Exam 2- True/False Questions

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

21 Terms

The size of beta is determined by the amount of systematic risk in a stock.

A. TRUE

B. FALSE

A. TRUE

The market portfolio risk premium is larger for small stocks than large stocks.

A. TRUE

B. FALSE

B. FALSE

- This is because the market risk portfolio is the same for all stocks

The main weakness of the finite stock pricing model is that we assume a future selling price.

A. TRUE

B. FALSE

A. TRUE

A manager must select among three mutually exclusive projects. Each project has a positive NPV and an IRR greater than the cost of capital. The manager should select the project with the largest IRR.

A. TRUE

B. FALSE

B. FALSE

- Because according to Pope, you always default to the NPV over the IRR

The profitability index is useful when a firm is constrained by some resource.

A. TRUE

B. FALSE

A. TRUE

- This entire point of a profitability index is to use it with constraints

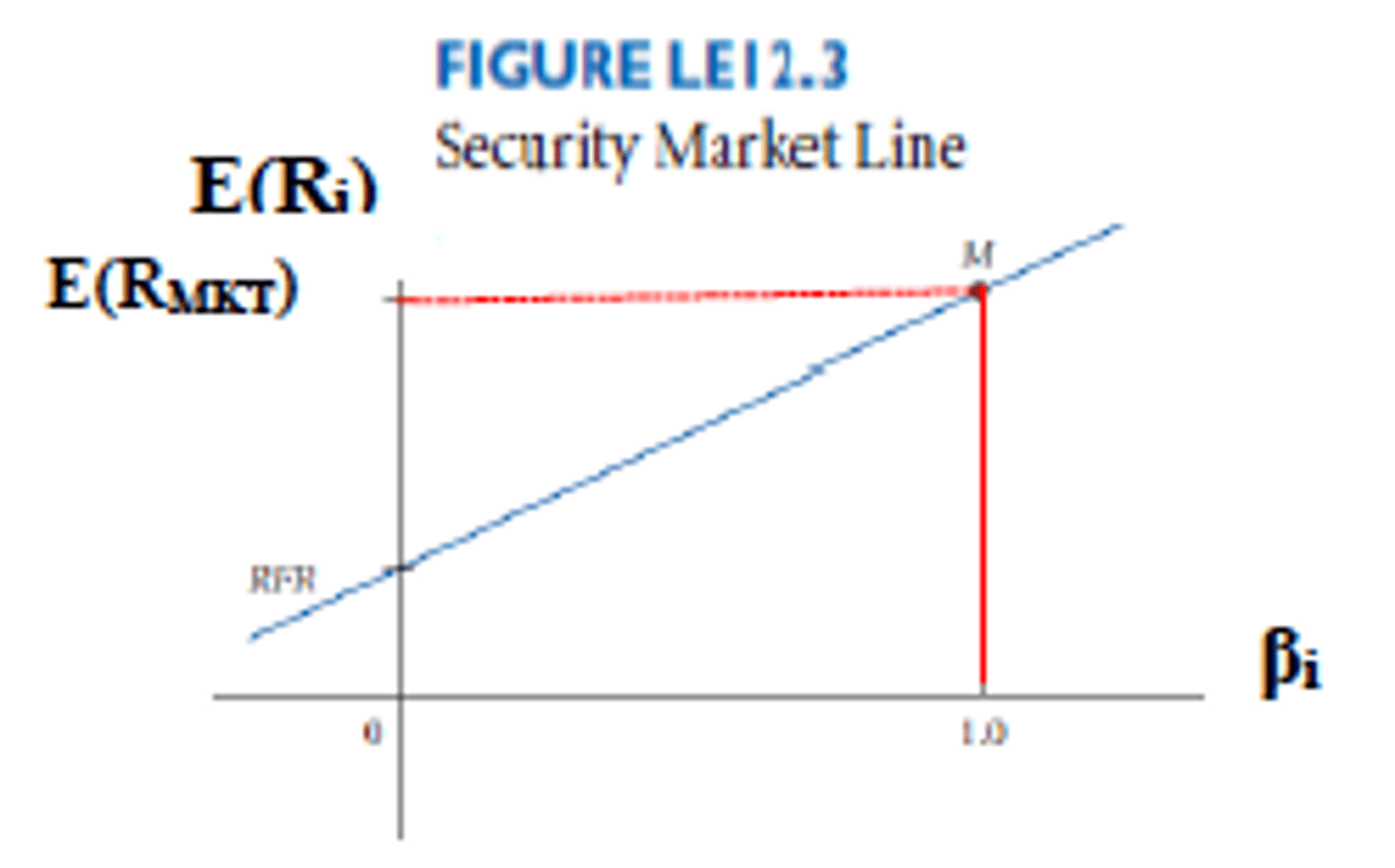

A stock is priced where the actual return plots above the security market line. We can say that this stock is overvalued.

