Quantic - Accounting and Finance

1/188

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

189 Terms

Generally Accepted Accounting Principles (GAAP)

US companies' standard set of rules for the reporting and recording of financial data

International Financial Reporting Standards (IFRS)

Foreign companies' standard set of rules for the reporting and recording of financial data

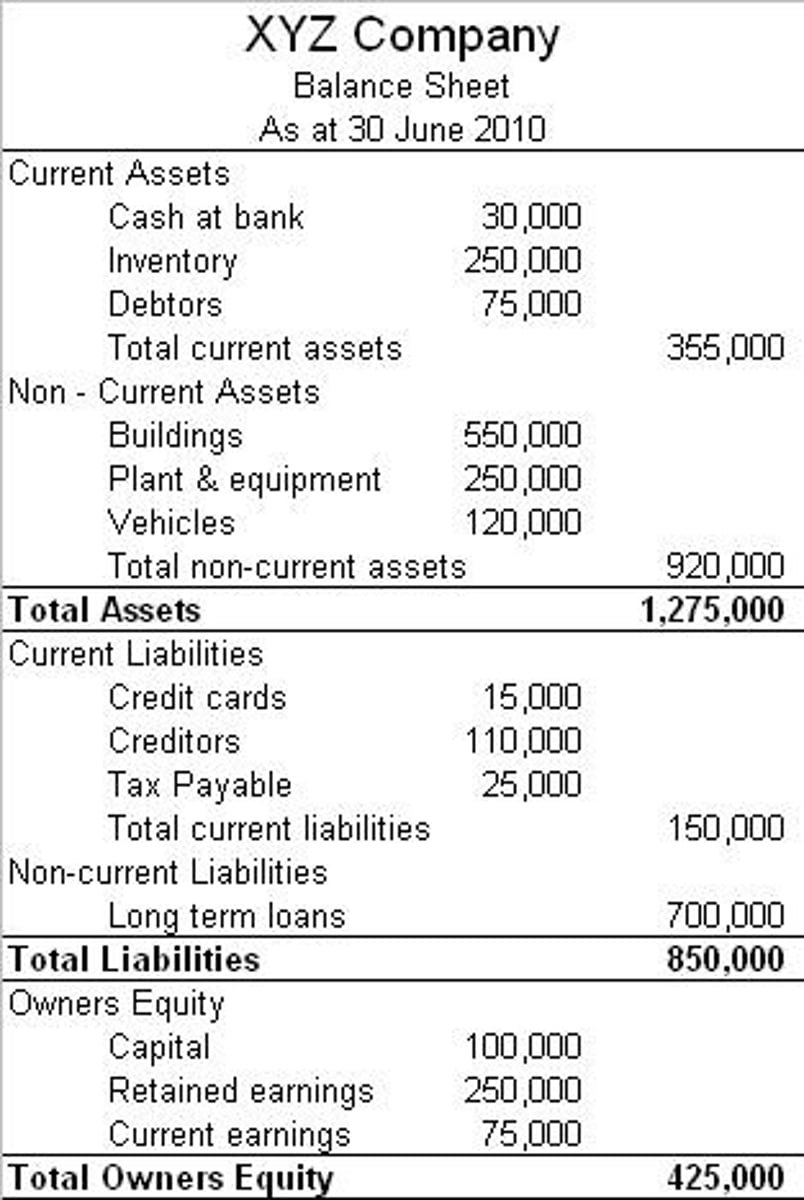

Balance Sheet

A financial statement that reports assets, liabilities, and owner's equity on a specific date. Gives a glimpse into the health and composition of a business.

Double-Entry Bookkeeping

A transaction requires at least two entries to keep the balance sheet balanced

Dual-Aspect Concept

A basic accounting concept stating that there are two sides to every accounting transaction. If there is a change in the total amount of assets, there needs to be a resulting change in liabilities, equity, or both. (Recording both sides of each transaction is known as 'double-entry bookkeeping' or 'double-entry accounting'.)

Money-Measurement Concept

Recording and reporting economic activity in a common monetary unit of measure such as the dollar. Only items expressed as monetary amount can go on a balance sheet.

Balance Sheet Equation

Assets = Liabilities + Equity (aka. the accounting equation)

Assets

Items owned and controlled by an entity, valuable to the entity, and acquired at a measurable cost

