Looks like no one added any tags here yet for you.

Lecture will examine

V A R I E T I E S O F C A P I TA L I S M

Mercantilist (Japan, Korea, Singapore, China).

Liberal (United States, UK, Ireland Canada, Australia, New Zealand).

Coordinated (Germany, Austria).

PPP per capita [GDP per capita]

Varieties of Capitalism Different capitalisms, same outcome

What this means is that

Thomas Friedman and the globalization prophets get it wrong.

• The world is not converging around any one economic system.

• Prosperity does not depend, as the WSJ and multiple US economists claim, on the world following the US tax and regulatory model.

• There are rather multiple equilibria. Capitalism is the only system that produces wealth, but there are many capitalisms. And they get to the same place. That is,

• Different polities with contrasting institutions produce comparable levels of wealth.

Germany/US comparison

Began with observation that both are very wealthy.

• US: largest economy in the world; $US 20 trillion GDP. • Germany: 4th largest, $US, 3.8 trillion GDP .

• US is the 2nd largest exporter in the world, Germany the 3rd .

• Both have high standards of living and high productivity.

• But: the two are very different.

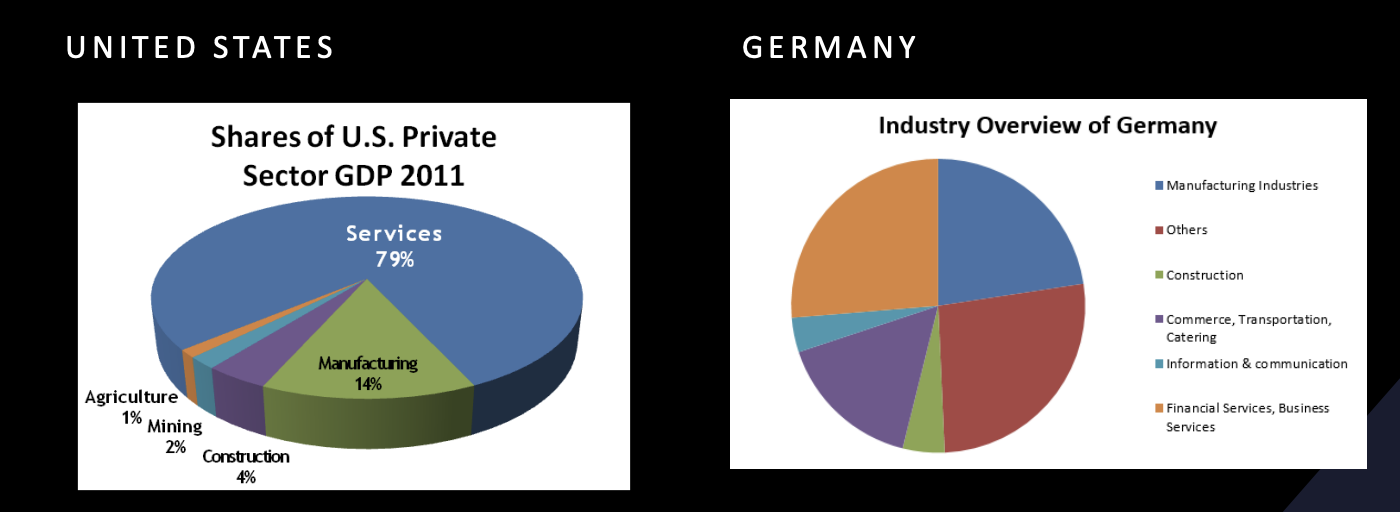

Economy by sector

Unionization & collective bargaining

C O L L E C T I V E B A R G A I N I N G C O V E R A G E R AT E ( 2 0 1 8 )

