Tax Forms Study Guide

1/8

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

9 Terms

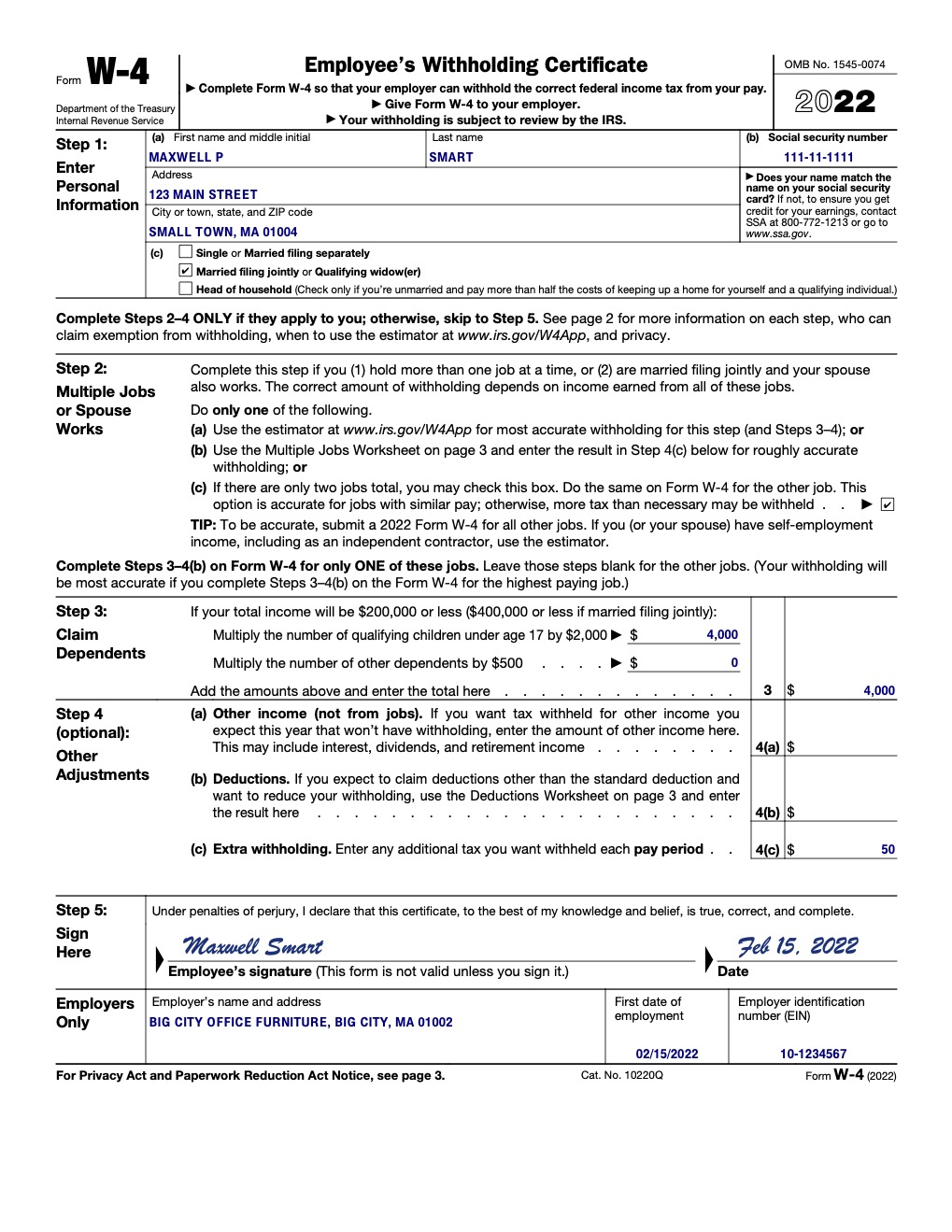

W-4

Used by your employer to withhold the proper amount of federal income tax from your paycheck.