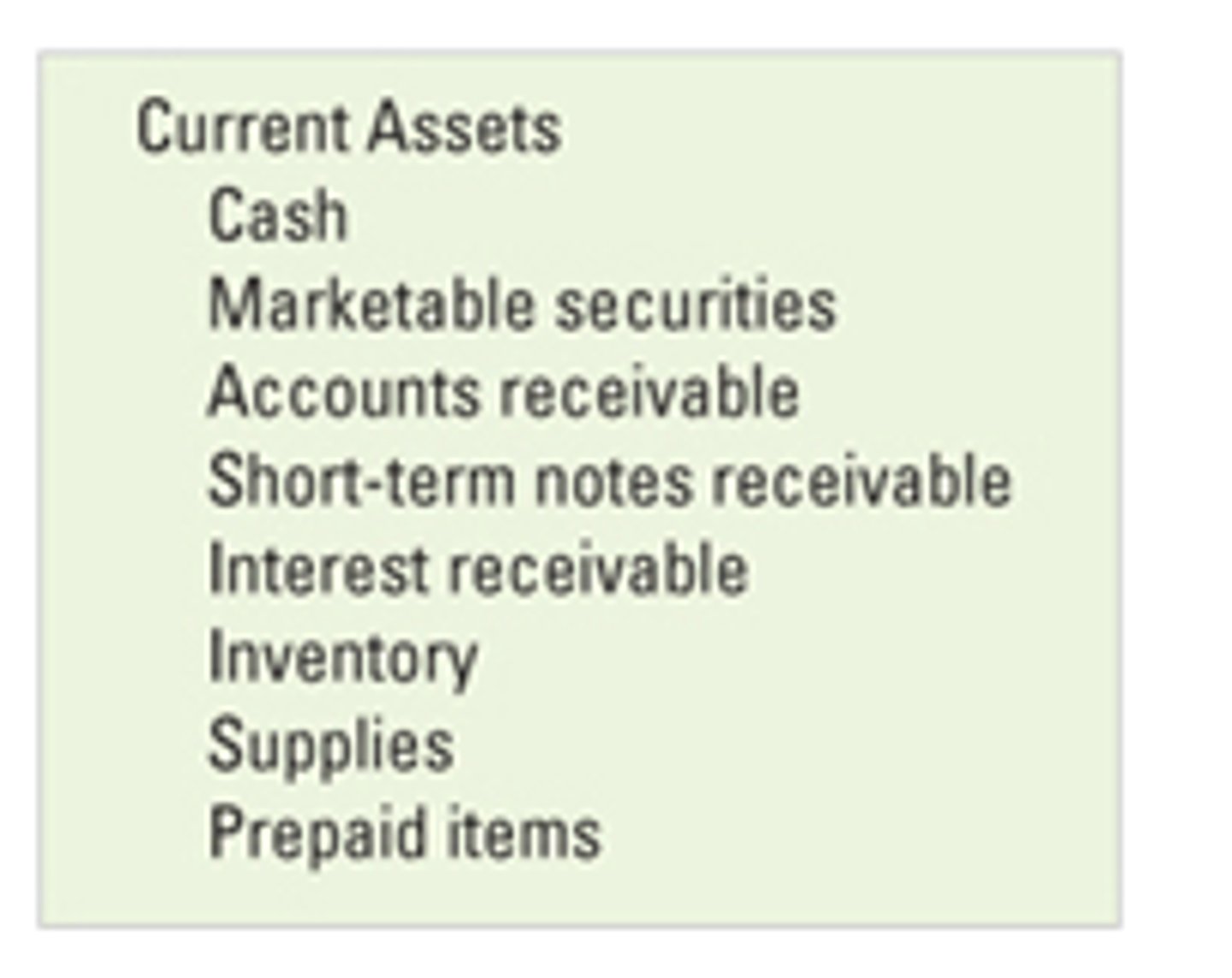

Current Assets

Assets expected to be converted into cash or used up by the business within one year

Accounts Receivable

Where a company records credit purchases by its customers. The company expects these customers to pay them in cash in the near future. (current asset)

Inventory

Goods an entity intends to sell (current asset)

Prepaid Expenses

Monies paid in advance for pending expenses - for example, paying rent in advance (current asset)

Noncurrent Assets

will not be used up or converted into cash for at least one year

Property, plant, and equipment (PP&E)

tangible assets that depreciate, or lose value, over time due to wear and tear (noncurrent asset)

Creditor

Anyone who lends money or extends credit

Liabilities

Debts owed to outside entities or creditors in return for borrowed goods, services, or monies