United States: 12.1%

Germany: 54%

Canada: 20.2%

France: 98%

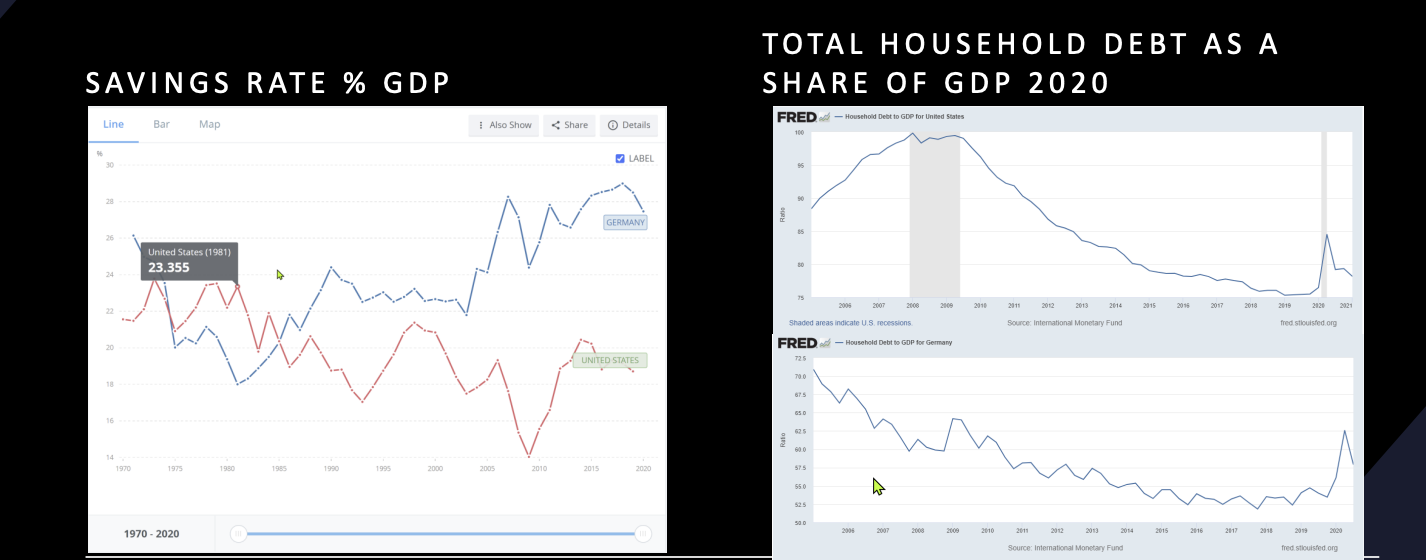

Savings rate & debt

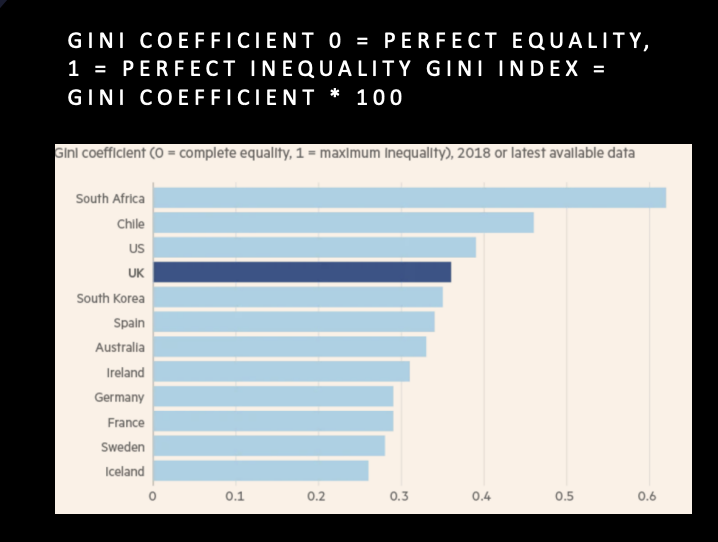

Inequality

R E G I O N A L I N E Q U A L I T Y

USA [excluding DC] New York: $90,043 GDP per capita.

Mississippi: $40,464 per capita [2.25]

Germany [excluding Hamburg, Bremen] Bavaria: $57,012

Saxony-Anhalt: $33,978 [1.67]

% of income going to the top centile:

Germany: 11%

United States: 40%

Exports

T R A D E D E F I C I T/ S U R P L U S E S

• US Trade Deficit: $616.8 billion (2020).

• German Trade Surplus: $293 billion (2019).

