4.4.1 - financial sector

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

15 Terms

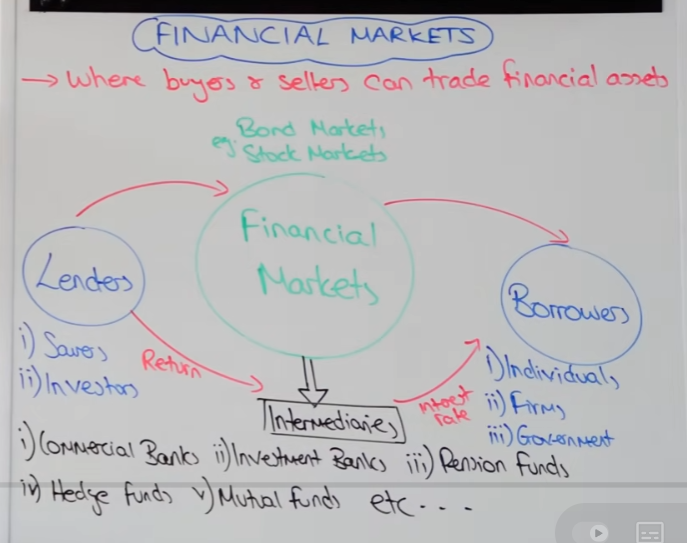

define financial market

a financial market is any exchange that facilitates the trading of financial instruments such as stocks, bonds, foreign exhcnage, insurance or commodities such as oil or gas

what are the key 5 roles of a financial market

to facilitate saving by households and business (secure place to save - store money - earn interest)

lend to businesses and individuals (financial market = intermediary between savers + borrowers)

facilitate the final exchange of goods and services - cash credit card contactless or foreign exchange

provide forward markets in currencies and commodities

to provide a market for equities

what are the three main types of financial markets

the money market - short term finance - up to 12 months - provided by commercial banks - provides short term gov borrowing to fund government budget deficit (fiscal)

the capital market - company shares or bonds are sold - long term 10 - 20 year loans - universities government and companies

foreign exchange market - currencies are traded - forward exchange or spot exchange

what is a forward market (currency)

a forward market in currency is a binding contract ( cant be broken ) in the foreign exchange market

locks in exchange rate for the buying and selling rate in the future

risk management technique + gives certainty - to guard against any changes in exhange rate

what is the forward market ( commodities )

it is a binding contract between buyers and sellers of a commodity

agreeing on a price of a commodity on a future date

binding means cant be broken

risk management technique and creates more certainty against changes in the price of the commodity

draw the link between financial markets and borrowers - describe it

commercial banks objective is to take lenders money, in a deposit, and return is payed

from savings, loans can be made and lent out to consumers and firms

they will charge a higher rate of interest to borrowers and reward savers with a lower rate of interest.

what are the characteristics of money

durability

portability

divisibility

acceptability

hard to counterfeit

valuable

what are the key functions of money

medium of exchange

store of value

unit of account

standard of deferred payment

what is market failure - and the types of market failure

market failure - occurs when a market fails to allocate recourses in an efficeint way, leading to a loss in economic and social welfare

externalities from financial instability

monopoly power in financial institution

market rigging/ collusion

speculative bubbles and irrational behaviour

moral hazard and attitudes to risk taking

asymmetric information + complexity

explain externalities from financial instability and give examples

third party effects by UK banks taking too much risk

tax payer - bail out cost - tax burden goes up

employees - higher unemployment rate

government - fiscal deficite

describe asymmetric information and give examples

one party holds more information then the other party

buyers and sellers of shares - insider information on stock

credit risk - banks knows more about the debtor

what is a moral hazard and examples of moral hazzard in the financial market

state bails out failing banks - this causes banks to be more risky as the state is likely to bail out

generous health insurance can lead to over prescription of drugs

describe market power and give examples

companies in the market act together ( collude ) to stop a market from acting as it should, in order to get an unfair advantge

illegal - stops market forces - supply and demand - harms rate of competition

e.g price fixing in the bond market

what is market power ( oligopoly/ monopoly ) and give examples

banking sector

high barriers to entry

unlikely to switch - habitual behaviour

what is speculative bubbles - give examples

a bubble exists when the market price is driven well above what it should bee - herd behaviour - market booms then busts

stages -

displacement stage - excitement grows

price boom - demand surges + limited ( inelastic supply )

euphoria - investors take advantage ( irrational exuberance )

profit taking stage - investors sell when prices are out of line with fundamentals

panic - herd mentality - desperate selling