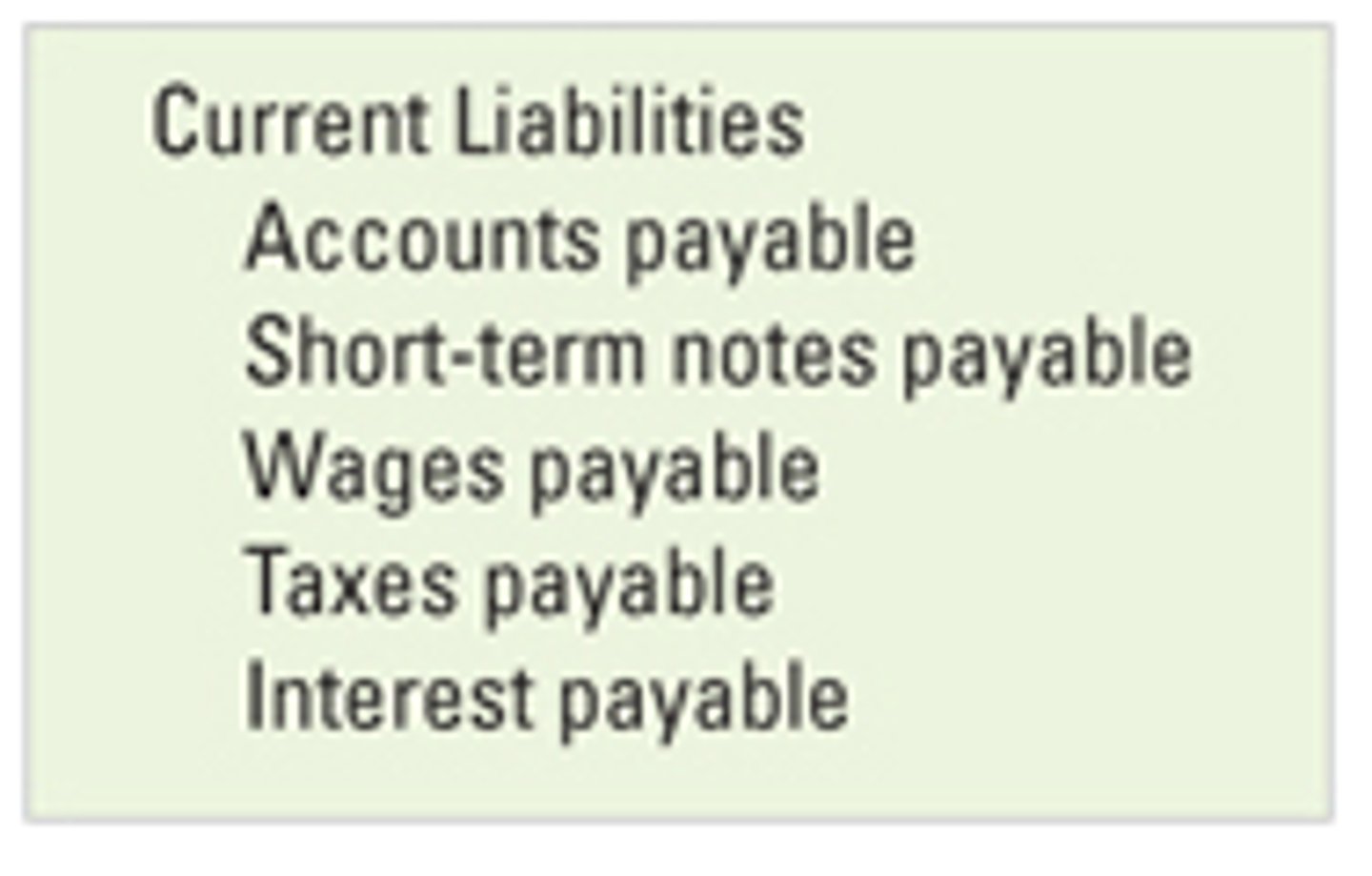

Current liabilities

obligations that will be paid within one year

Long-term liabilities

Obligations that won't be paid until at least a year has passed

Bank Loans (Bank Loan Payable)

Can be recorded under both current and long-term liabilities.

Accounts Payable

Obligatory monies owed by an entity for goods and services. The opposite of Accounts Receivable.

Estimated Tax Liability

The estimated amount of what will be due in taxes per year

Equity

Money (capital) either supplied by equity investors or collected in the form of an entity's retained earnings.

Paid-In Capital

Money supplied by investors through the purchase of stock

Retained Earnings

Income generated by an entity's successful operations that is reinvested in the entity

