HW - Topic 5: Process Costing

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

The costs of work performed in the earlier departments that are transferred into the present department are called:

Multiple Choice

Beginning inventory.

Transferred-in costs.

Work-in-Process inventory.

Transferred-out costs.

None of these answers are correct.

Transferred-in costs.

The first-in, first-out method assumes that:

Multiple Choice

Costs of production are relatively small.

The company only has one department.

The first units completed are among the first units sold.

The first units to enter a production process are the first units to be completed and transferred out.

The company has already calculated the weighted average method.

The first units to enter a production process are the first units to be completed and transferred out.All of these answer choices are correct.

Process costing can be found in which of the following companies (industries)?

Multiple Choice

Coca-Cola.

Royal Dutch Shell Group (petroleum).

Kimberly-Clark (paper products).

Reichhold Chemical (chemicals).

All of these answer choices are correct.

All of these answer choices are correct.

The number of the same or similar units that could have been produced given the amount of work actually performed on both complete and partially complete units is referred to as:

Multiple Choice

Physical units.

Completed units.

Equivalent units.

Produced units.

Units to account for.

Both FIFO and weighted average are correct.

Which method is (are) used to prepare the departmental production cost report when using a process cost system?

Multiple Choice

LIFO method.

FIFO method.

Weighted average method.

Both LIFO and FIFO are correct.

Both FIFO and weighted average are correct.

Both FIFO and weighted average are correct.

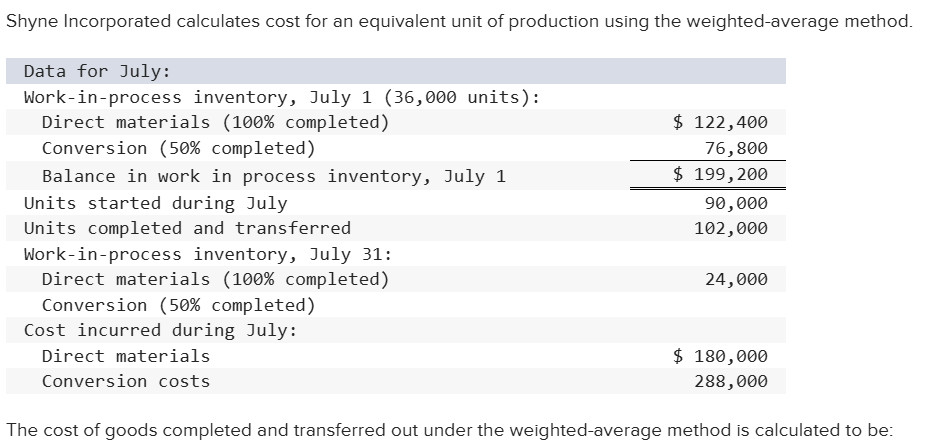

Multiple Choice

$96,000.

$476,400.

$571,200.

$484,000.

$468,200.

$571,200.

In a process costing system which assumes that normal spoilage occurs at the end of a process, the cost attributable to normal spoilage should be assigned to:

Multiple Choice

Beginning work-in-process inventory.

Ending work-in-process inventory.

Cost of goods manufactured and ending work-in-process inventory in the ratio of units worked on during the period to units remaining in work-in-process inventory.

Cost of goods manufactured (transferred out).

A separate loss account in order to highlight production inefficiencies.

Cost of goods manufactured (transferred out).

Normal spoilage and abnormal spoilage should be classified as:

| Normal | Abnormal |

|---|---|---|

A) | Period cost | Period cost |

B) | Product cost | Period cost |

C) | Period cost | Product cost |

D) | Product cost | Product cost |

Multiple Choice

Option A

Option B

Option C

Option D

None of the options are correct.

Option B

From the industries listed below, which one is most likely to use process costing in accounting for production costs?

Multiple Choice

Printing shop.

Accounting firm.

Electrical contractor.

Steel mill.

Automobile repair shop.

Steel mill.

Process cost systems are used in all of the following industries except:

Multiple Choice

Chemicals.

Home building.

Oil refining.

Textiles.

Steel.

Home building.

The key difference between weighted-average and FIFO process costing methods is the handling of the partially completed:

Multiple Choice

Beginning direct materials inventory.

Ending direct materials inventory.

Beginning work-in-process inventory.

Ending work-in-process inventory.

Beginning finished goods inventory.

Beginning work-in-process inventory.

In calculating unit cost in a process costing system, "conversion cost" is defined as the sum of:

Multiple Choice

Direct and indirect material costs.