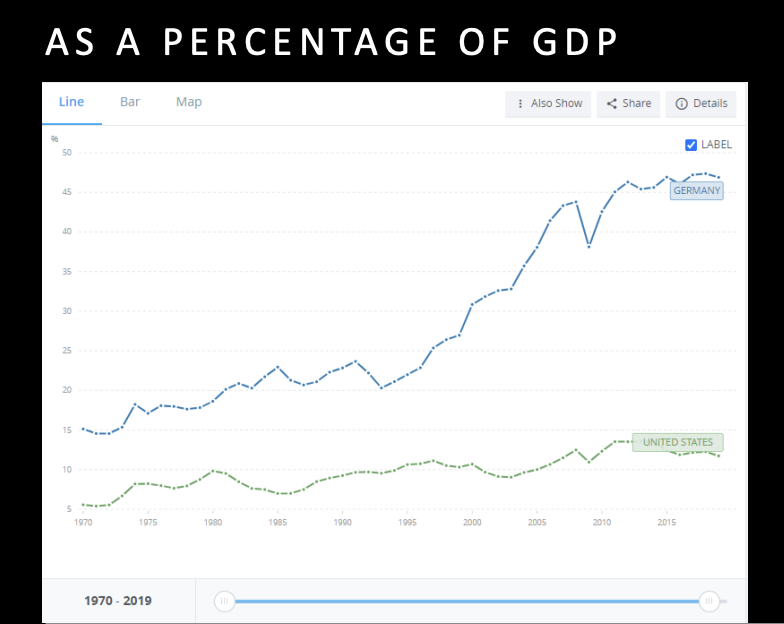

Consumption expenditure as a % of GDP

M A R K E T R E L AT I O N S H I P S VS V O C AT I O N A L T R A I N I N G

German apprenticeship model

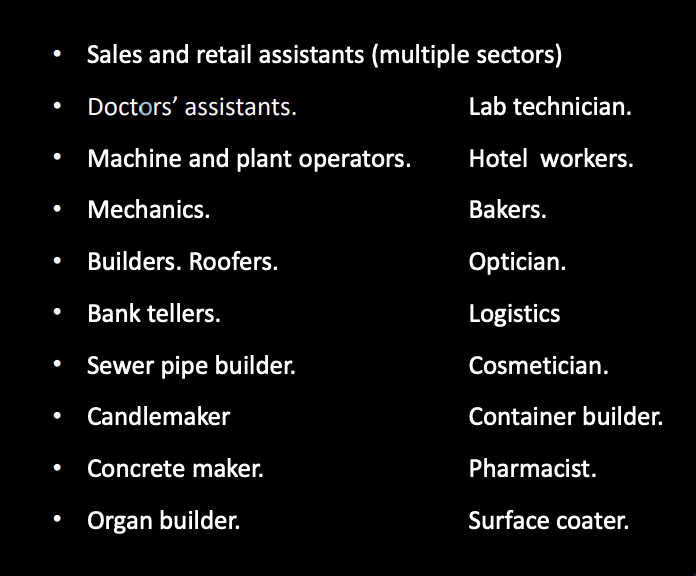

Found in all sectors: manufacturing (machine and plant operators, warehouse operators), the trades (hospitality services (hoteliers), postal services, and sales and retail services [the most popular].

• Can be from one-to-five years; standard model is three.

• Most apprentices enter the system after High School, but there are other entry points.

• “Dual System” combines a course at a training college with an apprenticeship.

• Around 1.5 million in apprenticeships in any given year.

• Companies take pride in their training programs, are very hostile to lowering standards, and hire most of those whom they train.