Proprietorship

An entity with one sole owner and investor

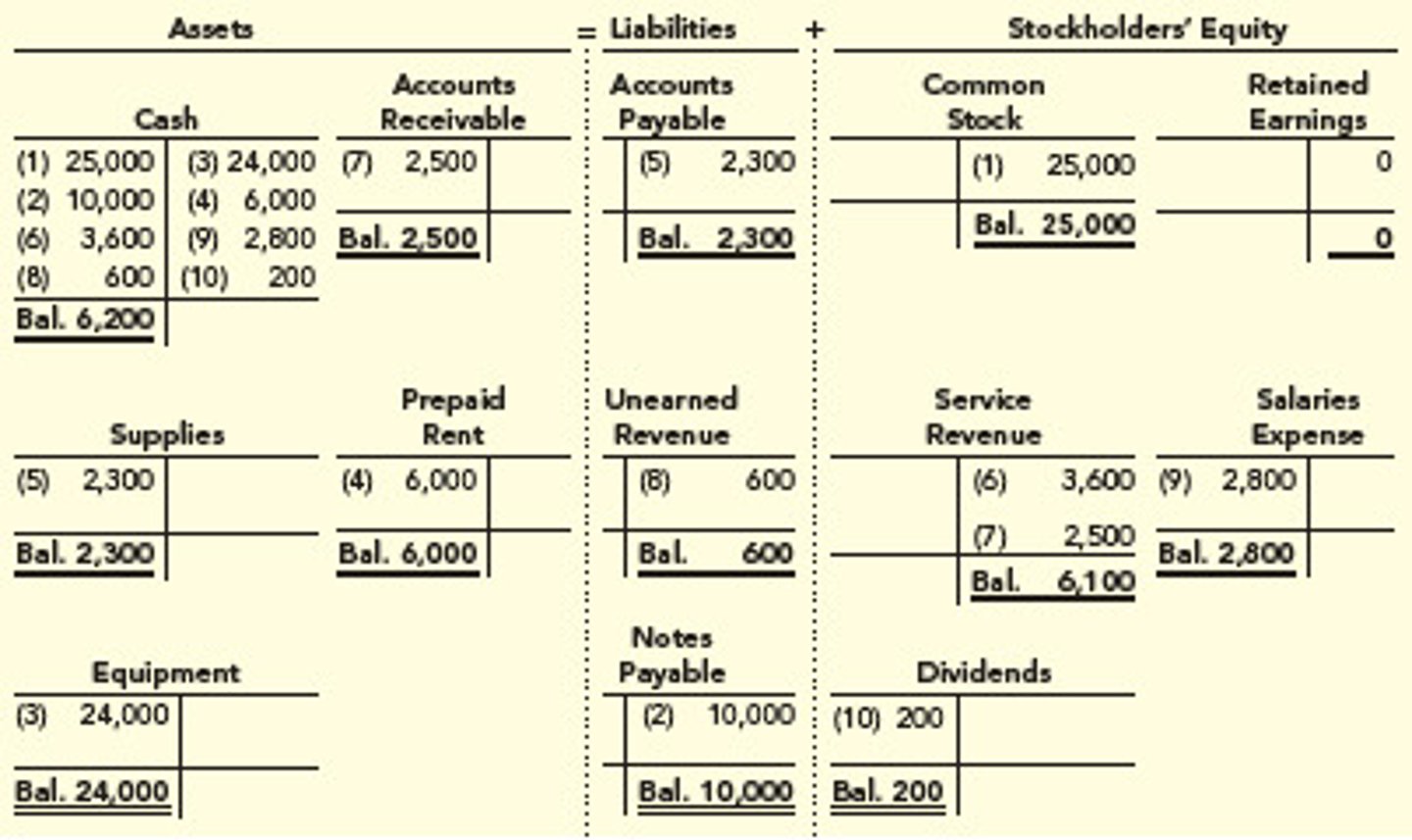

T-accounts

Charts used to record increases and decreases of individual accounts found on the balance sheet

