Unit 4 - Macro Economics Stephens

5.0(4)

Card Sorting

1/42

Earn XP

Last updated 1:47 PM on 5/22/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

43 Terms

1

New cards

aggregate

total of all (sum of all)

2

New cards

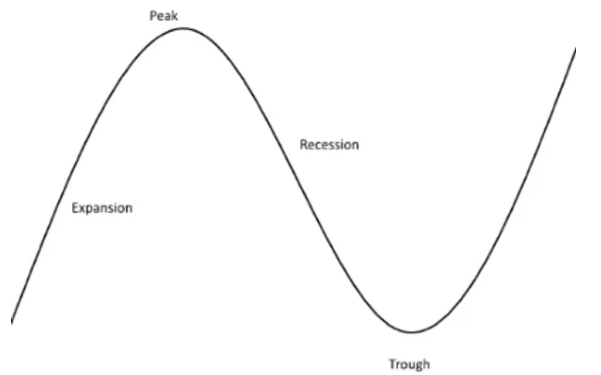

expansions

increased economic growth

(rising up on the business cycle)

(where we want to be)

(rising up on the business cycle)

(where we want to be)

3

New cards

peak

economic growth levels off

(tip of the business cycle)

(tip of the business cycle)

4

New cards

contraction

decreased economic growth

(going down on the business cycle)

(going down on the business cycle)

5

New cards

trough

recovery period

(bottom of the business cycle)

(bottom of the business cycle)

6

New cards

recessions

6 month decline in real GDP

7

New cards

inflation

increasing prices for goods and services

(normal in a growing economy)

(normal in a growing economy)

8

New cards

US economic goals

1 - growth

2 - low unemployment rates

3 - stable prices

2 - low unemployment rates

3 - stable prices

9

New cards

Federal Reserve Act

created the federal reserve bank

(1913)

(FED)

(1913)

(FED)

10

New cards

federal reserve bank

* board of governors

* 7 individuals nominated by President and approved by congress

* district banks

* 12 banks, 12 districts

* we live in district 7

* 7 individuals nominated by President and approved by congress

* district banks

* 12 banks, 12 districts

* we live in district 7

11

New cards

economic indicators

* GDP

* unemployment rate

* consumer price index (CPI)

* unemployment rate

* consumer price index (CPI)

12

New cards

GDP

measures the total value of all domestically produced goods/services

13

New cards

GDP equation

GDP=C+I+G+NX

c - consumer spending

I - investment (business)

G - government

NX - net exports (exports-imports)

c - consumer spending

I - investment (business)

G - government

NX - net exports (exports-imports)

14

New cards

real numbers

numbers adjusted for inflation

15

New cards

nominal numbers

numbers not adjusted for inflation

16

New cards

base year

equal to 1 or 100

used for chained dollars

used for chained dollars

17

New cards

chained dollars

$ chained into a base year

18

New cards

labor force

population 16 and older

19

New cards

unemployed population

16 or older actively seeking however unable to find employment

20

New cards

unemployment rate equation

unemployment rate=unemployed people/labor force

21

New cards

unemployment rate uses

* used as a major indicator of the business cycle

22

New cards

low unemployment rate

lower unemployment suggests expansions

23

New cards

high employment rate

rising unemployment suggests contractions

24

New cards

frictional unemployment

normal, people between jobs

25

New cards

structural unemployment

normal, unemployed because of market changes

26

New cards

seasonal unemployment

normal, expected due to seasonal changes

27

New cards

cyclical unemployment

caused by a downward movement in the business cycle, during a recession

28

New cards

natural unemployment rate equation

natural unemployment=frictional unemployment + structural unemployment

29

New cards

unemployment measuring

* the Bureau of Labor Statistics calculates this every month, gets media coverage

* unemployment in April 2023 was 3.4% (relatively low)

* unemployment in April 2023 was 3.4% (relatively low)

30

New cards

deflation

decrease in prices for goods and services

* usually caused by overproduction or decreasing demand

* not good long term for an economy

* usually caused by overproduction or decreasing demand

* not good long term for an economy

31

New cards

purchasing power

the ability to purchase goods and services with your $

* inflation causes decrease

* inflation causes decrease

32

New cards

groups harmed by inflation

* fixed incomes

* savers

* lenders

* savers

* lenders

33

New cards

groups helped by inflation

* some investors

* borrowers

* borrowers

34

New cards

demand pull inflation

will happen when aggregate demand increases

* increase in money supply

* increase in money supply

35

New cards

cost push inflation

will happen when productive resources increase in price

* productive resources (land, labor, capital)

* inflation causes inflation

* productive resources (land, labor, capital)

* inflation causes inflation

36

New cards

hyperinflation

excessive and increasing out of control, typically defined as 50% increase each month

37

New cards

consumer price index (CPI)

standard measurement of inflation

* calculated by the Bureau of Labor Statistics

* calculated by the Bureau of Labor Statistics

38

New cards

market basket

survey of prices of goods and services for atypical urban consumer (1982-84)

* products everyone would use (milk, eggs, gas)

* products everyone would use (milk, eggs, gas)

39

New cards

how countries control inflation

decrease the money supply, not popular for consumers/workers

* monetary policy, fiscal policy

* monetary policy, fiscal policy

40

New cards

monetary policy

decrease money supply (Federal Reserve Bank)

* used to control inflation

* used to control inflation

41

New cards

fiscal policy

increasing taxes

* used to control inflation

* used to control inflation

42

New cards

how countries deal with recessions

add money into circulation

* lower interest rates

* rates which banks loan money to the public

* open market operations

* buy bonds

* lower reserve ratio

* lowers money banks are required to hold

* lower interest rates

* rates which banks loan money to the public

* open market operations

* buy bonds

* lower reserve ratio

* lowers money banks are required to hold

43

New cards

business cycle

expansion, peak, contraction, trough