FAR: F1-F6

1/402

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

403 Terms

Classified balance sheet

Current assets/liab vs non current assets/liab

You have an asset that’s worth $100K. Has 10 year useful life.

End of year 6, it depreciated by 30K. What is the depreciation amount for year 7 if the useful life stays the the same and there’s no salvage value?

End of Year | Asset Value | Depreciation |

1 | 90 | 10 |

2 | 80 | 10 |

3 | 70 | 10 |

4 | 60 | 10 |

5 | 50 | 10 |

6 | Impaired: -$30K | |

7 | Depreciation? | |

8 | ||

9 | ||

10 |

End of Year | Asset Value | Depreciation |

1 | 90 | 10 |

2 | 80 | 10 |

3 | 70 | 10 |

4 | 60 | 10 |

5 | 50 | 10 |

6 | 10 = 50 - 30 (impar) -10 (depreciation during yr) | 10 |

7 | 2.5 =10/4 | |

8 | ||

9 | ||

10 |

In year 6, subtract the impaired amount and the depreciation to get to the ending asset value.

Example of expired and unexpired cost

Expired: COGS (IS)

Unexpired: inventory (BS)

What is salvage value and when is it relevant?

When depreciating PP&E, salvage value tells you how much you can get for your PP&E at the end of its useful life.

Relevant for all depreciation methods accept declining balance.

Note: If the PP&E is on leased land, (you won’t have access to it at the end of your lease), then you consider that there is no salvage value to you.

what are incremental costs?

extra costs you incur only if you generate the asset.

Ex: Sales commission.

It’s related to asset generation, like getting a contract. It’s incremental because you wouldn’t have incurred the cost unless you had gotten the asset.

Ex of a non-incremental cost:

Advertising cost → Not directly related to getting a new sales contract or asset.

Sales people salaries → You would have incurred this cost anyway.

What does the acronym BASE stand for in inventory accounting, and how is it used?

mnemonic to remember the inventory equation:

Beginning Inventory + Purchases − COGS = Ending Inventory

Beginning Inventory

Add Purchases (or Additions)

Subtract Cost of Goods Sold (or Subtractions)

Ending Inventory

You can rearrange it to solve for any missing amount, such as purchases.

Multiple step vs. single step income statement

Multiple step: operating versus non-operating.

Single step: all revenues together, all expenses together

What counts as discontinued operations

Operations that have been disposed or are held for sale

Do you calculate EPS including discontinued operations?

EPS for income from continuing operations must be reported on the face of the income statement.

Also, a separate EPS and diluted EPS must be shown including income from discontinued operations as well.

What is an estimated liability on purchase commitments?

What would the journal entry look like?

When a company promises to buy goods at a fixed price in the future.

Ex:

May Y1: Contract signed → I promise to buy your corn next year for $5M.

NO JOURNAL ENTRY.

You haven’t incurred the expense yet, you just know you will have to pay 5M in future.

Dec 31 Y1: The price of corn drops to $3M.

Dr. Loss on purchase commitments $2M

Cr. Liability on purchase commitments $2M

Sep Y2: Receive Corn

Dr. Corn Inventory $3M

Dr. Liability on purchase commitments $2M

Cr. AP $5M

3 causes of gains and losses from discontinued operations

operations

sale

Impairment

Where does discontinued operations show up on the income statement?

After continuing operations and before net income. Discontinued operations is shown net of tax.

When are foreign currency gains and losses reported?

anytime there is a remeasurement of transactions that occurred in foreign currency.

Ex: quarterly financials, year-end reporting, Any unrealized remeasurement of an actual transaction

Comprehensive income formula

Net income ± OCI changes

Purpose of comprehensive income statement

Captures real economic gains/losses (translation, pensions, AFS securities, hedges) that cause volatility but don’t reflect core operations → recorded in equity, not net income.

What is OCI? + PUFI pneumonic

Other comprehensive income

P: Pension adjustments

U: unrealized gains and losses from available for sale debt securities (bonds)

F: Foreign currency adjustments from translating financials of overseas subsidiaries or from consolidations. (Not from transactions)

I: Instrument specific credit risk

What are the two statements that OCI go to?

