Income Tax Preparation Study Guide

1/40

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

41 Terms

https://www.irs.gov/Links to an external site.

This site?

takes you to the IRS.

takes you to a place where you can get the information you need to complete your Income tax return.

At the IRS site listed in the previous question, what tab can you hover over to find Form 1040?

Forms and Instructions.

Check out this link: https://www.irs.gov/pub/irs-pdf/i1040gi.pdfLinks to an external site. This link takes you to the site for.

Instructions for Form 1040.

The Tax Table to find the tax you owe.

When preparing an income tax return, paying close attention to details is important.

True.

When preparing an income tax return, it is important to read everything for Instructions that will guide you.

True.

When preparing an Income Tax Return, it's okay to leave lines blank even if they apply to you.

False.

When preparing an Income Tax Return, it's okay to leave lines blank that don't apply to you.

True.

When preparing an Income Tax Return, it's okay to type NA or -0- on lines that don't apply to you.

False.

When preparing an Income Tax Return, be sure to include cents in the amounts you record on the lines so that you can get back every penny you're entitled to receive in your refund.

False.

When preparing an Income Tax Return, round your amounts, that you record on the lines, to the nearest whole dollar. Drop the cents and do not put .00.

True.

When preparing an Income Tax Return, the IRS prefers that you include cents in the amounts that you record because it reduces calculation errors.

False.

When preparing an Income Tax Return, be sure to use the $ sign on the lines so the IRS knows that your amounts are in dollars.

False.

When preparing an Income Tax Return, $ signs are unnecessary since the IRS knows that all amounts are in dollars.

True.

Based on the foregoing questions, Income Tax Preparation format means

You do not include commas (,) for thousand separators.

You do not include cents.

You do not add .00 to the dollar amount.

All amounts are rounded to the nearest whole dollar.

Round each of the following dollar amounts to the nearest whole dollar.

When preparing an Income Tax Return, if your earnings for the year, as shown on your W2 Form, are $10,053.54, you should record this amount on Line 1 of your Form 1040 as

10054

Commas for thousand separators are not necessary.

True.

https://www.irs.gov/pub/irs-pdf/fw4.pdfLinks to an external site.

Which of the following is TRUE regarding the Form depicted in the link above?

It is a W-4 Form.

The Form is used to determine how much Federal Income Tax will be withheld from each of your Paychecks.

You completed the Form when you got hired.

You complete a W-4 when you are hired.

True.

You may complete a new W-4 Form at any time to adjust the amount of Income Tax withheld from your Paychecks.

True.

The W-4 Form

Will determine what goes on your W-2 Form for Federal Income Tax Withheld.

will determine how much income tax you will have withheld.

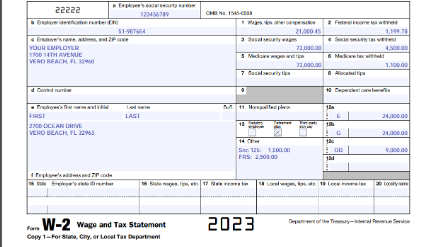

https://www.irs.gov/pub/irs-pdf/fw2.pdfLinks to an external site. With regard to the link above, which of the following are TRUE?

you receive this form in January from your Employer to complete your Income Tax Return.

this Form shows the tax you had withheld from your pay during the previous year

The link takes you to a W-2 Form.

You will receive different copies of the Form.

this Form shows the income you received during the previous year.

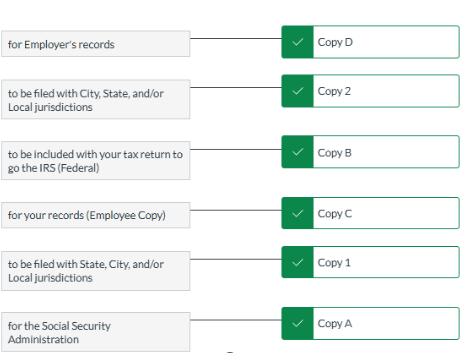

https://www.irs.gov/pub/irs-pdf/fw2.pdfLinks to an external site. Match the copy of the W-2 with the description below. You may use the link above to answer this question.

24) In January, you get your ___________ from your Employer.

W-2 Form.

An online Calculator will be available in Questions that require calculations.

True.

Click on the link below:https://www.irs.gov/pub/irs-pdf/f1040.pdfLinks to an external site.

This Income Tax Return is for 2024.

This is Form 1040.

For purposes of YOUR income tax return for this Study Guide and the Test, we will assume that you are NOT married.

True.

Click on the link below: https://www.irs.gov/pub/irs-pdf/f1040.pdfLinks to an external site. Referring to "Filing Status" underneath the heading for your name and address on Page 1 of form-1040 above, what is your Filing Status? Use Page 1 above and Page 2 below to fill in the blanks in Question 17.

Single.

It's okay to use your Cellphone's Calculator to do calculations on this Study Guide and Test.

False.

1, 21000, 1a, 1040, 21000, 1z, 1099-int, 1, 100, 9, 21100, 21100, 12, 14600, 14600, 15, Tax. Tax table, 16, 653, 0, 653, 24, 653, 25a, 33, 25a, 1200, 2, W-2, 1200, 547, 35a.

In the Tax Return you just completed, you

Will receive a Refund.

Why it's important to know how to prepare your own Income Tax Return:

- You are more self-sufficient and don't have to rely on somebody else.

- You can help friends and family members.

- You will save money on tax return preparation fees.

- Another step towards financial independence.

The Form 1040 changes somewhat every year.

True.

Check out the following link: https://www.irs.gov/pub/irs-pdf/i1040tt.pdfLinks to an external site. What resource(s) does this site offer?

Tax Table.

The Tax Table is what you look at to find...

Tax Owed.

Check out the following link: https://www.irs.gov/forms-instructionsLinks to an external site. This is the site you can go to find.

- Tax Forms.

- Instructions for Tax Forms.

- Standard Deduction Instructions.

The Standard Deduction for a Single person in 2024 is (enter the correct number in (Income Tax Preparation Format).

14600.

There is income tax preparation software available to help you complete your income tax return.

True.- Cash App Taxes

- TurboTax

- Jackson Hewitt

- H&R Block

- TaxSlayer

Which of the following offer tax return preparation software?

- Cash App Taxes

- TurboTax

- Jackson Hewitt

- H&R Block

- TaxSlayer

Tax Return Preparation software is free

False.

As a high school student working at Publix, your OCCUPATION, as recorded on your income tax return, could be any of the following, EXCEPT

- Produce

- Publix

- Deli