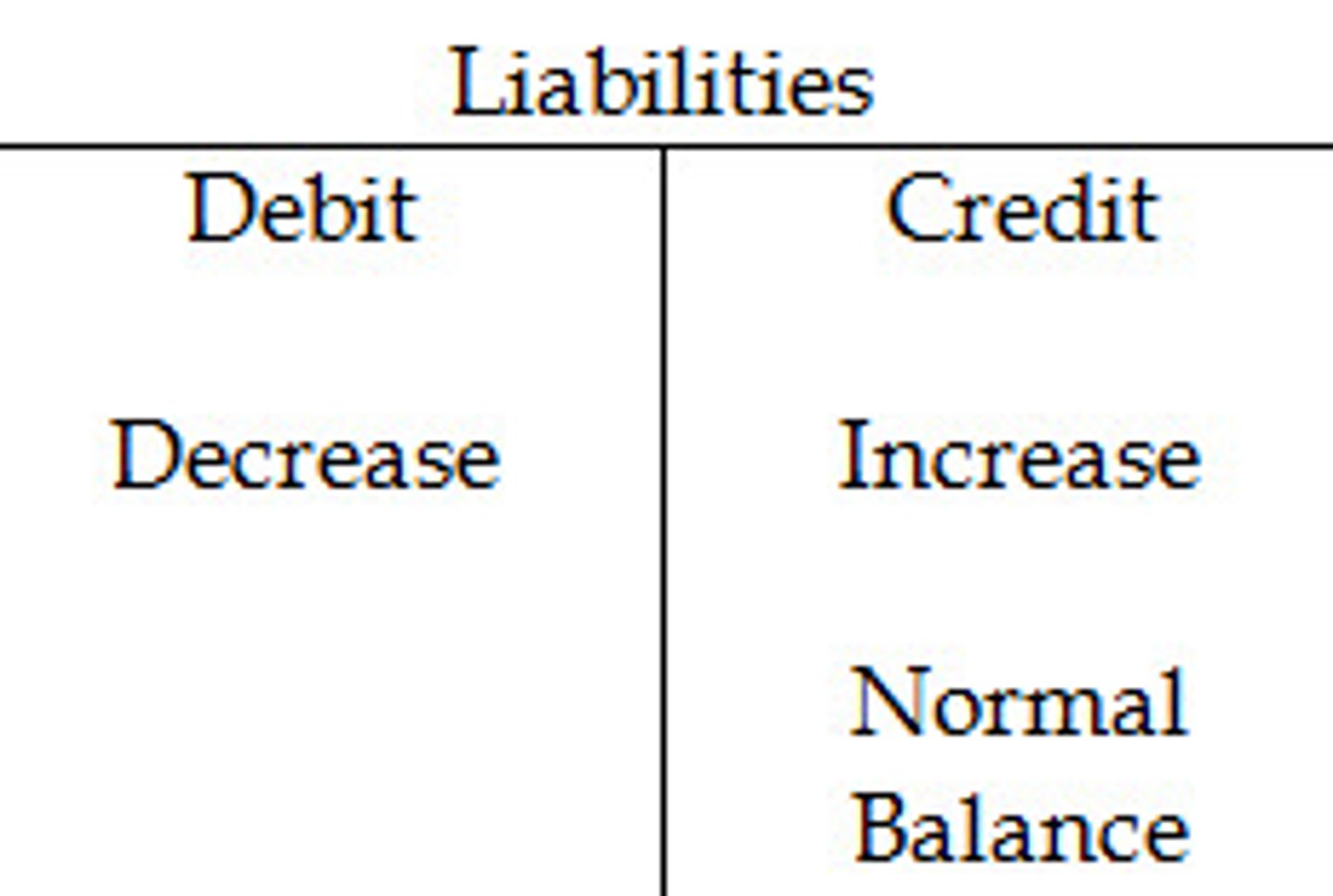

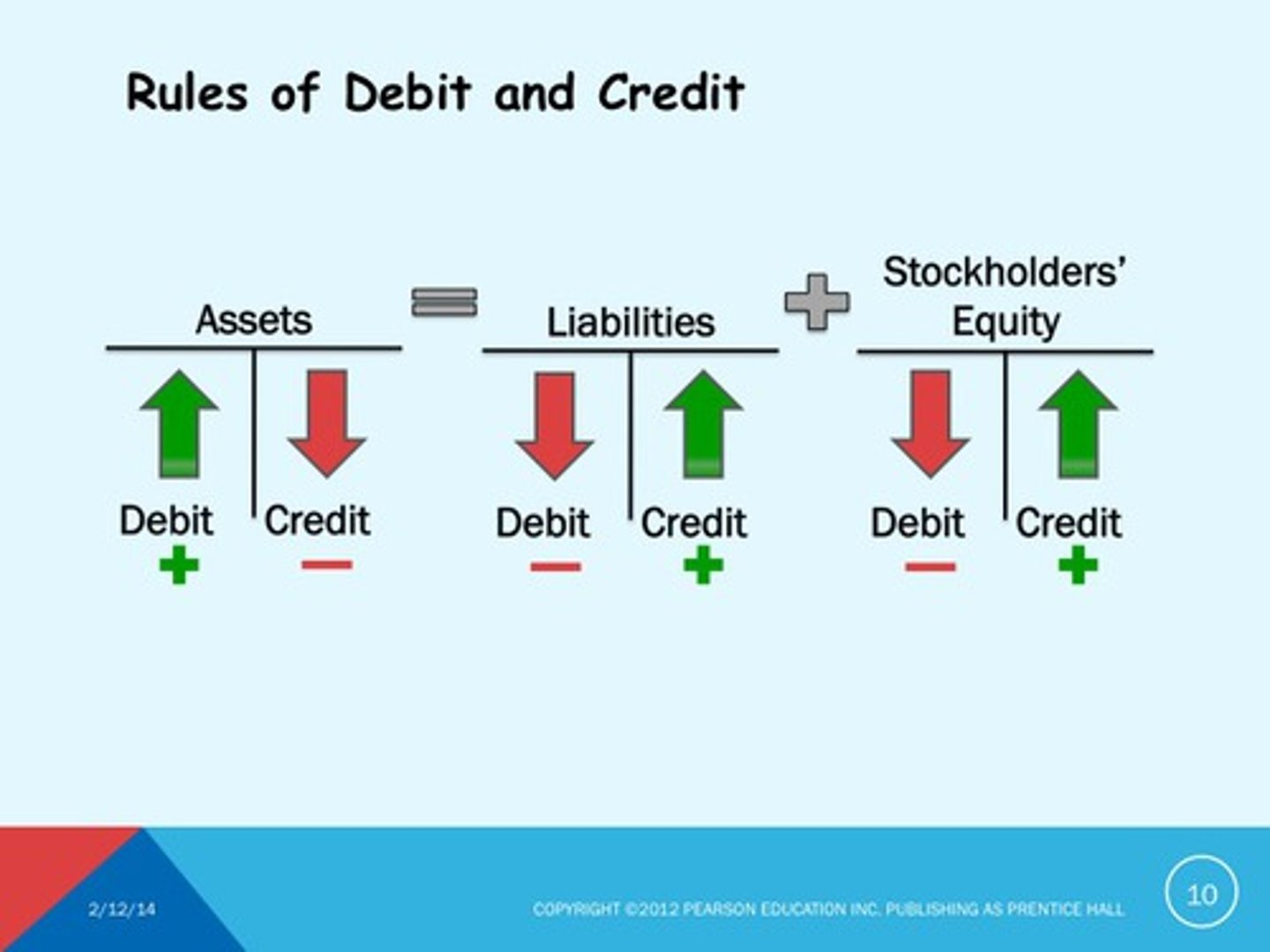

Debits

Represents an increase in an asset but a decrease in a liability or equity

Credits

Represents a decrease in an asset but an increase in a liability or equity

Asset accounts will normally have which type of a balance?

