previously Written-Off Account:

Step 1 Reinstate A/R: Debit: Accounts Receivable Credit: Allowance for Doubtful Accounts

Step 2 Record Cash Collection: Debit: Cash Credit: Accounts Receivable

Notes Recievable Journal Entry

a. Issuance of Note (Lend Money)

Debit: Notes Receivable

Credit: Cash

b. Accrue Interest Receivable:

Debit: Interest Receivable

Credit: Interest Revenue

c. Receipt of Interest at Maturity:

Debit: Cash

Credit: Interest Receivable (for accrued interest)

Credit: Interest Revenue (for remaining interest)

d. Repayment of Principal:

Debit: Cash

Credit: Notes Receivable

Interest Expense Calculation

Interest= Principal x Interest rate x Time

Interest expense Journal Entry

When interest is incurred (accrued but not yet paid):

Debit: Interest Expense

Credit: Interest Payable

When interest is paid in cash:

Debit: Interest Expense

Debit: Interest Payable (if accrued earlier)

Credit: Cash

Percentage of Credit Sales Method

Formula:

Bad Debt Expense = Credit Sales x Estimated % Uncollectible

Journal Entry:

Debit: Bad Debt Expense

Credit: Allowance for Doubtful Accounts

Depreciation and Accumulated Depreciation

Depreciation and Accumulated Depreciation Classification

Straight-Line method

(Cost - Residual Value) / Useful Life = Depreciation Expense

Double Declining Method

2 / Useful Life = Rate Rate x Beginning Book Value or Cost- accumulated depreciation = Depreciation

Notes Payable Journal Entry

When you borrow (issue a note):

Debit: Cash

Credit: Notes Payable

At period-end (to accrue interest):

Debit: Interest Expense

Credit: Interest Payable

Use formula: Principal × Rate × Time

When you repay the note and interest:

Debit: Notes Payable

Debit: Interest Payable (if accrued)

Debit: Interest Expense (if not yet accrued)

Credit: Cash

Notes payable Interest Calculation

Interest = Principal × Rate × Time

Bonds Payable Journal entry

1. Issuing Bonds at Face Value:

Debit: Cash

Credit: Bonds Payable

2. Issuing Bonds at a Discount:

(Issued for less than face value)

Debit: Cash

Debit: Discount on Bonds Payable

Credit: Bonds Payable

3. Issuing Bonds at a Premium:

(Issued for more than face value)

Debit: Cash

Credit: Premium on Bonds Payable

Credit: Bonds Payable

4. Interest Payment (Face Value Example):

Debit: Interest Expense

Credit: Cash

Discount: Increase interest expense

Premium: Reduce interest expense

Bonds Payable Interest Calculation

Interest = Face Value × Stated Rate × Time

Treasury Stock

Issued shares that have been reacquired by the company

Treasury Stock Repurchase Journal Entry

Debit: Treasury Stock

Credit: Cash

Treasury stock Reissuance Journal Entry

🔹 If Reissued at More Than Cost:

Debit: Cash

Credit: Treasury Stock

Credit: Additional Paid-In Capital (APIC) – Treasury Stock

🔹 If Reissued at Less Than Cost:

If there's enough APIC–Treasury Stock:

Debit: Cash

Debit: APIC – Treasury Stock

Credit: Treasury Stock

📌 Note:

Treasury Stock is always removed at original cost

APIC–Treasury Stock is used only for gains/losses on reissuance

Never record a gain or loss on treasury stock in net income

Number of Shares Issued Calculation

Shares Issued = Shares Outstanding + Treasury Shares

Outstanding Shares and Treasury Shares

Outstanding Shares

Shares currently owned by shareholders

Used to calculate earnings per share (EPS) and dividends

Treasury Shares

Shares repurchased by the company

Not considered outstanding

No voting rights or dividends

Stock Issuance Journal Entry

1. When Stock is Issued at Par Value:

Debit: Cash (Shares issued × Par value)

Credit: Common Stock (at par value)

2. When Stock is Issued Above Par (with Additional Paid-In Capital):

Debit: Cash (Total amount received)

Credit: Common Stock (Par value × shares issued)

Credit: Additional Paid-In Capital (Difference)

Dividend Journal Entry

1. When Dividends Are Declared:

Debit: Retained Earnings

Credit: Dividends Payable

2. When Dividends Are Paid:

Debit: Dividends Payable

Credit: Cash

Notes:

Declaration creates a liability.

Payment reduces cash and clears the liability.

Par Value Per Share

The nominal (legal) value assigned to each share of stock in the corporate charter.

Usually a very small amount (e.g., $0.01 or $1 per share).

Represents the minimum legal capital that must be retained in the business and cannot be distributed as dividends.

Debit: Cash

Credit: Common Stock (Par Value × Shares Issued)

Credit: Additional Paid-In Capital (any excess over par)

Operating Actiities

Cash inflows and outflows related to the components of net income

EX: Cash received from customers (sales revenue)

Cash paid to suppliers and employees (inventory, wages)

Interest paid and received (sometimes classified as operating)

Income taxes paid

Financing Activities

Cash inflows and outflows realted to financing sources external to the company

EX: Cash received from issuing stock or bonds

Cash paid to repurchase treasury stock

Dividends paid to shareholders

Borrowing money (notes payable, loans)

Repaying borrowed funds

Investing Activities

Cash inflows and outflows related to the sale or purchase of investments and long-lived assets

EX: Purchase of property, plant, and equipment (PPE)

Sale of PPE

Purchase or sale of investments (stocks, bonds, etc.)

Loans made to others (notes receivable)

Collection of loan principal

Statement of Cash Flows

Reports inflows and outflows of cash during the accounting period in the categories of operating, investing, and financing

Direct Method

A method of presenting the operating activities section of the statement of cash flows; reports the components of cash flows from operating activities as gross receipts and gross payments

Cash Flows from Operating Activities:

Cash received from customers: $XX,XXX

Cash paid to suppliers: (XX,XXX)

Cash paid to employees: (XX,XXX)

Cash paid for interest: (X,XXX)

Cash paid for income taxes: (X,XXX)

Net cash provided by operating activities: $XX,XXX

Indirect Method

Presntes the operating activities section of the cash flow statement by adjusting net income t ocompute cash flows from operating activities

Cash Flows from Operating Activities:

Net Income: $XX,XXX

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation expense: +X,XXX

Decrease (increase) in accounts receivable: +/−X,XXX

Increase (decrease) in accounts payable: +/−X,XXX

Other non-cash expenses or changes: +/−X,XXX

Net cash provided by operating activities: $XX,XXX