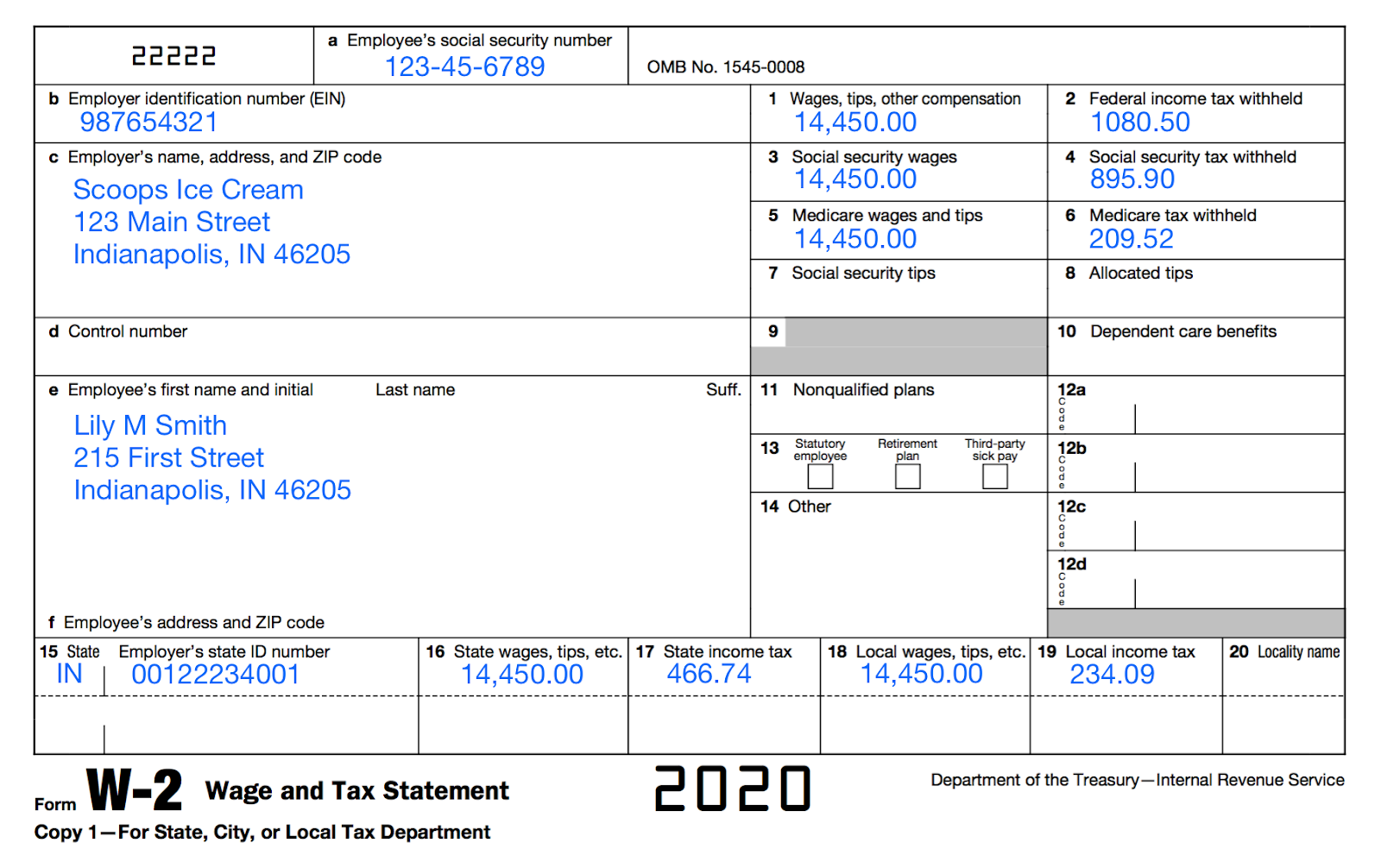

W-2

Reports an employee's annual wages and the amount of taxes withheld from their paycheck.