Debit

Liability and Equity accounts will normally have which type of a balance?

Credit

Revenues and Expenses are what type of account?

Equity

Revenues represent increases in what type of account? And what kind of balance?

Equity / credit

Expenses represent decreases in which type of account? And what kind of balance?

Equity / debit

What's the difference between revenue and expenses as equity accounts?

Revenues are debited and credited like equity accounts (i.e. debit is a decrease and credit is an increase).

Expenses are debited and credited like asset accounts (i.e. debit is an increase and credit is a decrease).

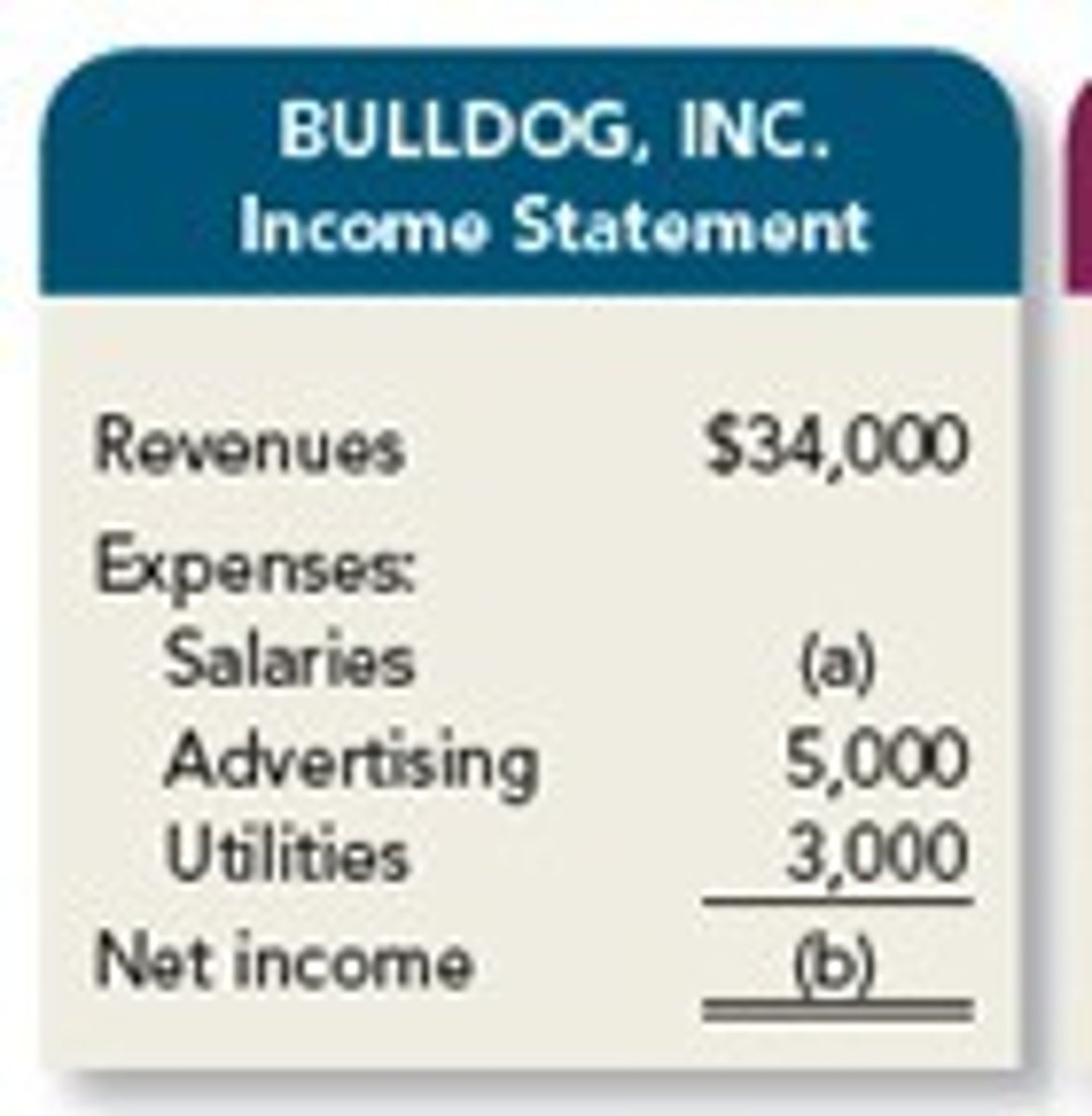

Income Statement

A financial statement that reports a company's revenues and expenses and resulting net income or net loss for a specific period of time.

Net Income

The difference between total revenues and total expenses. A firm's earnings after paying all expenses.

Net income = operating profit - (interest + taxes)

Net Income Equation

Net Income = Revenues - Expenses

What's the difference between balance sheets and income statements?

Balance sheets record one point in history and show a company's financial position. Income statements measure a company's financial performance over a period of time.

