4. planning audit risk

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

32 Terms

audit risk

the risk that the auditor does not detect one or more of the risks that relate to an audit and gives an opinion that the financial statement are true and fair

risk u give the incorrect opinion

audit risk =

inherent risk x control risk x detection risk

inherent risk

such risk is always present in areas of the client that are susceptible to fraud

control risk

another risk only present in clients, representing the risk of controls not preventing or detecting fraud

inherent risk and control risk make up the ______

risk of material misstatement

detection risk

the risk that audit procedures will not detect a misstatement

sampling risk

risk the sample doesn’t adequately represent the population

non-sampling risk

poor interpretation of the sample by the auditor

auditor may lack experience

2 characteristics of risk assessment process

likelihood - how possible

impact - how significant

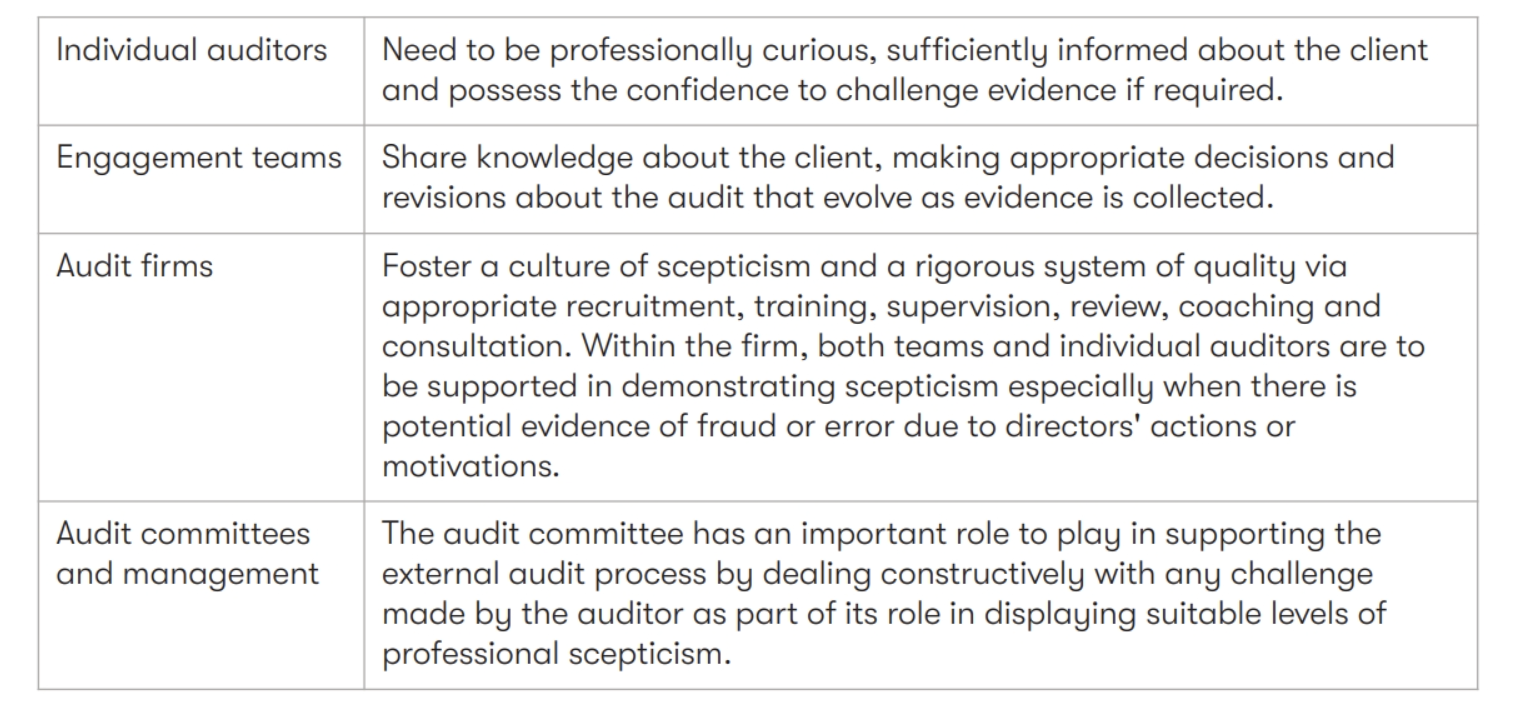

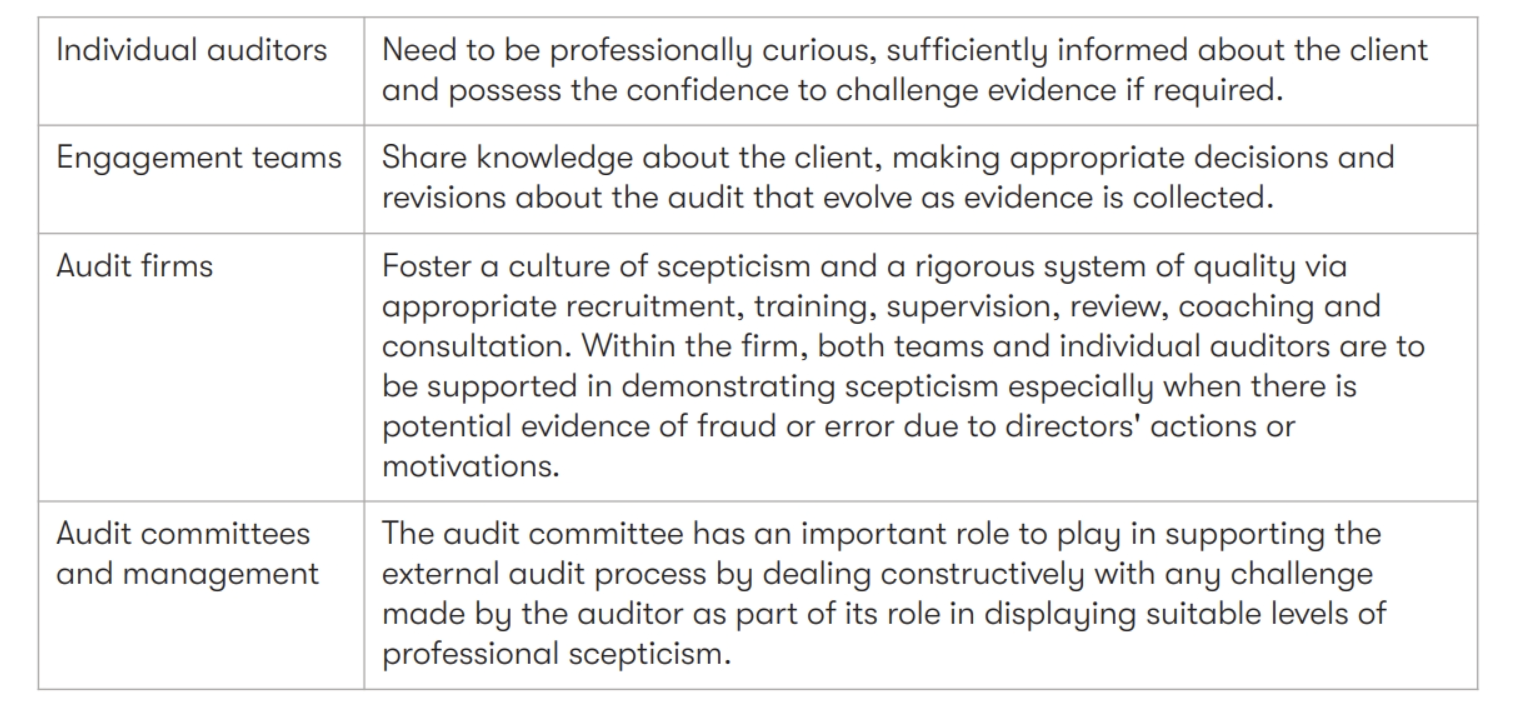

What do individual auditors need to demonstrate?

They need to be professionally curious, sufficiently informed about the client, and possess the confidence to challenge evidence if required.

What is the role of engagement teams in demonstrating professional scepticism?

They share knowledge about the client, make appropriate decisions, and revise the audit as evidence is collected.

What role do audit committees and management play in professional scepticism?

They support the external audit process by constructively dealing with challenges raised by auditors and demonstrating suitable levels of professional scepticism.

materiality

if the omission or misstatement could affect economic decision of the primary users of the financial statement

trade receivable has increased by 25% and revenue has increased by 7%

understated or overstated

overstated

trade payables has decreased by 5% and purchases has increase by 4%

understated or overstated

understated

materiality is important as it _____ the threshold above which further audit work becomes ____

determines

necessary

What is performance materiality?

It is the amount set by the auditor at less than materiality for the financial statements as a whole. It reduces the probability that the aggregate of uncorrected and undetected misstatements exceeds materiality for the financial statements.

