EC3333 Midterm Formulas

1/48

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

49 Terms

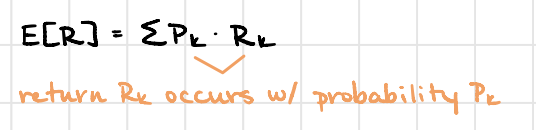

expected return

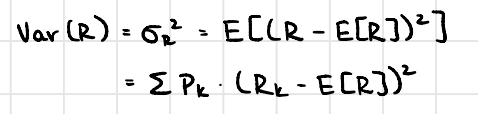

variance

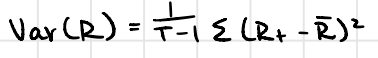

variance estimate

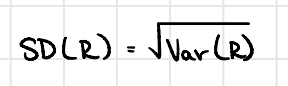

standard deviation

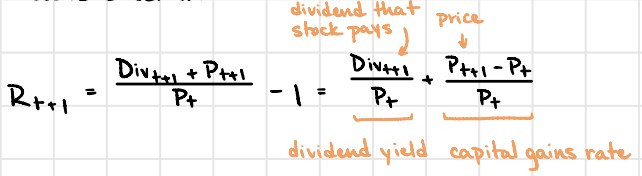

realized return

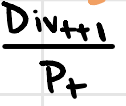

dividend yield

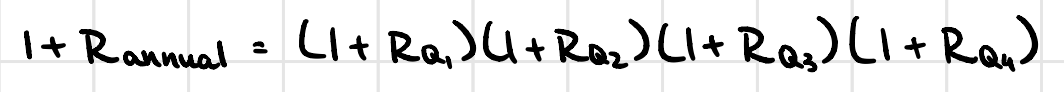

annual realized return

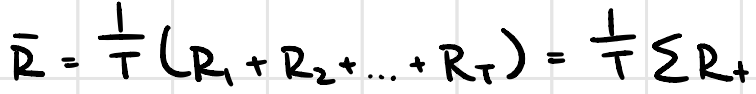

average annual return

compound annual return

standard error

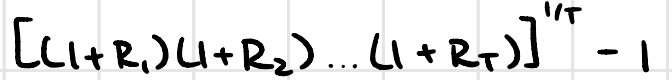

95% confidence interval

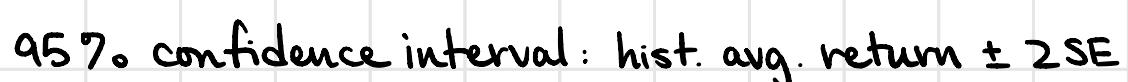

expected portfolio return - risky only

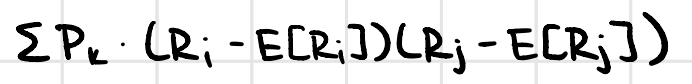

covariance

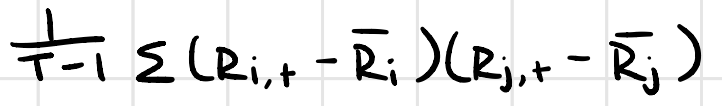

covariance estimate

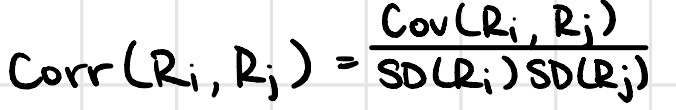

correlation

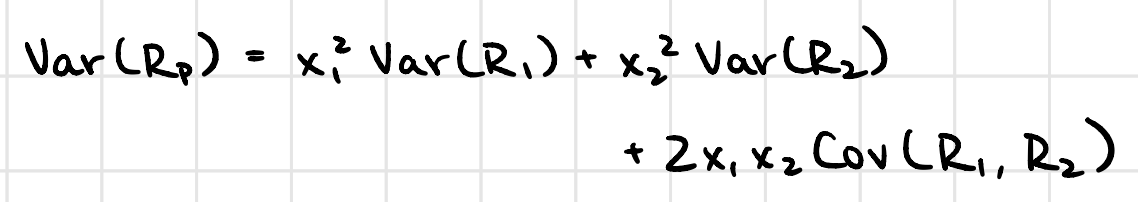

portfolio variance (2-asset)

