managerial accounting exam 3

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

25 Terms

The concept of capital budgeting

Convincing your company to lend you/your department the

resources for an investment to expand/improve your business.

Time value of money

a dollar today is worth more than that same dollar in the future

cost of capital

average rate of return a company must pay creditors and stockholders for use of their funds. also known as the discount rate.

payback method focuses on

cash Flows (NOT NOI), and DOES NOT USE Time Value of Money

what is the payback method?

How many years (or partial years) does it take to pay back the initial

investment? If given NOI, you must add back depreciation to get cash flows to calculate the

payback period

net present value

calculate NPV of all cash outflows and inflows using the

discount factor associated with the discount rate and the year of the cash outflow/inflow

if NPV is positive

project is acceptable because the internal rate of return is greater than the required rate of return

if NPV =0

project is acceptable because the internal rate of return is equal to the required rate of return

if NPV is negative

project is rejected because the internal rate of return is less than the required rate of return

internal rate of return (IRR)

IRR is the discount rate that makes the net present value

(NPV) of all cash flows equal to zero in a discounted cash flow analysis

simple rate of return focuses on

incremental NOI (NOT CASH FLOWS), and DOES NOT USE Time

Value of Money

simple rate of return

also called accounting rate of return. Calculated by dividing the

annual incremental NOI by the initial investment. It approximates the IRR

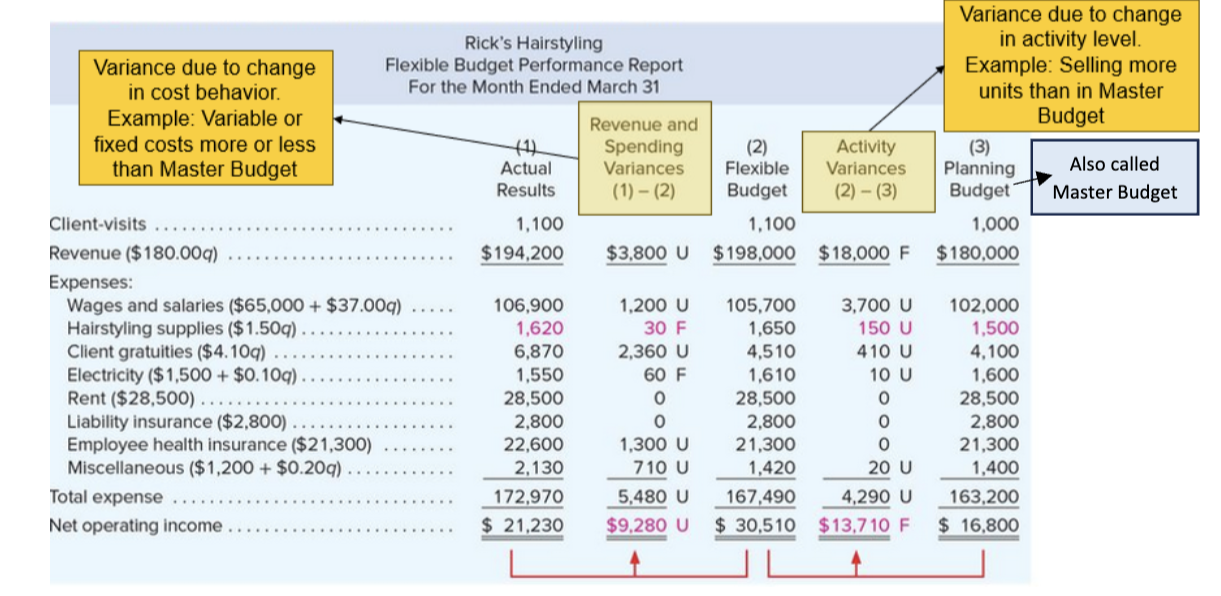

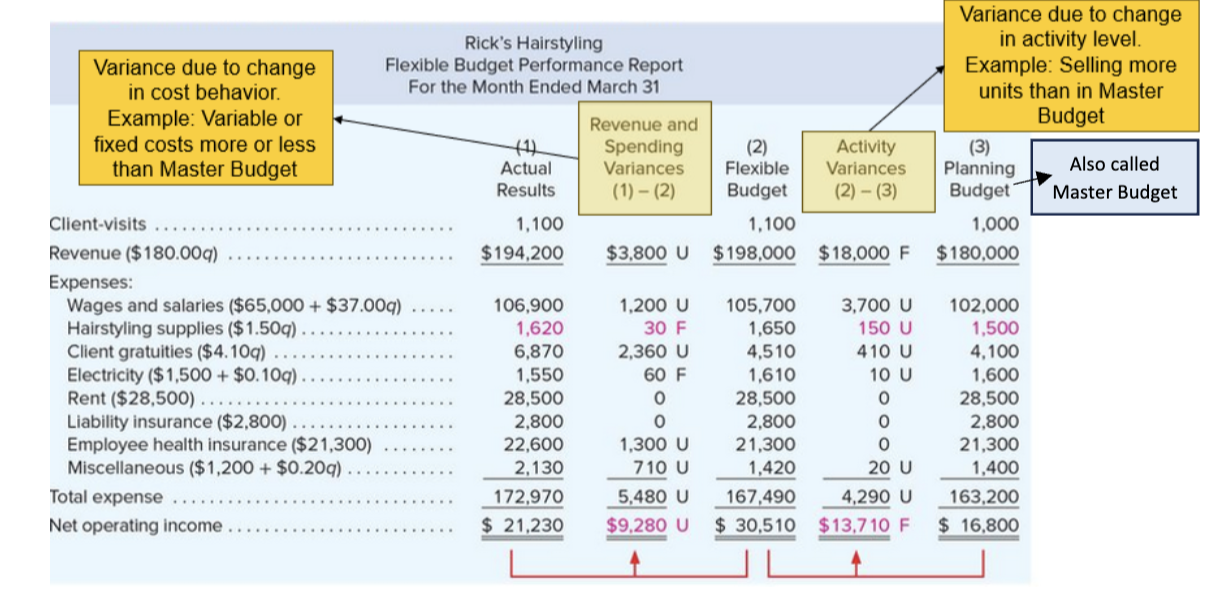

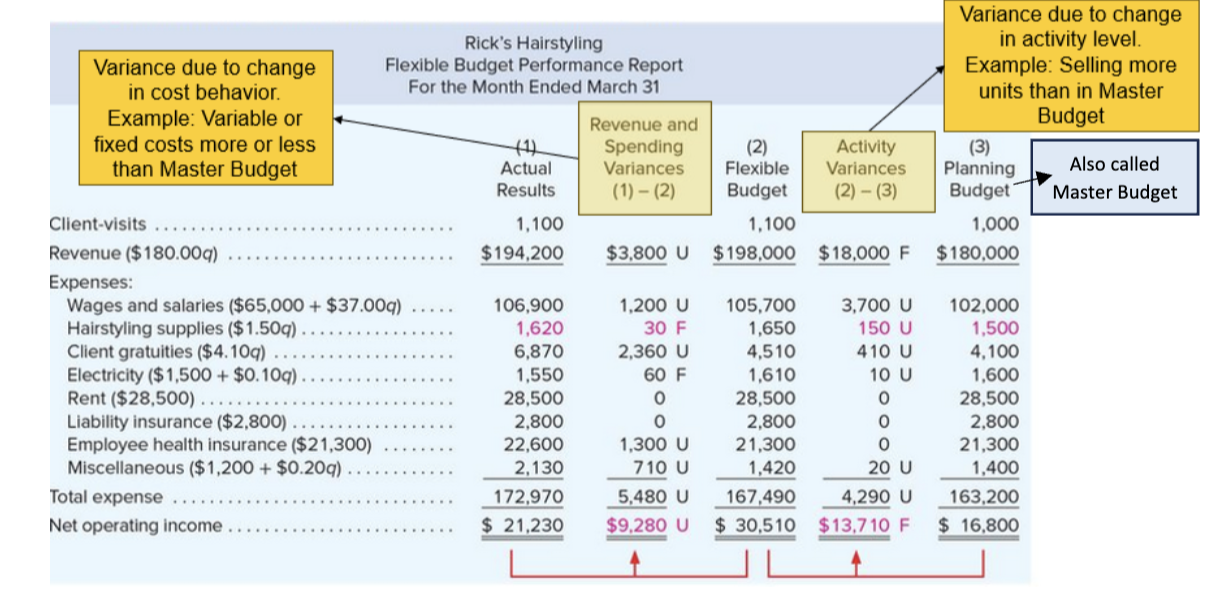

When evaluating performance, you should

not compare actual results at one activity level to a budget at another activity level