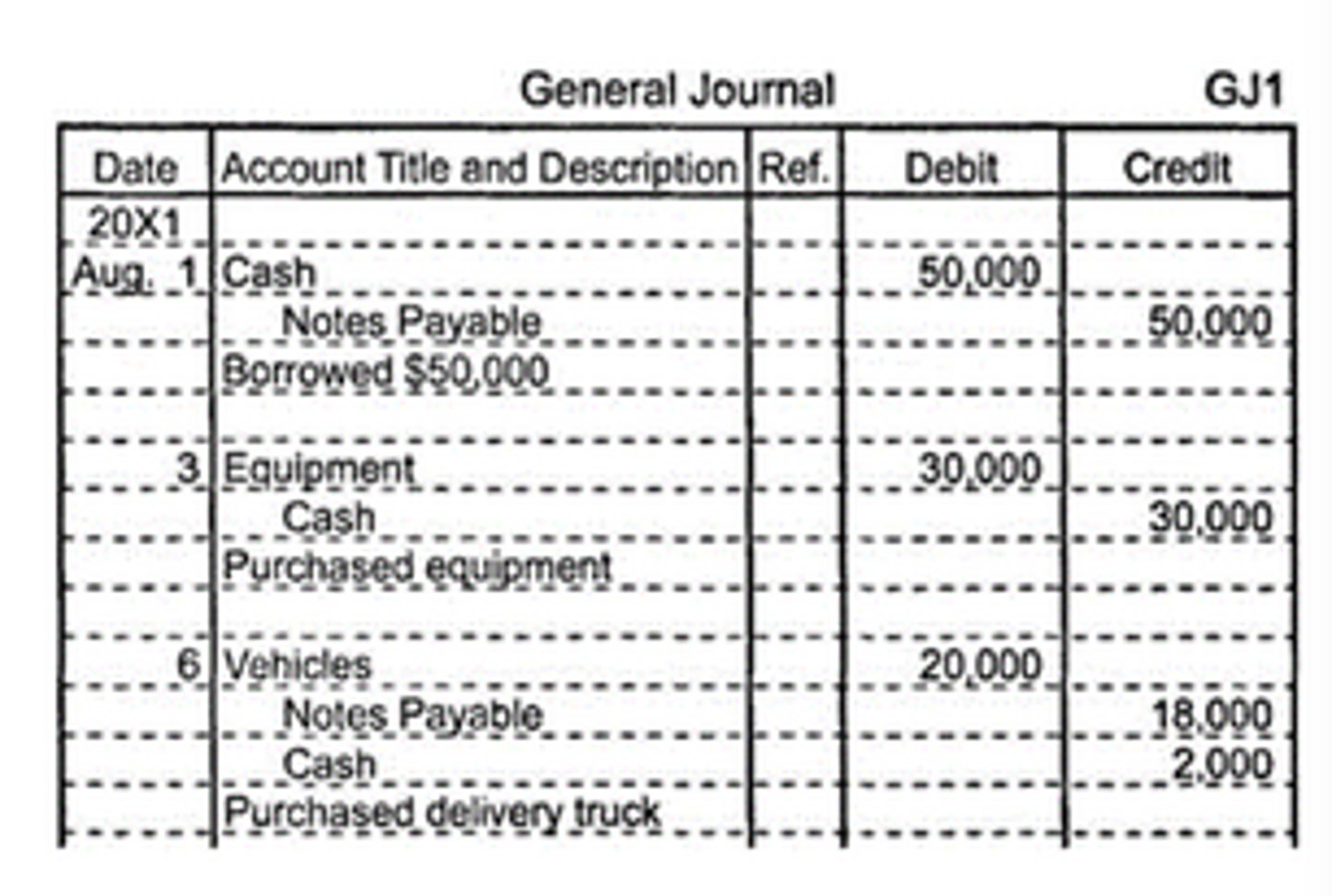

General Journal

The chronological record of every transaction. Uses the same rules as a T-account.

General Ledger

The collection of all T-accounts. Where Revenues and expenses are temporary accounts. At the end of a period they are closed out and their balances are transferred to the income statement.

Other asset, liability, and equity accounts are permanent accounts. They are not closed out, and their balances are transferred to the balance sheet.

Accrual accounting

Revenues and expenses are not necessary recognized when cash is received or paid out - unlike cash accounting, where revenues are recorded when cash is received and expenses are recorded when they are paid.

Conservatism Concept

Increases in revenue are recorded only when there is reasonable assurance that payment will be received.

Realization Concept

An increase to revenue isn't recorded until the product (or service) has been delivered.

Deferred Revenue

A liability account used when a customer has paid for a product or service but the product or service has not yet been delivered.

How do you record expenses?

Expenses are recorded in the same accounting period as their associated revenues or in the accounting period(s) in which their benefits are used.

Expenditures

Costs that are not expenses that either decrease assets or increase liabilities.

Unexpired Expenditures

The benefits of the expenditures have not yet been realized.

Expired Expenditures

The benefits of the expenditures have been used up. The expenditures are now expenses.