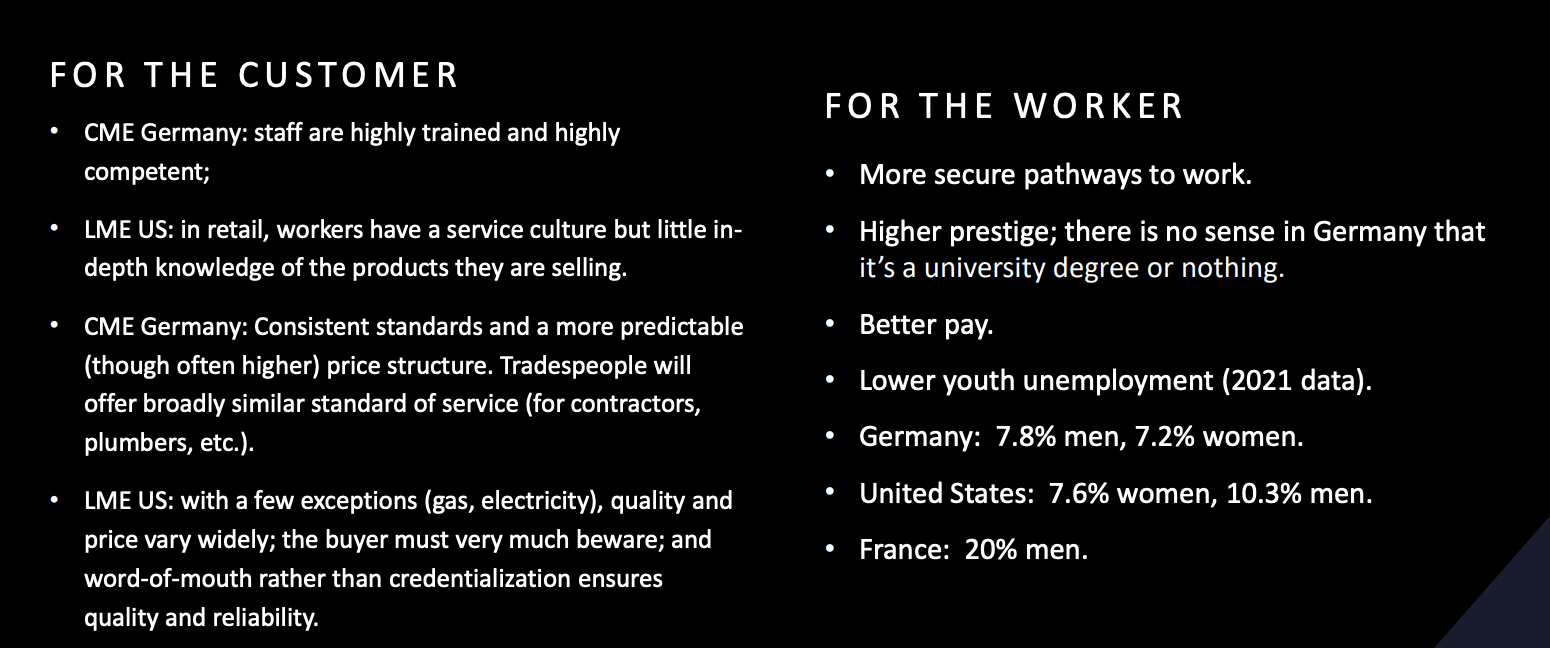

Contrasting results:

For the economy

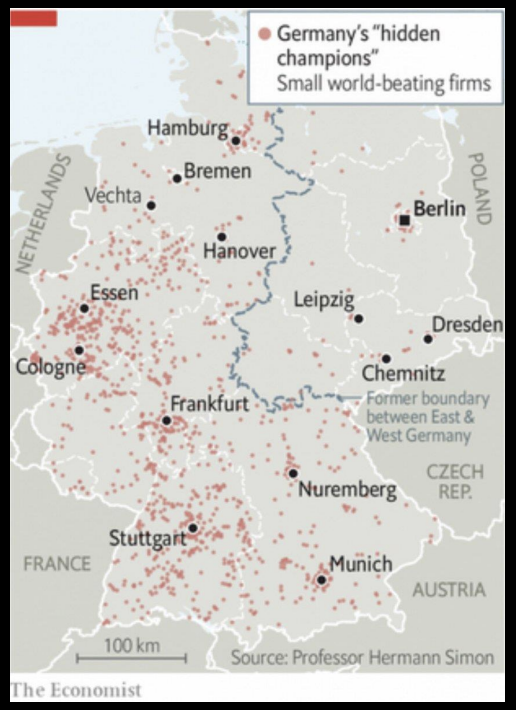

Mittelstand:

• Companies with fewer than 50 employees.

• Make up over 90% of all German companies.

• Employ 60% of German workers.

• Are distributed across the country, avoiding the wealth concentration seen around Paris and London/southeast.

