ACYTAXN: Capital Assets

1/7

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

8 Terms

Which of the following is considered a capital asset?

a. Stock in trade of the taxpayer, or other property of a kind which would properly be included in the inventory of the taxpayer

b. Property held by the taxpayer primarily for sale to customers in the ordinary course of trade or business

c. Real property used in trade or business of the taxpayer

d. None of the above

D

Which of the following statement/s is/are correct?

I. Capital assets include real property not used in trade or business of taxpayer.

II. The holding period does not apply to corporations; hence, capital gains and losses are capitalized at 50%.

III. In computing the gain or loss from sale or other disposition of property acquired as gift or donation, the basis of cost shall be the same as it would be in the hands of the donor.

IV. The gain or loss recognized from sale or exchange of capital assets by an individual taxpayer, other than real properties and shares of stocks, which are held for more than 12 months shall be 50% of the net capital gain.

a. I, II and IV b. I, III and IV

c. I, II and III d. All of the above

B

Which of the following is not one of the requisites for exemption from CGT on sale of principal residence?

a. The taxpayer is a citizen of the Philippines or resident alien

b. Notice to make such utilization was given to the BIR within 60 days from the date of sale

c. The proceeds of the sale was invested in acquiring a new principal residence

d. The reacquisition of the new residence must be within 18 months from date of sale

B

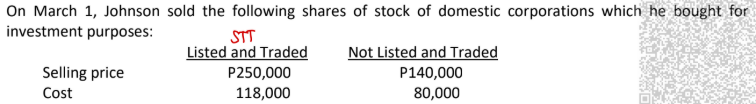

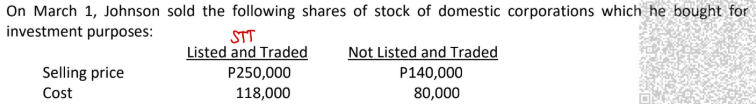

How much is the capital gains tax?

a. P3,000 b. P9,000

c. P6,000 d. P12,000

B

Assume that Johnson is a dealer in securities, the capital gains tax should be:

a. P0 b. P6,000

c. P3,000 d. P12,000

A

Assume the shares sold were issued by foreign corporations, the capital gains tax should be:

a. P0 b. P6,000

c. P3,000 d. P12,000

A

Assume the shares not listed and traded in the local stock exchange were only sold for 60,000, the capital gains tax should be:

a. P0 b. P9,000

c. P6,000 d. P12,000

A

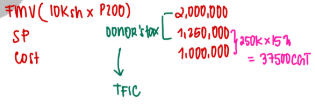

Derek sold 10,000 shares in Alpha Corporation, a closely-held domestic corporation, on June 30 for P1,250,000. The shares were acquired by Derek a year ago for P1,000,000. The book value per share based on the audited financial statements of the Company was 200. How much is the capital gains tax?

a. P0 b. P30,000

c. P20,000 d. P37,500

D