Statement of comprehensive income and statement of stockholders equity through (AOCI) accumulated other comprehensive income line

How is basic earnings-per-share calculated?

Income available to common stockholders / weighted average common shares outstanding (WACSO)

How is WACSO calculated?

For each new issuance:

(Existing outstanding stock value + Value of issuance) * (# of months in year that issuance is outstanding / 12)

For each buy back:

(Existing outstanding stock value - value or buyback) * (# of months in year that issuance is outstanding / 12)

for stock split:

Treat stock split as if occurred in beginning of year

What is diluted EPS?

If all of the convertible bonds or preferred stock, etc. Were converted to additional shares of common stock, then the denominator of earnings per share would be higher, causing EPS to be diluted or lowered.

What is the if converted method and the treasury stock method?

If converted method assesses if convertible bonds or preferred stock are dilutive, including additional shares in the WACSO for diluted EPS if they are dilutive.

Treasury stock method for options/warrants assumes proceeds from their conversion are used to repurchase shares, and the net effect impacts diluted EPS.

What is a contingent share?

Stock that will only be issued if certain conditions are met

How do contingent shares affect EPS?

Contingent shares will only be included in EPS if all the conditions are met

What are the 3 main types of filings to the SEC?

10 – K

10 – Q

8 – K

4 Components of 10 – K

Financial disclosures

Summary of financial data

Management discussion and analysis (MD&A)

Audited GAAP financial statements

3 deadlines for filing 10 – K for 3 different kinds of filers

60 days - large accelerated: >$250M public float

75 days- accelerated: $75M - $250M public float

90 days - all other: <$75M public float

Public float = # of common shares outstanding x market price

3 Components of 10 – Q

Unaudited GAAP financial statements

Interim Management Discussion & Analysis

Certain disclosures

2 deadlines for filing 10 – Q for 3 types of filers

40 days - large accelerated + accelerated

45 days - all other

Purpose of 8 – K

Disclose changes for material events

5 components of stockholders equity (CARAT)

CARAT

Common Stock

Additional paid in capital

Retained earnings

Accumulated other comprehensive income

Treasury stock

What are the three categories of capital stock?

Authorized- allowed to sell

Issued- can sell soon

Outstanding - currently sold

Common shareholders equity

Total stockholders equity minus preferred stock

Book value per share

Common shareholders equity Divided by number of common shares

4 Types of preferred stock

Cumulative

Participating

Convertible

Mandatory redeemable

cumulative preferred stock?

Set dividend amount every period, what’s not paid gets added to dividends in arrears

Dividend in arrears

Unpaid dividends to preferred shareholders. These must be paid before any dividends can be paid to common shareholders.

Dividends in arrears are not liabilities until they are declared as payable

Participating preferred stock

Preferred stock holders, receive their fixed dividend, common stock holders get equal amount. If $ still remains from declared dividend, remainder is split amongst common and preferred prorata.

Opposite of participating preferred stock is non-participating preferred stock where they only receive their fixed dividend

Additional paid in capital

Amount paid for stock by stockholders above par

What kind of account is treasury stock?

Contra-equity

Debit = Inc

Credit = Decrease

Treasury stock is always subtracted from total stockholders equity

What 5 events can increase or decrease retained earnings

Income

Losses

All dividends

Error adjustments

Accounting principle changes Cumulative effects

Quasi reorganization

Quasi reorganization?

Instead of legally, declaring bankruptcy, a company can essentially decide an accounting reset button That clears all their books to 0

What are the 2 methods to record treasury stock?

Cost method

Legal/ Par value method

When are “gains/losses” recognized w Cost method vs par method

Cost method: when reissue stock

Par method: When repurchase stock

What are each of the following SEC Regulations?

S-X

S-B

S-K

S-T

S-X → Financial statements look SEXY (form & content, e.g., 10-K, 10-Q).

S-B → Small Business disclosures.

S-K → Non-financial info is KOOL 😎 (MD&A, descriptions).

S-T → Tech rules for electronic filing (EDGAR).