A. TRUE

B. FALSE

B. FALSE

- If you draw a point above the market line, that represents that the stock is UNDERVALUED

- If you draw a point below the market line, that represents that the stock is OVERVALUED

One of the root causes of the financial crisis was that home buyers believed that home prices would always increase.

A. TRUE

B. FALSE

A. TRUE

Lyft will list their publicly traded shares on the New York Stock Exchange.

A. TRUE

B. FALSE

Suppose you are ranking a group of projects with the NPV rule and the payback rule. The highest ranked project with the payback rule will always match the highest ranked project using the NPV rule.

A. TRUE

B. FALSE

B. FALSE

Payback does not equal IRR

IRR does not equal NPV

Therefore, NPV does not equal Payback

Two stocks have the same diversifiable risk. This means that the two stocks will also have the same beta.

A. TRUE

B. FALSE

B. FALSE

- Beta measures NON-diversifiable risk

A strength of the CAPM model is that it uses historical data to forecast future required returns.

A. TRUE

B. FALSE

B. FALSE

- It is a WEAKNESS of the CAPm model that is uses historical data to forecast future required returns

The SEC was created in response to financial difficulties after World War II.

A. TRUE

B. FALSE

A manager is considering three projects that are contingent. Two of the projects have positive NPVs while the third project has negative project. Based on this information, the manager will always reject all three projects.

A. TRUE

B. FALSE

B. FALSE

- If you were considering three projects to be contingent, you would throw the projects together into one single project. With the information provided, you can't tell if you need to accept or reject all three of these projects

Our dividend pricing model is more commonly used in practice than our bond pricing model.

A. TRUE

B. FALSE

B. FALSE

- Bond Pricing is simple, and Dividend Pricing is more complex because it can be all over the map.

- Bond Pricing is probably more commonly used in practice.

- Bond pricing is governed by market interest rates (not much creativity to it) and dividend pricing is all over the map (100 different ways to do it).

If the Federal Reserve raises interest rates today unexpectedly, we would likely see an immediate decrease in stock prices.

A. TRUE

B. FALSE

A. TRUE

- If interest rates increase, spending decreases, and earning/price decreases

- You could also look at it in the opposite way...

If interest rates decrease, spending decreases, and earning/price increases

- Example:

P0 = FV/1+r

~ Let's say FV = $50, if you changed the interest rate from r = 10% to r = 20% it would show a decrease in stock prices as a result of moving the interest rate from 10% to 20%

Suppose you are ranking a group of projects with the NPV rule and the IRR rule. The highest ranked project with the IRR rule will always match the highest ranked project using the NPV rule.

A. TRUE

B. FALSE

B. FALSE

- NPV does not equal IRR

- If you had a bunch of projects and you are trying to figure out which one to pick (if they are independent) they are not always going to line up

The main weakness of the infinite dividend pricing model is that we think of corporations as having unlimited life.

A. TRUE

B. FALSE

B. FALSE

- It isn't really a weakness of the infinite dividend pricing model, let alone a main weakness

~ Example: If you own a corporation (like Apple) and you pass away, you corporation is going to keep going on forever

- Main Weakness of Infinite Dividend Pricing Model = it assumes that the dividends themselves will be consistent or constantly growing, and it is assuming you know what the dividends are

For an independent project, we would accept a project if the cost of capital is less than the internal rate of return.

A. TRUE

B. FALSE

A. TRUE

- If the IRR > r, we will accept it just as we would accept it in this scenario if r < IRR

We modified our basic finance principle to the following relationship: The greater the diversifiable risk, the greater the required return.

A. TRUE

B. FALSE

B. FALSE

The greater the NON-diversifiable risk, the greater the required return.

A project has a negative NPV. Accepting this project would result in a reduction in shareholder wealth.

A. TRUE

B. FALSE

A. TRUE

- NPV < 0; If we accepted, we would be losing the money of the shareholders (which is why you shouldn't accept the project)

News is released that the United States and China have worked out a framework for a trade agreement. We would expect prices to increase as investors now see less systematic risk in the economy.

A. TRUE

B. FALSE