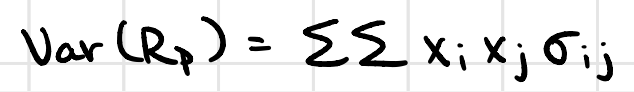

portfolio variance (n-asset)

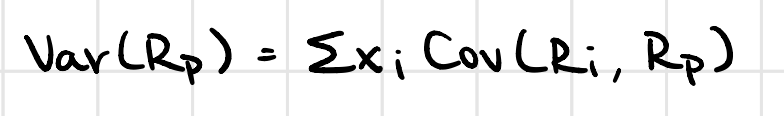

portfolio variance using each asset’s cov with the portfolio

portfolio volatility

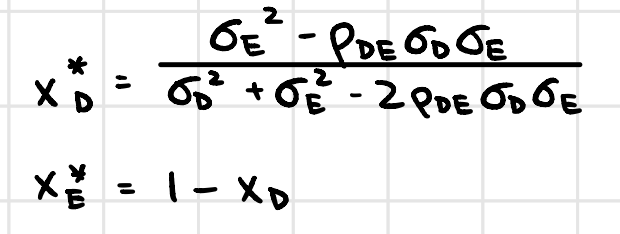

minimum variance portfolio weights

minimize variance w.r.t weight s.t weights add to 1

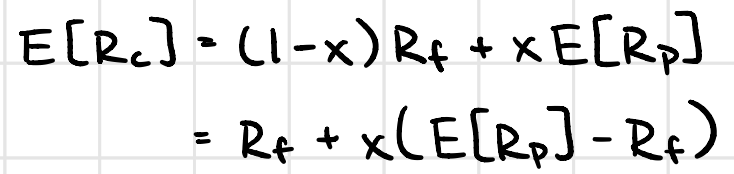

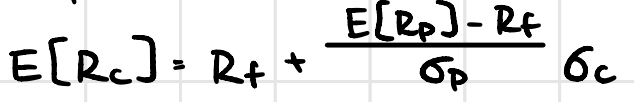

expected portfolio return - complete

complete portfolio volatility

capital allocation line

Sharpe ratio

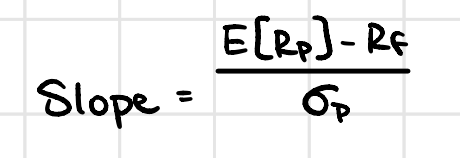

slope of CAL

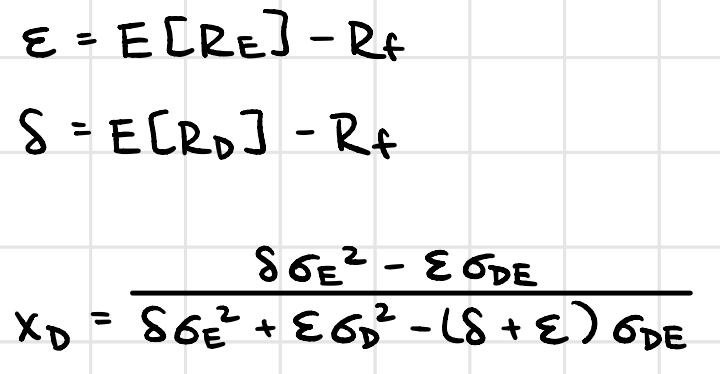