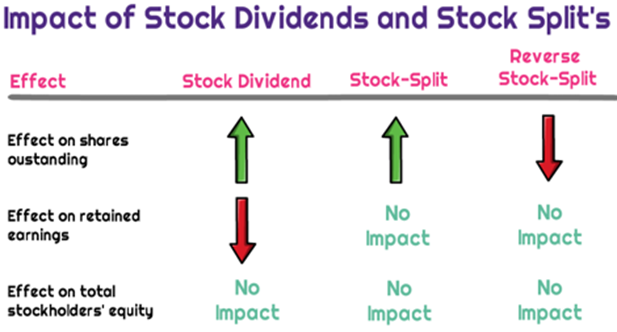

How do stock splits and stock dividends affect:

Shares outstanding

Retained earnings

Total stockholders equity

What are the steps to valuate inventory at LIFO using the lower of cost or market method?

A. Find the following:

Historical cost

Replacement cost

NRV = Selling price - costs to dispose

Floor = NRV - Profit

B. Find the “Market” value.

Market = Middle number between 2-4.

C. Inventory value = Whatever is smaller between Historical Cost and Market.

How are gains/losses from treasury stock shown under both cost and par method?

Never show treasury stock “gains/losses” on the income statement.

Gains go to APIC–TS, not Retained Earnings.

Losses reduce APIC–TS first, then hit Retained Earnings if APIC–TS is exhausted.

Journal entry for stock repurchase, and re-issue using cost method

Repurchase:

Dr. Treasury stock (Amount paid to buy back)

Cr. Cash

Reissue above buyback cost:

Dr. Cash

Cr. APIC -TS

Cr. Treasury stock

Reissue below buyback cost:

Dr. Cash

Dr. APIC -TS

Cr. Treasury stock

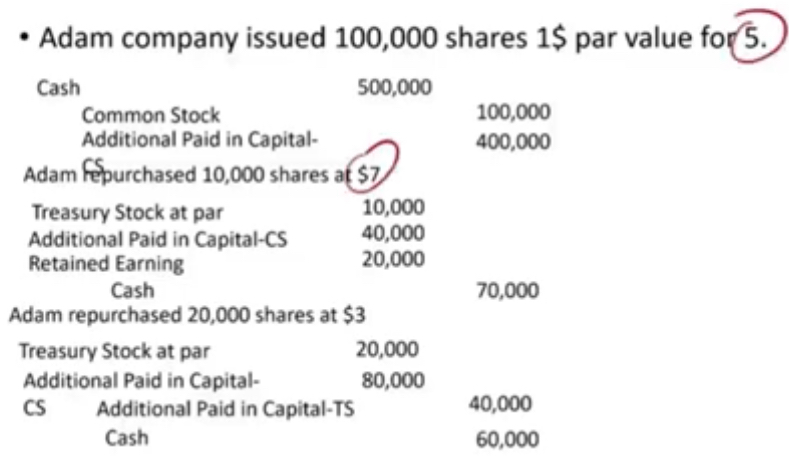

Journal entry for stock buyback, and re-issue using legal method

Credit cash for amount paid

Debit treasury stock at par

Debit APIC-CS at amount above par when originally issued

If loss, and there is balance in APIC-TS, debit APIC-TS. If no balance in APIC-TS, debit RE

If gain, credit APIC-TS

What are stock rights and how are they accounted for?

Stock rights = give existing shareholders the option to buy new shares (usually at a discount) to maintain their ownership % when new stock is issued.

Usually short-term and nontransferable.

Accounting:

Memo only when issued (no journal entry).

If exercised → record cash received + adjust Common Stock/APIC.

If allowed to expire → no entry needed.

When do dividends reduce retained earnings?

Date declared

How are property dividends recorded?

At fair value on declaration date, (same with gains and losses)

Difference between common stock and APIC

Common stock is the value at par

APIC is the value above par

What is a stock dividend?

Give more shares to stockholders (Not cash)

Ex: 10% stock dividend on 1,000 shares → receive 100 extra shares.

How do stock dividends affect total equity?