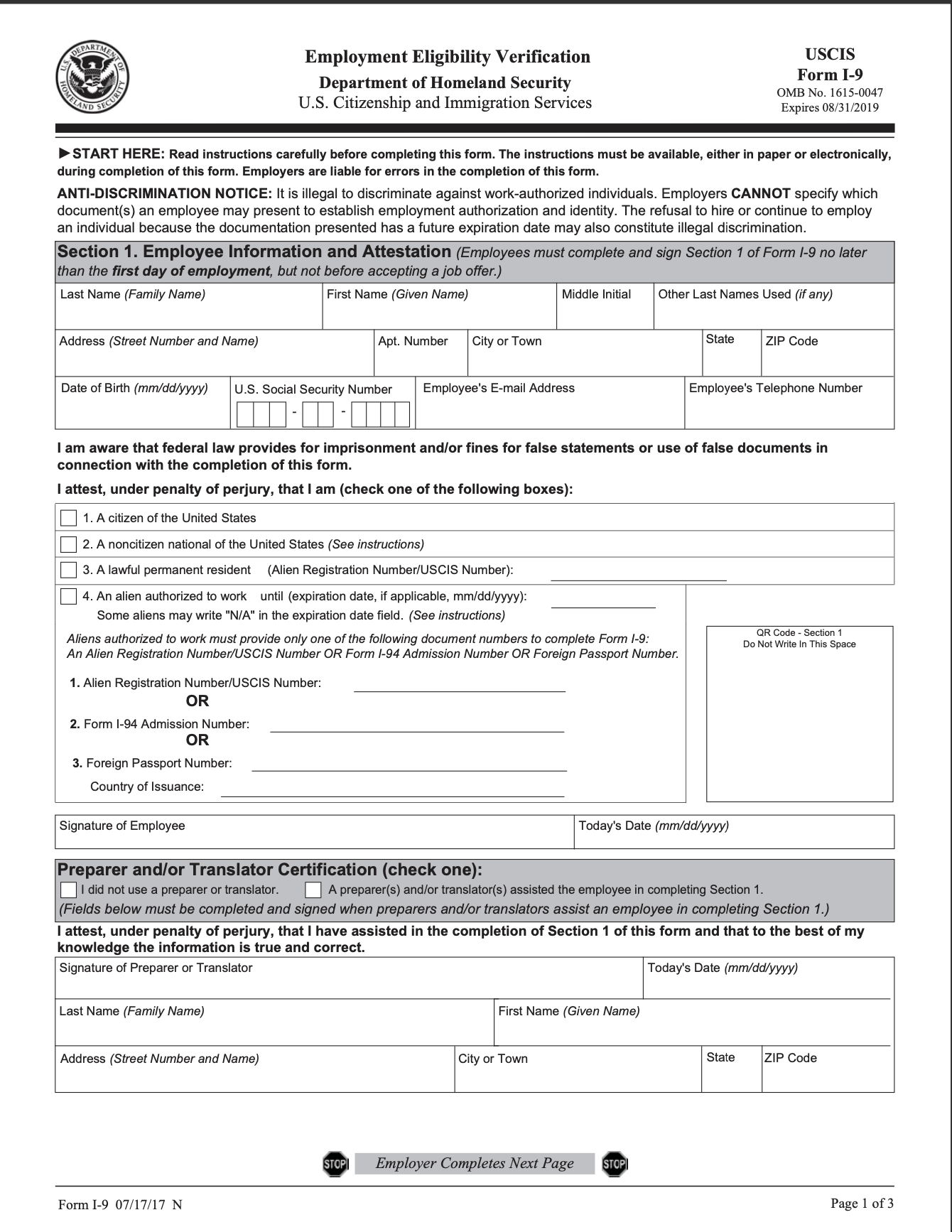

I-9

Employment eligibility verification form used to confirm an employee's identity and authorization to work in the U.S.