Finance: LME United States

• Capital has little inside knowledge of firms’ operations.

• Rely on publicly available information, above all balance sheets.

• Take a short-term view of profit with little interest in companies’ long-term viability.

• Companies are highly reliant on public listings (stock market) for capital, driven squarely by earnings.

Finance: CME Germany

Investors are much more closely linked to firms over a longer period.

• They have much more inside knowledge of firms and pay attention to much more than balance sheets.

• View of profit is long-term. • Many of Germany’s largest companies are not publicly listed:.

• As of 2018: Germany had 450 publicly listed companies, down from 760 in 2008.

• US, three times the size of Germany, has 4,266 publicly listed companies.

Unions

Result

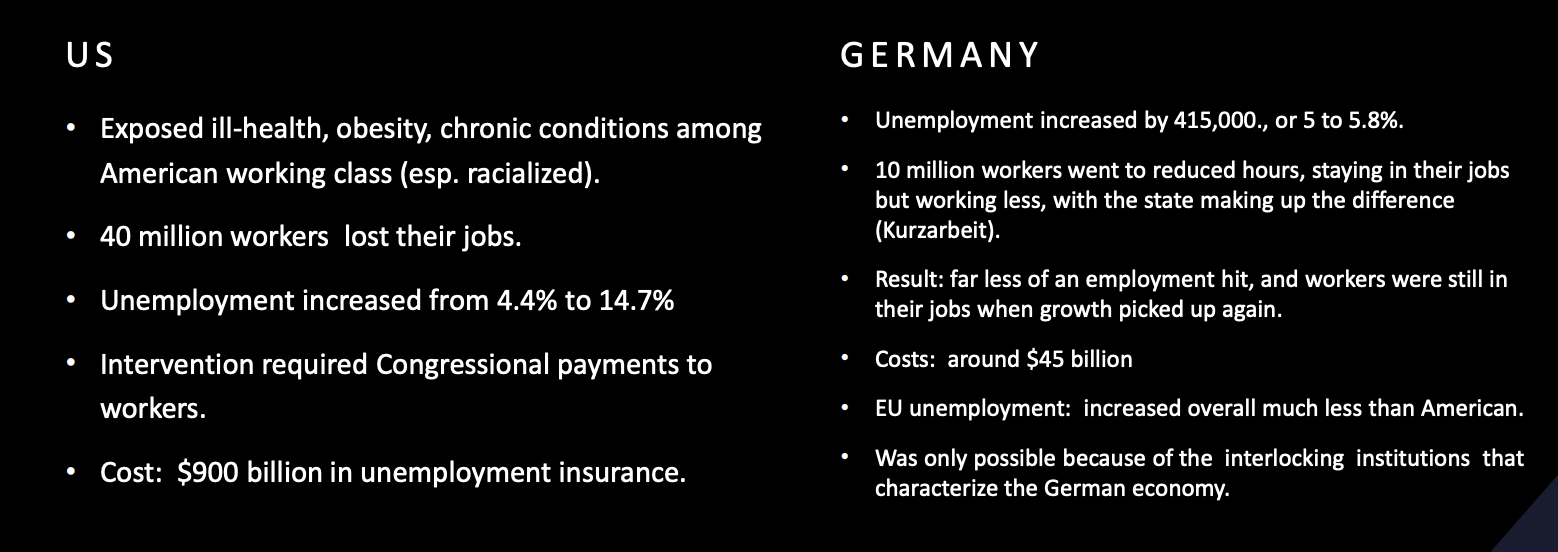

German workers are in a collaborative relationship with employers.

• They view themselves as part of the productive process.

• Have a say in, and care about, productivity, product/service quality, innovation.

• Much more likely to accept temporary restrictions – reduced work, flexible hours – to secure long-term profitability.

Covid & Varieties of Capitalism

Other VOCs: Japan

Genuine, if one party, democracy since 1945.

• Enjoyed staggering postwar economic growth; economy increased 55-fold from 1946 to 1976.

• Stagnated since; good example of the weaknesses of cultural explanation.

Ministry of International Trade and Industry (MITI)

Oversaw the whole process. Inspired by German Handelspolitik (or neomercantilism).