Stock dividends don’t affect total equity because their value is being shifted from a reduction of retained earnings to an increase in common stock and APIC

2 types of stock dividends and how they recorded

Small = <20-25% : recorded at FV

Large = >25% : recorded at par

What is the stock split and how is it recorded?

Ex: 2-for-1 stock split on 1,000 shares → now you own 2,000 shares, but each has half the par value.

No JE, just a memo

No change in equity.

Increase in # of stock outstanding retroactively

More # stock = lower EPS

If a stock split or stock dividend is issued after the balance sheet date (let’s say in Year 2), should it be considered in the Year 1 EPS calculation?

Yes.

Stock splits and dividends increase the WACSO, so they need to be recognized retroactively because this is relevant information for the viewer of the financial statements.

5 steps to recognize revenue

I am a STAR

Identify the contract with the customer

Separate performance obligations

Transaction price determination

Allocate the transaction price to the performance obligations

Recognize revenue when the entity satisfies a performance obligation.

what kind of contract modification would count as a new contract?

Scope increases (more work)

Price increases

2 methods of recognizing revenue:

the completed contract method

the percentage of completion method

2 methods of calculating percentage of completion:

Input - efforts expended. Ex: costs incurred or labor hours expended.

Output - results achieved. Ex: units produced, milestones achieved.

What is construction in progress (CIP)?

CIP:

Asset - B/S account

Represents the costs of a project that are not completed yet.

GP is also added to CIP

CIP is recognized in the balance sheet JEs for both point in time and % of completion method

B/S JEs to recognize:

CIP

billings on CIP

*used in both % of completion and point in time projects*

Dr. CIP (Costs incurred so far)

Cr. Cash

Dr. AR: Billing in progress ($ you’ve asked the customer to pay already — can be <>CIP)

Cr. Billings on CIP (Contra-Asset — is the reverse of CIP)

I/S JEs for % of completion method?

Dr. CIP — GP

Dr. Construction Expense

Cr. Revenue— Long-term contracts

Point in time contract will not have this revenue/expense entry until the project is complete.

Process to calculate % rev recognized on long-term construction projects?

What are the total expected costs for the project? → Costs actually incurred to date + Estimated costs

What % of total costs have been incurred? → Costs actually incurred / Total Expected Costs

Revenue to recognize is based on the #2 → % from #2 x total contract revenue

What happens if CIP > Billings?

What happens if CIP<Billings?

If CIP>Billings → Asset

If CIP<Billings → Liability

How to record loss in long-term construction project?

Recognized immediately in period incurred or probable to be incurred.

Same for both % of completion and point in time contracts.

JE:

Dr. Loss on construction project

Cr. CIP

What kind of costs to obtain a contract are treated as assets vs expenses?

Asset: expected to be recovered and directly related to the contract

Expenses: would be incurred regardless of if the contract was obtained

Principal vs Agent

Principal - the entity in control of the good/service. Records gross amount of revenue for providing.

Agent - helps principal sell to customer. Records commission as revenue.

Forward Option

Entity has an obligation to repurchase the asset.

Call Option

Entity has a right (option) to repurchase the asset.

Put Option

Customer has the right to require the entity to repurchase the asset.

Bill and Hold arrangement

special conditions where entity can recognize revenue even though customer doesn’t have control over product.

this is because:

it is a specialized product/service

is set aside and ready to be provided to the customer

Consignment Relationship

principal provides a dealer/agent with product.

principal recognizes revenue when agent sells to customer.

Principal recognizes revenue when expiration of time in contract.

Warranties are accounted for as a …

separate performance obligation.

Accounting Estimate change

prospective treatment.

ex: depreciation, change in useful life of asset.

no prior period adjustment needed.

Accounting Principal change

switching from one acceptable accounting method to another.

Ex: FIFO to LIFO, cost to equity method for investments, % of completion to point in time.

Wrong Ex: Cash to accrual is NOT acceptable method bc GAAP requires accrual→ this would be error correction.

when multiple years are presented on financial statements for comparison, change in principal requires restatement of prior years shown.

Cumulative effect of change adjusts beginning RE, net of tax.