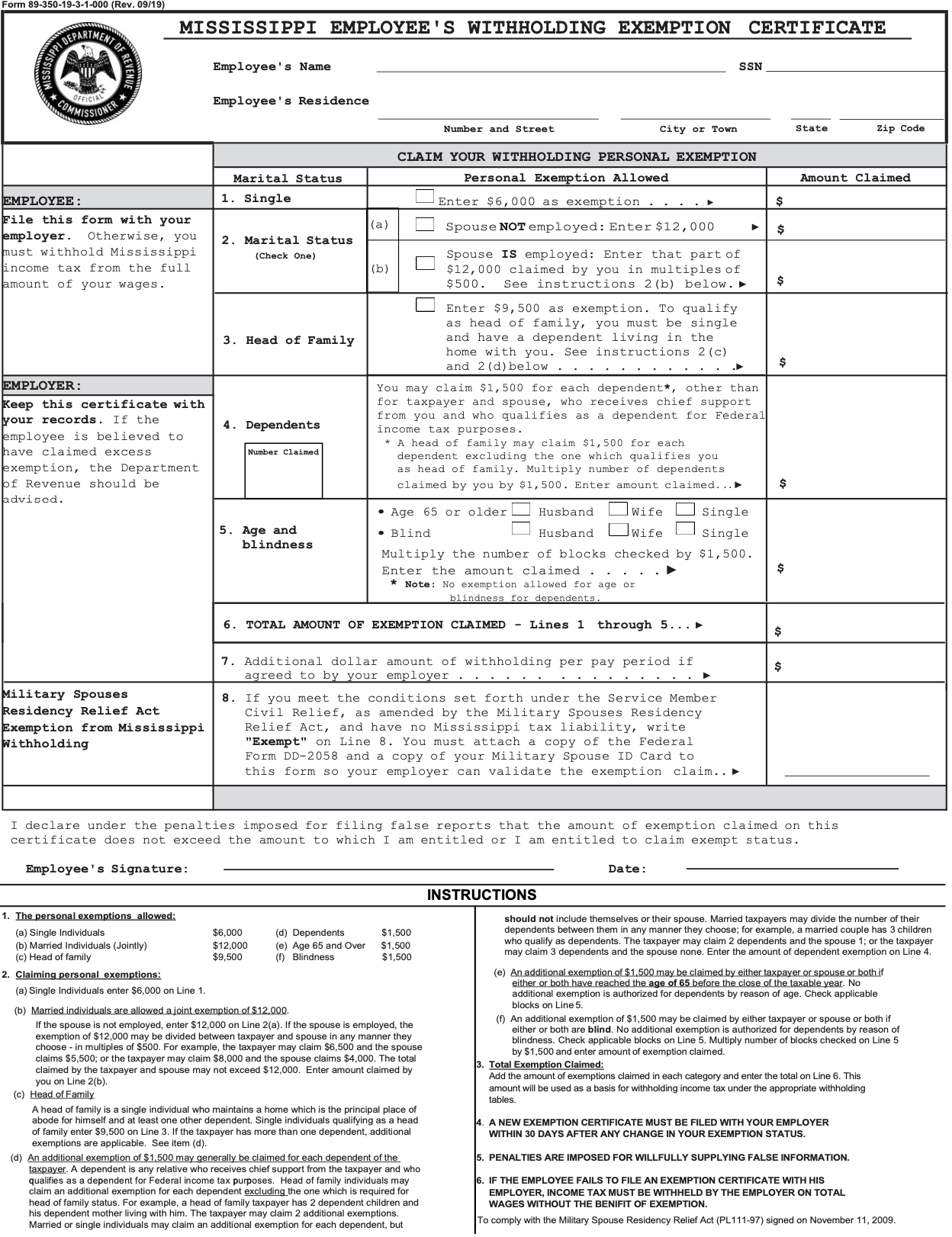

Mississippi Employee's Withholding Exemption Certificate

A form used by employees in Mississippi to claim withholding allowances for state income tax purposes, affecting the amount of state tax withheld from their paychecks.

1099

A tax form used to report various types of income received by individuals or entities, excluding wages, salaries, and tips. It is commonly utilized by freelancers and contractors.

1040

The standard IRS form used by individuals to file their annual income tax returns, reporting income, deductions, and credits.

Net Pay

The amount of money an employee takes home after all deductions, including taxes, have been subtracted from their gross wages.

Gross Pay

The total amount of money an employee earns before any deductions, such as taxes or benefits, are taken out of their wages.

Withheld Tax