optimal risky portfolio weights

maximize Sharpe ratio s.t. we are on the efficient frontier

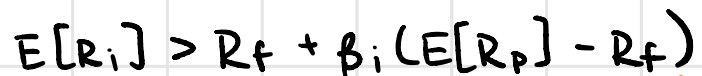

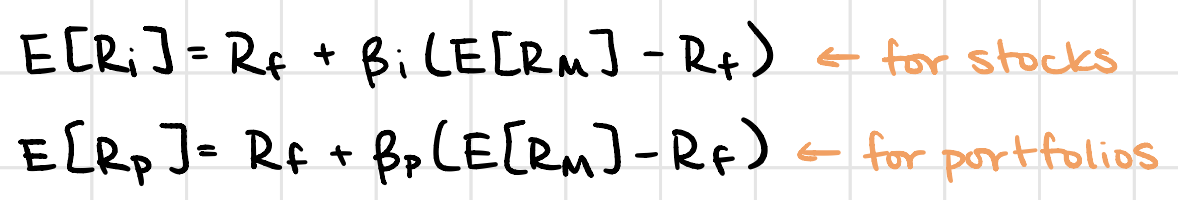

required return

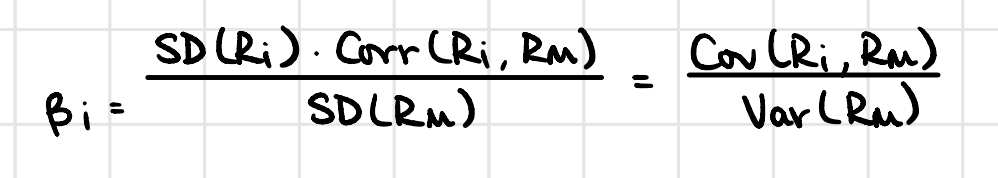

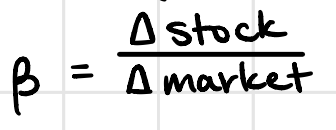

beta - individual stock

correlation using sharpe ratios of i and P

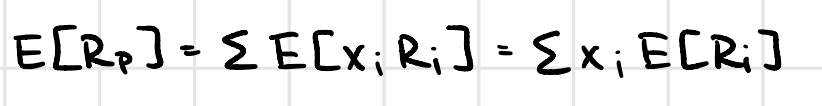

assumes P is efficient —> Sharpe ratio is maximized, E[Ri] = ri

![<p>assumes P is efficient —> Sharpe ratio is maximized, E[Ri] = ri</p>](https://knowt-user-attachments.s3.amazonaws.com/aa6c1293-0b4d-489c-9ad4-0816464cea0c.png)