Exception: When changing from FIFO to LIFO

Investment income vs return of capital

Under equity method:

Investment income = Company earnings * % ownership

Return of capital = proportion of dividends received

Accounting Entity change

when there’s a consolidation or merger. in this case, the entity must restate any prior period financials that are being presented on the statements for comparison.

Accounting Error

4 examples?

anytime there is:

mathematical mistake (ex: adding/subtracting incorrectly)

misapplication of GAAP (ex: expenses an asset instead of capitalizing)

misuse or oversight of facts available at the time (ex: forgetting to record depreciation)

fraud/intentional misstatement

corrections affect the retained earnings and are shown net of tax. If prior statements are shown to compare, these need to be restated

Summary of significant accounting policies

description of all significant policies included in financial statements

1st footnote: general description

2nd footnote: significant accounting policies

What’s included:

measurement based used in prepping the F/S

specific accounting principals and methods

Remaining notes to the financial statements

4 examples?

subsequent events

fair value estimates

contingency losses

contractual obligations

tells about various assumptions used in preparation that might not be clear in current statements.

Disclosures of risks and uncertainties

Nature of operations

Use of estimates in preparation of financials

Vulnerability due to certain concentrations

relying too heavily on a certain customer or industry that is vulnerable.

tells about the business environment of the entity to provide additional clarity for investors.

Subsequent Event

an event or transaction that occurs after the balance sheet date but before financial statements are issued or are available to be issued.

2 types of Subsequent Events

Type 1 - Recognized → condition that existed at B/S date → should be recognized in F/S

Type 2 - Nonrecognized → condition that did not exist at balance sheet date → should not be recognized in financial statements.

F/S = Available vs Issued

available → board approves the financials. could take weeks or months after year-end, depending on the company.

issued → same dates for 10-K or 10-Q, once widely distributed

Time period to continue evaluating subsequent events

Public companies → evaluate events until F/S are issued

Private companies → evaluate until statements are available

why reissue financial statements?

if there is a material accounting error, something has been omitted, auditors require it, or there is a change in accounting entity.

subsequent events after reissue?

should not recognize events that occurred after the original issue date unless required by GAAP.

most advantageous market

best price with lowest transaction costs

principal market

highest volume sold

3 types of FV valuation techniques:

MIC

Market

Income

Cost

Market Approach

Think: “What are others paying for something similar?”

Uses prices and info from actual market transactions (comparable companies, sales of similar assets).

Example: Using the P/E multiple of similar public companies to value your private company.

Cost Approach

Think: “What would it cost to replace or reproduce this?”

Based on the amount currently required to replace the service capacity of an asset, adjusted for depreciation/obsolescence.

Example: Valuing a machine by what it would cost to buy a new one today, minus wear and tear.

Income Approach

Think: “What future cash flows will this bring me, discounted back to today?”

Converts expected future amounts (like cash flows, earnings, or cost savings) into a single present value.

Example: DCF (discounted cash flow model).

FV hierarchy of inputs

Ranked by reliability. 1 = most reliable.

Level 1: Observable, active, identical. Quoted prices in active markets for identical assets or liabilities (most reliable).

Ex: Closing price of Apple stock on NASDAQ.

Level 2: Observable, quoted. Other observable inputs (directly or indirectly).

Ex: Prices for similar assets, interest rate curves, yield spreads.

Level 3: Unobservable and assumption based (least reliable, based on company assumptions/models).

Ex: Discounted cash flow for a private company’s shares.

FV disclosures

Fair value disclosures:

Valuation technique (MIC)

Which level of inputs were used (Level 1 to 3)

Changes in methods/assumptions from prior periods

Needed because it helps users judge quality and reliability of reports.

Exceptions for FV disclosures

if it is not practical to measure

can’t be reasonably determined

not super reliable

Special Purpose Frameworks

OCBOA

alternate set of accounting rules from GAAP/IFRS.

OCBOA → other comprehensive bases of accounting

exist because it might be cheaper or simpler than GAAP and are used when GAAP isn’t required.

Main condition: financial statements have to be clear on which framework is being used.