• Japan was a developmental state, as distinct from a regulatory state, which focuses on the rules of economic competition.

• A developmental state sets strategic economic goals (1960 Income Doubling Plan).

• Most talented graduates went into MITI as well as Finance, Agriculture, Construction & Economic Planning. They made the key decisions on the budget and all economic policy innovation.

• At retirement, around age 50-55, they went into private enterprise, banking, and public companies; thus a tight link between bureaucracy, the government, and private enterprise.

Going for growth

Civil service – above all MITI – intervened directly at the micro-level: the state intruded on the detailed operations of individual enterprises (new production techniques, equipment and management techniques), used tax and spending to encourage and close down particular sectors, and set targets for growth.

• Until the 1960s, high tariffs, stringent ownership rules, and capital controls nurtured domestic industry.

• Degree of intervention made Japan closer to planned socialist economies of EE than France or West Germany; US military would be the closest NA analogy.

• Model delivered staggering economic growth until the late 1980s; then Japan entered a longer period of stagnation.

• The question is why….No one knows.

• But whatever the reason, Japan is both a example of contrasting example wealth creation and a model for other countries, including….

Korea - GDP PER CAPITA

Korea

G D P P E R C A P I T A 1 9 6 0 : $ 1 5 8

G D P P E R C A P I T A 2 0 1 8 : $ 3 3 , 4 5 2

Model of authoritarian development

Park Chung-hee ruled from 1961 to 1979; compare with Lee Kuan Yew of Singapore?

• Korea built an export-based economy based first on cheap labor, through state intervention. The state traded subsidies for firms with performance standards that the firms need to meet. It would also close and transfer ownership of unviable firms.

• The state owns all commercial banks; it limits the number of firms in a field (helping encourage the Chaebol , massive conglomerate, structure: Samsung, Hyundai, LG); controls commodity prices; limits capital flight (thus avoiding public subsidies being used to build private fortunes abroad), and uses taxes to invest heavily in infrastructure (and not social services).

• Accent has been on export-led growth and industry protected by tariffs. Cheap domestic labor helped keep exports competitive.

• Relatively little innovation but rather incremental improvements in and capture of market share in fields previously dominated by others: shipbuilding, electronics automobiles.

Singapore

Authoritarian capitalism.

• Are elections, but candidates are chosen by the state on the basis of academic merit. Salaries are high, and there is zero tolerance for corruption.

• Economy is highly open to trade but run by technocrats. Government used tax policy to attract foreign capital, set up an Innovation Fund to support High-Tech investment, and spends heavily on R & D.

• Life is highly regulated: demonstrations are banned, where you live is regulated to avoid segregation, public criticism is monitored, and daily life faces a series of rules – on dress, exercise, and selling chewing gum. Singaporeans accept limitations on freedom in exchange for wealth and public health care, education, housing (though marriage is necessary to secure it), and infrastructure of a very high standard.

• Brexiters’ dream of London become a Singapore on the Thames is ludicrous.

China

Another model of state-directed capitalism.

• Communist party kept formal commitment to Mao and Communism but introduced market mechanisms, starting in the coastal cities.

• State sets growth and production targets, maintains tariffs, and controls capital, and limits internal migration. • State subsidies, and controls, strategic industries: machinery, automobiles, technology, construction, and iron & steel.

• Taxes and subsidies encourage foreign investment and export-led growth; China is the world’s leading exporter.

• Like Korea, little innovation but rather market share capture.

• Economic success supported by a massive domestic market and abundant cheap domestic labor.

• Over 40 years, the state lifted hundreds of millions of people out of poverty.

Conclusion

Both generate high levels of wealth.

• US provides higher salaries for skilled workers and more opportunities for (upper?) middle class wealth acquisition via asset price inflation, above all in housing.

• US has a much more bifurcated wage structure . In the US, the average CEO earns 300 times as much as the average worker; in Germany, the figure is 136.

• Germany has a large low-wage sector (largest in western Europe after the UK), but its pool of secure, wellpaid workers is much larger than the US.

• CMEs find it relatively difficult to incorporate migrants into the labor market.

• German capitalism is more socially just, but it would be impossible to transform American capitalism into German because the latter rests of a dense set of institutions that do not exist in North America.