Direct and indirect labor costs.

Direct labor and factory overhead costs.

Indirect labor and factory overhead costs.

Indirect material and factory overhead costs.

Direct labor and factory overhead costs.

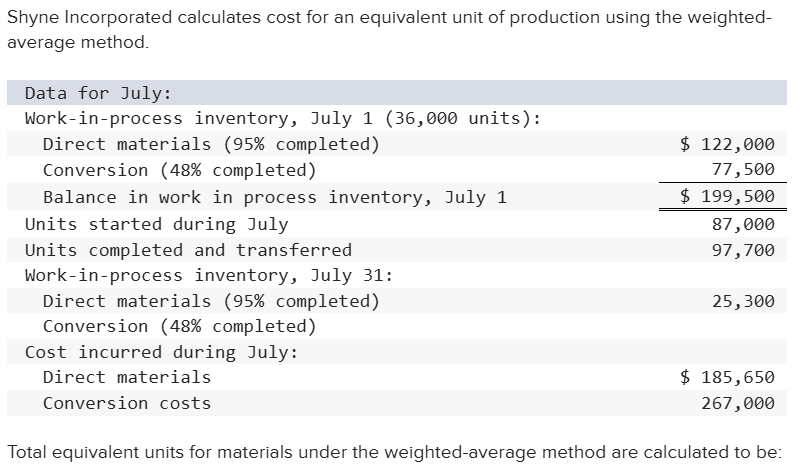

Multiple Choice

121,735 equivalent units.

109,844 equivalent units.

87,000 equivalent units.

97,700 equivalent units.

92,564 equivalent units.

121,735 equivalent units.

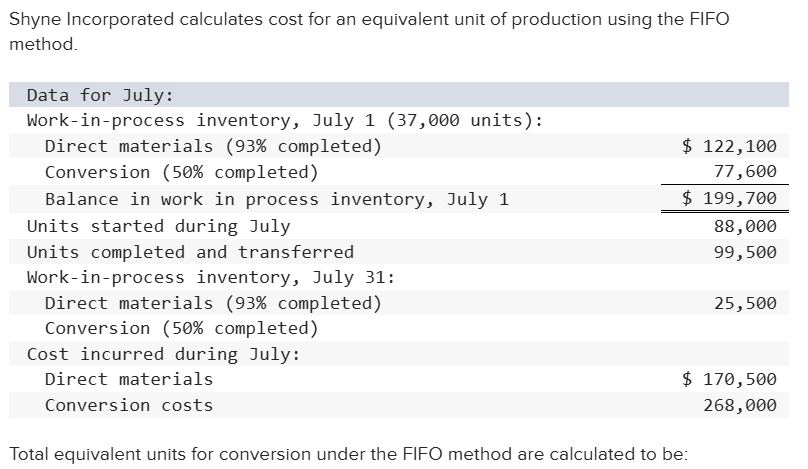

Multiple Choice

123,215 equivalent units.

112,250 equivalent units.

88,000 equivalent units.

99,500 equivalent units.

93,750 equivalent units.

93,750 equivalent units.

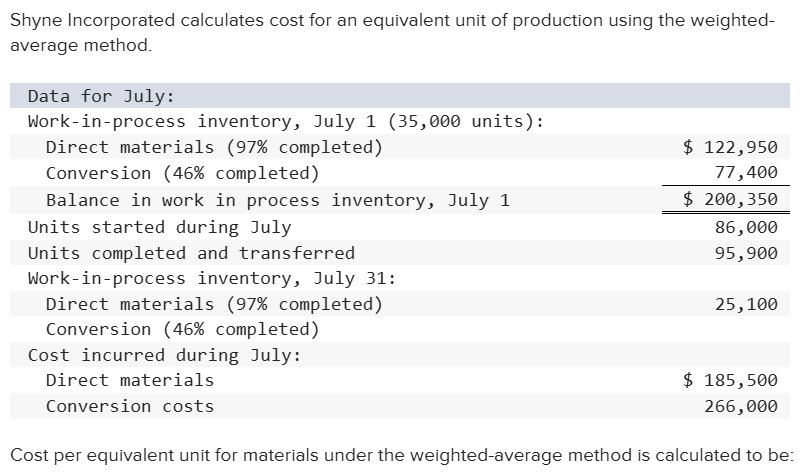

Multiple Choice

$2.16.

$2.57.

$2.91.

$3.01.

$3.09.

$2.57.