True or False: Performance reports help managers identify the difference between actual results and planned

results

True

activity variance

explains the change in revenue and expenses when the master budget

Revenue or spending variance

explains the change in revenue and expenses related to

a change in cost behaviors. Compare Actual Results with Flexible Budget.

Favorable (F)

Will increase net operating income

Unfavorable (U)

Will decrease net operating income

management by exception is used when

evaluating variances that need to be investigated further

Step 1 in flexible budget performance report

complete master (planning) budget before the period begins (before march in the example)

Step 2 in flexible budget performance report

add actual results for the period (march)

Step 3 in flexible budget performance report

Complete Flexible Budget using the Actual Activity Level (Client visits of 1,100 in the above example). The flexible budget tells us what should have happened based on the actual level of activity

Step 4 in flexible budget performance report

Calculate Activity Variances (Flexible Budget minus Master Budget). Enter as absolute values and identify each line-item variance as Favorable (F) or Unfavorable (U) depending on how they affect NOI. The Activity Variance is the Master Budget variance due to change in the activity level. Also called Master Budget

Step 5 on flexible budget performance report

Calculate Revenue and Spending Variances (Actual Results minus Flexible Budget). Enter as absolute values and identify each line-item variance as Favorable (F) or Unfavorable (U) depending on how they affect NOI. The Revenue and Spending Variance is the Master Budget variance due to changes in cost behaviors

calculate total variance=

Revenue and Spending Variance +/- Activity Variance. In the above example, $9,280 U plus $13,710 F = Overall Variance of $4,430 F. Or calculate as Actual Results NOI of $21,230 less Master Budget NOI of $16,800 equals Overall Variance of $4,430 F.