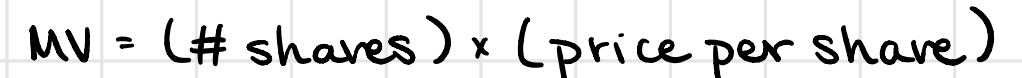

market cap

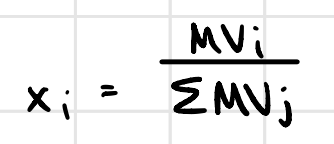

value-weighted portfolio

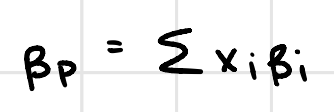

beta - portfolio

SML

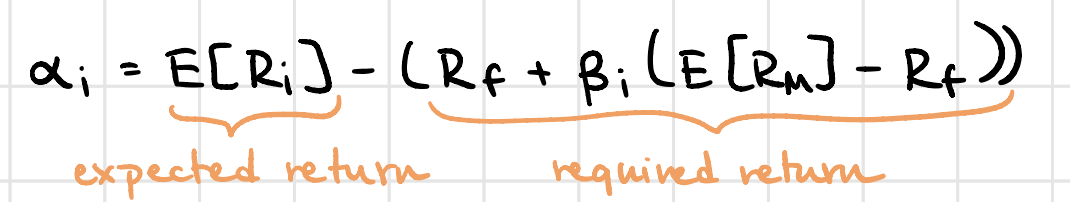

alpha

beta with stock changes vs. market portfolio changes

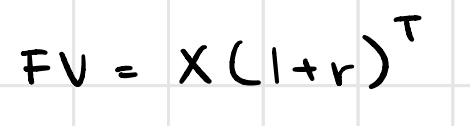

future value

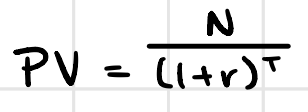

present value

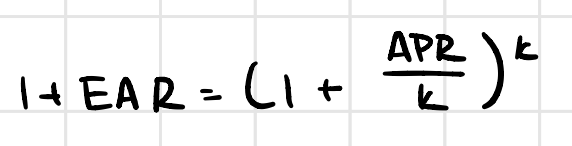

EAR

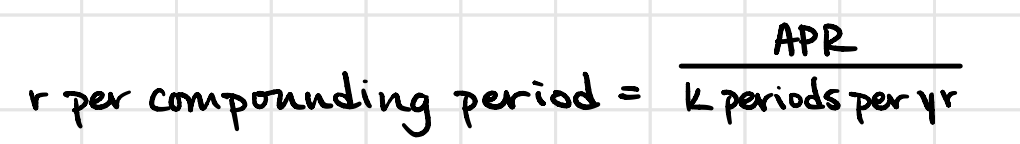

APR

relating EAR and APR

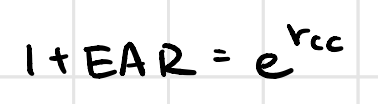

EAR with continuous compounding

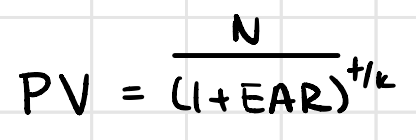

PV using EAR

fisher reltaion

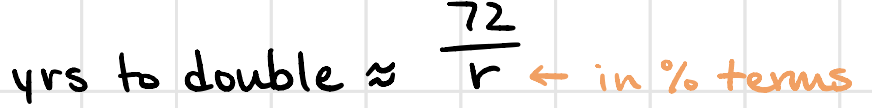

rule of 72

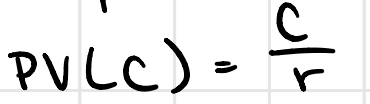

PV of perpetuity

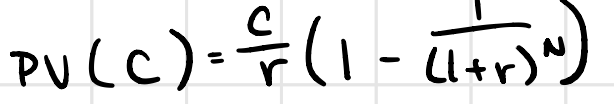

PV of annuity

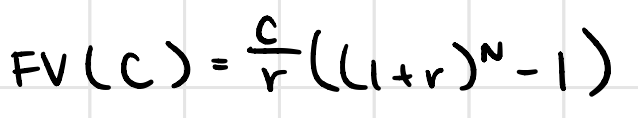

FV of annuity

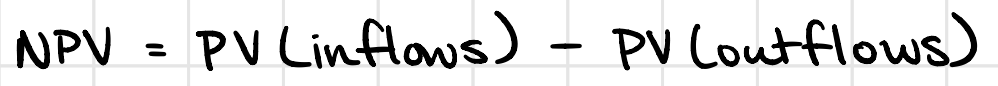

NPV

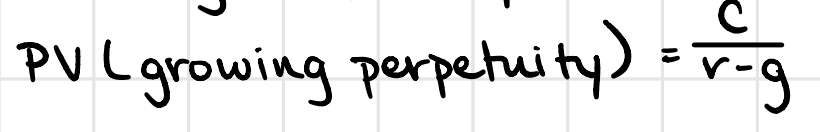

PV of growing perpetuity

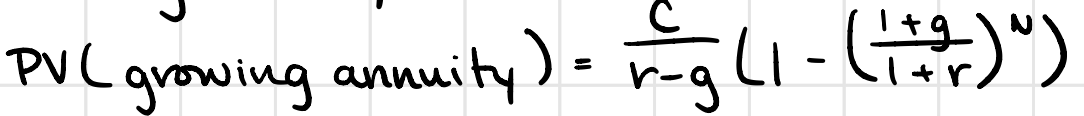

PV of growing annuity