Bad Debt

Revenue owed, but failed to be collected.

Allowance for Doubtful Accounts

An estimation accounts use to preemptively assume how much revenue (bad debt) will fail to be collected. Contra-asset account containing the estimated uncollectible accounts receivable. The allowance for doubtful accounts is subtracted from accounts receivable at the end of the accounting period.

What type of account is Accounts Receivable?

Asset

What type of account is the allowance for doubtful accounts?

Contra-asset

What type of account is the Bad Debt Expense?

Equity

What type of account is Deferred Revenue?

Liability

Cost Accounting

An area of accounting that involves measuring, recording, and reporting product costs. The process of determining how much a unit of inventory costs.

Cost of Goods Sold (COGS)

The expense account associated with the sale of inventory. The expenses required to make goods or provide services. This includes the cost of materials and labor needed to make the good or provide the services. gross profit = revenue - COGS

Specific identification method

An inventory costing method based on the specific cost of particular units of inventory. Identifying the cost of inventory by expensing inventory sales as they occur.

First-In, First-Out (FIFO) Method

Method of accounting for the cost of inventory by expensing the cost of the oldest inventory first.

Last-In, First-Out (LIFO) Method

Method of accounting for the cost of inventory by expensing the cost of the newest inventory first.

Conversion Costs

Include direct labor and overhead costs for producing a good or service (i.e. converting raw materials into the inventory product)

Direct Costs

Include material costs and labor costs for a good or service

Indirect Costs

Include overhead costs for a good or service

Production Overhead

An indirect cost that includes all the general costs of the production process, minus direct costs (direct labor and raw materials) and selling, general, and administrative (SG&A) activities.

Overhead Rate

Distributes the overhead costs to inventory based on metrics such as labor costs, labor hours, etc.

Fixed Assets

Tangible, non-current assets

Service Life of a Fixed Asset

The expected amount of time (often estimated by a tax authority) that a fixed asset will remain useful before succumbing to wear-and-tear or obsolescence.

Depreciation

The means by which the cost of a fixed asset is expensed over time.

Depreciation expense

The amount of depreciation assigned to an asset each accounting period.

Straight-line depreciation

A method of depreciating an asset in equal amounts each accounting period of the asset's service life.

Units of production

A method of assigning depreciation based on the output of an asset.

Accelerated depreciation

A method of assigning more depreciation expense in the beginning of an asset's service life and less at its end.

Accumulated depreciation

The total depreciation a fixed asset has undergone to-date; also the contra-asset account recording the total depreciation of all assets.

Book Value (of an asset)

The difference between an asset's cost and its accumulated depreciation

Gain (Loss) on Asset Disposal

Where the difference between the sale value of an asset and its book value is recorded - as an equity account

Wasting Assets

Natural resources - such as wells and mines - that undergo depletion

Depletion

Occurs as wasting assets are used up

Depletion Base (of a wasting asset)

Similar to the depreciable cost of an asset, this is the total value of a wasting asset that will undergo depletion.

Depletion Rate (of a wasting asset)

Is equal to the depletion base divided by the total number of units of a substance that will be extracted from a resource.

Amortization

Process by which intangible assets (e.g. logos) are expensed over time in accordance with the matching concept.

Dividend

A sum of money paid by a company to its shareholders.

Stock

A security (financial instrument) that signifies partial ownership of a company. Also known as a share.

Common Stock

Owners of common stock have the right to vote for a corporation's board of directors. Dividends are not guaranteed. Bigger risk, bigger reward.

Preferred Stock

Owners of preferred stock lack voting rights but are usually paid regular dividends. These must be paid before dividends are distributed to common shareholders. Less risk, less reward.

Convertibles (stocks)

Preferred shares that can be converted into common shared.

Treasury Stocks

Shared that a company has bought back from its shareholders.

Declaration Date

The day a company approves a dividend disbursement but not the actual distribution date.

Dividends Payable

Dividends that a company's board of directors has declared but not yet paid to its shareholders.

Appreciate (stock)

When a stock increases in value

When does a bull market occur?

When the stock market rises consistently.

Depreciate (stocks)

When a stock decreases in value.

When does a bear market occur?

When the stock market falls consistently.

Where can public stocks be purchased?

At an exchange or on the stock market?

What is the difference between the primary and secondary market (for stocks)?

The primary market is where a company can sell its stock to individuals - the secondary market is where stocks are traded after being purchased from the issuing company. "Stock market" usually refers to the secondary market.

Par value (stocks)

The printed price of a share, often only $.01. Par value is not required in some jurisdictions.

Additional Paid-In Capital

Any payment received from the investors for stock that exceeds the par value of the stock.

Contra-Equity Account

An account with a debit balance (i.e. debit for increases and credit for decreases) that reduced a company's total equity.

Debt (bonds)

Money borrowed in exchange for interest

Secured debt (bonds)

Borrowed money that is backend by one or more assets as collateral.

Unsecured debt (bonds)

Borrowed money that is not backed by collateral.

Principal (bonds)

The original amount of money that was borrowed