Why is performance materiality used?

to address the risk that individually immaterial misstatements could aggregate and exceed materiality for the financial statements as a whole.

What happens if a lower materiality level is concluded during the audit?

The auditor must revise performance materiality and determine whether the nature, timing, and extent of further audit procedures remain appropriate.

What must be documented by the auditor regarding materiality?

Materiality for the financial statements as a whole

Materiality level(s) for particular classes of transactions, account balances, or disclosures (if applicable)

Performance materiality

Any revision of the above amounts during the audit

What are the three types of audit risk?

Inherent risk: Susceptibility of certain items to be misstated (client-driven).

Control risk: Failure of internal controls to deal with inherent risks (client-driven).

Detection risk: Risk that the auditor does not detect a misstatement, including sampling and non-sampling risk.

How can risk be assessed and expressed?

Graphically on a risk matrix and numerically by assigning a suitable grade.

What are analytical procedures used for?

To identify and understand risks within financial statements using techniques like ratios, comparisons, and benchmarks.

Why is materiality a difficult area for auditors?

It heavily relies on judgement, making it challenging to apply effectively.

_____ risk: risks arising as a result of the nature of the business, its transactions and environment

inherent

______ risk - the risk that the control system at the company does not detect, correct or prevent misstatement

control

_____ risk - risk the auditors don’t discover misstatements in the financial statements

detection

what can go wrong with balances, transactions and events at the fs level

items can be overstated or understated

items requiring disclosure can be omitted

materiality is the concept of importance to users

t/f

t

calculating materiality and selecting samples on the basis of materiality helps the auditor to reduce audit risk to an acceptable level

t/f

t

material and pervasive is taken to mean the misstatemnt is

_____ to one item in the financial statements

______ to one item, but the item could represent a substantial portion of the financial statements

if relating to disclosure, ____ to users understanding of the financial statements

not confined

confined

fundamental