class 10- Central banks & monetary policy.

1/21

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

22 Terms

What are the 3 functions of central banks?

STATE INSTITUTIONS=

manage finances of state

manage currency to allow economic activity

unique lender of last resort to banks, governments & economy.

Central banks and emergency finace:

try to prevent emergencies instead of reacting.

signaling to markets that they will not be able to make money by selling off a currency on financial markets:

3 examples: 2008, 2012, 2020.

On an international level?

provider of last resort= hegemon’s central banks

What do central banks engage in when the manage the economy?

MONETARY POLICY.

ensure enough loney in circulation.

ensure banks have enough

ensure governments have acces to finance.

act through primary interest rate

What are the 3 main goals of the central bank?

PRICE STABILITY= low inflation

ECONOMIC STABILITY= smoothing

FINANCIAL STABILITY= preventing economic crashes.

What is the fisher equation?

real interest rate= nominal interest rate- inflation rate

What is disinflation?

= decrease in the rate of inflation

Who are the winners & losers from inflation?

winners=

anyone earning money

debt payers

losers=

anyone who has money

investors, savers, creditos

pensions (fixed benefits)

who are the winners & losers from deflation?

winners=

anyone who has money

investors, savers, creditos

pensions (fixed benefits)

real value of assets increase

losers=

anyone earning money

debt payers

society= consumption drops → delays.

If inflation is too high…

If unemployemt too high

→ central banks can…

too high → raise interest rate.

unemployement → lower interest rates

The measurement approach: (pros/ cons)

Central bank pays attention to prices in order to change interest rates. (rise when prices rise…)

PRO: evidence based, works without paying attention to money supplu.

CON: suffers blind spots (didnt think housing was part of inflation)

The WS/ PS model approach:

Central bank think inflation caused by how workers and firms bargain over prices.

PROS: goes beyond economic shocks to look at how firms and workers react

CONS: suffers from blind spots: ignores financial markets = unrealistic

How can firms & workers cause inflation?

baraganing power of firms increases over consumers= greedflation.

of workers over firms: wage increase that doesnt result from increased productivity.

When increase in price of oil:

downwards shift PS curve

prices rise

real wages fall

positive baragaing gap

peristently higher inflation

Inflation can be caused by supply and demand shocks:

supply shock ?

solution= windfall taxes on firms

demand shock =cannot boost production → rise prices.

solution= fiscal policy investments to increase supply or higher interest rates

Philipps curve

inflation and unemployement curve

moderate inflation is okay as long as employement goes with it

baragining power and inflation:

bargaining power can increase inflation over time

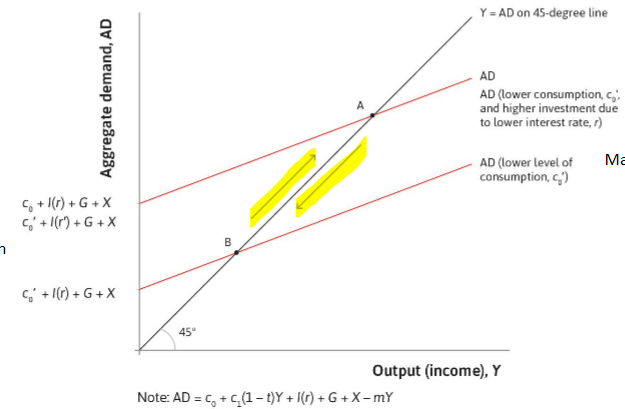

How does the central bank stimulate investment?

lowering real interest rate.

AD curve shifts upwards

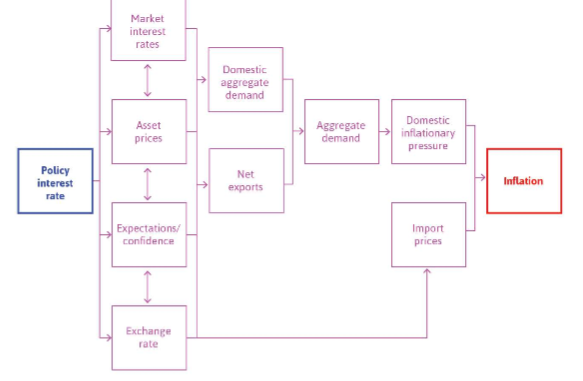

Transmission mechanisms

asset prices: interest rate goes down → asset prices go up

Exports: interest rate goes down → exports go up

expensive imports drives up inflation.

Can interest rate go below 0%?

no “zero lower bound”

should use fiscal policy

if not use quantitative easing

Do Monetary and fiscal policy work together?

Ideally yes → work in same direction as they share the same path.

created success in US.

What does the effectivness of central banks depend on?

transmission mechanisms

interaction with fiscal policy

capacity constraints (zero lower bound)